UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No.

__)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

Rocky Mountain Chocolate Factory, Inc.

|

(Name of Registrant as Specified In Its Charter)

AB VALUE PARTNERS, LP

AB VALUE MANAGEMENT LLC

BRADLEY RADOFF

ANDREW T. BERGER

RHONDA J. PARISH

MARK RIEGEL

SANDRA ELIZABETH TAYLOR

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

AB Value Partners, LP,

AB Value Management LLC (together with AB Value Partners, LP, “AB Value”), Bradley Radoff, Andrew T. Berger, Rhonda J. Parish,

Mark Riegel and Sandra Elizabeth Taylor filed a definitive proxy statement and accompanying BLUE proxy card with the Securities and Exchange

Commission on September 13, 2021, to be used to solicit votes for the election of their slate of highly-qualified director nominees at

the 2021 annual meeting of shareholders (including any other meeting of shareholders held in lieu thereof, and adjournments, postponements,

reschedulings or continuations thereof, the “Annual Meeting”) of Rocky Mountain Chocolate Factory, Inc., a Delaware corporation,

and for the approval of a business proposal to be presented at the Annual Meeting.

On September 23, 2021, AB Value issued a press

release, a copy of which is filed as Exhibit 1.

Also on September 23, 2021, AB Value filed a complaint

in the Court of Chancery of the State of Delaware against Rocky Mountain Chocolate Factory, Inc. and certain members of its Board of Directors,

a copy of which is filed as Exhibit 2.

Exhibit 1

Concerned Shareholders of Rocky Mountain File Lawsuit to Hold

Rocky Mountain Chocolate Factory Board Accountable for Acts to Disenfranchise Shareholders

WESTFIELD, N.J.--(BUSINESS WIRE)--AB Value Management

LLC, collectively with its affiliates (“AB Value”), and the other participants in this solicitation (collectively, the “Concerned

Shareholders of Rocky Mountain”) representing approximately 14.59% of the outstanding shares of Rocky Mountain Chocolate Factory,

Inc. (NASDAQ: RMCF) (the “Company”), today announced that AB Value has filed a lawsuit in the Court of Chancery of the State

of Delaware against the Company and certain members of its Board of Directors (the “Board”), seeking to rescind and declare

invalid the Board’s resolutions shrinking the number of Board seats up for election from seven to six right before the Company’s

2021 Annual Meeting of Shareholders (the “2021 Annual Meeting”).

Absent the Board’s last minute reduction

in size, shareholders would have had the opportunity to choose who would be best suited to fill Mary Kennedy Thompson’s seat from

the Concerned Shareholders of Rocky Mountain’s slate of candidates at the 2021 Annual Meeting.

Commenting on the complaint, Andrew T. Berger,

Managing Member of AB Value stated: “The Board’s attempt to block one of our director candidates from being elected by shareholders

is the latest in a series of crude efforts by Board members to thwart the shareholder franchise, further entrenching themselves in order

to safeguard their own Board seats. As part of the Company’s largest shareholder group, we plan to defend the rightful owners of

the Company by fighting these egregious acts in court.”

In its lawsuit, AB Value asks the Court to find

that the defendant Board members breached their fiduciary duties by voting to shrink the Board without legal analysis from Delaware counsel

and without making a reasonable inquiry as to the effect such an act would have on all of the Company’s shareholders. Unless the

Board’s invalid actions are overturned by the Court, the Concerned Shareholders of Rocky Mountain believe that these Board members

have deprived shareholders of the full and fair opportunity to exercise their right to vote for seven directors at the 2021 Annual Meeting,

less than two weeks away.

The full complaint filed by AB Value can be accessed

at https://velaw.box.com/v/ConcernedShareholdersRMCF.

With two competing slates vying over the Company’s

fate, it will be up to shareholders to decide who should lead the Company—and it should be up to shareholders to decide on

seven Board seats, not six. If elected, the Concerned Shareholders of Rocky Mountain’s nominees—Andrew T. Berger, Mark Riegel,

Sandra Elizabeth Taylor and Rhonda J. Parish—will consider the full impact of their decisions as fiduciaries and take the steps

necessary to enhance value for all shareholders. We strongly encourage all shareholders to act now and vote FOR the Concerned Shareholders

of Rocky Mountain on the BLUE proxy card.

Important Additional Information

AB Value Partners, LP and AB Value Management

LLC, Andrew T. Berger, Bradley Radoff, Rhonda J. Parish, Mark Riegel, and Sandra Elizabeth Taylor (collectively, the “Participants”)

have filed a definitive proxy statement and an accompanying BLUE proxy card with the SEC to solicit proxies from shareholders of

the Company for use at the 2021 Annual Meeting. THE PARTICIPANTS STRONGLY ADVISE ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT

AND OTHER PROXY MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Such proxy materials are available at no charge on the SEC’s

website at http://www.sec.gov. In addition, the Participants in this proxy solicitation will provide copies of the proxy statement without

charge, upon request. Requests for copies should be directed to the Participants’ proxy solicitor.

