Seacoast Banking Corporation of Florida (NASDAQ: SBCF)

("Seacoast"), the holding company for Seacoast National Bank

("Seacoast Bank"), announced today the completion of its

acquisition of First Bank of the Palm Beaches ("First Bank"),

effective March 13, 2020, pursuant to the merger of First Bank

with and into Seacoast.

Under the terms of the merger agreement, First

Bank shareholders will receive 0.2000 shares of Seacoast common

stock for each share of First Bank common stock. The resulting

aggregate merger consideration paid by Seacoast was approximately

$21.9 million.

First Bank, headquartered in West Palm Beach,

has deposits of approximately $173 million and loans of $143

million as of December 31, 2019. Prior to the merger, First Bank

operated two branches in Palm Beach County. The acquisition

increases Seacoast’s presence in Palm Beach County, one of the

strongest and fastest growing market economies in Florida.

The acquisition complements Seacoast’s prior acquisitions in this

market, including Grand Bankshares, Inc. in 2015 and Palm Beach

Community Bank in 2017.

“We warmly welcome First Bank’s customers and

employees into the Seacoast family,” said Dennis S. Hudson, III,

Seacoast Chairman and CEO. “We are confident they will

readily enjoy our broad range of convenient and mobile-accessible

products and services as well as Seacoast’s personalized brand of

customer service.”

Transaction Details

Piper Sandler Companies served as financial

advisor and Alston & Bird LLP served as legal counsel to

Seacoast. Keefe, Bruyette & Woods, a Stifel Company, served as

financial advisor and Gunster, Yoakley & Stewart, P.A. served

as legal counsel to First Bank.

Customer Information

First Bank customers will benefit immediately

from the merger with access to Seacoast’s full suite of digital

banking products and local Florida-based customer service.

Additionally, customers will have fee-free access to Seacoast ATMs

and more than 1,100 Publix ATMs across the Southeast.

About Seacoast Banking Corporation of

Florida (NASDAQ: SBCF)

Seacoast Banking Corporation of Florida is one

of the largest community banks headquartered in Florida with

approximately $7.1 billion in assets and $5.6 billion in deposits

as of December 31, 2019. The Company provides integrated

financial services including commercial and retail banking, wealth

management, and mortgage services to customers through advanced

banking solutions and 48 traditional branches of its

locally-branded, wholly-owned subsidiary bank, Seacoast Bank.

Seacoast operates primarily in Florida, with concentrations in the

state's fastest growing markets. The Company's offices stretch from

the southeast, including Fort Lauderdale, Boca Raton and Palm Beach

north along the east coast to the Daytona area, into Orlando and

Central Florida and the adjacent Tampa market, and west to

Okeechobee and surrounding counties. More information about the

Company is available at www.SeacoastBanking.com.

Cautionary Notice Regarding

Forward-Looking Statements

This press release contains "forward-looking

statements" within the meaning, and protections, of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including, without limitation, statements

about future financial and operating results, cost savings,

enhanced revenues, economic and seasonal conditions in our markets,

and improvements to reported earnings that may be realized from

cost controls, tax law changes, new initiatives and for integration

of banks that we have acquired, or expect to acquire, including

First Bank, as well as statements with respect to Seacoast's

objectives, strategic plans, including Vision 2020, expectations

and intentions and other statements that are not historical facts.

Actual results may differ from those set forth in the

forward-looking statements.

Forward-looking statements include statements

with respect to our beliefs, plans, objectives, goals,

expectations, anticipations, assumptions, estimates and intentions

about future performance and involve known and unknown risks,

uncertainties and other factors, which may be beyond our control,

and which may cause the actual results, performance or achievements

of Seacoast to be materially different from future results,

performance or achievements expressed or implied by such

forward-looking statements. You should not expect us to update any

forward-looking statements.

