Rush Enterprises, Inc. (NASDAQ:RUSHA)

(NASDAQ:

RUSHB), which operates the largest

network of commercial vehicle dealerships in North America, today

announced that for the quarter ended June 30, 2018, the Company

achieved revenues of $1.349 billion and net income of $29.4

million, or $0.72 per diluted share, compared with revenues of

$1.204 billion and net income of $22.0 million, or $0.54 per

diluted share, in the quarter ended June 30, 2017. During the

second quarter of 2018, the Company incurred an additional pre-tax

charge to amortization expense and a charge to selling, general and

administrative expense totaling of $10.7 million, or $0.20 per

diluted share, associated with the upgrade and replacement of

certain components of the Company’s Enterprise Resource Planning

software platform (ERP Platform).

“We are extremely proud of our exceptional performance this

quarter and our teams who worked hard to achieve it,” said W.M.

“Rusty” Rush, Chairman, Chief Executive Officer and President of

Rush Enterprises, Inc. Rush added, “Additionally, I am

pleased to announce the approval of our first ever cash dividend

this quarter, which reflects our confidence in the Company’s future

performance. Our strategic initiatives continue to have a

positive impact on our financial results, which were further

strengthened by widespread activity across the commercial vehicle

market and strong general economic conditions.” “As always, I’d

like to thank our employees for their focus on our strategic growth

initiatives, which continues to have a direct and positive impact

on our financial results,” said Rush. “Their endless

hard work and dedication to our customers has made and kept us

successful for more than 53 years and I believe it will keep us

successful for many years to come.”

Capital Allocation

In recognition of the Company’s strong cash flow generation and

their confidence in the Company’s financial outlook, the Company’s

Board of Directors authorized management of the Company to initiate

a quarterly cash dividend as part of the Company’s capital

allocation strategy, which also uses free cash flow from operations

to fund the Company’s strategic growth initiatives and its share

repurchase program. Accordingly, on July 24, 2018, the

Company’s Board of Directors declared an initial quarterly cash

dividend of $0.12 per share of Class A and Class B Common Stock, to

be paid on August 29, 2018, to all shareholders of record as of

August 8, 2018. The Company expects to increase the dividend

on an annual basis over time, however, future declarations of

dividends are subject to approval by the Company’s Board of

Directors and may be adjusted as business needs or market

conditions change.

“Initiating a quarterly cash dividend reflects the confidence of

both the Company’s Board of Directors and our executive management

team in our strategic growth plan, strong balance sheet and our

ability to generate positive free cash flow in all truck market

cycles. We believe that issuing a quarterly dividend

and continuing our share repurchase program, while continuing to

invest in our strategic growth initiatives, strikes an optimal

balance between our commitment to long-term growth and to returning

capital to shareholders,” said Rush.

Operations

Aftermarket SolutionsAftermarket services

accounted for approximately 64.8% of the Company's total gross

profits, with parts, service and body shop revenues reaching $422.9

million, up 15.4%, as compared to the second quarter of 2017.

The Company achieved a quarterly absorption ratio of 122.8% in the

second quarter of 2018.

“Our strong aftermarket performance was driven by our strategic

initiatives, particularly through additions to our aftermarket

sales organization, focus on our all-makes and Rig Tough parts

growth, and investment in technology and productivity improvements

for our Parts operations. Our results were further supported by

robust activity across the United States.

“We also added 300 technicians to our organization over the past

year, significantly expanding our service capabilities throughout

the country. Mobile technicians make up a significant portion

of this growth, illustrating our abilities to serve customers no

matter where and when they need us,” he said.

“Throughout our Navistar dealerships, our aftermarket revenues

have been hindered for the past two years because there are fewer

International trucks in operation,” Rush said. “While we expect

those headwinds to continue, we are encouraged by the increased

activity we saw in the second quarter,” he added.

“With our aftermarket sales team building momentum and continued

growth from our strategic initiatives, we believe our aftermarket

results will remain solid through the second half of 2018,” Rush

said.