Certain Information Regarding the Participants

The Participants in the proxy solicitation are:

AB Value Partners, LP, AB Value Management LLC, Andrew T. Berger, Bradley Radoff, Rhonda J. Parish, Mark Riegel, and Sandra Elizabeth

Taylor. As of the date hereof, AB Value Partners, LP directly owns 224,855 shares of common stock, $0.001 par value per share of the Company

(“Common Stock”). As of the date hereof, AB Value Management LLC beneficially owns 460,189 shares of Common Stock. As of the

date hereof, Mr. Radoff directly owns 433,624 shares of Common Stock. As of the date hereof, none of Mr. Berger, Ms. Parish, Mr. Riegel,

or Ms. Taylor directly own any shares of Common Stock.

Contacts

John Glenn Grau

InvestorCom LLC

(203) 295-7841

Exhibit 2

IN THE COURT OF CHANCERY OF THE

STATE OF DELAWARE

|

AB VALUE PARTNERS, LP and AB

|

)

|

|

|

|

|

VALUE MANAGEMENT LLC,

|

)

|

|

|

|

|

|

)

|

|

|

|

|

Plaintiffs,

|

)

|

|

|

|

|

|

)

|

C.A. No.

|

|

|

|

v.

|

)

|

|

|

|

|

|

)

|

|

|

|

|

ROCKY MOUNTAIN

|

)

|

|

|

|

|

CHOCOLATE FACTORY, INC.,

|

)

|

|

|

|

|

BRYAN J. MERRYMAN, RAHUL

|

)

|

|

|

|

|

MEWAWALLA, FRANKLIN E.

|

)

|

|

|

|

|

CRAIL, BRETT P. SEABERT, and

|

)

|

|

|

|

|

JEFFREY R. GEYGAN,

|

)

|

|

|

|

|

|

)

|

|

|

|

|

Defendants.

|

)

|

|

|

|

VERIFIED COMPLAINT

FOR

DECLARATORY AND INJUNCTIVE RELIEF

Plaintiffs AB

Value Partners, LP and AB Value Management LLC (together, “Plaintiffs” or “AB Value”), for their complaint against

Rocky Mountain Chocolate Factory, Inc. (“Rocky Mountain” or the “Company”) and individual defendants Bryan J.

Merryman, Rahul Mewawalla, Franklin E. Crail, Brett P. Seabert, and Jeffrey R. Geygan (collectively, the “Director Defendants”,

and, together with Rocky Mountain, the “Defendants”), make the following allegations upon personal knowledge as to themselves

and their own actions and, where indicated, upon personal observation, and upon information and belief as to all other matters:

NATURE OF THE ACTION

1. This

is an action to redress Defendants’ unilateral constriction of Rocky Mountain’s board of directors (the “Board”)

from seven members to six, in the middle of a proxy contest for control over the board, approximately two weeks before the Company’s

annual meeting, scheduled for October 6, 2021. This is the latest in a series of crude efforts by Rocky Mountain’s incumbent directors

to thwart the stockholder franchise by further entrenching themselves in order to safeguard their own board seats.

2. Rocky Mountain has

languished under its current management. Since 2015, Rocky Mountain’s stock price has dropped from a high of $15.27 per share

to $7.85 per share.1 Plaintiff AB Value, which first invested in the Company in December 2018, has led an effort to

change the composition of the Board to ensure objective and independent oversight of the Company’s management, strategy and

operations. Plaintiffs and Defendants have been engaged in two proxy fights since July 2019 – the first one settled in

November 2019 and the second one, which commenced in June 2021, is scheduled to go to a shareholder vote on October 6, 2021 at Rocky

Mountain’s annual meeting of shareholders (the “2021 Annual Meeting”).

3. The

Board’s response to AB Value’s public involvement has been haphazard, defensive and reactionary at every turn. The Board has

delayed the Company’s annual meeting in violation of Delaware law, caused the Company to make false and materially misleading statements

to stockholders, conducted meetings without properly notifying all board members, and sought to intimidate stockholders affiliated with

AB Value.

4. On

August 30, 2021, Rocky Mountain filed a preliminary proxy statement nominating a slate of seven director candidates for election to Rocky

Mountain’s seven-member board at the 2021 Annual Meeting.

5. On

September 2, 2021, Plaintiffs filed a preliminary proxy statement nominating a competing slate of five director candidates. Plaintiffs’

and Defendants’ competing slates included one common director nominee: Mary K. Thompson.

6. On

September 16, 2021, Ms. Thompson resigned from the Rocky Mountain board and withdrew from both slates due to frustration regarding the

parties’ inability to reach a settlement agreement.

7. On

Sunday, September 19, 2021, just seventeen days before the scheduled stockholder vote, the Director Defendants unilaterally adopted resolutions

reducing the size of the Company’s board from seven directors to six.

8. The

Director Defendants reduced the size of the Board for the sole purpose of impeding the effective exercise of the stockholder

franchise in advance of the upcoming, contested director election, in breach of their fiduciary duties of care and loyalty. Absent

Defendants’ unlawful actions, one of Plaintiffs’ director candidates would have been guaranteed a seat following the

scheduled annual meeting unless stockholders filled the vacancy with a new candidate not listed on either competing slate.

9. Shrinking

the Board was a defensive action, but the existence of an open Board seat was and is not a threat to the Company.

10. Absent

declaratory and injunctive relief, the Director Defendants’ latest entrenchment exercise will cause irreparable harm to Rocky Mountain’s

common stockholders by depriving them of their lawful right to elect directors.

