ScanSource, Inc. (NASDAQ: SCSC), a leading provider of

technology products and solutions, today announced financial

results for the third quarter ended March 31, 2020.

Quarter ended March

31,

2020

2019

Change

(in millions, except per share

data)

Net sales

$

872.5

$

893.4

(2

)%

Non-GAAP net sales, excluding Planned

Divestitures(1)

744.6

752.8

(1

)%

Operating income

6.3

18.8

(66

)%

Non-GAAP operating income(1)

(2)

14.8

30.6

(52

)%

Net income

1.7

11.7

(85

)%

Non-GAAP net income(1) (2)

9.3

20.6

(55

)%

Diluted EPS

$

0.07

$

0.45

(84

)%

Non-GAAP diluted EPS(1) (2)

$

0.37

$

0.80

(54

)%

(1) A reconciliation of non-GAAP financial

information to GAAP financial information is presented in the

Supplementary Information (Unaudited) below.

(2) Non-GAAP results exclude amortization

of intangible assets related to acquisitions, change in fair value

of contingent consideration, the impact of Planned Divestitures and

other non-GAAP items. A reconciliation of non-GAAP to GAAP

financial information is presented below.

“In March, companies around the world, including ours,

immediately shifted to work-from-home,” said Mike Baur, Chairman

and CEO, ScanSource, Inc. “I am proud of how our ScanSource

employees made the transition to work-from-home and delivered the

same level of customer service. During the quarter, we saw an

accelerated decline in our sales of premise-based communications

products. However, we had a significant increase in sales of

headsets, cameras, speakers, keyboards, displays, back-up power

supplies, IP desk phones, and connectivity to support remote

workers. Overall, we are pleased with our results delivering on our

sales expectations.”

Quarterly Results

Net sales were $872.5 million for the third quarter of fiscal

year 2020, down 2% year-over-year, principally from the negative

impact of foreign currency translation. Excluding the foreign

currency translation and net sales from the Planned Divestitures

and acquisitions, organic net sales growth for third quarter of

fiscal year 2020 totaled 0.5%. Net sales grew across most of

ScanSource’s diversified technologies in North America and Brazil.

In addition, the sales growth reflected accelerated growth for

work-from-home solutions from the immediate move to remote

workforces in March.

Operating income for the third quarter decreased to $6.3 million

year-over-year, and non-GAAP operating income decreased to $14.8

million from the prior-year quarter. This decrease includes a $4.5

million expense for inventory charges following the conversion to a

new inventory management system. This charge increased cost of

goods sold, which lowered gross profit for the third quarter of

fiscal year 2020.

On a GAAP basis, net income for the third quarter of fiscal year

2020 totaled $1.7 million, or $0.07 per diluted share, compared to

net income of $11.7 million, or $0.45 per diluted share, for the

prior-year quarter. Non-GAAP net income totaled $9.3 million, or

$0.37 per diluted share, compared to $20.6 million, or $0.80 per

diluted share, for the prior-year quarter.

As of March 31, 2020, ScanSource had cash and cash equivalents

of $35 million and total debt of $321 million. In the third quarter

of fiscal year 2020, the Company generated $32 million of operating

cash flow.

Plan to Divest Certain Businesses Outside of US, Canada and

Brazil

On August 20, 2019, ScanSource announced plans to divest its

physical products distribution businesses outside of the United

States, Canada and Brazil. ScanSource continues to operate and

invest in its digital distribution business in these geographies.

These plans are part of a strategic portfolio repositioning to

align investments with higher-growth, higher-margin businesses. The

Company has identified potential buyers for these businesses and is

in due diligence and purchase agreement negotiations. There can be

no assurance that this sale process will result in a transaction or

regarding the timing of any transaction. The Planned Divestitures,

comprised of physical product businesses in Europe, UK, Mexico,

Colombia, Chile, Peru and the Miami-based export operations, had

net sales of $127.9 million for the third quarter of fiscal year

2020 and at March 31, 2020 had working capital of $155.5

million.

