737 MAX Woes Hobble Budget Carrier Ryanair--Update

July 16 2019 - 6:07AM

Dow Jones News

By Oliver Griffin

Ryanair Holdings PLC said delays in deliveries of Boeing Co.'s

737 MAX passenger jet will lower growth next summer, forcing

Europe's largest budget airline to close some of its bases and make

cuts at others this winter.

The carrier said Tuesday it now expects passenger growth of 3%

in the summer of 2020, down from an earlier forecast of 7%. Ryanair

blamed the lower guidance on expected delays in receiving a fleet

of 737 MAXs. The news represents the latest ripple effect across

the aviation industry of the grounding of the Boeing jet and the

continued uncertainty on when the plane will be able to fly

again.

The 737 MAX is the latest version of Boeing's best-selling,

single-aisle passenger jet. It competes with a version of Airbus

SE's narrow-body A320. The two planes have grown into the aviation

industry's workhorses, prized by airlines for their fuel-efficient

engines, expanded range and smaller size -- allowing flexibility to

serve smaller markets.

The jet was grounded earlier this year following two fatal

crashes, one in Ethiopia earlier this year and one off the coast of

Indonesia last year. Boeing is working on a software fix to its

flight control system and will need regulatory approval around the

world once it has done that.

Ryanair said it remains committed to the 737 MAX jets and now

expects it will return to flying service before the end of 2019,

though it added that an exact date remains uncertain. The airline

is a large buyer of the MAX 200, a variant of the new jet, having

ordered 58 of the aircraft, but is now planning its 2020 summer

schedules based on taking up to 30 by the end of May 2020.

The airline, which had been due to receive its first MAX planes

this spring, had already warned in May that profit would be dented

this year because of the grounding.

Ryanair said the grounding would reduce its overall fleet size

next year. It expects to add 30 jets to its network by next summer,

instead of the planned 58. This also means that passenger numbers

in the year to March 2021 are now expected to be around 157

million, down from 162 million it previously forecast.

The company said it is starting talks with its airports to

determine which of Ryanair's underperforming or loss-making

destinations could be cut or closed. The airline said it would

start such pruning in November.

Other airlines have also warned about the impact of the MAX

grounding. On Monday American Airlines Group Inc. said issues

related to jet are expected to continue to cause significant

disruption to customers and financial costs, while Norwegian Air

Shuttle ASA last week said it would book an accounting charge and

that growth would be weaker because of the grounding.

(END) Dow Jones Newswires

July 16, 2019 05:52 ET (09:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

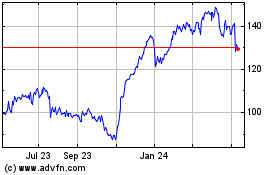

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

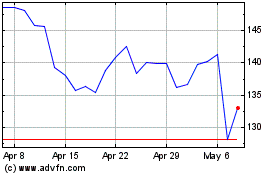

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024