1 As of market close on September 21, 2021.

PARTIES AND RELEVANT NON-PARTIES

I.

PLAINTIFFS

11. Plaintiff

AB Value Partners, LP is a limited partnership organized under the laws of Delaware. Its primary business is investment in securities.

12. Plaintiff

AB Value Management, LLC, which manages AB Value Partners, LP, is a limited liability company organized under the laws of New Jersey.

13. AB

Value and its affiliates2 collectively own approximately 14.63% of the outstanding common stock of Rocky Mountain. The principal

business address of AB Value is 208 Lenox Ave., #409, Westfield, NJ 07090.

II.

DEFENDANTS

14. Defendant

Rocky Mountain is an SEC-reporting publicly traded corporation incorporated under the laws of the state of Delaware on August 6, 2014.

Rocky Mountain is an international franchisor, confectionery manufacturer and retail operator that manufactures and supplies its franchises

with a line of premium chocolate candies and other confectionery products.

15. Defendant

Rahul Mewawalla serves as Chairperson of the Rocky Mountain Board of Directors. Mr. Mewawalla was appointed to the Board in June 2021,

and he was elevated to chair in August 2021.

16. Defendant Bryan J. Merryman

serves as a Director on the Rocky Mountain Board, a position he has held for more than twenty years. He also currently serves as the

Company’s Chief Executive Officer, Chief Financial Officer, President, and Treasurer. Mr. Merryman served as Chairperson of the

Board until June 2021, when Rocky Mountain issued a press release disclosing its decision to separate the CEO and Chairman roles following

public pressure from AB Value to do exactly that.

17. Franklin

E. Crail, founder of Rocky Mountain, has served as a Director on the Board for almost forty years. Mr. Crail served as Rocky Mountain’s

President, Chief Executive Officer, Chairperson of the Board and member of the Compensation Committee until February 26, 2019.

18. Brett

P. Seabert has served as a Director on the Rocky Mountain Board since 2017, and he served as Chair of the Compensation Committee from

2019 until August 2021. Mr. Merryman was the best man in Mr. Seabert’s wedding.

19. Jeffrey

R. Geygan has served as a Director on the Rocky Mountain Board since August 2021. In June 2021, Mr. Geygan, through his fund, Global Value

Investment Corp. (“GVIC”), attempted a tender offer aimed at securing a control-like stake in the Company and threatened to

replace a near-majority of the Board. He has indicated on multiple occasions his desire to take control of the Company. Mr. Geygan was

appointed to the Board as a condition of a cooperation agreement executed between GVIC and the Company in August 2021 (the “GVIC

Cooperation Agreement”). The GVIC Cooperation Agreement imposed a standstill period of less than one year, during which GVIC and

Mr. Geygan must vote their shares as recommended by the Board and refrain from waging proxy fights.

2 As of September 13, 2021, AB Value and affiliates Bradley Radoff, Mr. Berger, Rhonda J. Parish, Mark Riegel, Sandra Elizabeth Taylor, and Mary Kennedy Thompson (collectively referred to in certain AB Value proxy materials as the “Concerned Shareholders of Rocky Mountain”) owned an aggregate of 895,813 shares of the company’s 6,124,288 outstanding shares of common stock.

III.

NON-DEFENDANT DIRECTORS

20. Andrew

T. Berger, managing partner of AB Value, has served as a Director on the Rocky Mountain Board since January 2020. He was nominated by

the Company pursuant to a December 2019 settlement agreement between AB Value and the Company (the “AB Value Settlement Agreement”)

and elected by stockholders during the annual meetings of shareholders of Rocky Mountain held in January and September 2020.

21. Mary

K. Thompson, nominated pursuant to the AB Value Settlement Agreement and subsequently elected by the Company’s stockholders at the

January and September 2020 annual meetings, served as a Director from January 2020 through September 16, 2021.

JURISDICTION AND VENUE

22. This Court has subject

matter jurisdiction under 10 Del. C. § 341 and 8 Del. C. § 111.

23. Defendant

Rocky Mountain is incorporated in Delaware and is subject to suit here.

24. The

Director Defendants have consented to personal jurisdiction in Delaware under 10 Del. C. § 3114.

25. Venue

is proper in this Court because Plaintiffs seek injunctive and declaratory relief involving a Delaware corporation.

FACTUAL BACKGROUND

A.

Management’s Failures and AB Value’s Investment

26. Since 2015, Rocky Mountain’s

managers and the Board that oversees them have consistently failed the Company’s stockholders. Between February 24, 2015, and July

15, 2019, the Company’s stock price decreased 45%, from a peak of $15.27 to $8.47 per share at close on July 15, 2019. During this

period, factory sales, retail sales and royalty, and marketing and franchise fees all declined.

27. From

fiscal year 2015 to fiscal year 2019, the Company’s overall revenues plummeted 17%, from $41.5 million to $34.5 million. During

the same five-year period, net income collapsed 43%, from $3.9 million to $2.2 million.

28. As

of November 2019, the average tenure of the Board’s then-current directors was 17.4 years, and the Company’s named executive

officers had held their current positions for an average of approximately 16 years and had worked at the Company for an average of approximately

24 years.