COVID-19 Update

Our top priority during the COVID-19 Pandemic is protecting the

health and safety of our employees. We have implemented travel

restrictions and moved quickly to transition our employees, where

possible, to a fully remote working environment. Nearly all

office-based employees around the world are working remotely. We

have taken a number of measures to ensure our teams feel secure in

their jobs and have the flexibility and resources they need to stay

safe and healthy. We expect higher costs from these safety measures

to protect our employees. We are continuing to provide the high

level of customer service our partners expect from us.

Update on Forecasts

Given the uncertainties related to the COVID-19 pandemic and the

changing economic environment, we are not providing our

expectations for net sales or earnings per share for the fourth

quarter of fiscal year 2020.

Webcast Details and CFO Commentary

At approximately 4:15 p.m. ET today, a CFO commentary, as a

supplement to this press release and the Company's conference call,

will be available on ScanSource's website, www.scansource.com

(Investor Relations section). ScanSource will present additional

information about its financial results in a conference call today,

May 11, 2020, at 5:00 p.m. ET. A webcast of the call will be

available for all interested parties and can be accessed at

www.scansource.com (Investor Relations section). The webcast will

be available for replay for 60 days.

Safe Harbor Statement

This press release contains “forward-looking” statements,

including the Company's Planned Divestitures and the impact of the

COVID-19 pandemic, which involve risks and uncertainties. Any

number of factors could cause actual results to differ materially

from anticipated results, including, but not limited to, the impact

of the COVID-19 pandemic on our operations and financial condition,

the Company's ability to complete the Planned Divestitures on

acceptable terms or to otherwise dispose of the operations, changes

in interest and exchange rates and regulatory regimes impacting the

Company's international operations, the impact of tax reform laws,

the failure of acquisitions to meet the Company's expectations, the

failure to manage and implement the Company's organic growth

strategy, credit risks involving the Company's larger customers and

suppliers, termination of the Company's relationship with key

suppliers or a significant modification of the terms under which it

operates with a key supplier, the decline in demand for the

products and services that the Company provides, reduced prices for

the products and services that the Company provides due both to

competitor and customer action, changes in the Company's operating

strategy, and other factors set forth in the "Risk Factors"

contained in the Company's annual report on Form 10-K for the year

ended June 30, 2019 and quarterly report on Form 10-Q for the

quarter ended March 31, 2020, filed with the Securities and

Exchange Commission. Except as may be required by law, the Company

expressly disclaims any obligation to update these forward-looking

statements to reflect events or circumstances after the date of

this press release or to reflect the occurrence of unanticipated

events.

Non-GAAP Financial Information

In addition to disclosing results that are determined in

accordance with United States Generally Accepted Accounting

Principles ("GAAP"), the Company also discloses certain non-GAAP

financial measures, which are summarized below. Non-GAAP financial

measures are used to understand and evaluate performance, including

comparisons from period to period. Non-GAAP results exclude

amortization of intangible assets related to acquisitions, change

in fair value of contingent consideration, acquisition costs,

restructuring costs and other non-GAAP adjustments.

Net sales on a constant currency basis, excluding Planned

Divestitures and acquisitions: The Company discloses the percentage

change in net sales excluding the translation impact from changes

in foreign currency exchange rates between reporting periods and

excluding the net sales from Planned Divestitures, as well as

acquisitions prior to the first full year from the acquisition

date. This measure enhances the comparability between periods to

help analyze underlying trends on an organic basis.

Income Statement Non-GAAP Metrics: To evaluate current period

performance on a more consistent basis with prior periods, the

Company discloses non-GAAP net sales, non-GAAP gross profit,

non-GAAP operating income, non-GAAP other expense, net, non-GAAP

pre-tax income, non-GAAP net income and non-GAAP diluted earnings

per share (non-GAAP diluted "EPS"). Non-GAAP results exclude

amortization of intangible assets related to acquisitions, changes

in fair value of contingent consideration, acquisition and

divestiture costs, impact of Planned Divestitures and other

non-GAAP adjustments. Non-GAAP metrics are useful in assessing and

understanding the Company's operating performance, especially when

comparing results with previous periods or forecasting performance

for future periods.