Truck SalesU.S. Class 8 retail sales were

60,812 units in the second quarter, up 24.7% over the same period

last year, according to ACT Research. The Company sold 3,218

Class 8 trucks in the second quarter and accounted for 5.3% of the

U.S. Class 8 truck market. ACT Research forecasts U.S. retail

sales for Class 8 vehicles to be 251,700 units in 2018, a 27.6%

increase compared to 2017.

“Our new Class 8 truck deliveries were down slightly in the

second quarter, primarily due to truck and component manufacturer

production constraints. However, our new Class 8 truck

deliveries are up 7.8% year to date as compared to the same time

frame last year,” said Rush. “The healthy economy created

significant activity in virtually all market segments and

especially strong demand from over-the-road, construction and

refuse customers,” he said.

“Our used truck unit sales were up 18% over the second quarter

of 2017, and we continue to believe our inventory is

well-positioned to support the market. The used truck market is

strong, due in part to extended lead times for new Class 8 truck

deliveries. We believe this will help stabilize used truck

values and help lessen the impact of the large number of used

trucks entering the market through the rest of the year,” Rush

said.

“We expect our Class 8 vehicle sales will accelerate through the

second half of 2018, although manufacturer production capacity

limitations could delay some deliveries into 2019,” he added.

The Company sold 3,474 Class 4-7 medium-duty commercial vehicles

in the second quarter, an increase of 13% compared to the second

quarter of 2017, and accounted for 5.3% of the U.S. Class 4-7

commercial vehicle market. ACT Research forecasts U.S. retail

sales for Class 4-7 vehicles to reach 251,250 units in 2018, a 3.8%

increase over 2017.

“Our medium-duty truck sales significantly outpaced the market

in the second quarter, due to the strong activity from the

construction sector and our leasing and rental fleet customers,”

said Rush. “Due to our continued ability to support customers

with a nationwide inventory of ready-to-roll trucks, we believe our

medium-duty sales will remain strong through the rest of the year,”

said Rush. “Light-duty truck sales were also strong this quarter,”

Rush noted.

Financial Highlights

In the second quarter of 2018, the Company’s gross revenues

totaled $1.349 billion, a 12.1% increase from gross revenues of

$1.204 billion reported for the quarter ended June 30, 2017.

Net income for the quarter was $29.4 million, or $0.72 per diluted

share, compared to net income of $22.0 million, or $0.54 per

diluted share, in the quarter ended June 30, 2017. During the

second quarter of 2018, the Company incurred an additional pre-tax

charge to amortization expense and selling, general and

administrative expense of $10.7 million, or $0.20 per diluted

share, associated with the upgrade and replacement of certain

components of the Company’s Enterprise Resource Planning software

platform (ERP Platform).

Parts, service and body shop revenues were $422.9 million in the

second quarter of 2018, compared to $366.6 million in the second

quarter of 2017. The Company delivered 3,218 new heavy-duty

trucks, 3,474 new medium-duty commercial vehicles, 679 new

light-duty commercial vehicles and 2,055 used commercial vehicles

during the second quarter of 2018, compared to 3,352 new heavy-duty

trucks, 3,073 new medium-duty commercial vehicles, 473 new

light-duty commercial vehicles and 1,743 used commercial vehicles

during the second quarter of 2017.

During the second quarter of 2018, the Company repurchased $8.0

million of its common stock and ended the quarter with $148.3

million in cash and cash equivalents.

“We are confident in our long-term profitability, which is

reflected in our decision to announce a cash dividend. We remain

well-positioned to invest in our strategic initiatives while

returning capital to our shareholders,” Rush added.

Conference Call

Information

Rush Enterprises will host its quarterly

conference call to discuss earnings for the second quarter on

Wednesday July 25, 2018, at 10 a.m. Eastern/9 a.m.

Central. The call can be heard live by dialing

877-638-4557 (Toll Free) or 914-495-8522 (Conference ID

1072067) or via the Internet

at http://investor.rushenterprises.com/events.cfm.

For those who cannot listen to the live

broadcast, the webcast will be available on our website at the

above link until October 10, 2018. Listen to the audio replay

until August 1, 2018, by dialing 855-859-2056 (Toll Free)

or 404-537-3406 and entering the Conference ID

1072067.