29. Recognizing

that Rocky Mountain’s entrenched management—under the supervision of its entrenched Board—was driving the Company into

a downward spiral, AB value made its initial investment in the Company on December 3, 2018.

B.

AB Value’s 2019 Proxy Solicitation

30. Between April 21 and

May 26, 2019, AB Value called and emailed Rocky Mountain Board members on several different occasions attempting to initiate a

constructive dialogue regarding the addition of Mr. Berger and Ms. Thompson to the Board. The Company declined to engage.

31. On

May 18, 2019, AB Value delivered a notice to the Corporate Secretary of Rocky Mountain of AB Value’s intent to (i) nominate a slate

of two highly qualified director candidates with directly relevant industry experience, comprised of Mr. Berger and Ms. Thompson (the

“AB Value Nominees”), for election to the Board at the 2019 annual meeting of stockholders, which had not yet been scheduled.

32. On

May 22, 2019, AB Value filed Amendment No. 1 to its Schedule 13D with the SEC to disclose the nomination of Mr. Berger and Ms. Thompson.

33. On

May 29, 2019, Rocky Mountain announced, in conjunction with its annual earnings results, that it was “conducting a process to explore

and evaluate strategic alternatives to maximize stockholder value and position the Company for long-term success,” and had engaged

North Point Advisors to act as its financial advisor and Perkins Coie LLP as legal counsel to assist with this review.

34. On May 30, 2019, Mr.

Berger spoke with Mr. Merryman regarding the AB Value Nominees. During this conversation, Mr. Merryman confirmed to Mr. Berger that

AB Value’s nomination of the AB Value Nominees was a motivating factor in the Board’s determination that the Company

should conduct an exploration and evaluation of strategic alternatives. At no point had or has AB Value ever suggested that the

Company conduct such an evaluation.

35. On

July 25, 2019, AB Value filed its preliminary proxy statement in connection with the Company’s annual meeting.

36. On

August 13, 2019, AB Value delivered a demand letter to the Company pursuant to 8 Del. C. § 220, demanding to inspect, among

other things, books and records containing information related to the review of strategic alternatives announced by the Company on May

29, 2019 (the “Strategic Review Demand”) in an effort to confirm the extent to which the Company’s announcement of strategic

alternatives was driven by AB Value’s nomination notice, as suggested by Mr. Merryman.

37. On

August 22, 2019, the Company refused to provide the requested materials and asserted, incorrectly, that AB Value did not have a proper

purpose for inspecting the requested books and records.

38. On

August 23, 2019, the Company announced that its Board had set the date of the annual meeting for January 9, 2020, nearly seventeen months

after the Company’s previous 2018 annual meeting, in violation of Delaware law. Defendants delayed the meeting for the specific

purpose of thwarting, or at least delaying, AB Value’s efforts to secure board seats.

39. On

September 9, 2019, AB Value delivered an open letter to the Board, expressing dissatisfaction with its egregious delay in holding the

Annual Meeting. In addition, AB Value questioned the Board’s motives for (1) announcing a strategic review one week after AB Value

had submitted its nomination notice and (2) its refusal to meet with the AB Value Nominees, despite AB Value’s timely and qualifying

submission of the nomination notice.

40. On

September 20, 2019, another Rocky Mountain stockholder filed a complaint against Rocky Mountain in this Court (the “Section 211

Action”). The complaint observed that the Company had unlawfully deferred the Annual Meeting until January 9, 2020, nearly seventeen

months after the Company’s last annual meeting held on August 17, 2018, in violation of 8 Del. C. § 211(c).

41. On November 4, 2019,

the Court issued its Order of Final Judgment in the Section 211 Action. The Court declined to accelerate the scheduled January 9,

2020 annual meeting the directors had set due to the December holidays, but it chastised the directors for their apparent

gamesmanship. See Geser v. Rocky Mountain Chocolate Factory, Inc., C.A. No. 2019-0764-AGB at *16 (Del. Ch. Nov. 1, 2019)

(TRANSCRIPT) (“Every year in May [the Company] figures out when it’s going to have a meeting, issues a proxy in June,

has a meeting in August. Four years straight. This year they get a letter indicating people want to nominate two members of the

board….But, lo and behold, [the meeting] gets delayed, basically gets pushed back four months. Plaintiffs can’t even

sue until the 13th month passes. So they’re just sort of stuck because there’s case law that you can’t

do it. Why isn’t that ample reason to have an order no matter what the date is I pick?”).

42. In

its November 4, 2019 ruling, the Court ordered the Company to hold the annual meeting on January 9, 2020, and to set the record date for

the annual meeting as the close of business on November 22, 2019. The Court also held that the number of shares present at the annual

meeting would constitute a quorum, notwithstanding any contrary provision in the Company’s Charter or by-laws. The Court also prohibited

the Company from changing the date of the annual meeting or its applicable record date and quorum requirements without prior approval

from the Court.

43. On

December 3, 2019, the Company reached a settlement agreement with AB Value, pursuant to which it nominated Mr. Berger and Ms. Thompson

to the Board.

44. On

January 9, 2020, at the belated 2019 annual meeting, stockholders elected Mr. Berger, Ms. Thompson, Scott G. Capdevielle, Franklin E.

Crail, Tariq Farid,3 Mr. Merryman, and Mr. Seabert to the seven-member Board.

C.