Return on invested capital ("ROIC"): Management uses ROIC as a

performance measurement to assess efficiency in allocating capital

under the Company's control to generate returns. Management

believes this metric balances the Company's operating results with

asset and liability management, is not impacted by capitalization

decisions and correlates with shareholder value creation. In

addition, it is easily computed, communicated and understood. ROIC

also provides management a measure of the Company's profitability

on a basis more comparable to historical or future periods.

ROIC assists management in comparing the Company's performance

over various reporting periods on a consistent basis because it

removes from operating results the impact of items that do not

reflect core operating performance. ROIC is calculated as adjusted

EBITDA over invested capital. Adjusted earnings before interest

expense, income taxes, depreciation and amortization ("Adjusted

EBITDA") excludes the change in fair value of contingent

consideration, in addition to other non-GAAP adjustments. Invested

capital is defined as average equity plus average daily funded

interest-bearing debt for the period. Management believes the

calculation of ROIC provides useful information to investors and is

an additional relevant comparison of the Company's performance

during the year.

These non-GAAP financial measures have limitations as analytical

tools, and the non-GAAP financial measures that the Company reports

may not be comparable to similarly titled amounts reported by other

companies. Analysis of results and outlook on a non-GAAP basis

should be considered in addition to, and not in substitution for or

as superior to, measurements of financial performance prepared in

accordance with GAAP. A reconciliation of the Company's non-GAAP

financial information to GAAP is set forth in the Supplementary

Information (Unaudited) below.

About ScanSource, Inc.

ScanSource, Inc. (NASDAQ: SCSC) is at the center of the

technology solution delivery channel, connecting businesses and

providing solutions for their complex needs. ScanSource sells

through multiple, specialized routes-to-market with digital,

physical and services offerings from the world’s leading suppliers

of point-of-sale (POS), payments, barcode, physical security,

unified communications and collaboration, telecom and cloud

services. ScanSource enables its sales partners to create, deliver

and manage solutions for end-customers across almost every vertical

market. Founded in 1992 and headquartered in Greenville, South

Carolina, ScanSource was named one of the Best Places to Work in

South Carolina and on FORTUNE magazine’s 2020 List of World’s Most

Admired Companies. ScanSource ranks #643 on the Fortune 1000. For

more information, visit www.scansource.com.

ScanSource, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands)

March 31, 2020

June 30, 2019*

Assets

Current assets:

Cash and cash equivalents

$

34,596

$

23,818

Accounts receivable, less allowance of

$34,119 at March 31, 2020 and $38,849 at June 30, 2019

618,758

654,983

Inventories

666,458

697,343

Prepaid expenses and other current

assets

116,221

101,171

Total current assets

1,436,033

1,477,315

Property and equipment, net

60,891

63,363

Goodwill

338,358

319,538

Identifiable intangible assets, net

133,228

127,939

Deferred income taxes

23,635

24,724

Other non-current assets

81,656

54,382

Total assets

$

2,073,801

$

2,067,261

Liabilities and Shareholders'

Equity

Current liabilities:

Accounts payable

$

608,417

$

558,101

Accrued expenses and other current

liabilities

108,086

91,407

Current portion of contingent

consideration

45,660

38,393

Income taxes payable

989

4,310

Short-term borrowings

143

4,590

Current portion of long-term debt

6,901

4,085

Total current liabilities

770,196

700,886

Deferred income taxes

1,077

1,395

Long-term debt, net of current portion

145,050

151,014

Borrowings under revolving credit

facility

168,502

200,817

Long-term portion of contingent

consideration

—

39,532

Other long-term liabilities

91,298

59,488

Total liabilities

1,176,123

1,153,132

Shareholders' equity:

Common stock

62,314

64,287

Retained earnings

964,538

939,930

Accumulated other comprehensive income

(loss)

(129,174

)

(90,088

)

Total shareholders' equity

897,678

914,129

Total liabilities and shareholders'

equity

$

2,073,801

$

2,067,261

*

Derived from audited financial

statements.

