Additional Proxy Soliciting Materials (definitive) (defa14a)

March 05 2019 - 11:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Sanmina Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY FORMER CEO COMPENSATION INFORMATION FOR FISCAL YEAR 2018

In order to help stockholders better understand our pay-for-performance programs, Sanmina Corporation (the “Company”) is providing the following supplementary information concerning the former CEO’s reported compensation during fiscal 2018. This information is intended to be read in conjunction with the information contained in the Company’s proxy statement for its 2019 Annual Meeting of stockholders being held on March 11, 2019 filed with the Securities and Exchange Commission on January 24, 2019.

|

|

|

Base Salary

|

|

Change in Pension,

Deferred

Compensation, All

Other Compensation

|

|

Bonus and Non-Equity Incentives

|

|

Restricted

Stock

|

|

Option Grant

|

|

Total

|

|

|

Amount stated in Summary Compensation Table

|

|

$0.9M

|

|

$5.8M

|

|

$0

|

|

$7.7M

|

|

$4.4M

|

|

$18.9M(1)

|

|

|

Amount actually received

|

|

$0.9M

|

|

$4.8M from vesting of equity awards granted in 2015 and 2016 for which performance criteria was met during 2016 and 2017 while former CEO was serving as CFO;

|

|

$0 (not eligible due to separation; 14% payout percentage reduced to 0% for all executive officers by Compensation Committee)

|

|

$0 (all grants canceled either due to metrics not being achieved in 2018 or as a result of separation)

|

|

$0 (all grants canceled either due to metrics not being achieved or stock price being below exercise price of $38.45)

|

|

$6.7M

|

|

|

|

|

|

|

$0.6M from vesting of time based awards previously granted;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0.4M change in value of deferred compensation plan

|

|

|

|

|

|

|

|

|

|

(1) Numbers do not foot due to rounding.

1

Below is a description of the vesting criteria of and status of payout under the former CEO’s equity awards granted during fiscal 2018.

|

Type of Award

|

|

Number of Shares

|

|

Grant Date Fair Value

|

|

Vesting Provisions

|

|

PSU

|

|

33,000

|

|

$1.3M

|

|

Performance Stock Units vest in full on the date the Company publicly reports revenue of at least $7.5 billion and non-GAAP operating margin of at least 4.2% in fiscal 2018, provided that such Performance Stock Units shall be canceled on December 31, 2018 if such financial metrics are not achieved in fiscal 2018

(canceled due to metric not achieved)

.

|

|

PSU

|

|

33,000

|

|

$1.3M

|

|

Performance Stock Units vest in full on the date the Company publicly reports revenue of at least $7.8 billion and non-GAAP operating margin of at least 4.4% in fiscal 2019 or, if earlier, during any four consecutive fiscal quarters occurring prior to the end of fiscal 2019, provided that such Performance Stock Units shall be canceled on December 31, 2019 if such financial metrics are not achieved prior to the end of fiscal 2019

(canceled in connection with separation)

.

|

|

PSU

|

|

34,000

|

|

$1.3M

|

|

Performance Stock Units vest in full on the date the Company publicly reports revenue of at least $8.0 billion and non-GAAP operating margin of at least 4.5% in fiscal 2020 or, if earlier, during any four consecutive fiscal quarters occurring prior to the end of fiscal 2020, provided that such Performance Stock Units shall be canceled on December 31, 2020 if such financial metrics are not achieved prior to the end of fiscal 2020

(canceled in connection with separation)

.

|

|

Stock options

|

|

200,000

|

|

$4.4M

|

|

The option vests as follows: (a) 50,000 shares shall be fully vested and exercisable on the date of grant(2); (b) an additional 50,000 shares shall become fully vested and exercisable in the event and on the date that the closing price of the Company’s common stock equals or exceeds $50.00 per

|

(2) Stock price was below exercise price of $38.45 per share at the time of separation.

2

|

Type of Award

|

|

Number of Shares

|

|

Grant Date Fair Value

|

|

Vesting Provisions

|

|

|

|

|

|

|

|

share on or prior to the Target Date; (c) an additional 50,000 shares shall become fully vested and exercisable in the event and on the date that the closing price of the Company’s common stock equals or exceeds $55.00 per share on or prior to the Target Date; and (d) the final 50,000 shares shall become fully vested and exercisable in the event and on the date that the closing price of the Company’s common stock equals or exceeds $60.00 per share on or prior to the Target Date. The Target Date shall be December 31, 2021. If, upon the Target Date, any tranches of the option remain unvested, such tranches shall be canceled

(canceled in connection with separation)

.

|

|

RSU

|

|

100,000

|

|

$3.8M

|

|

Restricted Stock Units vest 33,000 shares on the second anniversary of the grant date, 33,000 shares on the third anniversary of the grant date and 34,000 shares on the fourth anniversary of the grant date, assuming the continued service of former CEO through such dates

(canceled in connection with separation)

.

|

|

Total

|

|

400,000

|

|

$12.1M

|

|

All grants canceled due to metrics not being achieved in 2018 or as a result of separation.

|

3

In addition, the Company provides the following information in order to assist stockholders in understanding the at-risk nature of equity awards granted to executive officers.

|

|

|

Number of

Shares

Subject to

Options

Granted Fiscal 2016 -

2018

|

|

Number of

Shares

Subject to

RSUs

Granted Fiscal

2016 - 2018

|

|

Number of

Shares Forfeited

or Canceled

|

|

Net Number of Shares

Granted during Fiscal

2016- 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers, as a group

|

|

200,000

|

|

1,729,000

|

|

675,000(35%)

|

|

1,254,000

|

|

THE BOARD OF DIRECTORS CONTINUES TO RECOMMEND THAT STOCKHOLDERS VOTE FOR ALL PROPOSALS CONTAINED IN THE PROXY STATEMENT, IN PARTICULAR THE 2019 EQUITY INCENTIVE PLAN.

4

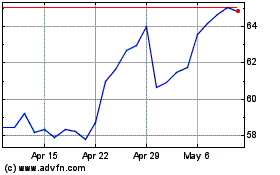

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Mar 2024 to Apr 2024

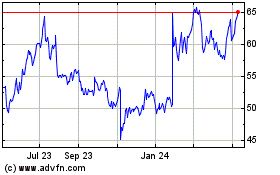

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Apr 2023 to Apr 2024