Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

January 28 2020 - 1:41PM

Edgar (US Regulatory)

Filed by Seacoast

Banking Corporation of Florida

Pursuant to

Rule 425 under the Securities Act of 1933

Subject Company:

First Bank of the Palm Beaches

SEC Registration

Statement No.: 333-235892

January 27, 2020

To Our Shareholders:

The purpose of this communication is to remind our shareholders

of the importance of locating your original stock certificates to facilitate the exchange of shares pursuant to the proposed

merger of First Bank of the Palm Beaches (“First Bank”) with and into Seacoast National Bank (“Seacoast”)

pursuant to the merger agreement by and among First Bank, Seacoast and Seacoast Banking Corporation of Florida (“SBCF”).

If you cannot locate your original certificate, you must file

a lost certificate affidavit with First Bank prior to Friday, February 21, 2020 to replace the lost, stolen or destroyed certificate.

After this date, you will incur significant fees to facilitate this process.

If First Bank shareholders approve the merger with Seacoast

and the merger is consummated, you will receive a communication from SBCF’s stock transfer agent requesting that you return

your original First Bank stock certificates in exchange for the merger consideration in the form of SBCF common stock. If an original

First Bank stock certificate cannot be produced, the exchange agent will only issue shares of SBCF common stock upon receipt of

the following two items:

|

|

(1)

|

An affidavit from you that the certificate has been

lost, stolen or destroyed

|

and

|

|

(2)

|

The posting of a bond in favor of the exchange agent,

the cost of which will be approximately 3% of the value of the shares represented by the lost, stolen, or destroyed certificate,

which you must pay to the bonding company.`

|

To mitigate this issue, if your certificate

has been lost, stolen or destroyed, please contact Dawn Myers at dmyers@firstbankpb.bank

or (561) 847-2701 by February 21, 2020 to arrange for replacement certificate(s).

Sincerely,

Joseph B. (Jay) Shearouse, III

Chairman & Chief Executive Officer

|

First Bank of the Palm Beaches – 415 5th Street,

West Palm Beach, FL 33401 – (561) 847-2700

|

|

Additional Information

SBCF has filed a

registration statement on Form S-4 with the United States Securities and Exchange Commission (the “SEC”) in

connection with the proposed merger. The registration statement includes a proxy statement of First Bank and a prospectus of

SBCF. A definitive proxy statement/prospectus will be mailed to shareholders of First Bank. This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. WE

URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH

THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION.

Investors may

obtain (when available) these documents free of charge at the SEC’s Web site (www.sec.gov).

In addition, documents filed with the SEC by SBCF will be available free of charge by contacting Investor Relations at (772) 288-6085.

First Bank, its directors and executive

officers and other members of management and employees may be considered participants in the solicitation of proxies in connection

with the proposed merger. Information regarding the participants in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, is contained in the proxy statement/prospectus and other relevant materials

to be filed with the SEC.

Cautionary Notice Regarding Forward-Looking

Statements

This letter

contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, and is intended to be protected by the safe harbor provided by the same. These statements

are subject to numerous risks and uncertainties. These risks and uncertainties include, but are not limited to, the following:

failure to obtain the approval of shareholders of First Bank in connection with the merger; the timing to consummate the proposed

merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the risk that a regulatory approval

that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the

parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly

and effectively integrate the businesses of SBCF and First Bank, including unexpected transaction costs, the costs of integrating

operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger;

the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the

risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining

relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; the

difficulties and risks inherent with entering new markets; and changes in general economic conditions. For additional information

concerning factors that could cause actual conditions, events or results to materially differ from those described in the forward-looking

statements, please refer to the factors set forth under the headings "Risk Factors" and "Management's Discussion

and Analysis of Financial Condition and Results of Operations" in SBCF's most recent Form 10-K report, Form 10-Q report and

Form 8-K reports, which are available online at www.sec.gov. No assurances can be given that any of the events anticipated

by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results

of operations or financial condition of SBCF or First Bank.

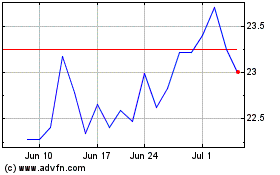

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

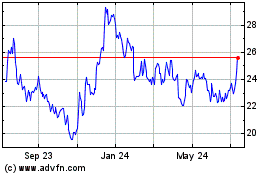

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Apr 2023 to Apr 2024