ScanSource, Inc. and

Subsidiaries

Condensed Consolidated Income

Statements (Unaudited)

(in thousands, except per

share data)

Quarter ended March

31,

Nine months ended March

31,

2020

2019

2020

2019

Net sales

$

872,483

$

893,357

$

2,850,812

$

2,912,278

Cost of goods sold

777,674

783,342

2,530,020

2,569,570

Gross profit

94,809

110,015

320,792

342,708

Selling, general and administrative

expenses

78,923

77,688

244,557

236,569

Depreciation expense

3,493

3,417

10,500

9,954

Intangible amortization expense

5,486

5,005

16,079

14,708

Change in fair value of contingent

consideration

618

5,101

6,266

11,535

Operating income

6,289

18,804

43,390

69,942

Interest expense

3,421

3,670

10,964

9,415

Interest income

(1,080

)

(682

)

(2,629

)

(1,397

)

Other expense, net

296

21

102

254

Income before income taxes

3,652

15,795

34,953

61,670

Provision for income taxes

1,939

4,080

10,345

15,651

Net income

$

1,713

$

11,715

$

24,608

$

46,019

Per share data:

Net income per common share, basic

$

0.07

$

0.46

$

0.97

$

1.79

Weighted-average shares outstanding,

basic

25,346

25,704

25,386

25,647

Net income per common share, diluted

$

0.07

$

0.45

$

0.97

$

1.79

Weighted-average shares outstanding,

diluted

25,363

25,762

25,444

25,755

ScanSource, Inc. and

Subsidiaries

Supplementary Information

(Unaudited)

Net Sales by Segment:

Quarter ended March

31,

2020

2019

% Change

Worldwide Barcode, Networking &

Security:

(in thousands)

Net sales, reported

$

583,642

$

596,913

(2.2

)%

Planned Divestitures

(94,424

)

(100,170

)

Non-GAAP net sales, excluding Planned

Divestitures

489,218

496,743

(1.5

)%

Foreign exchange impact (a)

3,590

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

492,808

$

496,743

(0.8

)%

Worldwide Communications &

Services:

Net sales, reported

$

288,841

$

296,444

(2.6

)%

Planned Divestitures

(33,451

)

(40,341

)

Non-GAAP net sales, excluding Planned

Divestitures

255,390

256,103

(0.3

)%

Foreign exchange impact (a)

9,738

—

Less: Acquisitions(b)

(1,677

)

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

263,451

$

256,103

2.9

%

Consolidated:

Net sales, reported

$

872,483

$

893,357

(2.3

)%

Planned Divestitures

(127,875

)

(140,511

)

Non-GAAP net sales, excluding Planned

Divestitures

744,608

752,846

(1.1

)%

Foreign exchange impact (a)

13,328

—

Less: Acquisitions(b)

(1,677

)

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

756,259

$

752,846

0.5

%

(a) Year-over-year net sales growth rate

excluding the translation impact of changes in foreign currency

exchange rates. Calculated by translating the net sales for the

quarter ended March 31, 2020 into U.S. dollars using the average

foreign exchange rates for the quarter ended March 31, 2019.

(b) Reflects a revenue recognition change

to a net basis for the intY acquisition.

