Record Quarterly Net Sales; EPS Exceeds

Forecast Range

ScanSource, Inc. (NASDAQ: SCSC), a leading

global provider of technology products and solutions, today

announced financial results for the second quarter ended

December 31, 2018.

Quarter ended December 31, 2018

2017 Change (in millions,

except per share data) Net sales $ 1,046.0

$ 1,032.2 1 %

Operating income

29.7 22.3 33 %

Non-GAAP operating income(1)

36.7 34.7 6 %

GAAP net income 20.0 8.0 151 %

Non-GAAP net income(1)

25.4 23.0 10 %

GAAP diluted

EPS $ 0.78 $ 0.31 152 %

Non-GAAP diluted

EPS(1)

$ 0.99 $ 0.90 10 % (1) Non-GAAP

results exclude amortization of intangible assets related to

acquisitions, change in fair value of contingent consideration and

other non-GAAP items. A reconciliation of non-GAAP financial

information to GAAP financial information is presented in the

Supplementary Information (Unaudited) below.

"We are very pleased with our outstanding second quarter results

and continued successful execution of our strategic plan," said

Mike Baur, CEO, ScanSource, Inc. "Our strategic plan is focused on

building end customer solutions and enabling our channel partners

to deliver more value."

Quarterly Results

For the second quarter of fiscal year 2019, net sales increased

1% to $1,046.0 million, reflecting sales growth in North America

and Brazil. Organic sales, which exclude the impact from foreign

currency translation and recent acquisitions, grew 3.2%

year-over-year. Operating income increased to $29.7 million, as the

expense for the change in contingent consideration related to

Network1 decreased. Non-GAAP operating income increased 6% to $36.7

million, driven by higher sales volumes and higher margins.

On a GAAP basis, net income for the second quarter of fiscal

year 2019 totaled $20.0 million, or $0.78 per diluted share,

compared with net income of $8.0 million, or $0.31 per diluted

share, for the prior-year quarter. Non-GAAP net income for the

second quarter of fiscal year 2019 increased 10% to $25.4 million,

or $0.99 per diluted share, compared to $23.0 million, or $0.90 per

diluted share, for the prior-year quarter.

Forecast for Next Quarter

For the third quarter of fiscal year 2019, ScanSource expects

net sales to range from $910 million to $970 million, diluted

earnings per share to range from $0.48 to $0.54 per share and

non-GAAP diluted earnings per share to range from $0.76 to $0.82

per share. Non-GAAP diluted earnings per share exclude amortization

of intangible assets related to acquisitions, change in fair value

of contingent consideration and other non-GAAP items.

Webcast Details and CFO Commentary

At approximately 4:15 p.m. ET today, a CFO commentary, as a

supplement to this press release and the Company's conference call,

will be available on ScanSource's website, www.scansource.com

(Investor Relations section). ScanSource will present additional

information about its financial results and outlook in a conference

call today, February 5, 2019, at 5:00 p.m. ET. A webcast of

the call will be available for all interested parties and can be

assessed at www.scansource.com (Investor Relations section). The

webcast will be available for replay for 60 days.

Safe Harbor Statement

This press release contains “forward-looking” statements,

including the forecast of sales and earnings per share for next

quarter, that involve risks and uncertainties. Any number of

factors could cause actual results to differ materially from

anticipated or forecasted results, including, but not limited to,

changes in interest and exchange rates and regulatory regimes

impacting the Company's international operations, the impact of tax

reform laws, the failure of acquisitions to meet the Company's

expectations, the failure to manage and implement the Company's

organic growth strategy, credit risks involving the Company's

larger customers and vendors, termination of the Company's

relationship with key vendors or a significant modification of the

terms under which it operates with a key vendor, the decline in

demand for the products and services that the Company provides,

reduced prices for the products and services that the Company

provide due both to competitor and customer action, and other

factors set forth in the "Risk Factors" contained in the Company's

annual report on Form 10-K for the year ended June 30, 2018, filed

with the Securities and Exchange Commission. Except as may be

required by law, the Company expressly disclaims any obligation to

update these forward-looking statements to reflect events or

circumstances after the date of this press release or to reflect

the occurrence of unanticipated events.

Non-GAAP Financial Information

In addition to disclosing results that are determined in

accordance with United States Generally Accepted Accounting

Principles ("GAAP"), the Company also discloses certain non-GAAP

financial measures, which are summarized below. Non-GAAP financial

measures are used to understand and evaluate performance, including

comparisons from period to period. Non-GAAP results exclude

amortization of intangible assets related to acquisitions, change

in fair value of contingent consideration, acquisition costs and

other non-GAAP adjustments.