About Rush Enterprises,

Inc. Rush Enterprises, Inc. is the premier

solutions provider to the commercial vehicle industry. The Company

owns and operates Rush Truck Centers, the largest network of

commercial vehicle dealerships in the United States, with more than

100 dealership locations in 21 states. These vehicle centers,

strategically located in high traffic areas on or near major

highways throughout the United States, represent truck and bus

manufacturers, including Peterbilt, International, Hino, Isuzu,

Ford, Mitsubishi, IC Bus and Blue Bird. They offer an integrated

approach to meeting customer needs — from sales of new and used

vehicles to aftermarket parts, service and body shop operations

plus financing, insurance, leasing and rental. Rush Enterprises'

operations also provide vehicle upfitting, CNG fuel systems and

vehicle telematics products. Additional information about Rush

Enterprises’ products and services is available at

www.rushenterprises.com. Follow our news on Twitter at

@rushtruckcenter and on Facebook at

facebook.com/rushtruckcenters.

Certain statements contained herein, including

those concerning current and projected market conditions, sales

forecasts, market share forecasts, demand for the Company’s

services and the impact of strategic initiatives are

“forward-looking” statements (as such term is defined in the

Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Important factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements include, but are not limited to,

competitive factors, general U.S. economic conditions, economic

conditions in the new and used commercial vehicle markets, customer

relations, relationships with vendors, the interest rate

environment, governmental regulation and supervision, product

introductions and acceptance, changes in industry practices,

one-time events and other factors described herein and in filings

made by the Company with the Securities and Exchange Commission. In

addition, the declaration and payment of cash dividends under the

newly initiated quarterly cash dividend program remains at the sole

discretion of the Company’s Board of Directors and the issuance of

future dividends will depend upon the Company’s financial results,

cash requirements, future prospects, applicable law and other

factors that may be deemed relevant by the Company’s Board of

Directors.

-Tables

and Additional Information to Follow-

| RUSH ENTERPRISES, INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (In Thousands, Except Shares and Per Share

Amounts) |

|

|

June 30, |

|

December 31, |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

(Unaudited) |

|

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

148,316 |

|

|

$ |

124,541 |

|

| Accounts

receivable, net |

|

201,197 |

|

|

|

183,875 |

|

| Note

receivable affiliate |

|

17,368 |

|

|

|

11,914 |

|

|

Inventories, net |

|

1,126,613 |

|

|

|

1,033,294 |

|

| Prepaid

expenses and other |

|

12,494 |

|

|

|

11,969 |

|

| Assets

held for sale |

|

6,622 |

|

|

|

9,505 |

|

| Total

current assets |

|

1,512,610 |

|

|

|

1,375,098 |

|

| Investments |

|

6,025 |

|

|

|

6,375 |

|

| Property and equipment,

net |

|

1,166,814 |

|

|

|

1,159,595 |

|

| Goodwill, net |

|

291,391 |

|

|

|

291,391 |

|

| Other assets, net |

|

39,623 |

|

|

|

57,680 |

|

| Total

assets |

$ |

3,016,463 |

|

|

$ |

2,890,139 |

|

| |

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

| Floor

plan notes payable |

$ |

867,992 |

|

|

$ |

778,561 |

|

| Current

maturities of long-term debt |

|

155,743 |

|

|

|

145,139 |

|

| Current

maturities of capital lease obligations |

|

17,137 |

|

|

|

17,119 |

|

| Trade

accounts payable |

|

150,904 |

|

|

|

107,906 |

|

| Customer

deposits |

|

32,036 |

|

|

|

27,350 |

|

| Accrued

expenses |

|

88,677 |

|

|

|

96,132 |

|

| Total

current liabilities |

|

1,312,489 |

|

|

|

1,172,207 |

|

| Long-term debt, net of

current maturities |

|

434,743 |

|

|

|

466,389 |

|

| Capital lease

obligations, net of current maturities |

|

57,548 |

|

|

|

66,022 |

|

| Other long-term

liabilities |

|

11,544 |

|

|

|

9,837 |

|

| Deferred income taxes,

net |

|

140,061 |

|

|

|

135,311 |

|

| Shareholders’