ScanSource, Inc. and

Subsidiaries

Supplementary Information

(Unaudited)

Net Sales by Segment:

Nine months ended March

31,

2020

2019

% Change

Worldwide Barcode, Networking &

Security:

(in thousands)

Net sales, as reported

$

1,967,670

$

1,953,664

0.7

%

Planned Divestitures

(322,264

)

(340,862

)

Non-GAAP net sales, excluding Planned

Divestitures

1,645,406

1,612,802

2.0

%

Foreign exchange impact (a)

5,484

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

1,650,890

$

1,612,802

2.4

%

Worldwide Communications &

Services:

Net sales, as reported

$

883,142

$

958,614

(7.9

)%

Planned Divestitures

(116,893

)

(132,905

)

Non-GAAP net sales, excluding Planned

Divestitures

766,249

825,709

(7.2

)%

Foreign exchange impact (a)

15,169

—

Less: Acquisitions(b)

(7,767

)

(1,062

)

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

773,651

$

824,647

(6.2

)%

Consolidated:

Net sales, as reported

$

2,850,812

$

2,912,278

(2.1

)%

Planned Divestitures

(439,157

)

(473,767

)

Non-GAAP net sales, excluding Planned

Divestitures

2,411,655

2,438,511

(1.1

)%

Foreign exchange impact (a)

20,653

—

Less: Acquisitions(b)

(7,767

)

(1,062

)

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

2,424,541

$

2,437,449

(0.5

)%

(a) Year-over-year net sales growth rate

excluding the translation impact of changes in foreign currency

exchange rates. Calculated by translating the net sales for the

nine months ended March 31, 2020 into U.S. dollars using the

average foreign exchange rates for the nine months ended March 31,

2019.

(b) Reflects a revenue recognition change

to a net basis for the intY acquisition.

ScanSource, Inc. and

Subsidiaries

Supplementary Information

(Unaudited)

Net Sales by Geography:

Quarter ended March

31,

2020

2019

% Change

United States and Canada:

(in thousands)

Net sales, as reported

$

670,175

$

672,155

(0.3

)%

Less: Acquisitions(b)

(141

)

—

Non-GAAP net sales, excluding

acquisitions

$

670,034

$

672,155

(0.3

)%

International:

Net sales, as reported

$

202,308

$

221,202

(8.5

)%

Planned Divestitures

(127,875

)

(140,511

)

Non-GAAP net sales, excluding Planned

Divestitures

74,433

80,691

(7.8

)%

Foreign exchange impact(a)

13,328

—

Less: Acquisitions(b)

(1,536

)

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

86,225

$

80,691

6.9

%

Consolidated:

Net sales, as reported

$

872,483

$

893,357

(2.3

)%

Planned Divestitures

(127,875

)

(140,511

)

Non-GAAP net sales, excluding Planned

Divestitures

744,608

752,846

(1.1

)%

Foreign exchange impact(a)

13,328

—

Less: Acquisitions (b)

(1,677

)

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

756,259

$

752,846

0.5

%

(a) Year-over-year net sales growth rate

excluding the translation impact of changes in foreign currency

exchange rates. Calculated by translating the net sales for the

quarter ended March 31, 2020 into U.S. dollars using the average

foreign exchange rates for the quarter ended March 31, 2019.

(b) Reflects a revenue recognition change

to a net basis for the intY acquisition.

ScanSource, Inc. and

Subsidiaries

Supplementary Information

(Unaudited)

Net Sales by Geography:

Nine months ended March

31,

2020

2019

% Change

United States and Canada:

(in thousands)

Net sales, as reported

$

2,173,516

$

2,189,567

(0.7

)%

Less: Acquisitions(b)

(3,623

)

(1,062

)

Net sales, excluding acquisitions

$

2,169,893

$

2,188,505

(0.9

)%

International:

Net sales, as reported

$

677,296

$

722,711

(6.3

)%

Planned Divestitures

(439,157

)

(473,767

)

Non-GAAP net sales, excluding Planned

Divestitures

238,139

248,944

(4.3

)%

Foreign exchange impact(a)

20,653

—

Less: Acquisitions(b)

(4,144

)

—

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

254,648

$

248,944

2.3

%

Consolidated:

Net sales, as reported

$

2,850,812

$

2,912,278

(2.1

)%

Planned Divestitures

(439,157

)

(473,767

)

