Filed by Clever Leaves Holdings Inc.

Pursuant to

Rule 425 under the Securities Act of 1933, and

deemed filed

pursuant to Rule 14a-12 under the

Securities

Exchange Act of 1934

Subject Companies:

Clever Leaves

International Inc.

Schultze Special

Purpose Acquisition Corp.

(Commission

File No. 001-38760)

Clever Leaves Business Combination

Agreement Update

Dear Friends and Investors,

Regardless of what side of the political aisle you sit on, the

clear takeaway from the recent US elections is that the end of cannabis prohibition is an unstoppable train that is picking up

steam. While you cannot time everything in life, it is with great timing that we are pleased to announce an exciting revision

to the transaction terms of our upcoming business combination with Schultze Special Purpose Acquisition Corp. (SAMA). Since initially

announcing our definitive agreement in July 2020, we have been working diligently with the SAMA team to construct an agreement

with two goals in mind: (i) raising the necessary capital to execute the company’s business plan and (ii) creating value

for our shareholders by enhancing the liquidity profile of the company by listing on Nasdaq. Accordingly, we are pleased to share

these revised terms which we believe will increase transaction certainty and add further value to our shareholders. Please see

below for some of the amendment highlights1:

|

|

·

|

Enterprise Value Reduction of 20%: The expected enterprise

value has been reduced from $255 million to $206 million. Since the initial transaction announcement, peer company valuation multiples

have increased by approximately 20%.

|

|

|

·

|

Significant Reduction in the Minimum Cash Condition to $26 Million:

The minimum cash condition for SAMA to achieve closing has been reduced from $60 million to $26 million, substantially increasing

the likelihood of the transaction completion.

|

|

|

·

|

Institutional Investor Sponsorship through Private Placement and

Reduction of SAMA’s Sponsor Economics: In connection with these revised terms, institutional investors, including

existing equity holders, existing convertible noteholders and a new institutional investor, have committed over $10.0 million through

a private placement to be funded at closing of the Business Combination. This is in addition to private capital investments

closed over the past few weeks of over $4 million. Schultze Special Purpose Acquisition Sponsor, LLC has also restructured

its equity ownership to better align with the capital retained at closing.

|

|

|

·

|

Committed Capital Pool in Excess of the Minimum Cash Condition:

Combined with the private placement, certain stockholders holding over 1.5 million shares of SAMA common stock have agreed not

to redeem their shares (subject to certain conditions), providing a path to over $16 million of additional committed capital available

to Clever Leaves at closing, bringing the committed capital pool to over $26 million, which would satisfy the Minimum Cash Condition.

When including SAMA’s cash in trust, we are hopeful to secure over $80 million of cash on the balance sheet following closing.

|

|

|

·

|

Committed Capital Pool in Excess of the Minimum Cash Condition:

In addition to contributions to the $10 million private placement,

our existing convertible noteholders have agreed to several amendments which will become effective

only upon closing of the SAMA transaction. These amendments include: (i) reducing the interest rate to 8% from 10% commencing

January 1, 2021, (ii) granting the company the option to pay interest by issuing common shares, (iii) granting the company

the option to prepay the convertible notes at any time, and (iv) granting the company the option to repay up to $2

million of principal every quarter through issuing common shares. Combined, nearly 1/3rd of amounts owed to the convertible

noteholders through maturity could be repaid in common shares, creating a significant show of support and mutual alignment about

compounding equity value over time.

|

Read the full press release here2:

SAMA and Clever Leaves Announce Revised Transaction Terms

I would like to take a moment to thank the Clever Leaves and SAMA team members who have worked tirelessly for the last couple months on drafting documents and conducting investor outreach, and we will continue to work together to stay on pace to consummate the transaction in the coming weeks.

Additionally, I would like to thank all existing investors and supporters who have helped build Clever Leaves into what we are today. For any questions on disclosed terms or general questions on the transaction, please feel free to reach out to our Investor Relations team at Gateway by emailing Cody Slach (cody@gatewayir.com), Sean Mansouri (sean@gatewayir.com) or Del Wright (del.wright@cleverleaves.com).

Please keep an eye out in the coming

weeks for an update on commercial developments, which we anticipate to carry even more of an impact within the industry as we

watch the shift in momentum as a result of the U.S. Presidential election. Thank you for the continued support and we will be

in touch soon!

Cultivate Mojo. Create Value. Change Lives.

Regards,

Kyle Detwiler

CEO, Clever Leaves

www.cleverleaves.com

1 This summary of the transaction is qualified in its

entirety by the information contained in the Registration Statement on Form S-4 (Registration Statement) filed by Clever

Leaves Holdings Inc. with the SEC on November 9, 2020, which can be found by accessing the following link2:

https://www.sec.gov/Archives/edgar/data/1819615/000121390020036028/fs42020a2_cleverleaves.htm

2 The information contained on our website or any external websites does not form a part of, and is not incorporated by reference into, this announcement.

About Schultze Special Purpose

Acquisition Corp.

