Security National Financial Corporation Reports Financial Results for the Quarter Ended March 31, 2019

May 16 2019 - 9:30AM

Security National Financial Corporation (SNFC) (NASDAQ symbol

"SNFCA") announced financial results for the quarter ended March

31, 2019.

For the three months ended March 31, 2019, SNFC’s

after-tax earnings from operations decreased 88.6% from $16,926,000

in 2018 to $1,930,000 in 2019, on a 25.1% decrease in revenues to

$61,494,000.

Scott M. Quist, President of the Company, said,

“Even recognizing the decrease in net income, I must say that I am

quite pleased with our Company’s first quarter performance.

For the first quarter last year, excluding the Dry Creek sale, our

pre-tax earnings would have been a loss of approximately

$690,000. This year, with no Dry Creek sale, our pre-tax

earnings improved from that loss to a positive $2,432,000, for a

positive swing in pre-tax earnings of $3,122,000.

“Looking at our operations by segment, our life

insurance operations continue their upward trend with a 6% increase

in revenue which translated into 14% increase in profitability,

consistent with 2018’s first quarter improvement. We have

seen first year premiums flatten out a bit, but we continue to see

a rotation by our sales force into a more profitable product mix,

which we believe will yield dividends into the future. Our

Memorial segment delivered a stellar quarter with a 15% increase in

revenue which translated into a 38% improvement in

profitability. That improvement was broad-based in both

cemetery and mortuary operations and investment returns. We

finalized the acquisition of Probst Family Funerals &

Cremations mid first quarter and it is delivering its expected

profitability. Our mortgage segment showed remarkable

improvement. The first quarter of 2018 saw a decrease in

volume of 18%, which translated into a decrease in revenue of 34%,

demonstrating the margin compression that was so rampant in late

2017 and throughout 2018. This year, while our volume slipped

10%, our revenue decreased only 3% giving a profitability

improvement of $2.54 million. While it is true that the

mortgage segment still ran a loss of $838,000 for the quarter,

given the marked margin improvement I am very encouraged that our

considerable rationalization efforts are bearing fruit and I am

looking forward to a much improved 2019 for the mortgage

segment.”

SNFC has three business segments. The

following table shows the revenues and earnings before taxes for

the three months ended March 31, 2019, as compared to 2018, for

each of the three business segments:

| |

Revenues |

|

Earnings before Taxes |

|

|

|

2019 |

|

|

2018 |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

Life Insurance |

$ |

30,506,000 |

|

$ |

50,860,000 |

|

(40.0%) |

|

$ |

2,085,000 |

|

|

$ |

23,711,000 |

|

|

(91.2%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cemeteries/Mortuaries |

$ |

4,359,000 |

|

$ |

3,776,000 |

|

15.4% |

|

$ |

1,185,000 |

|

|

$ |

861,000 |

|

|

37.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgages |

$ |

26,629,000 |

|

$ |

27,440,000 |

|

(3.0%) |

|

$ |

(838,000 |

) |

|

$ |

(3,385,000 |

) |

|

(75.2%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

61,494,000 |

|

$ |

82,076,000 |

|

(25.1%) |

|

$ |

2,432,000 |

|

|

$ |

21,187,000 |

|

|

(88.5%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per common share was $.11 for the three months

ended March 31, 2019, compared to net earnings of $.99 per share

for the prior year, as adjusted for the effect of annual stock

dividends. Book value per common share was $10.09 as of March

31, 2019, compared to $9.99 as of December 31, 2018.

The Company has two classes of common stock

outstanding, Class A and Class C. There were 17,241,664 Class

A equivalent shares outstanding as of March 31, 2019.

If there are any questions, please contact Mr.

Garrett S. Sill or Mr. Scott Quist at:

Security National Financial CorporationP.O. Box

57250Salt Lake City, Utah 84157Phone: (801) 264-1060Fax:

(801) 265-9882

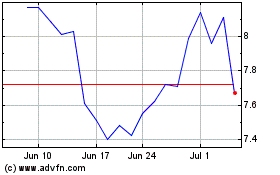

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

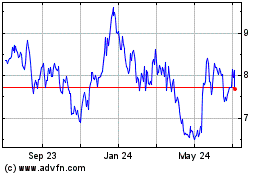

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Apr 2023 to Apr 2024