Non-GAAP net sales, excluding Planned

Divestitures

2,411,655

2,438,511

(1.1

)%

Foreign exchange impact(a)

20,653

—

Less: Acquisitions(b)

(7,767

)

(1,062

)

Non-GAAP net sales, constant currency

excluding Planned Divestitures and acquisitions

$

2,424,541

$

2,437,449

(0.5

)%

(a) Year-over-year net sales growth rate

excluding the translation impact of changes in foreign currency

exchange rates. Calculated by translating the net sales for the

nine months ended March 31, 2020 into U.S. dollars using the

average foreign exchange rates for the nine months ended March 31,

2019.

(b) Reflects a revenue recognition change

to a net basis for the intY acquisition.

ScanSource, Inc. and

Subsidiaries

Supplementary Information

(Unaudited)

Non-GAAP Financial Information:

Quarter ended March 31,

2020

Reported GAAP measure

Intangible amortization

expense

Change in fair value of

contingent consideration

Acquisition, divestiture and

restructuring costs(a)

Tax recovery, net

Impact of Planned

Divestitures

Non-GAAP measure

in thousands, except per share

data

Net sales

$

872,483

$

—

$

—

$

—

$

—

$

(127,875

)

$

744,608

Gross profit

94,809

—

—

—

—

(10,206

)

84,603

Operating income

6,289

5,486

618

935

(1,529

)

3,020

14,819

Other expense, net

2,637

—

—

—

—

(759

)

1,878

Pre-tax income

3,652

5,486

618

935

—

4,571

15,262

Net income

1,713

4,171

467

894

(1,224

)

3,248

9,269

Diluted EPS

$

0.07

$

0.16

$

0.02

$

0.04

$

(0.05

)

$

0.13

$

0.37

Quarter ended March 31,

2019

Reported GAAP measure

Intangible amortization

expense

Change in fair value of

contingent consideration

Acquisition, divestiture and

restructuring costs(b)

Tax recovery, net

Impact of Planned

Divestitures

Non-GAAP measure

in thousands, except per share

data

Net sales

$

893,357

$

—

$

—

$

—

$

—

$

(140,511

)

$

752,846

Gross profit

110,015

—

—

—

—

(14,208

)

95,807

Operating income

18,804

5,005

5,101

814

—

898

30,622

Other expense, net

3,009

—

—

—

—

(257

)

2,752

Pre-tax income

15,795

5,005

5,101

814

—

1,155

27,870

Net income

11,715

3,789

3,619

665

—

846

20,634

Diluted EPS

$

0.45

$

0.15

$

0.14

$

0.03

$

—

$

0.03

$

0.80

(a) Acquisition and divestiture costs

totaled $0.8 million for the quarter ended March 31, 2020 and are

generally nondeductible for tax purposes. Restructuring costs

totaled $0.1 million for the quarter ended March 31, 2020.

(b) Acquisition and divestiture costs

totaled $0.2 million for the quarter ended March 31, 2019 and are

generally nondeductible for tax purposes. Restructuring costs

totaled $0.6 million for the quarter ended March 31, 2019.

Nine months ended March 31,

2020

Reported GAAP measure

Intangible amortization

expense

Change in fair value of

contingent consideration

Acquisition, divestiture and

restructuring costs(a)

Tax recovery, net

Impact of Planned

Divestitures

Non-GAAP measure

(in thousands, except per

share data)

Net sales

$

2,850,812

$

—

$

—

$

—

$

—

$

(439,157

)

$

2,411,655

Gross profit

320,792

—

—

—

—

(39,073

)

281,719

Operating income

43,390

16,079

6,266

3,503

(1,529

)

3,156

70,865

Other expense, net

8,437

—

—

—

—

(1,137

)

7,300

Pre-tax income

34,953

16,079

6,266

3,503

$

—

5,085

65,886

Net income

24,608

12,206

4,737

3,308

(1,224

)

3,571

47,206

Diluted EPS

$

0.97

$

0.48

$

0.19

$

0.13

$

(0.05

)