The 2021 Proxy Battle

45. During

the first eighteen months of Mr. Berger’s tenure as a Company Director, the Board rejected virtually all of the governance reforms

he suggested, including separating the CEO/Chairman role, redeeming the Company’s existing poison pill, which was adopted in 2015

and had a ten-year term, and replacing certain long-standing directors on the Board with independent directors.

46. On

June 8, 2021, Mr. Geygan, CEO of GVIC, sent a letter to the Board in which GVIC proposed, among other things, (i) to commence a tender

offer to purchase up to 30% of the Company’s outstanding stock, and (ii) for the Board to thereafter appoint certain representatives

of GVIC to the Board. Between June 10 and June 16, the Board engaged in further discussions with GVIC regarding its proposal.

47. On

June 17, 2021, the Board met at Mr. Berger’s request. Mr. Berger conveyed to the Board that, as a result of GVIC’s actions

and proposals, AB Value intended to file a Schedule 13D disclosing that it had been requesting certain Board and management changes before

GVIC first approached the Board. At the meeting, the Board discussed the proposed appointment of Mr. Mewawalla to the Board to fill the

vacancy left by Mr. Farid. The Board unanimously approved Mr. Mewawalla’s appointment, and he became a director effective June 18,

2021.

3 Mr. Farid served as a director until his resignation on January 13, 2021.

48. Later

on June 17, 2021, AB Value filed an amendment to its Schedule 13D with the SEC, in which it reported its discussions with the Company

regarding AB Value’s desired changes to its Board membership, structure, management and strategy. AB Value also reported that, if

sufficient changes were not made, it intended to nominate and seek to elect additional persons to the Board at the Company’s annual

meeting.

49. On

June 22, 2021, Mr. Seabert and (then-director) Mr. Capdevielle met telephonically with two of AB Value’s proposed director nominees

to investigate their experience and qualifications as potential Board members.

50. On

June 28, 2021, AB Value emailed a nomination notice to the Company (the “AB Value Nomination Notice”), which it submitted

for the purpose of (i) nominating five individuals for election as directors of the Company and (ii) proposing that the Company redeem

any rights previously issued under the Company’s poison pill and not adopt or extend any stockholder rights plan unless such adoption

or extension has been submitted to a stockholder vote.

51. Between June 28 and July

19, 2021, Rocky Mountain and AB Value negotiated over the AB Value Nomination Notice. During the discussions, AB Value proposed (i) the

nomination of Mr. Berger, Ms. Thompson and one other director listed in the AB Value Nomination Notice for election at the annual meeting,

(ii) certain rights with respect to Board committees, and (iii) a public announcement that the Company intended to search for a new Chief

Executive Officer of the Company.

52. The

parties reached an agreement in principle on July 19, 2021. That day, the Company represented to AB Value that a heavily negotiated settlement

agreement resolving the issues raised in the AB Value Nomination Notice would be submitted to the Board for approval on July 21, 2021.

53. Instead,

all of the members of the Board, except Mr. Berger, met on July 21, 2021. Directly after the meeting, the Company issued a press release

announcing “a continued commitment to accelerate corporate governance and leadership changes in response to discussions with it

[sic] shareholders[.]” (The “July 21 Press Release”). The July 21 Press Release touted “the Board[’s] further

commit[ment] to additional Board refreshment by replacing one of the Board’s current, legacy members with a new, independent director

with experience and expertise to further assist the Company with executing its long-term strategy, at or before the Company’s 2021

meeting.” The July 21 Press Release also noted the Board’s commitment to “separating the roles of Chairperson of the

Board and Chief Executive Officer (CEO) of the Company.”

54. The July 21 Press

Release, which purported to speak on behalf of a unanimous Board, was news to Mr. Berger. Mr. Berger never received notice of a

Board meeting or any request for Board action with respect to the management and Board compositional changes contemplated by the

July 21 Press Release. Nor did Mr. Berger approve of, or see in advance, a draft or proposed final version of the July 21 Press

Release.

55. The

July 21 Press Release omitted the fact that, more than a month earlier, AB Value had suggested to the Board that the Chairperson and CEO

roles be separated, that a management transition should commence immediately and that legacy directors needed to step down. The Board

chose instead to take credit for matters to which they never gave serious consideration prior to Mr. Berger’s advocacy as a director

and recent public pressure from AB Value and other large stockholders.

56. On

July 24, 2021, AB Value informed the Board that then-director Scott Capdevielle had made highly inappropriate public statements on social

media about certain religious denominations and demanded his resignation from the Board.

57. On

July 26, 2021, Mr. Capdevielle resigned, but Rocky Mountain failed to disclose in its corresponding press release either the reasons for

his resignation or the fact that AB Value had brought his statements—which contravened the Company’s Code of Conduct and core

values—to the Board’s attention.

58. On

July 30, 2021, the Rocky Mountain Board formed a Special Committee to manage AB Value’s proxy fight. The same day, Rocky

Mountain appointed Mr. Mewawalla to serve as the independent Chairperson of the Board, supposedly in furtherance of the

Board’s new goals—“board refreshment” and separation of the roles of Chairperson and CEO—prompted by

Mr. Berger’s recommendations.

59. AB

Value repeatedly requested that the Special Committee engage to discuss settlement. The Special Committee failed to respond or engage

with AB Value for five weeks.

