Rosehill Resources Inc. Announces Pricing of Class A Common Stock Offering

September 27 2018 - 8:15PM

Rosehill Resources Inc. (NASDAQ: ROSE, ROSEW, ROSEU) (the

“Company”) announced today the pricing of a public offering (the

“Offering”) of 6,150,000 shares of its Class A common stock (“Class

A Common Stock”) for aggregate gross proceeds of approximately

$37.5 million, before underwriting discounts and commissions and

estimated offering expenses, pursuant to a registration

statement on Form S-1 (the “Registration Statement”) filed

previously with the U.S. Securities and Exchange

Commission (“SEC”). In connection with the Offering, the Company

has granted the underwriters a 30-day option to purchase up to an

additional 922,500 shares of Class A Common Stock. The

Company anticipates the proceeds from the Offering (after

underwriting discounts and commissions and estimated offering

expenses) will be approximately $35.6 million, excluding any

exercise of the Company’s option to purchase additional shares of

Common Stock. The Company intends to contribute all of the

net proceeds of the Offering to Rosehill Operating Company, LLC

(“Rosehill Operating”) in exchange for a number of units in

Rosehill Operating equal to the number of shares of Class A Common

Stock issued by the Company in the Offering. Rosehill Operating

intends to use the net proceeds to finance its development plan and

for general corporate purposes, including to fund potential future

acquisitions.

Citigroup, SunTrust Robinson Humphrey and J.P.

Morgan are acting as joint book-running managers for the

Offering.

A registration statement relating to the

Offering was declared effective by the Securities and Exchange

Commission on September 27, 2018. This press release shall

not constitute an offer to sell or a solicitation of an offer to

buy the securities, nor shall there be any sale of the securities

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

The Offering is being made only by means of a

prospectus that meets the requirements of Section 10 of the

Securities Act of 1933, as amended. A copy of the prospectus may be

obtained from:

| Citigroup

Global Markets Inc.c/o Broadridge Financial Services1155 Long

Island Avenue,Edgewood, NY 11717Telephone: (800) 831-9146 J.P.

Morgan Securities LLCc/o Broadridge Financial Services1155 Long

Island Avenue,Edgewood, NY 11717Attention: Prospectus

DepartmentTelephone: (866) 803-9204Email:

prospectus-eq_fi@jpmchase.com |

SunTrust

Robinson Humphrey, Inc.3333 Peachtree Road NE, 9th FloorAtlanta, GA

30326Attention: Prospectus DepartmentTelephone: (404) 926-5744Fax:

(404) 926-5464Email: strh.prospectus.com |

|

|

|

About Rosehill Resources

Inc.

Rosehill Resources Inc. is an oil and gas

exploration company with producing assets in Texas and New Mexico

with its investment activity focused in the Delaware Basin portion

of the Permian Basin. The Company’s strategy for growth includes

the organic development of its two core acreage areas in the

Northern Delaware Basin and the Southern Delaware Basin, as well as

focused acquisitions in the Delaware Basin.

Cautionary Statement Concerning

Forward-Looking Statements

Certain statements contained in this press

release constitute “forward-looking statements” within the meaning

of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements, including statements regarding the

closing of the Offering and the Company’s use of proceeds from the

Offering, represent the Company’s expectations or beliefs

concerning future events, and it is possible that the results

described in this press release will not be achieved. These

forward-looking statements are subject to risks, uncertainties and

other factors, many of which are outside of the Company’s control,

that could cause actual results to differ materially from the

results discussed in the forward-looking statements.

Any forward-looking statement speaks only as of

the date on which it is made, and, except as required by law, the

Company does not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. New factors emerge from time to time,

and it is not possible for the Company to predict all such factors.

When considering these forward-looking statements, you should keep

in mind the risk factors and other cautionary statements in the

prospectus filed with the SEC in connection with the Offering. The

risk factors and other factors noted in the Company’s prospectus

could cause its actual results to differ materially from those

contained in any forward-looking statement.

Contact Information:

| Gary C.

Hanna |

Craig

Owen |

John

Crain |

| Interim

President and Chief Executive Officer |

Chief

Financial Officer |

Senior

Manager – Finance & Investor Relations |

|

281-675-3400 |

281-675-3400 |

281-675-3493 |

| |

|

|

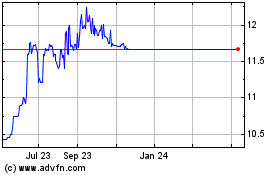

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Apr 2023 to Apr 2024