All statements other than statements of

historical fact could be forward-looking statements. You can

identify these forward-looking statements through our use of words

such as "may", "will", "anticipate", "assume", "should", "support",

"indicate", "would", "believe", "contemplate", "expect",

"estimate", "continue", "further", "plan", "point to", "project",

"could", "intend", "target" or other similar words and expressions

of the future. These forward-looking statements may not be realized

due to a variety of factors, including, without limitation: the

effects of future economic and market conditions, including

seasonality; governmental monetary and fiscal policies, including

interest rate policies of the Board of Governors of the Federal

Reserve, as well as legislative, tax and regulatory changes;

changes in accounting policies, rules and practices; the risks of

changes in interest rates on the level and composition of deposits,

loan demand, liquidity and the values of loan collateral,

securities, and interest sensitive assets and liabilities; interest

rate risks, sensitivities and the shape of the yield curve;

uncertainty related to the impact of LIBOR calculations on

securities and loans; changes in borrower credit risks and payment

behaviors; changes in the availability and cost of credit and

capital in the financial markets; changes in the prices, values and

sales volumes of residential and commercial real estate; our

ability to comply with any regulatory requirements; the effects of

problems encountered by other financial institutions that adversely

affect us or the banking industry; our concentration in commercial

real estate loans; the failure of assumptions and estimates, as

well as differences in, and changes to, economic, market and credit

conditions; the impact on the valuation of our investments due to

market volatility or counterparty payment risk; statutory and

regulatory dividend restrictions; increases in regulatory capital

requirements for banking organizations generally; the risks of

mergers, acquisitions and divestitures, including our ability to

continue to identify acquisition targets and successfully acquire

desirable financial institutions; changes in technology or products

that may be more difficult, costly, or less effective than

anticipated; our ability to identify and address increased

cybersecurity risks; inability of our risk management framework to

manage risks associated with our business; dependence on key

suppliers or vendors to obtain equipment or services for our

business on acceptable terms; reduction in or the termination of

our ability to use the mobile-based platform that is critical to

our business growth strategy; the effects of war or other

conflicts, acts of terrorism, natural disasters, health

emergencies, epidemics, or pandemics or other catastrophic events

that may affect general economic conditions; unexpected outcomes

of, and the costs associated with, existing or new litigation

involving us; our ability to maintain adequate internal controls

over financial reporting; potential claims, damages, penalties,

fines and reputational damage resulting from pending or future

litigation, regulatory proceedings and enforcement actions; the

risks that our deferred tax assets could be reduced if estimates of

future taxable income from our operations and tax planning

strategies are less than currently estimated and sales of our

capital stock could trigger a reduction in the amount of net

operating loss carryforwards that we may be able to utilize for

income tax purposes; the effects of competition from other

commercial banks, thrifts, mortgage banking firms, consumer finance

companies, credit unions, securities brokerage firms, insurance

companies, money market and other mutual funds and other financial

institutions operating in our market areas and elsewhere, including

institutions operating regionally, nationally and internationally,

together with such competitors offering banking products and

services by mail, telephone, computer and the Internet; and the

failure of assumptions underlying the establishment of reserves for

possible loan losses.

The risks relating to the First Bank merger

include, without limitation: the diversion of management time on

issues related to the merger; unexpected transaction costs,

including the costs of integrating operations; the risks that the

businesses will not be integrated successfully or that such

integration may be more difficult, time- consuming or costly than

expected; the potential failure to fully or timely realize expected

revenues and revenue synergies, including as the result of revenues

following the merger being lower than expected; the risk of deposit

and customer attrition; any changes in deposit mix; unexpected

operating and other costs, which may differ or change from

expectations; the risks of customer and employee loss and business

disruptions, including, without limitation, as the result of

difficulties in maintaining relationships with employees; increased

competitive pressures and solicitations of customers by

competitors; as well as the difficulties and risks inherent with

entering new markets.

All written or oral forward-looking statements

attributable to us are expressly qualified in their entirety by

this cautionary notice, including, without limitation, those risks

and uncertainties described in our annual report on Form 10-K for

the year ended December 31, 2019, under "Special Cautionary Notice

Regarding Forward-looking Statements" and "Risk Factors", and

otherwise in our SEC reports and filings. Such reports are

available upon request from the Company, or from the Securities and

Exchange Commission, including through the SEC's Internet website

at www.sec.gov.

Media Contact:Joel

Staley407-242-9994joel@jcs-communications.com

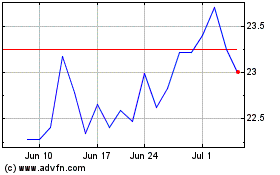

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

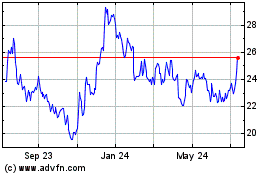

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Apr 2023 to Apr 2024