60. On

August 9, 2021, Mr. Crail announced his intention to resign as a member of the Board upon appointment or election of a new independent

director, and that he would not be standing for re-election at the upcoming annual meeting.

61. On

August 12, 2021, GVIC and Rocky Mountain executed a cooperation agreement resulting in Mr. Geygan’s appointment to the Board (the

“GVIC Cooperation Agreement”). The GVIC Cooperation Agreement contained standstill provisions and voting commitments that

cover one annual meeting and last less than one year (despite the fact that GVIC and Mr. Geygan had recently sought a tender offer directed

toward a control-like stake in the Company).

62. On

August 30, 2021, Rocky Mountain filed a proxy statement on Schedule 14A (the “August 30 Proxy Statement”). The August 30

Proxy Statement stated (falsely) that the Special Committee was established “to oversee the process of identifying new

qualified, independent directors for the Company’s next chapter of grown, innovation and transformation,” without

disclosing the real reason for the establishment of the committee—the proxy fight with AB Value.

63. The

Company’s August 30 Proxy Statement solicited stockholders to vote for a slate of seven directors: Mr. Mewawalla, Mr. Merryman,

Mr. Arreaga, Mr. Charles, Mr. Geygan, Mr. Seabert and Ms. Thompson. The Company asserted in the August 30 Proxy Statement that it did

not believe “AB Value’s nominees (except Mary K. Thompson) ha[ve] the requisite experience, skill sets or expertise to best

serve the interests of all stockholders and truly help drive the Company’s transformation, strategy and growth moving forward[.]”

64. On

September 2, 2021, AB Value and its affiliates filed a preliminary proxy statement (the “September 2 Preliminary Proxy Statement”)

soliciting stockholders to (i) elect five director candidates to the Company’s Board: Mr. Berger, Ms. Thompson, Rhonda J. Parish,

Mark Riegel, Sandra Elizabeth Taylor and Mary Kennedy Thompson, and (ii) request that the Board redeem any previously- issued, and not

adopt or extend any, poison pill, unless such adoption or extension has been submitted to a stockholder vote.

65. On

September 4, 2021, the Special Committee responded for the first time to AB Value’s requests for engagement through

newly-appointed director Mr. Geygan. The Special Committee proposed the following settlement terms: (i) Rocky Mountain would

reimburse AB value for some portion of AB Value’s expenses incurred after June 8, 2021, (ii) AB Value would be allowed input

into the Company’s ongoing CEO search, (iii) Rocky Mountain would issue a mutually agreeable press release disclosing the

settlement, (iv) there would be no compositional changes to the Board, which was described as a “red-line” for the

Company, (v) an off-market standstill that is three annual meetings-long (nearly four years), and (v) GVIC, Mr. Geygan’s fund,

would agree to a cooling-off period after its standstill of less than one year expires, prohibiting Mr. Geygan from making a bid or

tender offer for the Company for an undetermined amount of time.

66. On

September 7, 2021, AB Value issued a press release (the “September 7, 2021 Press Release”) criticizing both the Company’s

recent settlement offer and the Board’s recent mistreatment of AB Value (and all of the Company’s stockholders) under the

leadership of Chairperson Mewawalla. AB Value noted that the Board’s “red-line” refusal to agree to compositional changes

in the Board was a non-starter, and that the standstill provisions and voting commitments the Board proposed were far more restrictive

than those recently imposed on Mr. Geygan and GVIC, who had recently threatened to replace the Board after the Company rejected his control

attempts.

67. AB Value also noted in the

September 7, 2021 Press Release that Mr. Mewawalla, who has no prior public board experience, no C-level experience with a public

company, and no food and beverage experience, was the first and only candidate brought forward as part of the Board’s

“refreshment efforts.” In addition, AB Value pointed out that the Board rushed Mr. Mewawalla through the nomination

process with minimal vetting of his background and qualifications, and then appointed him Chairperson of the Board a mere 43 days

into his tenure. All of this was and is true.

68. AB

Value emphasized that Chairperson Mewawalla oversaw the Board’s (i) decision to back out of a heavily negotiated settlement

agreement with AB Value after misleading AB Value into believing Board approval was imminent, and instead to issue the July 21, 2021

Press Release announcing many of the very changes that the parties had agreed would be part of the settlement agreement, (ii)

failure to identify issues of Mr. Capdevielle’s fitness as a public company director,

(iii) engagement of a costly technology expert who lacks consumer experience as a lead

consultant to identify director candidates, an endeavor spearheaded by Mr. Mewawalla, and (iv) packing of the Board at the last

minute in advance of the 2021 annual meeting for the purported purpose of “board refreshment”—an endeavor the

Company never mentioned—let alone prioritized—until July 22, 2021, less than a month after AB value submitted its notice

of nomination to the Company.

69. Later

that day, Chairperson Mewawalla sent Mr. Berger a personal email, copying the Company’s legal counsel, demanding that he cease

“any and all further unlawful defamation, slander and/or libel with regards to [Mr. Berger’s] statements and actions

relating to [Mr. Mewawalla].”

70. On

September 9, 2021, AB Value responded to the Special Committee’s September 4, 2021 settlement proposal. AB Value noted that the

“red- lines’ drawn by Rocky Mountain were not in the best interests of the Company’s stockholders.