equity: |

|

|

|

| Preferred

stock, par value $.01 per share; 1,000,000 shares authorized; 0

shares outstanding in 2018 and 2017 |

|

– |

|

|

|

– |

|

| Common

stock, par value $.01 per share; 60,000,000 Class A shares and

20,000,000 Class B shares authorized; 30,647,051 Class A shares and

8,430,123 Class B shares outstanding in 2018; and 31,345,116 Class

A shares and 8,469,427 Class B shares outstanding in 2017 |

|

457 |

|

|

|

454 |

|

|

Additional paid-in capital |

|

363,440 |

|

|

|

348,044 |

|

| Treasury

stock, at cost: 1,768,354 class A shares and 4,890,941 class

B shares in 2018 and 934,171 class A shares and

4,625,181 class B shares in 2017 |

|

(166,804 |

) |

|

|

(120,682 |

) |

| Retained

earnings |

|

862,985 |

|

|

|

812,557 |

|

| Total

shareholders’ equity |

|

1,060,078 |

|

|

|

1,040,373 |

|

|

Total liabilities and shareholders’ equity |

$ |

3,016,463 |

|

|

$ |

2,890,139 |

|

|

|

|

|

|

|

|

|

|

| RUSH ENTERPRISES, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS

OF OPERATIONS |

| (In Thousands, Except Per Share

Amounts)(Unaudited) |

| |

|

|

Three Months EndedJune

30, |

|

Six Months EndedJune

30, |

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

| New and

used commercial vehicle sales |

$ |

857,025 |

|

$ |

775,988 |

|

$ |

1,630,125 |

|

$ |

1,411,941 |

|

| Parts and

service sales |

|

422,940 |

|

|

366,599 |

|

|

823,235 |

|

|

716,705 |

|

| Lease and

rental |

|

58,993 |

|

|

53,048 |

|

|

116,517 |

|

|

104,292 |

|

| Finance

and insurance |

|

5,492 |

|

|

4,392 |

|

|

10,233 |

|

|

8,321 |

|

|

Other |

|

4,381 |

|

|

3,496 |

|

|

9,502 |

|

|

7,061 |

|

| Total

revenue |

|

1,348,831 |

|

|

1,203,523 |

|

|

2,589,612 |

|

|

2,248,320 |

|

| Cost of

products sold: |

|

|

|

|

|

|

|

| New and

used commercial vehicle sales |

|

791,608 |

|

|

718,253 |

|

|

1,502,522 |

|

|

1,306,373 |

|

| Parts and

service sales |

|

265,183 |

|

|

231,992 |

|

|

519,627 |

|

|

456,458 |

|

| Lease and

rental |

|

48,663 |

|

|

44,206 |

|

|

97,091 |

|

|

88,510 |

|

| Total

cost of products sold |

|

1,105,454 |

|

|

994,451 |

|

|

2,119,240 |

|

|

1,851,341 |

|

| Gross

profit |

|

243,377 |

|

|

209,072 |

|

|

470,372 |

|

|

396,979 |

|

| Selling, general and

administrative expense |

|

178,654 |

|

|

159,353 |

|

|

350,324 |

|

|

309,756 |

|

| Depreciation and

amortization expense |

|

21,693 |

|

|

12,444 |

|

|

44,601 |

|

|

24,936 |

|

| Gain (loss) on sale of

assets |

|

396 |

|

|

132 |

|

|

368 |

|

|

(31 |

) |

| Operating

income |

|

43,426 |

|

|

37,407 |

|

|

75,815 |

|

|

62,256 |

|

| Interest expense,

net |

|

4,494 |

|

|

2,824 |

|

|

8,800 |

|

|

5,615 |

|

| Income before

taxes |

|

38,932 |

|

|

34,583 |

|

|

67,015 |

|

|

56,641 |

|

| Provision for income

taxes |

|

9,543 |

|

|

12,584 |

|