Schultze Special Purpose Acquisition

Corp. (Nasdaq: SAMA, SAMAW, and SAMAU) is a blank check company formed for the purpose of entering into a merger, stock exchange,

asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses

or entities. SAMA’s sponsor is an affiliate of Schultze Asset Management, LP, an alternative investment management firm founded

in 1998 that focuses on distressed, special situation and event-driven securities and has invested over $3.2 billion since inception

with a notable track-record through its active investment strategy. SAMA itself is backed by an experienced team of operators and

investors with a successful track-record of creating material value in public and private companies.

About Clever Leaves

Clever Leaves is a multi-national

cannabis company with a mission to operate in compliance with federal and state laws and with an emphasis on ecologically sustainable,

large-scale cultivation and pharmaceutical-grade processing as the cornerstones of its global cannabinoid business. With operations

and investments in Canada, Colombia, Germany, Portugal, and the United States, Clever Leaves has created an effective distribution

network and global footprint, with a foundation built upon capital efficiency and rapid growth. Clever Leaves aims to be one of

the industry's leading global cannabinoid companies recognized for its principles, people, and performance while fostering a healthier

global community.

Additional Information and Where

to Find It

SAMA, Clever Leaves and Clever Leaves

Holdings Inc. (“Holdco”) urge investors, stockholders and other interested persons to read the Registration Statement,

including the proxy statement/prospectus contained therein, as well as other documents filed with the SEC, because these documents

will contain important information about the proposed business combination between Clever Leaves and SAMA (the “Business

Combination”). Following the Registration Statement having been declared effective by the SEC, a definitive proxy statement/prospectus

will be mailed to stockholders of SAMA as of a record date to be established for voting on the Business Combination. SAMA’s

stockholders will also be able to obtain a copy of such documents, without charge, by directing a request to: Schultze Special

Purpose Acquisition Corp, 800 Westchester Avenue, Suite 632, Rye Brook, New York 10573; e-mail: sdu@samco.net. These documents,

once available, can also be obtained, without charge, at the SEC’s web site (http://www.sec.gov).

Participants in Solicitation

SAMA, Clever Leaves, Holdco and

their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed

to be participants in the solicitation of proxies of SAMA stockholders in connection with the Business Combination. Information

regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to SAMA’s stockholders

in connection with the Business Combination is set forth in the preliminary proxy statement/prospectus contained in the Registration

Statement and will also be included in the definitive proxy statement/prospectus for the Business Combination when available. Information

concerning the interests of SAMA’s and Clever Leaves’ participants in the solicitation, which may, in some cases, be

different than those of SAMA’s and Clever Leaves’ equity holders generally, is also set forth in the proxy statement/prospectus

contained in the Registration Statement, and will also be included in the definitive proxy statement/prospectus for the Business

Combination when available.

Forward Looking Statements

This announcement includes

forward-looking statements that involve risks and uncertainties. Forward-looking statements are statements that are not historical

facts and may be identified by the words "estimates," "projected," "expects," "anticipates,"

"forecasts," "plans," "intends," "believes," "seeks," "may," "will,"

"should," "future," "propose" and variations of these words or similar expressions (or the negative

versions of such words or expressions). Such forward-looking statements are subject to risks and uncertainties, which could cause

actual results to differ from the forward-looking statements. Factors that may cause such differences include, without limitation,

SAMA's and Clever Leaves' inability to complete the transactions contemplated by the Business Combination; matters discovered

by the parties as they complete their respective due diligence investigation of the other; the inability to recognize the anticipated

benefits of the Business Combination, which may be affected by, among other things, the amount of cash available following any

redemptions by SAMA stockholders and the ability to close the private placement with certain institutional investors; the ability

to meet Nasdaq's listing standards following the consummation of the Business Combination; costs related to the Business Combination;

expectations with respect to future operating and financial performance and growth, including when Clever Leaves or Holdco will

become cash flow positive; the timing of the completion of the Business Combination; Clever Leaves' ability to execute its business

plans and strategy and to receive regulatory approvals; potential litigation involving the parties; global economic conditions;

geopolitical events, natural disasters, acts of God and pandemics, including, but not limited to, the economic and operational

disruptions and other effects of COVID-19; regulatory requirements and changes thereto; access to additional financing; and other

risks and uncertainties indicated from time to time in filings with the SEC. Other factors include the possibility that the proposed

transaction does not close, including due to the failure to receive required security holder approvals or the failure to satisfy

other closing conditions. The foregoing list of factors is not exclusive. Additional information concerning certain of these and

other risk factors is contained in SAMA's most recent filings with the SEC and is contained in the Registration Statement, including

the proxy statement/prospectus contained therein. All subsequent written and oral forward-looking statements concerning SAMA,

Clever Leaves or Holdco, the transactions described herein or other matters and attributable to SAMA, Clever Leaves, Holdco or

any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned

not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Each of SAMA, Clever Leaves

and Holdco expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in their expectations with respect thereto or any change in events, conditions

or circumstances on which any statement is based.

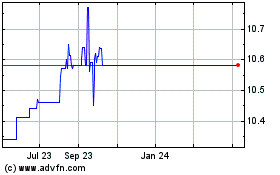

Schultze Special Purpose... (NASDAQ:SAMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Schultze Special Purpose... (NASDAQ:SAMA)

Historical Stock Chart

From Apr 2023 to Apr 2024