Seanergy Maritime Holdings Corp. Announces the Results of its Successful Recent Capital Raising Transactions

May 08 2020 - 9:00AM

Seanergy Maritime Holdings Corp. (NASDAQ: SHIP) (“SHIP” or the

“Company”) today announced the results of its successful recent

capital raising transactions.

In recent weeks, SHIP has undertaken a series of

equity raisings beginning with an underwritten public offering

which priced on March 31, 2020. Through this capital markets

activity, the Company has raised approximately $30 million in gross

proceeds. Based on this positive outcome, it is SHIP’s intention to

pause its capital markets participation for the near term, although

the Company will continue to monitor market activity in the

future.

Stamatis Tsantanis, SHIP’s Chairman

& Chief Executive Officer, stated:

“We are pleased to announce the successful

closing of our most recent registered direct offering, which

represents the culmination of our recent capital raising

transactions. As a result of strong institutional interest, we

raised more than $30 million and have further strengthened our

balance sheet. This capital is highly accretive to our net asset

value.”

“Our sector is emerging from a period of

historical low rates, and as a result of our capital raising

program, we believe Seanergy is in a strong position to capitalize

on the improving market fundamentals.”

Following SHIP’s capital markets activity since

the end of March, SHIP’s pro-forma capitalization table is as

follows:

|

(amounts in thousands USD) |

Actual (31 Dec 2019) (audited) |

Pro-Forma (7 May 2020) (unaudited) |

|

Debt: |

|

|

|

Long-term debt (1) |

207,303 |

201,018 |

|

Convertible promissory notes (2) |

14,608 |

14,608 |

|

Total debt |

221,911 |

215,626 |

|

|

|

|

|

|

|

Total Shareholder’s equity (3) |

29,858 |

57,598 |

|

Total capitalization (4) |

251,769 |

273,224 |

| |

|

|

|

|

| (1) |

|

Includes arrangement fees and various deferred charges and excludes

all convertible promissory notes. |

| (2) |

|

Includes $3.4 million of the total outstanding $38.7 million in

convertible promissory notes that are classified under liabilities

in accordance with the beneficial conversion feature guidance of

U.S. GAAP. The balance of $11.2 million is the net non-cash

amortization in accordance with the beneficial conversion feature

guidance of U.S. GAAP. |

| (2) |

|

Includes $35.3 million of the total outstanding $38.7 million in

convertible promissory notes that are classified under equity in

accordance with the beneficial conversion feature guidance of U.S.

GAAP. |

| (2) |

|

Does not give any effect to the potential future exercise of

warrants issued in the recent transaction or other outstanding

warrants. |

| |

|

|

About Seanergy Maritime Holdings

Corp.

Seanergy Maritime Holdings Corp. is the only

pure-play Capesize ship-owner publicly listed in the US. Seanergy

provides marine dry bulk transportation services through a modern

fleet of 10 Capesize vessels, with a cargo-carrying capacity of

approximately 1,748,581 dwt and an average fleet age of

approximately 11 years. The Company is incorporated in the Marshall

Islands and has executive offices in Athens, Greece and an office

in Hong Kong. The Company's common shares trade on the Nasdaq

Capital Market under the symbol "SHIP", its Class A warrants under

"SHIPW" and its Class B warrants under “SHIPZ”.

Please visit our company website at:

www.seanergymaritime.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events. Words such as "may",

"should", "expects", "intends", "plans", "believes", "anticipates",

"hopes", "estimates" and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks and are based upon

a number of assumptions and estimates, which are inherently subject

to significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the Company's operating

or financial results; the Company's liquidity, including its

ability to service its indebtedness; competitive factors in the

market in which the Company operates; shipping industry trends,

including charter rates, vessel values and factors affecting vessel

supply and demand; future, pending or recent acquisitions and

dispositions, business strategy, areas of possible expansion or

contraction, and expected capital spending or operating expenses;

risks associated with operations outside the United States; and

other factors listed from time to time in the Company's filings

with the SEC, including the Registration Statement and its most

recent annual report on Form 20-F. The Company's filings can be

obtained free of charge on the SEC's website at www.sec.gov. Except

to the extent required by law, the Company expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

For further information please

contact:

Capital Link, Inc. Judit Csepregi 230 Park

Avenue Suite 1536 New York, NY 10169 Tel: (212) 661-7566 E-mail:

seanergy@capitallink.com

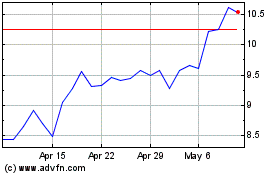

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

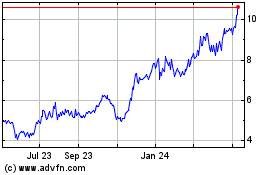

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Apr 2023 to Apr 2024