71. During

a September 13, 2021 settlement discussion between AB Value and the Company, Mr. Mewawalla, acting on behalf of the Company, renewed his

legal threats against Mr. Berger. Mr. Mewawalla made these threats for the specific purpose of intimidating Mr. Berger and AB Value into

silence.

72. On

September 16, 2021, AB Value countered Rocky Mountain’s proposal. The same day, Ms. Thompson gave notice to the Board that she was

resigning as Director and withdrawing from both Rocky Mountain’s and AB Value’s slates of proposed directors. Ms. Thompson’s

resignation left a single vacancy on Rocky Mountain’s seven-member Board.

73. The

incumbent Board saw an opportunity, and they took it. On September 18, 2021, the Special Committee rejected AB Value’s September

16, 2021 proposal with no explanation or counter-proposal.

74. Then,

on September 19, 2021, rather than engaging further with AB Value or allowing the stockholders to fill the vacancy, the Board met

hastily via WebEx conference to pass resolutions (over Mr. Berger’s objection) reducing the Company’s Board from seven

members to six.

75. The

vacant Board seat was not a threat to the Company, but the Director Defendants chose to treat it as one. There was and is no valid justification

for the Board’s defensive decision to shrink the Board.

76. The

Board reduced the size of the Board to increase its leverage against AB Value and minimize AB Value’s chances at winning Board seats.

Unless the Board had filled the vacancy with new candidates, stockholders could have filled it with one of AB Value’s director candidates

at the October 6, 2021 meeting.

77. AB

Value intends to pursue its proxy contest and maintains that the challenged resolutions are invalid, illegal and ineffective. Accordingly,

stockholders are entitled to fill seven seats at the annual stockholder meeting.

COUNT I

(Breach of Fiduciary Duty of Loyalty)

78. Plaintiffs

repeat and reallege each and every allegation above as if set forth in full herein.

79. At

all relevant times, the Director Defendants were fiduciaries and owed a duty of loyalty to all holders of Rocky Mountain common stock.

This duty included the obligation to refrain from impeding the effective exercise of the stockholder franchise absent compelling justification.

This duty also includes the obligation to refrain from acting for the sole or primary purpose of entrenchment.

80. The

Director Defendants breached their duty of loyalty by voting to shrink the board, entrench themselves and stifle independent thought and

discussion at Board meetings.

81. The

Director Defendants’ breaches of fiduciary duty have caused and are continuing to cause harm to Plaintiffs and the holders of Rocky

Mountain common stock by depriving them of the full and fair opportunity to exercise their right to vote for seven directors at the upcoming

October 6, 2021 Annual Meeting. Plaintiffs have no adequate remedy at law.

COUNT II

(Breach of Fiduciary Duty of Care)

82. Plaintiffs

repeat and reallege each and every allegation above as if set forth in full herein.

83. The

Director Defendants owed the Plaintiffs and all holders of common stock the utmost fiduciary duty of care. This duty included the obligation

to gather all information reasonably available prior to approving a transaction affecting corporate control.

84. By

approving a reduction of the Board’s size from seven to six members, at the eleventh hour before an annual election, without seeking

legal analysis from Delaware counsel, and without making a reasonable inquiry as to the effect such an act would have on the Company

and its stockholders, the Director Defendants breached their duty of care.

85. The

Director Defendants’ breaches of fiduciary duty have caused and are continuing to cause harm to Plaintiffs and the holders of Rocky

Mountain common stock by depriving them of the full and fair opportunity to exercise their right to vote for seven directors at the upcoming

October 6, 2021 Annual Meeting. Plaintiffs have no adequate remedy at law.

PRAYER FOR RELIEF

86. WHEREFORE,

Plaintiffs requestion judgment and permanent declaratory and injunctive relief as follows:

a) A

declaration that the Director Defendants breached their fiduciary duties of care and loyalty by reducing the number of director seats

up for election from seven to six for the primary purpose of entrenchment and without any compelling justification;

b) A

declaration that the resolutions reducing the number of director seats up for election were invalid, illegal and ineffective.

c) An

order rescinding the resolutions reducing the number of director seats up for election and permanently enjoining future acts for purposes

of interfering with Plaintiffs’ lawful right to vote for Company management and to vote to fill Board vacancies; and,

d) A

declaration that the Rocky Mountain board consists of seven director seats, all of which are up for election at the upcoming October 6,

2021, annual stockholder meeting.

|

|

/s/ Eric A. Veres

|

|

Dated: September 23, 2021

|

A. Thompson Bayliss (#4379)

Eric A. Veres (#6728)

ABRAMS & BAYLISS LLP

|

|

|

20 Montchanin Road, Suite 200

|

|

|

Wilmington, Delaware 19807

|

|

|

(302) 778-1000

|

|

|

|

|

|

Attorneys for Plaintiffs AB Value Partners,

LP and AB Value Management LLC

|

IN THE COURT OF CHANCERY

OF THE STATE OF DELAWARE

|

AB VALUE PARTNERS, LP and AB

|

)

|

|

|

|

|

VALUE MANAGEMENT LLC,

|

)

|

|

|

|

|

Plaintiffs,

|

)

|

|

|

|

|

|

)

|

C.A. No.

|

|

|

|

v.

