Star Bulk Carriers Corp. (the "Company" or "Star Bulk") (Nasdaq:

SBLK, Oslo: SBLK), a global shipping company focusing on the

transportation of dry bulk cargoes announced today that it has

entered into an en bloc definitive agreement with entities

controlled by Delphin Shipping LLC (“Delphin” or “Sellers”), an

entity affiliated with Kelso & Company (“Kelso”), pursuant to

which the Company will acquire eleven (11) operating dry bulk

vessels (the “Vessels”) for an aggregate purchase price of $139.5

million (“Purchase Price”), payable in the form of a) $80.0 million

in cash and b) 4.503 million common shares of Star Bulk (the

“Consideration Shares”), (the “Vessel Acquisition”). The Company

has secured exhaust gas cleaning systems (“EGCS” or “Scrubbers”)

for all of the Vessels with attractive delivery dates.

The cash portion of the Purchase Price will be

financed through proceeds of a new seven-year capital lease of up

to $93.6 million with China Merchants Bank Leasing, and an

additional tranche of $15.0 million for financing of Scrubbers,

thus offering approx. $9.0 million of additional liquidity for Star

Bulk.

Below are the details of the Vessels to be

acquired from Delphin:

|

The Acquired Vessels: |

|

|

|

|

Vessel |

YoB |

Yard |

DWT |

| Apus |

2014 |

Jiangsu

Hantong |

63,100 |

|

Aquila |

2012 |

Jiangsu

Hantong |

56,500 |

|

Cepheus |

2012 |

Jiangsu

Hantong |

56,500 |

|

Columba |

2012 |

Jiangsu

Hantong |

56,500 |

| D.

Centaurus |

2012 |

Jiangsu

Hantong |

56,600 |

|

Dorado |

2013 |

Jiangsu

Hantong |

56,500 |

|

Hercules |

2012 |

Jiangsu

Hantong |

56,500 |

|

Hydrus |

2013 |

Jiangsu

Hantong |

56,600 |

| Leo |

2013 |

Jiangsu

Hantong |

56,600 |

|

Pegasus |

2013 |

Jiangsu

Hantong |

56,500 |

|

Pyxis |

2013 |

Jiangsu

Hantong |

56,600 |

|

Total |

|

|

628,500 |

The Vessel Acquisition, which is expected to be

consummated in June 2019, remains subject to the execution of

definitive finance agreements and customary closing conditions. The

technical management of the 11 vessels will remain with an entity

affiliated with Technomar, while commercial management will be

taken over by Star Bulk.

As a result of the contemplated transaction,

entities affiliated with Kelso are expected to own approximately

4.6% of the outstanding common shares of the Company. After giving

effect to the Vessel Acquisition, Star Bulk will have a fleet of

120 vessels on a fully delivered basis, aggregate cargo-carrying

capacity of approximately 13.1 million deadweight tons and vessels

with an average age of 7.8 years.

About Star Bulk

Star Bulk is a global shipping company providing

worldwide seaborne transportation solutions in the dry bulk sector.

Star Bulk’s vessels transport major bulks, which include iron ore,

coal and grain, and minor bulks, which include bauxite, fertilizers

and steel products. Star Bulk was incorporated in the Marshall

Islands on December 13, 2006 and maintains executive offices in

Athens, Oslo, New York, Cyprus and Geneva. Its common stock trades

on the Nasdaq Global Select Market and on the Oslo Stock Exchange

under the symbol “SBLK”. On a fully delivered basis, Star Bulk will

have a fleet of 120 vessels, with an aggregate capacity of 13.1

million dwt, consisting of 17 Newcastlemax, 19 Capesize, 2 Mini

Capesize, 7 Post Panamax, 35 Kamsarmax, 2 Panamax, 18 Ultramax and

20 Supramax vessels with carrying capacities between 52,055 dwt and

209,537 dwt. Where we refer to information on a “fully delivered

basis,” we are referring to such information after giving

effect to the delivery of two newbuilding vessels and the

successful consummation of the Vessel Acquisition.

Forward-Looking Statements

Matters discussed in this press release may

constitute forward looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Company desires to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and is including this cautionary statement in

connection with this safe harbor legislation. The words “believe,”

“anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “may,” “should,” “expect,” “pending” and similar

expressions identify forward-looking statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, examination by the Company’s management of historical

operating trends, data contained in its records and other data

available from third parties. Although the Company believes that

these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond the Company’s control, the Company cannot assure you that it

will achieve or accomplish these expectations, beliefs or

projections.

In addition to these important factors, other

important factors that, in the Company’s view, could cause actual

results to differ materially from those discussed in the

forward-looking statements include general dry bulk shipping market

conditions, including fluctuations in charterhire rates and vessel

values; the strength of world economies; the stability of Europe

and the Euro; fluctuations in interest rates and foreign exchange

rates; changes in demand in the dry bulk shipping industry,

including the market for our vessels; changes in our operating

expenses, including bunker prices, dry docking and insurance costs;

changes in governmental rules and regulations or actions taken by

regulatory authorities; potential liability from pending or future

litigation; general domestic and international political

conditions; potential disruption of shipping routes due to

accidents or political events; the availability of financing and

refinancing; our ability to meet requirements for additional

capital and financing to complete our newbuilding program and grow

our business; the impact of the level of our indebtedness and the

restrictions in our debt agreements; vessel breakdowns and

instances of off‐hire; risks associated with vessel construction;

potential exposure or loss from investment in derivative

instruments; potential conflicts of interest involving our Chief

Executive Officer, his family and other members of our senior

management and our ability to complete acquisition transactions as

planned. Please see our filings with the Securities and Exchange

Commission for a more complete discussion of these and other risks

and uncertainties. The information set forth herein speaks only as

of the date hereof, and the Company disclaims any intention or

obligation to update any forward‐looking statements as a result of

developments occurring after the date of this communication.

Contacts

Company:Simos Spyrou, Christos

BeglerisCo ‐ Chief Financial Officers Star Bulk Carriers Corp.c/o

Star Bulk Management Inc.40 Ag. Konstantinou Av.Maroussi

15124Athens, GreeceEmail: info@starbulk.comwww.starbulk.com

Investor Relations / Financial Media:

Nicolas BornozisPresidentCapital Link, Inc.230

Park Avenue, Suite 1536New York, NY 10169Tel. (212) 661‐7566E‐mail:

starbulk@capitallink.comwww.capitallink.com

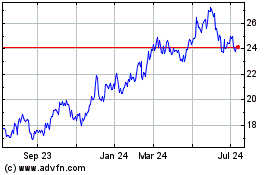

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

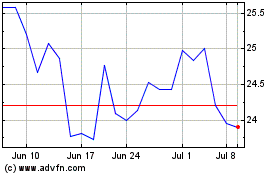

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Apr 2023 to Apr 2024