Net sales on a constant currency basis, excluding acquisitions:

The Company discloses the percentage change in net sales excluding

the translation impact from changes in foreign currency exchange

rates between reporting periods and excluding the net sales from

acquisitions prior to the first full year from the acquisition

date. This measure enhances the comparability between periods to

help analyze underlying trends on an organic basis.

Non-GAAP operating income, non-GAAP pre-tax income, non-GAAP net

income and non-GAAP diluted earnings per share: To evaluate current

period performance on a more consistent basis with prior periods,

the Company discloses non-GAAP operating income, non-GAAP pre-tax

income, non-GAAP net income and non-GAAP diluted earnings per share

(non-GAAP diluted "EPS"). These non-GAAP results exclude

amortization of intangible assets related to acquisitions, change

in the fair value of contingent consideration, acquisition costs

and other non-GAAP adjustments. Non-GAAP operating income, non-GAAP

net income, and non-GAAP diluted EPS measures are useful in

assessing and understanding the Company's operating performance,

especially when comparing results with previous periods or

forecasting performance for future periods.

Return on invested capital ("ROIC"): Management uses ROIC as a

performance measurement to assess efficiency in allocating capital

under the Company's control to generate returns. Management

believes this metric balances the Company's operating results with

asset and liability management, is not impacted by capitalization

decisions and correlates with shareholder value creation. In

addition, it is easily computed, communicated and understood. ROIC

also provides management a measure of the Company's profitability

on a basis more comparable to historical or future periods.

ROIC assists management in comparing the Company's performance

over various reporting periods on a consistent basis because it

removes from operating results the impact of items that do not

reflect core operating performance. ROIC is calculated as adjusted

EBITDA over invested capital. Adjusted earnings before interest

expense, income taxes, depreciation and amortization ("Adjusted

EBITDA") excludes the change in fair value of contingent

consideration and acquisition costs, in addition to other non-GAAP

adjustments. Invested capital is defined as average equity plus

average daily funded interest-bearing debt for the period.

Management believes the calculation of ROIC provides useful

information to investors and is an additional relevant comparison

of the Company's performance during the year.

These non-GAAP financial measures have limitations as analytical

tools, and the non-GAAP financial measures that the Company reports

may not be comparable to similarly titled amounts reported by other

companies. Analysis of results and outlook on a non-GAAP basis

should be considered in addition to, and not in substitution for or

as superior to, measurements of financial performance prepared in

accordance with GAAP. A reconciliation of the Company's non-GAAP

financial information to GAAP is set forth in the Supplementary

Information (Unaudited) below.

About ScanSource, Inc.

ScanSource, Inc. (NASDAQ: SCSC) is a leading global provider of

technology products and solutions, focusing on point-of-sale (POS),

payments, barcode, physical security, unified communications and

collaboration and telecom and cloud services. ScanSource's teams

provide value-added solutions and operate from two segments:

Worldwide Barcode, Networking & Security, which includes POS

Portal, and Worldwide Communications & Services, which includes

Intelisys and Canpango. ScanSource is committed to helping its

customers choose, configure and deliver the industry's best

solutions across almost every vertical market in North America,

Latin America and Europe. Founded in 1992 and headquartered in

Greenville, South Carolina, ScanSource was named one of the 2018

Best Places to Work in South Carolina and on FORTUNE magazine's

2019 List of World's Most Admired Companies. ScanSource ranks #653

on the Fortune 1000. For more information, visit

www.scansource.com.

ScanSource, Inc. and Subsidiaries Condensed

Consolidated Balance Sheets (Unaudited) (in thousands)

December 31, 2018 June

30, 2018* Assets Current assets: Cash and cash

equivalents $ 22,749 $ 25,530 Accounts receivable, less allowance

of $45,240 at December 31, 2018 and $45,561 at June 30, 2018

708,531 678,940 Inventories 704,444 595,948 Prepaid expenses and

other current assets 59,785 61,744

Total current assets 1,495,509 1,362,162 Property and equipment,

net 73,354 73,042 Goodwill 326,675 298,174 Identifiable intangible

assets, net 129,020 136,806 Deferred income taxes 20,448 22,199

Other non-current assets 50,727 52,912

Total assets $ 2,095,733 $ 1,945,295

Liabilities and Shareholders' Equity Current liabilities:

Accounts payable $ 604,630 $ 562,564 Accrued expenses and other

current liabilities 89,444 90,873 Current portion of contingent

consideration 39,729 42,975 Income taxes payable 2,421 13,348

Current portion of long-term debt 335 551

Total current liabilities 736,559 710,311 Deferred income

taxes 1,958 1,769 Long-term debt, net of current portion 4,764

4,878 Borrowings under revolving credit facility 367,311 244,000

Long-term portion of contingent consideration 32,157 65,258 Other

long-term liabilities 53,481 52,703

Total liabilities 1,196,230 1,078,919 Shareholders' equity: Common

stock 70,912 68,220 Retained earnings 916,636 882,333 Accumulated

other comprehensive income (loss) (88,045 ) (84,177 )

Total shareholders' equity 899,503 866,376

Total liabilities and shareholders' equity $ 2,095,733

$ 1,945,295

* Derived from audited financial

statements.