|

)

|

|

|

|

|

|

)

|

|

|

|

|

ROCKY MOUNTAIN

|

)

|

|

|

|

|

CHOCOLATE FACTORY, INC.,

|

)

|

|

|

|

|

BRYAN J. MERRYMAN, RAHUL

|

)

|

|

|

|

|

MEWAWALLA, FRANKLIN E.

|

)

|

|

|

|

|

CRAIL, BRETT P. SEABERT, and

|

)

|

|

|

|

|

JEFFREY R. GEYGAN,

|

)

|

|

|

|

|

Defendants.

|

)

|

|

|

|

UNSWORN DECLARATION AND VERIFICATION

OF COMPLAINT

Pursuant

to 10 Del. C. § 3927, paragraph 4 of the Delaware Supreme Court’s Administrative Order No. 22, dated June 29, 2021,

and the Delaware Court of Chancery’s Standing Order No. 6, dated July 12, 2021, I, Andrew T. Berger, state as follows:

1. I

am the Managing Member of AB Value Management, LLC, which serves as the General Partner of AB Value Partners, LP. I am authorized to make

this verification on behalf of AB Value Management, LLC and AB Value Partners, LP (“AB Value”).

2. I

have reviewed the Verified Complaint for Declaratory and Injunctive Relief (the “Complaint”).

3. To

the extent the allegations in the Complaint concern my actions or the actions of AB Value, I know those allegations to be true and correct.

4. To

the extent the allegations in the Complaint concern the actions of parties other myself or AB Value, I believe those allegations to

be true and correct.

5. I declare under penalty

of perjury under the laws of Delaware that the foregoing is true and correct.

Executed on the 22nd day of September

2021.

|

|

Andrew T. Berger

|

|

|

Printed Name

|

|

|

|

|

|

/s/ Andrew T.Berger

|

|

|

Signature

|

SUPPLEMENTAL INFORMATION

PURSUANT TO RULE 3(A)

OF THE RULES OF THE COURT OF CHANCERY

The information contained herein is for

the use by the Court for statistical and administrative purposes only. Nothing stated herein shall be deemed an admission by or binding

upon any party.

1.

Caption of Case:

AB Value Partners, LP and AB Value Management

LLC v. Rocky Mountain Chocolate Factory, Inc., Bryan J. Merryman, Rahul Mewawalla, Franklin E. Crail, Brett P. Seabert, and Jeffrey R.

Geygan

2.

Date Filed: September 23, 2021

3.

Name and address of counsel for plaintiff(s):

A. Thompson

Bayliss (#4379) Eric A. Veres (#6728) Abrams & Bayliss LLP

20 Montchanin Road, Suite 200

Wilmington, DE 19807

4.

Short statement and nature of claim asserted:

Complaint seeking declaratory and injunctive relief.

5.

Substantive field of law involved (check one):

|

____

|

Administrative law

|

____

|

Labor law

|

____

|

Trusts, Wills and Estates

|

|

____

|

Commercial law

|

____

|

Real Property

|

____

|

Consent trust petitions

|

|

____

|

Constitutional law

|

____

|

348 Deed Restriction

|

____

|

Partition

|

|

__X__

|

Corporation law

|

____

|

Zoning

|

____

|

Rapid Arbitration (Rules 96,97)

|

|

____

|

Trade secrets/trademark/or other intellectual property

|

____

|

Other

|

6. Related cases,

including any Register of Wills matters (this requires copies of all documents in this matter to be filed with the Register of Wills):

7.

Basis of court’s jurisdiction (including the citation of any statute(s) conferring jurisdiction):

10 Del. C. § 341, 8 Del. C. § 111,

and 10 Del. C. § 3114

8.

If the complaint seeks preliminary equitable relief, state the specific preliminary relief sought.

9. If the complaint seeks a TRO, summary proceedings,

a Preliminary Injunction, or Expedited Proceedings, check here . (If #9 is checked, a Motion to Expedite must accompany

the transaction.)

10. If the complaint

is one that in the opinion of counsel should not be assigned to a Master in the first instance, check here and attach a statement of good

cause. _X_

|

|

/s/ A. Thompson Bayliss

|

|

|

A. Thompson Bayliss (#4379)

|

STATEMENT OF GOOD CAUSE

I am an

attorney at Abrams & Bayliss LLP and a member in good standing of the Bar of the State of Delaware. With my firm, I am counsel to

the plaintiffs in this action. We respectfully submit that this action is inappropriate for submission to a Master in the first instance,

as it involves complex issues of Delaware corporate law. Accordingly, this action should proceed directly before the Chancellor or a Vice

Chancellor of this Court.

|

|

/s/ A. Thompson Bayliss

|

|

|

A. Thompson Bayliss (#4379)

Eric A. Veres (#6728)

ABRAMS & BAYLISS LLP

|

|

|

20 Montchanin Road, Suite 200

|

|

|

Wilmington, Delaware 19807

|

|

|

(302) 778-1000

|

|

Dated: September 23, 2021

|

Attorneys for Plaintiffs AB Value Partners,

LP and AB Value Management LLC

|

16

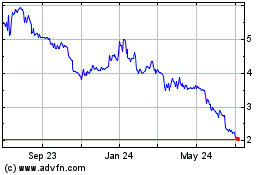

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024