Sanofi to Acquire US Company Principia Biopharma for $3.68 Billion

August 17 2020 - 2:06AM

Dow Jones News

By Cecilia Butini

Sanofi SA said Monday that it entered into a definitive

agreement for the acquisition of U.S.-based biopharmaceutical

company Principia Biopharma Inc. for a total enterprise value of

roughly $3.68 billion.

Under the transaction--which was unanimously approved by the

board of directors of both companies--Sanofi plans to acquire all

of Principia's outstanding shares for $100 a share in cash through

a tender offer that should start later this month, the French

pharmaceutical company said.

"Following the successful completion of the tender offer, a

wholly owned subsidiary of Sanofi will merge with Principia and the

outstanding Principia shares not tendered in the tender offer will

be converted into the right to receive the same $100 per share in

cash paid in the tender offer," Sanofi said.

The deal is expected to close during the fourth quarter of this

year, it said.

Principia Biopharma's focus include develping treatments for

immune-mediated diseases, Sanofi said.

Sanofi said the acquisition will strengthen research and

development in areas such as autoimmune and allergic diseases.

The company said the deal will allow it to fully control the

brain-penetrant BTK inhibitor SAR442168, which is used in the

treatment of multiple sclerosis and which is currently licensed to

Sanofi.

Write to Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

August 17, 2020 01:51 ET (05:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

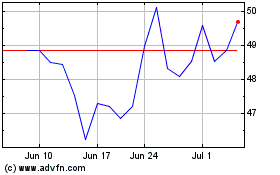

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

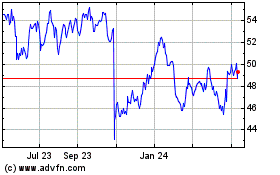

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024