UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 27, 2020

SANDY SPRING BANCORP, INC.

(Exact name of registrant as specified in

its charter)

|

Maryland

|

000-19065

|

52-1532952

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

17801 Georgia Avenue, Olney, Maryland

20832

(Address of principal executive offices,

including zip code)

Registrant’s telephone number, including

area code: (301) 774-6400

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

x

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $1.00 per share

|

SASR

|

The NASDAQ Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

On January 27, 2020,

Sandy Spring Bancorp, Inc. (“Sandy Spring”), the parent company of Sandy Spring Bank, issued a press release announcing

that it has received the requisite regulatory approvals from the Board of Governors of the Federal Reserve System and the Maryland

Office of the Commissioner of Financial Regulation to complete the merger of Revere Bank with and into Sandy Spring Bank.

A copy of the press

release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report

on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with

respect to the financial condition, results of operations, plans, objectives, future performance and business of Sandy Spring and

Revere. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of Sandy Spring’s and Revere’s

management and on information currently available to management, are generally identifiable by the use of words such as “believe,”

“expect,” “anticipate,” “plan,” “intend,” “outlook,” “estimate,”

“forecast,” “project,” “may,” “will,” “would,” “could,”

“should” or other similar words and expressions. These forward-looking statements are subject to numerous assumptions,

risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and neither

Sandy Spring nor Revere undertakes any obligation to update any statement in light of new information or future events.

In addition to factors

previously disclosed in Sandy Spring’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”),

the following factors among others, could cause actual results to differ materially from those in its forward-looking statements:

(i) the possibility that any of the anticipated benefits of the proposed transaction between Sandy Spring and Revere will not be

realized or will not be realized within the expected time period; (ii) the risk that integration of operations of Revere with those

of Sandy Spring will be materially delayed or will be more costly or difficult than expected; (iii) the inability to complete the

proposed transaction due to the failure to obtain the required shareholder approvals; (iv) the failure to satisfy other conditions

to completion of the proposed transaction, including conditions set forth in any previously obtained regulatory approvals; (v)

the failure of the proposed transaction to close for any other reason; (vi) the effect of the announcement of the transaction on

customer relationships and operating results; (vii) the possibility that the transaction may be more expensive to complete than

anticipated, including as a result of unexpected factors or events; (viii) general economic conditions and trends, either nationally

or locally; (ix) conditions in the securities markets; (x) changes in interest rates; (xi) changes in deposit flows, and in the

demand for deposit, loan, and investment products and other financial services; (xii) changes in real estate values; (xiii) changes

in the quality or composition of Sandy Spring’s or Revere’s loan or investment portfolios; (xiv) changes in competitive

pressures among financial institutions or from non-financial institutions; (xv) the ability to retain key members of management;

and (xvi) changes in legislation, regulations, and policies.

Additional Information About the

Acquisition and Where to Find It

In connection with

the proposed Merger, Sandy Spring has filed with the Securities and Exchange Commission a Registration Statement on Form S-4 that

includes a Joint Proxy Statement of Sandy Spring and Revere Bank, and a Prospectus of Sandy Spring, as well as other relevant documents

concerning the proposed Merger. The Registration Statement on Form S-4 was declared effective on December 30, 2019 and the definitive

Joint Proxy Statement/Prospectus was mailed to shareholders of Sandy Spring and Revere Bank on or about January 6, 2020. Shareholders

are urged to read the Joint Proxy Statement/Prospectus regarding the proposed Merger and any other relevant documents filed with

the SEC, as well as any amendments or supplements to those documents, because they contain important information about Sandy Spring,

Revere Bank and the proposed Merger.

A free copy of the

Joint Proxy Statement/Prospectus, as well as other filings containing information about Sandy Spring, may be obtained at the SEC’s

Internet site (http://www.sec.gov). You may also obtain the Joint Proxy Statement/Prospectus, free of charge, from Sandy Spring

at www.sandyspringbank.com under the tab “Investor Relations,” and then under the heading “SEC Filings.”

Alternatively, this document can be obtained free of charge from Sandy Spring upon written request to Sandy Spring Bancorp, Inc.,

Corporate Secretary, 17801 Georgia Avenue, Olney, Maryland 20832 or by calling (800) 399-5919 or to Revere Bank, Corporate Secretary,

2101 Gaither Road, 6th Floor, Rockville, Maryland or by calling (240) 264-5346.

Participants in the Solicitation

Sandy Spring and Revere

Bank and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from

the shareholders of Sandy Spring and Revere Bank in connection with the proposed Merger. Information about the directors and executive

officers of Sandy Spring is set forth in the proxy statement for Sandy Spring’s 2019 annual meeting of shareholders, as filed

with the SEC on a Schedule 14A on March 13, 2019. Additional information regarding the interests of those participants and other

persons who may be deemed participants in the proposed Merger may be obtained by reading the Joint Proxy Statement/Prospectus.

Free copies of this document may be obtained as described in the preceding paragraph.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

99.1

|

Press Release dated January 27, 2020

|

|

|

104

|

Cover Page Interactive Data File (embedded within

the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

SANDY SPRING BANCORP, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: January 27, 2020

|

By:

|

/s/ Aaron M. Kaslow

|

|

|

|

Aaron M. Kaslow

Executive Vice President, General Counsel

and Secretary

|

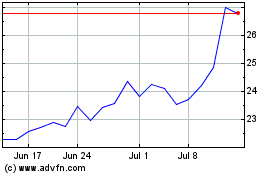

Sandy Spring Bancorp (NASDAQ:SASR)

Historical Stock Chart

From Mar 2024 to Apr 2024

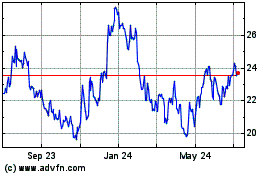

Sandy Spring Bancorp (NASDAQ:SASR)

Historical Stock Chart

From Apr 2023 to Apr 2024