$

0.14

$

1.86

Nine months ended March 31,

2019

Reported GAAP measure

Intangible amortization

expense

Change in fair value of

contingent consideration

Acquisition, divestiture and

restructuring costs(b)

Tax recovery, net

Impact of Planned

Divestitures

Non-GAAP Measure

(in thousands, except per

share data)

Net sales

$

2,912,278

$

—

$

—

$

—

$

—

$

(473,767

)

$

2,438,511

Gross profit

342,708

—

—

—

—

(46,404

)

296,304

Operating income

69,942

14,708

11,535

2,907

—

(1,253

)

97,839

Other expense, net

8,272

—

—

—

—

(603

)

7,669

Pre-tax income

61,670

14,708

11,535

2,907

—

(650

)

90,170

Net income

46,019

11,154

8,514

2,386

—

150

68,223

Diluted EPS

$

1.79

$

0.43

$

0.33

$

0.09

$

—

$

0.01

$

2.65

(a) Acquisition and divestiture costs

totaled $2.7 million for the nine months ended March 31, 2020 and

are generally nondeductible for tax purposes. Restructuring costs

totaled $0.8 million for the nine months ended March 31, 2020.

(b) Acquisition and divestiture costs

totaled $1.0 million for the nine months ended March 31, 2019 and

are generally nondeductible for tax purposes. Restructuring costs

totaled $1.9 million for the nine months ended March 31, 2019.

ScanSource, Inc. and

Subsidiaries

Supplementary Information

(Unaudited)

(in thousands, except

percentages)

Non-GAAP Financial Information:

Quarter ended March

31,

2020

2019

Return on invested capital ratio (ROIC),

annualized (a)

6.1

%

11.4

%

Reconciliation of

net income to EBITDA:

Net income (GAAP)

$

1,713

$

11,715

Plus: Interest expense

3,421

3,670

Plus: Income taxes

1,939

4,080

Plus: Depreciation and amortization

9,539

9,363

EBITDA (non-GAAP)

16,612

28,828

Plus: Change in fair value of contingent

consideration

618

5,101

Plus: Tax recovery, net

(1,529

)

—

Plus: Acquisition and divestiture

costs

780

222

Plus: Restructuring costs

155

456

Plus: Impact of Planned Divestitures

3,231

854

Adjusted EBITDA (numerator for ROIC)

(non-GAAP)

$

19,867

$

35,461

Invested Capital

Calculation

Equity – beginning of the quarter

$

927,580

$

899,503

Equity – end of the quarter

897,678

911,063

Plus: Change in fair value of contingent

consideration, net of tax

467

3,619

Plus: Acquisition and divestiture

costs

780

222

Plus: Restructuring, net of tax

114

334

Plus: Tax recovery, net

(1,224

)

—

Plus: Impact of Planned Divestitures, net

of tax

3,248

1,181

Average equity

914,322

907,961

Average funded debt(b)

405,533

357,443

Invested capital (denominator for ROIC)

(non-GAAP)

$

1,319,855

$

1,265,404

(a) Calculated as earnings before interest

expense, income taxes, depreciation and amortization (EBITDA), plus

change in fair value of contingent consideration and other

adjustments, annualized and divided by invested capital for the

period. Invested capital is defined as average equity plus average

daily funded interest-bearing debt for the period.

(b) Average funded debt is calculated as

the average daily amounts outstanding on short-term and long-term

interest-bearing debt.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200511005894/en/

Contact: Gerald Lyons Executive Vice President, Chief

Financial Officer ScanSource, Inc. (864) 286-4854

- or -

Mary M. Gentry Vice President, Treasurer and Investor Relations

ScanSource, Inc. (864) 286-4892

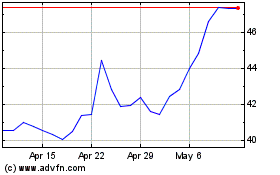

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Apr 2023 to Apr 2024