Statement of Changes in Beneficial Ownership (4)

March 02 2020 - 4:07PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Drago John Patrick |

2. Issuer Name and Ticker or Trading Symbol

SAFETY INSURANCE GROUP INC

[

SAFT

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

VP - Marketing |

|

(Last)

(First)

(Middle)

20 CUSTOM HOUSE STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/26/2020 |

|

(Street)

BOSTON, MA 02110

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 2/26/2020 | | A | | 1616 | A | $0 (1) | 17193 | D | |

| Common Stock | 2/26/2020 | | A | | 1951 | A | $0 (2) | 19144 | D | |

| Common Stock | 2/26/2020 | | J | | 860 (3) | A | $0 | 20004 | D | |

| Common Stock | 2/26/2020 | | F | | 268 (4) | D | $89.988 (5) | 19736 | D | |

| Common Stock | 2/26/2020 | | F | | 51 (4) | D | $91.031 (6) | 19685 | D | |

| Common Stock | 2/27/2020 | | F | | 68 (4) | D | $85.424 (7) | 19617 | D | |

| Common Stock | 2/27/2020 | | F | | 150 (4) | D | $86.917 (8) | 19467 | D | |

| Common Stock | 2/27/2020 | | F | | 151 (4) | D | $88.220 (9) | 19316 | D | |

| Common Stock | 2/27/2020 | | F | | 60 (4) | D | $89.150 (10) | 19256 | D | |

| Common Stock | 2/28/2020 | | F | | 284 (4) | D | $78.557 (11) | 18972 | D | |

| Common Stock | 2/28/2020 | | F | | 285 (4) | D | $79.772 (12) | 18687 | D | |

| Common Stock | 2/28/2020 | | F | | 650 (4) | D | $80.749 (13) | 18037 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Represents restricted stock awards effective February 26, 2020, with respect to which sale or transfer rights shall vest over three years with installments of 30% on February 26, 2021, 30% on February 26, 2022, and the remaining 40% on February 26, 2023, provided the grantee meets certain employment conditions. |

| (2) | Represents restricted stock awards granted effective February 26, 2020 with respect to which sale or transfer rights will vest over a three-year performance period commencing on January 1, 2020 and ending on December 31, 2022. Vesting of these shares is dependent upon the attainment of pre-established performance objectives, and any difference between shares granted and shares earned at the end of the performance period will be reported at the conclusion of the performance period in 2023. |

| (3) | Represents the difference between performance shares, with a three year performance period, that were granted on February 22, 2017 and actual shares earned at the end of the performance period on December 31, 2019. Final shares were approved by the Compensation Committee on February 26, 2020. |

| (4) | Represents securities delivered in payment of a tax liability with respect to vesting of securities issued in accordance with Rule 16b-3. |

| (5) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $89.58 to $90.55 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (6) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $90.89 to $91.07 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (7) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $85.11 to $85.63 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (8) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $86.44 to $87.43 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (9) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $87.75 to $88.69 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (10) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $88.87 to $89.29 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (11) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $78.14 to $79.14 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (12) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $79.18 to $80.01 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

| (13) | Represents the weighted average sale price of multiple open market same day sales with prices ranging from $80.25 to $81.23 per share. Full information regarding the number of shares sold at each separate price will be provided to the Securities and Exchange Commission or a security holder of the issuer upon request. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Drago John Patrick

20 CUSTOM HOUSE STREET

BOSTON, MA 02110 |

|

| VP - Marketing |

|

Signatures

|

| /s/John P. Drago | | 3/2/2020 |

| **Signature of Reporting Person | Date |

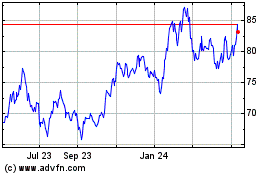

Safety Insurance (NASDAQ:SAFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

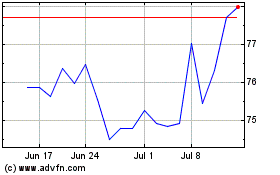

Safety Insurance (NASDAQ:SAFT)

Historical Stock Chart

From Apr 2023 to Apr 2024