ScanSource, Inc. and Subsidiaries Condensed

Consolidated Income Statements (Unaudited) (in thousands,

except per share data)

Quarter ended December 31, Six

months ended December 31, 2018 2017 2018

2017 Net sales $ 1,046,021 $ 1,032,212 $ 2,018,921 $

1,956,771 Cost of goods sold 925,543 919,241

1,786,229 1,737,883 Gross profit

120,478 112,971 232,692 218,888 Selling, general and administrative

expenses 80,950 74,763 158,880 147,950 Depreciation expense 3,272

3,467 6,538 6,707 Intangible amortization expense 4,700 5,487 9,703

10,498 Change in fair value of contingent consideration

1,850 6,913 6,434 23,794

Operating income 29,706 22,341 51,137 29,939 Interest

expense 3,119 2,285 5,746 3,870 Interest income (264 ) (580 ) (715

) (1,462 ) Other expense, net 201 326

233 441 Income before income taxes

26,650 20,310 45,873 27,090 Provision for income taxes 6,668

12,341 11,570 14,974

Net income $ 19,982 $ 7,969 $ 34,303 $

12,116 Per share data: Net income per common share, basic $

0.78 $ 0.31 $ 1.34 $ 0.48

Weighted-average shares outstanding, basic 25,640

25,506 25,619 25,470

Net income per common share, diluted $ 0.78 $ 0.31

$ 1.33 $ 0.47 Weighted-average shares

outstanding, diluted 25,750 25,648

25,752 25,612

ScanSource, Inc. and Subsidiaries Supplementary

Information (Unaudited) Net

Sales by Segment: Quarter ended December 31, 2018

2017 % Change Worldwide Barcode,

Networking & Security: (in thousands) Net sales, as

reported $ 701,639 $ 719,786 (2.5 )% Foreign exchange impact (a)

7,805 — Net sales, constant currency

(non-GAAP) 709,444 719,786 (1.4 )% Less: Acquisitions —

— Net sales, constant currency excluding acquisitions

(non-GAAP) $ 709,444 $ 719,786 (1.4 )%

Worldwide

Communications & Services: Net sales, as reported $ 344,382

$ 312,426 10.2 % Foreign exchange impact (a) 12,915

— Net sales, constant currency (non-GAAP) 357,297 312,426

14.4 % Less: Acquisitions (1,832 ) — Net sales,

constant currency excluding acquisitions (non-GAAP) $ 355,465

$ 312,426 13.8 %

Consolidated: Net sales, as

reported $ 1,046,021 $ 1,032,212 1.3 % Foreign exchange impact (a)

20,720 — Net sales, constant currency

(non-GAAP) 1,066,741 1,032,212 3.3 % Less: Acquisitions

(1,832 ) — Net sales, constant currency excluding

acquisitions (non-GAAP) $ 1,064,909 $ 1,032,212 3.2 %

(a) Year-over-year net sales growth rate excluding the translation

impact of changes in foreign currency exchange rates. Calculated by

translating the net sales for the quarter ended December 31, 2018

into U.S. dollars using the average foreign exchange rates for the

quarter ended December 31, 2017.

ScanSource, Inc. and Subsidiaries

Supplementary Information (Unaudited) Net Sales by

Segment: Six months ended December 31, Worldwide

Barcode, Networking & Security: 2018 2017

% Change (in thousands) Net sales, as reported $

1,356,752 $ 1,340,114 1.2 % Foreign exchange impact (a)

15,317 — Net sales, constant currency

1,372,069 1,340,114 2.4 % Less: Acquisitions (23,465 )

(14,553 ) Net sales, constant currency excluding

acquisitions $ 1,348,604 $ 1,325,561 1.7 %

Worldwide Communications & Services: Net sales, as

reported $ 662,169 $ 616,657 7.4 % Foreign exchange impact (a)

26,221 — Net sales, constant currency

688,390 616,657 11.6 % Less: Acquisitions (2,796 ) —

Net sales, constant currency excluding acquisitions $

685,594 $ 616,657 11.2 %

Consolidated:

Net sales, as reported $ 2,018,921 $ 1,956,771 3.2 % Foreign

exchange impact (a) 41,538 — Net sales,

constant currency 2,060,459 1,956,771 5.3 % Less: Acquisitions

(26,261 ) (14,553 ) Net sales, constant currency

excluding acquisitions $ 2,034,198 $ 1,942,218 4.7 %

(a) Year-over-year net sales growth rate excluding the

translation impact of changes in foreign currency exchange rates.