|

16,587 |

|

|

20,163 |

|

| Net

income |

$ |

29,389 |

|

$ |

21,999 |

|

$ |

50,428 |

|

$ |

36,478 |

|

| |

|

|

|

|

|

|

|

| Earnings per

common share: |

|

|

|

|

|

|

|

| Basic |

$ |

.75 |

|

$ |

.55 |

|

$ |

1.27 |

|

$ |

.92 |

|

| Diluted |

$ |

.72 |

|

$ |

.54 |

|

$ |

1.23 |

|

$ |

.90 |

|

| |

|

|

|

|

|

|

|

| Weighted

average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

|

39,399 |

|

|

39,642 |

|

|

39,567 |

|

|

39,493 |

|

| Diluted |

|

40,690 |

|

|

40,839 |

|

|

40,967 |

|

|

40,737 |

|

|

|

|

|

|

|

|

|

|

This press release and the attached financial

tables contain certain non-GAAP financial measures as defined under

SEC rules, such as Adjusted total debt, Adjusted net (cash) debt,

EBITDA, Adjusted EBITDA, Free cash flow, Adjusted free cash flow

and Adjusted invested capital, which exclude certain items

disclosed in the attached financial tables. The Company

provides reconciliations of these measures to the most directly

comparable GAAP measures.

Management believes the presentation of these

non-GAAP financial measures provides useful information about the

results of operations of the Company for the current and past

periods. Management believes that investors should have the

same information available to them that management uses to assess

the Company’s operating performance and capital structure.

These non-GAAP financial measures should not be considered in

isolation or as a substitute for the most comparable GAAP financial

measures. Investors are cautioned that non-GAAP financial

measures utilized by the Company may not be comparable to similarly

titled non-GAAP financial measures used by other

companies.

| |

|

Three Months Ended |

|

Vehicle Sales Revenue (in thousands) |

|

June 30, 2018 |

|

June 30, 2017 |

| New heavy-duty

vehicles |

|

$ |

474,368 |

|

|

$ |

468,317 |

|

| New medium-duty

vehicles (including bus sales revenue) |

|

|

257,012 |

|

|

|

213,192 |

|

| New light-duty

vehicles |

|

|

27,397 |

|

|

|

18,216 |

|

| Used vehicles |

|

|

92,753 |

|

|

|

72,194 |

|

| Other vehicles |

|

|

5,495 |

|

|

|

4,069 |

|

| |

|

|

|

|

| Absorption

Ratio |

|

|

122.8% |

|

|

|

121.8% |

|

Absorption RatioManagement uses

several performance metrics to evaluate the performance of its

commercial vehicle dealerships and considers Rush Truck Centers’

“absorption ratio” to be of critical importance. Absorption

ratio is calculated by dividing the gross profit from the parts,

service and body shop departments by the overhead expenses of all

of a dealership’s departments, except for the selling expenses of

the new and used commercial vehicle departments and carrying costs

of new and used commercial vehicle inventory. When 100%

absorption is achieved, then gross profit from the sale of a

commercial vehicle, after sales commissions and inventory carrying

costs, directly impacts operating profit.

