Current Report Filing (8-k)

March 08 2019 - 5:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): March 5, 2019

Rush Enterprises, Inc.

(Exact name of registrant as specified in its charter)

|

Texas

(State or other jurisdiction

of incorporation)

|

0-20797

(Commission File Number)

|

74-1733016

(IRS Employer Identification No.)

|

|

|

|

|

|

555 IH-35 South, Suite 500

New Braunfels, Texas

(Address of principal executive offices)

|

|

78130

(Zip Code)

|

Registrant’s telephone number, including area code:

(830) 302-5200

Not Applicable

______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e) On March 5, 2019, the Board of Directors of Rush Enterprises, Inc. (the “Company”), upon the recommendation of the Compensation Committee of the Company (the “Compensation Committee”), approved the following compensation payments to the below named executive officers of the Company:

Cash Bonus Payments

After a review of competitive market data and the Company’s operating results for the 2018 fiscal year, the Compensation Committee approved the following cash bonus payments:

|

Name / Title

|

|

Cash Bonus

|

|

|

|

|

|

|

|

|

W. M. “Rusty” Rush

Chairman, President, Chief Executive Officer and Director

|

|

$

|

2,500,000

|

|

|

|

|

|

|

|

|

Michael J. McRoberts

Chief Operating Officer

|

|

$

|

565,000

|

|

|

|

|

|

|

|

|

Steven L. Keller

Chief Financial Officer and Treasurer

|

|

$

|

438,000

|

|

|

|

|

|

|

|

|

Derrek Weaver

Executive Vice President

|

|

$

|

438,000

|

|

|

|

|

|

|

|

|

James E. Thor

Senior Vice President, Truck Sales and Marketing

|

|

$

|

413,000

|

|

The cash bonuses will be paid on March 15, 2019.

Stock Option Grants

The Compensation Committee approved the following stock options exercisable for shares of the Company’s Class A common stock (the “Stock Options”):

|

Name / Title

|

|

Stock Options (#)

|

|

|

|

|

|

|

|

|

W. M. “Rusty” Rush

Chairman, President, Chief Executive Officer and Director

|

|

|

35,000

|

|

|

|

|

|

|

|

|

Michael J. McRoberts

Chief Operating Officer

|

|

|

10,000

|

|

|

|

|

|

|

|

|

Steven L. Keller

Chief Financial Officer and Treasurer

|

|

|

10,000

|

|

|

|

|

|

|

|

|

Derrek Weaver

Executive Vice President

|

|

|

10,000

|

|

|

|

|

|

|

|

|

James E. Thor

Senior Vice President, Truck Sales and Marketing

|

|

|

10,000

|

|

The Stock Options will be granted under the Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan (the “Plan”) on March 15, 2019 (the “Grant Date”). The Stock Options will have an exercise price equal to the closing sale price of the Company’s Class A common stock on the Grant Date and will vest in three equal annual installments beginning on the third anniversary of the Grant Date. Additional terms and conditions applicable to the Stock Options are set forth in the Form of Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan Stock Option Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Restricted Stock

Awards

The Compensation Committee approved the following restricted stock awards (the “RSAs”):

|

Name / Title

|

|

RS

As

(#)

|

|

|

|

|

|

|

|

|

W. M. “Rusty” Rush

Chairman, President, Chief Executive Officer and Director

|

|

|

61,000

|

|

|

|

|

|

|

|

|

Michael J. McRoberts

Chief Operating Officer

|

|

|

18,000

|

|

|

|

|

|

|

|

|

Steven L. Keller

Chief Financial Officer and Treasurer

|

|

|

14,000

|

|

|

|

|

|

|

|

|

Derrek Weaver

Executive Vice President

|

|

|

14,000

|

|

|

|

|

|

|

|

|

James E. Thor

Senior Vice President, Truck Sales and Marketing

|

|

|

12,400

|

|

The RSAs will be granted under the Plan on the Grant Date. The RSAs entitle the grantee to receive shares of the Company’s Class B common stock upon satisfaction of the vesting conditions. The RSAs will vest in three equal installments beginning on the first anniversary of the Grant Date. Additional terms and conditions applicable to the RSAs are set forth in the Form of Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan Restricted Stock Award Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01 Other Events.

The Company’s Board of Directors recently approved amendments to the following Company governance documents: (i) the Corporate Governance Guidelines; (ii) the Nominating and Governance Committee Charter; and (iii) the Audit Committee Charter. The amendments are intended to bring these documents further into conformance with current corporate governance “best practices” and to update certain activities and responsibilities that the Board of Directors and its committees perform or undertake today and that were not reflected prior to the amendments. The updated governance documents are available on our website at

www.rushenterprises.com

.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No.

Description

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RUSH ENTERPRISES, INC.

|

|

|

|

|

|

By:

|

/s/ Michael Goldstone

|

|

|

|

|

Michael Goldstone

Vice President, General Counsel

and Corporate Secretary

|

Dated: March 8, 2019

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan Form of Stock Option Agreement.

|

|

|

|

|

|

10.2

|

|

Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan Form of Restricted Stock Award Agreement.

|

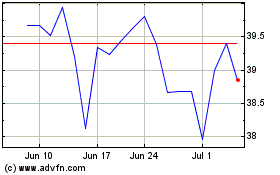

Rush Enterprises (NASDAQ:RUSHB)

Historical Stock Chart

From Mar 2024 to Apr 2024

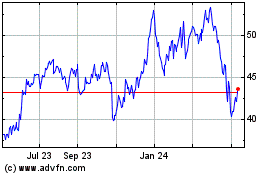

Rush Enterprises (NASDAQ:RUSHB)

Historical Stock Chart

From Apr 2023 to Apr 2024