Calculated by translating the net sales for the six months ended

December 31, 2018 into U.S. dollars using the average foreign

exchange rates for the six months ended December 31, 2017.

ScanSource, Inc. and Subsidiaries Supplementary

Information (Unaudited)

Net Sales by Geography: Quarter ended December

31, 2018 2017 % Change United States

and Canada: (in thousands) Net sales, as reported $

779,455 $ 755,312 3.2 % Less: Acquisitions (1,832 ) —

Net sales, excluding acquisitions (non-GAAP) $ 777,623 $

755,312 3.0 %

International: Net sales, as reported $

266,566 $ 276,900 (3.7 )% Foreign exchange impact (a) 20,720

— Net sales, constant currency (non-GAAP) 287,286

276,900 3.8 % Less: Acquisitions — — Net

sales, constant currency excluding acquisitions (non-GAAP) $

287,286 $ 276,900 3.8 %

Consolidated: Net

sales, as reported $ 1,046,021 $ 1,032,212 1.3 % Foreign exchange

impact (a) 20,720 — Net sales, constant

currency (non-GAAP) 1,066,741 1,032,212 3.3 % Less: Acquisitions

(1,832 ) — Net sales, constant currency excluding

acquisitions (non-GAAP) $ 1,064,909 $ 1,032,212 3.2 %

(a) Year-over-year net sales growth rate excluding the translation

impact of changes in foreign currency exchange rates. Calculated by

translating the net sales for the quarter ended December 31, 2018

into U.S. dollars using the average foreign exchange rates for the

quarter ended December 31, 2017.

ScanSource, Inc. and Subsidiaries

Supplementary Information (Unaudited) Net Sales by

Geography: Six months ended December 31, 2018

2017 % Change United States and Canada: (in

thousands) Net sales, as reported $ 1,517,412 $ 1,441,982 5.2 %

Less: Acquisitions (26,261 ) (14,553 ) Net sales,

excluding acquisitions $ 1,491,151 $ 1,427,429 4.5 %

International: Net sales, as reported $ 501,509 $

514,789 (2.6 )% Foreign exchange impact (a) 41,538

— Net sales, constant currency 543,047 514,789 5.5 %

Less: Acquisitions — — Net sales,

constant currency excluding acquisitions $ 543,047 $ 514,789

5.5 %

Consolidated: Net sales, as reported $

2,018,921 $ 1,956,771 3.2 % Foreign exchange impact (a)

41,538 — Net sales, constant currency

2,060,459 1,956,771 5.3 % Less: Acquisitions (26,261 )

(14,553 ) Net sales, constant currency excluding

acquisitions $ 2,034,198 $ 1,942,218 4.7 % (a)

Year-over-year net sales growth rate excluding the translation

impact of changes in foreign currency exchange rates. Calculated by

translating the net sales for the six months ended December 31,

2018 into U.S. dollars using the average foreign exchange rates for

the six months ended December 31, 2017.

ScanSource, Inc. and Subsidiaries Supplementary

Information (Unaudited) (in thousands, except per share

data)

Non-GAAP Financial Information: Quarter ended December

31, 2018

Operatingincome

Pre-taxincome

Netincome

DilutedEPS

GAAP measure $ 29,706 $ 26,650 $ 19,982 $ 0.78 Adjustments:

Amortization of intangible assets 4,700 4,700 3,567 0.14 Change in

fair value of contingent consideration 1,850 1,850 1,408 0.05

Acquisition costs (a) 414 414 414 0.02

Non-GAAP measure $ 36,670 $ 33,614 $ 25,371 $

0.99

Quarter ended December 31, 2017

Operatingincome

Pre-taxincome

Netincome

DilutedEPS

GAAP measure $ 22,341 $ 20,310 $ 7,969 $ 0.31 Adjustments:

Amortization of intangible assets 5,487 5,487 3,648 0.14 Change in

fair value of contingent consideration 6,913 6,913 4,742 0.18 Tax

reform charges $ — $ — $ 6,689 $ 0.26 Non-GAAP

measure $ 34,741 $ 32,710 $ 23,048 $ 0.90

(a) Acquisition costs are non-deductible for tax purposes.

