Additional Proxy Soliciting Materials (definitive) (defa14a)

April 30 2019 - 5:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

SBA Communications Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form of Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

SBA COMMUNICATIONS CORPORATION SUPPLEMENTAL PROXY MATERIALS

For the Annual Meeting of Shareholders to be Held on

May 16, 2019

Re: Proposal 3: Advisory Vote to Approve

Executive Compensation

April 30, 2019

Dear SBA

Shareholder,

SBA Communications Corporation, SBA, is asking for your support at the 2019 Annual Meeting of Shareholders by voting in

accordance with the recommendations of our Board of Directors on all proposals. In connection with this request, we are making available these supplemental proxy materials to provide additional disclosure regarding the financial and operational

metrics that were part of our 2018 annual incentive compensation program which is more fully described in the Compensation Discussion & Analysis (“CD&A”) section of our Proxy Statement, dated April 5, 2019 (the

“Proxy Statement”), for the 2019 Annual Meeting of Shareholders, beginning on page 27. As we stated in the CD&A, we believe that the annual incentive compensation program encourages executive officers to focus on those short-term

financial, operational and qualitative performance metrics that will be the basis of long-term growth. We reward financial, operational and qualitative corporate metrics that we believe will drive long-term shareholder value appreciation. As

disclosed in our Proxy Statement, 60% of an NEO’s annual bonus target opportunity under our annual incentive compensation program is based on company-wide financial metrics, specifically Annualized Adjusted EBITDA (30%) and AFFO per share

(30%). In addition, 40% of the NEO’s annual bonus target opportunity is based on SBA’s performance against a number of selected financial and operational metrics and the Compensation Committee’s subjective analysis of each NEO’s

contribution to the 2018 performance level as well as qualitative performance metrics regarding the NEO’s performance.

For 2018, as

disclosed on page 39 of the Proxy Statement, these metrics included the financial metrics of (1) tower acquisitions and ground lease extensions and acquisitions, (2) leasing results on owned towers, (3) the financial and operational

performance of our international operations, and (4) total cash selling, general and administrative (“SG&A”) costs as a percentage of total cash revenue. In addition, these metrics included operational and qualitative performance

metrics of institutional contribution, including cross-departmental collaboration, succession planning and improved business processes and communications, and executive performance, which includes numerous areas of focus, based on the NEO, including

regulatory compliance, audit results and capital allocation. Based on his responsibilities, each NEO was

assigned three to four of these financial, operational or qualitative metrics upon which he was evaluated. During 2018, the budget/target level for each NEO was set at or above the prior

year’s budget performance level and the threshold/minimum level was set between 75% and 95% of the budget level. As described on page 38 of the Proxy Statement, for 2018, (1) achievement at the minimum level (set slightly below budget),

entitled the NEO to approximately 50% of the bonus earnable for the applicable metric, (2) achievement at the budget level entitled the NEO to 75% of the bonus earnable for the applicable metric (3) achievement at the stretch entitled the

NEO to 100% of the bonus earnable for the applicable metric and (4) achievement at the maximum level entitled the NEO to 200% of the bonus earnable for the applicable metric. The Compensation Committee does not, however, allocate a specific

percentage of the 40% bonus opportunity to the individual financial, operational or qualitative metrics.

The table below sets forth the minimum, budget, stretch and maximum performance levels for

each of the financial and operational metrics that were set at the beginning of the period as part of the 2018 annual incentive compensation program and the performance achieved.

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial or

Operational

Metric

|

|

Minimum

(50%)

|

|

Budget

(75%)

|

|

Stretch

(100%)

|

|

Max.

(200%)

|

|

Performance

Achieved

(Component

Credit %)

|

|

|

|

|

|

|

|

|

Tower Acquisitions

|

|

$336 mm

|

|

$448 mm

|

|

$560 mm

|

|

$1,008 mm

|

|

$342.9 mm

(51.5%)

|

|

|

|

|

|

|

|

|

Ground Lease Extensions and Acquisitions

|

|

900

Sites

|

|

1,000

Sites

|

|

1,100

Sites

|

|

1,600

Sites

|

|

1,359

Sites

(151.8%)

|

|

|

|

|

|

|

|

|

Domestic Leasing Results

|

|

0.153

BBE

|

|

0.170

BBE

|

|

0.187

BBE

|

|

0.272

BBE

|

|

0.22

BBE

(138.8%)

|

|

|

|

|

|

|

|

|

International Performance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Build Towers

|

|

373

|

|

415

|

|

457

|

|

664

|

|

383

(56.0%)

|

|

|

|

|

|

|

|

|

Organic Lease-Up

|

|

$8.73 mm

|

|

$9.70 mm

|

|

$10.67 mm

|

|

$15.52 mm

|

|

$14.2 mm

(173.1%)

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$200.8 mm

|

|

$211.4 mm

|

|

$222.0 mm

|

|

$243.1 mm

|

|

$219.3 mm

(93.6%)

|

|

|

|

|

|

|

|

|

Cash SG&A as % of Cash Revenue

|

|

5.74%

|

|

5.45%

|

|

5.19%

|

|

4.74%

|

|

5.44%

(75.0%)

|

Based on our financial and operational results, each of our NEOs achieved 107.6% of their

30% Adjusted EBITDA target opportunity and 95.1% of their 30% AFFO per share target opportunity or a combined 60.8% of the 60% bonus opportunity directly tied to the two company-wide financial metrics. The Compensation Committee then evaluated, for

each NEO, the financial results above for each of the metrics previously assigned to him, the results of the qualitative metrics described in the Proxy Statement and the contribution of each NEO to such results. Based on these results, the NEOs

earned an average of 96.4% of the 40% target opportunity relating to the financial, operational and qualitative metrics and the CEO earned 86% of the 40% target opportunity. Consequently, our NEOs earned between 92% and 115% of their annual bonus

target, while our CEO earned 95% of his annual bonus target.

We appreciate your time and consideration on these matters and ask that

you vote “FOR” Proposal 3: Advisory Vote to Approve Executive Compensation.

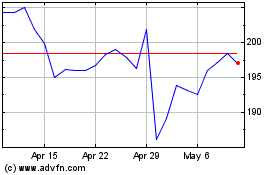

SBA Communications (NASDAQ:SBAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

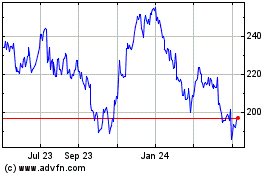

SBA Communications (NASDAQ:SBAC)

Historical Stock Chart

From Apr 2023 to Apr 2024