|

Debt Analysis (in

thousands) |

|

June 30, 2018 |

June 30, 2017 |

| Floor plan notes

payable |

|

$ |

867,992 |

|

$ |

692,125 |

|

| Current maturities of

long-term debt |

|

|

155,743 |

|

|

137,320 |

|

| Current maturities of

capital lease obligations |

|

|

17,137 |

|

|

15,443 |

|

| Long-term debt, net of

current maturities |

|

|

434,743 |

|

|

443,465 |

|

| Capital lease

obligations, net of current maturities |

|

|

57,548 |

|

|

66,313 |

|

| Total Debt

(GAAP) |

|

|

1,533,163 |

|

|

1,354,666 |

|

|

Adjustments: |

|

|

|

| Debt

related to lease & rental fleet |

|

|

(579,434) |

|

|

(560,380) |

|

| Floor

plan notes payable |

|

|

(867,992) |

|

|

(692,125) |

|

| Adjusted Total

Debt (Non-GAAP) |

|

|

85,737 |

|

|

102,161 |

|

|

Adjustment: |

|

|

|

| Cash and

cash equivalents |

|

|

(148,316) |

|

|

(123,807) |

|

| Adjusted Net

Debt (Cash) (Non-GAAP) |

|

$ |

(62,579) |

|

$ |

(21,646) |

|

Management uses “Adjusted Total Debt” to reflect

the Company’s estimated financial obligations less debt related to

lease and rental fleet (L&RFD) and floor plan notes payable

(FPNP), and “Adjusted Net (Cash) Debt” to present the amount of

Adjusted Total Debt net of cash and cash equivalents on the

Company’s balance sheet. The FPNP is used to finance the

Company’s new and used inventory, with its principal balance

changing daily as vehicles are purchased and sold and the sale

proceeds are used to repay the notes. Consequently, in

managing the business, management views the FPNP as interest

bearing accounts payable, representing the cost of acquiring the

vehicle that is then repaid when the vehicle is sold, as the

Company’s credit agreements require it to repay loans used to

purchase vehicles when such vehicles are sold. The Company’s

lease & rental fleet are fully financed and are either (i)

leased to customers under long-term lease arrangements or (ii), to

a lesser extent, dedicated to the Company’s rental business.

In both cases, the lease and rental payments received fully cover

the capital costs of the lease & rental fleet (i.e., the

interest expense on the borrowings used to acquire the vehicles and

the depreciation expense associated with the vehicles), plus a

profit margin for the Company. The Company believes excluding

the FPNP and L&RFD from the Company’s total debt for this

purpose provides management with supplemental information regarding

the Company’s capital structure and leverage profile and assists

investors in performing analysis that is consistent with financial

models developed by Company management and research analysts.

“Adjusted Total Debt” and “Adjusted Net (Cash) Debt” are both

non-GAAP financial measures and should be considered in addition

to, and not as a substitute for, the Company’s debt obligations, as

reported in the Company’s consolidated balance sheet in accordance

with U.S. GAAP. Additionally, these non-GAAP measures may

vary among companies and may not be comparable to similarly titled

non-GAAP measures used by other companies.

| |

|

Twelve Months Ended |

|

EBITDA (in thousands) |

|

June 30, 2018 |

June 30, 2017 |

| Net Income

(GAAP) |

|

$ |

186,079 |

|

$ |

63,848 |

|

| (Benefit) provision for

income taxes |

|

|

(39,306) |

|

|

37,491 |

|

| Interest expense |

|

|

15,495 |

|

|

11,892 |

|

| Depreciation and

amortization |

|

|

69,734 |

|

|

50,729 |

|

| (Gain) loss on sale of

assets |

|

|

(294) |

|

|

(1,719) |

|

| EBITDA

(Non-GAAP) |

|

|

231,708 |

|

|

162,241 |

|

|

Adjustments: |

|

|

|

| Interest

expense associated with FPNP |

|

|

(13,513) |

|

|

(9,747) |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

218,195 |

|

$ |

152,494 |

|

The Company presents EBITDA and Adjusted EBITDA,

for the twelve months ended each period presented, as additional

information about its operating results. The presentation of

Adjusted EBITDA that excludes the addition of interest expense

associated with FPNP to EBITDA is consistent with management’s

presentation of Adjusted Total Debt, in each case reflecting

management’s view of interest expense associated with the FPNP as

an operating expense of the Company, and to provide management with

supplemental information regarding operating results and to assist

investors in performing analysis that is consistent with financial

models developed by management and research analyst. “EBITDA”

and “Adjusted EBITDA” are both non-GAAP financial measures and

should be considered in addition to, and not as a substitute for,

net income of the Company, as reported in the Company’s

consolidated statements of income in accordance with U.S.

GAAP. Additionally, these non-GAAP measures may vary among

companies and may not be comparable to similarly titled non-GAAP

measures used by other companies.