ScanSource, Inc. and Subsidiaries

Supplementary Information (Unaudited) (in thousands,

except per share data)

Non-GAAP Financial Information: Six

months ended December 31, 2018

Operatingincome

Pre-taxincome

Netincome

DilutedEPS

GAAP measure $ 51,137 $ 45,873 $ 34,303 $ 1.33 Adjustments:

Amortization of intangible assets 9,703 9,703 7,365 0.29 Change in

fair value of contingent consideration 6,434 6,434 4,895 0.19

Acquisition costs (a) 769 769 769 0.03 Restructuring costs 1,328

1,328 955 0.04 Non-GAAP measure $ 69,371

$ 64,107 $ 48,287 $ 1.88

Six months

ended December 31, 2017

Operatingincome

Pre-taxincome

Netincome

DilutedEPS

GAAP measure $ 29,939 $ 27,090 $ 12,116 $ 0.47 Adjustments:

Amortization of intangible assets 10,498 10,498 6,909 0.27 Change

in fair value of contingent consideration 23,794 23,794 15,747 0.61

Acquisition costs (a) 172 172 172 0.02 Legal settlement, net of

attorney fees 952 952 771 0.03 Tax reform charges

6,689 0.26 Non-GAAP measure $ 65,355 $ 62,506

$ 42,404 $ 1.66 (a) Acquisition costs are

non-deductible for tax purposes.

ScanSource, Inc.

and Subsidiaries Supplementary Information (Unaudited)

(in thousands, except percentages)

Non-GAAP Financial Information:

Quarter endedDecember

31,

Six months endedDecember

31,

2018 2017 2018 2017 Return on invested

capital (ROIC), annualized (a) 13.3 % 13.3 %

13.1 % 13.1 %

Reconciliation of

Net Income to Adjusted EBITDA

Net income (GAAP) $ 19,982 $ 7,969 $ 34,303 $ 12,116 Plus: Interest

expense 3,119 2,285 5,746 3,870 Plus: Income taxes 6,668 12,341

11,570 14,974 Plus: Depreciation and amortization 8,935

9,901 18,203 18,766

EBITDA (non-GAAP) 38,704 32,496 69,822 49,726 Adjustments:

Change in fair value of contingent consideration 1,850 6,913 6,434

23,794 Acquisition costs 414 — 769 172 Restructuring costs — —

1,328 — Legal settlement, net of attorney fees —

— — 952 Adjusted EBITDA

(numerator for ROIC) (non-GAAP) $ 40,968 $ 39,409 $

78,353 $ 74,644

Invested Capital

Calculation

Equity - beginning of the quarter $ 877,897 $ 852,976 $ 866,376 $

837,145 Equity - end of the quarter 899,503 860,787 899,503 860,787

Adjustments: Change in fair value of contingent consideration, net

of tax 1,408 4,742 4,895 15,747 Acquisition costs 414 — 769 172

Restructuring costs, net of tax — — 955 — Legal settlement, net of

attorney fees, net of tax — — — 771 Tax reform charges —

6,689 — 6,689

Average equity 889,611 862,597 886,249 860,656 Average funded debt

(b) 333,138 311,327 302,707

268,141 Invested capital (denominator for

ROIC) (non-GAAP) $ 1,222,749 $ 1,173,924 $ 1,188,956

$ 1,128,797 (a) Calculated as net income plus

interest expense, income taxes, depreciation and amortization

(EBITDA), plus change in fair value of contingent consideration and

other adjustments, annualized and divided by invested capital for

the period. Invested capital is defined as average equity plus

average daily funded interest-bearing debt for the period. (b)

Average funded debt is calculated as the average daily amounts

outstanding on short-term and long-term interest-bearing debt.

ScanSource, Inc. and Subsidiaries

Supplementary Information (Unaudited)

Non-GAAP Financial Information:

Forecast for Quarterending March

31, 2019

Range Low Range High GAAP diluted EPS $ 0.48 $ 0.54

Adjustments: Amortization of intangible assets 0.14 0.14 Change in

fair value of contingent consideration 0.14 0.14 Non-GAAP

diluted EPS $ 0.76 $ 0.82

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190205005928/en/

Gerald LyonsExecutive Vice President, Chief Financial

OfficerScanSource, Inc.(864) 286-4854orMary M. GentryVice

President, Treasurer and Investor RelationsScanSource, Inc.(864)

286-4892

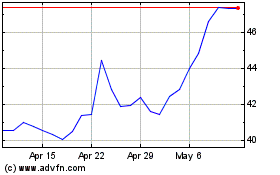

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Apr 2023 to Apr 2024