| |

|

Twelve Months Ended |

|

Free Cash Flow (in thousands) |

|

June 30, 2018 |

June 30, 2017 |

| Net cash

provided by operations (GAAP) |

|

$ |

211,998 |

|

$ |

428,976 |

|

| Acquisition of property

and equipment |

|

|

(246,563) |

|

|

(161,269) |

|

| Free cash flow

(Non-GAAP) |

|

|

(34,565) |

|

|

267,707 |

|

| Adjustments: |

|

|

|

| Draws

(payments) on floor plan financing, net |

|

|

106,203 |

|

|

(151,966) |

|

| Proceeds

from L&RFD |

|

|

169,723 |

|

|

103,806 |

|

| Principal

payments on L&RFD |

|

|

(155,884) |

|

|

(159,665) |

|

|

Non-maintenance capital expenditures |

|

|

33,613 |

|

|

34,142 |

|

| Adjusted Free

Cash Flow (Non-GAAP) |

|

$ |

119,090 |

|

$ |

94,024 |

|

“Free Cash Flow” and “Adjusted Free Cash Flow”

are key financial measures of the Company’s ability to generate

cash from operating its business. Free Cash Flow is

calculated by subtracting the acquisition of property and equipment

included in the Cash flows from investing activities from Net cash

provided by (used in) operating activities. For purposes of

deriving Adjusted Free Cash Flow from the Company’s operating cash

flow, Company management makes the following adjustments: (i) adds

back draws (or subtracts payments) on the floor plan financing that

are included in Cash flows from financing activities as their

purpose is to finance the vehicle inventory that is included in

Cash flows from operating activities; (ii) adds back proceeds from

notes payable related specifically to the financing of the lease

and rental fleet that are reflected in Cash flows from financing

activities; (iii) subtracts draws on floor plan financing, net and

proceeds from L&RFD related to business acquisition assets that

are included in Cash flows from investing activities; (iv)

subtracts principal payments on notes payable related specifically

to the financing of the lease and rental fleet that are included in

Cash flows from financing activities; and (v) adds back

non-maintenance capital expenditures that are for growth and

expansion (i.e. building of new dealership facilities) that are not

considered necessary to maintain the current level of cash

generated by the business. “Free Cash Flow” and “Adjusted

Free Cash Flow” are both presented so that investors have the same

financial data that management uses in evaluating the Company’s

cash flows from operating activities. “Free Cash Flow” and

“Adjusted Free Cash Flow” are both non-GAAP financial measures and

should be considered in addition to, and not as a substitute for,

net cash provided by (used in) operations of the Company, as

reported in the Company’s consolidated statement of cash flows in

accordance with U.S. GAAP. Additionally, these non-GAAP

measures may vary among companies and may not be comparable to

similarly titled non-GAAP measures used by other

companies.

|

Invested Capital (in thousands) |

|

June 30, 2018 |

June 30, 2017 |

| Total

Shareholders' equity (GAAP) |

|

$ |

1,060,078 |

|

$ |

894,880 |

|

| Adjusted net debt

(cash) (Non-GAAP) |

|

|

(62,579) |

|

|

(21,646) |

|

| Adjusted

Invested Capital (Non-GAAP) |

|

$ |

997,499 |

|

$ |

873,234 |

|

“Adjusted Invested Capital” is a key financial

measure used by the Company to calculate its return on invested

capital. For purposes of this analysis, management excludes

L&RFD, FPNP, and cash and cash equivalents, for the reasons

provided in the debt analysis above and uses Adjusted Net Debt in

the calculation. The Company believes this approach provides

management a more accurate picture of the Company’s leverage

profile and capital structure, and assists investors in performing

analysis that is consistent with financial models developed by

Company management and research analysts. “Adjusted Net

(Cash) Debt” and “Adjusted Invested Capital” are both non-GAAP

financial measures. Additionally, these non-GAAP measures may

vary among companies and may not be comparable to similarly titled

non-GAAP measures used by other companies.

Contact:Rush Enterprises, Inc., San Antonio

Steven L. Keller, 830-302-5226

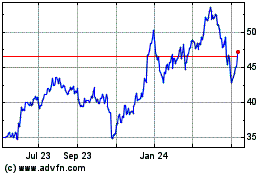

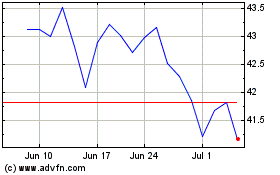

Rush Enterprises (NASDAQ:RUSHA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rush Enterprises (NASDAQ:RUSHA)

Historical Stock Chart

From Apr 2023 to Apr 2024