UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

265 Turner Drive

Durango, Colorado 81303

SUPPLEMENT TO THE PROXY STATEMENT DATED DECEMBER 10, 2019

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON January 9, 2020

This proxy statement supplement (this “Supplement”), dated December 23, 2019, supplements the definitive proxy statement on Schedule 14A (the “Proxy Statement”) of Rocky Mountain Chocolate Factory, Inc., a Delaware corporation (the “Company”, “we”, “our” or “us”), dated December 10, 2019, furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of the Company for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, January 9, 2020, at 10:00 a.m. (local time), at The Doubletree Hotel, 501 Camino Del Rio, Durango, Colorado 81301. Except as specifically supplemented by the information contained in this Supplement, all information set forth in the Proxy Statement continues to apply and should be considered in voting your shares.

On December 23, 2019, the Company announced that it had entered into a strategic alliance (the “Strategic Alliance”) with Edible Arrangements, LLC and Farids & Co. LLC (collectively and with its permitted transferees, “Edible Arrangements”), pursuant to which, among other things, the Company will become the exclusive provider of certain branded chocolate products to Edible Arrangements, LLC, its affiliates and franchisees. In addition, pursuant to the Strategic Alliance, Farids & Co. LLC, an affiliate of Tariq Farid, the founder and Chief Executive Officer of Edible Arrangements, will purchase approximately $1 million of common stock from the Company, and Edible Arrangements was granted a warrant to purchase up to 960,677 shares of the Company’s common stock, which vests only upon achievement of certain revenue targets under an exclusive supplier agreement with the Company. The Company also agreed to nominate Tariq Farid for election to the Board at the Annual Meeting. See “Certain Relationship and Related Person Transactions—Strategic Alliance with Edible Arrangements” in this Supplement for additional information on the Strategic Alliance.

This Supplement is being filed to revise our slate of nominees for election to the Board of Directors at the Annual Meeting by removing Clyde Wm. Engle, and adding Tariq Farid to the slate of directors to be elected at the Annual Meeting. The Company is also revising its proxy card to reflect the change in the slate of directors to be elected at the Annual Meeting, which is enclosed with this Supplement.

The Proxy Statement, this Supplement and the Company’s 2019 Annual Report on Form 10-K, as amended, are available on the Internet at www.proxy-direct.com/geo-31036.

The Board of Directors recommends that you vote “FOR” the election of each of the nominees on the enclosed revised proxy card, or if you own your shares in “street name” through a broker, bank, trustee or other nominee on the revised voting instruction form you receive from the holder of record. The revised proxy card or revised voting instruction form contains the change of the slate of directors as described in this Supplement and differs from the previous proxy card furnished by the Company, in that it does not include Mr. Engle and includes Mr. Farid as a director nominee, as listed in Proposal 1.

Whether or not you plan to attend the Annual Meeting, you are urged to sign, date and promptly return the revised proxy card or revised voting instruction form, or vote via the Internet or by telephone following the instructions on the revised proxy card or the revised voting instruction form. You may also vote in person at the Annual Meeting. If you have already submitted the previous proxy card or previous voting instruction form, your vote will no longer be valid. In order to have your vote represented, you must cast your vote by using the revised enclosed proxy card. For specific instructions on voting, please refer to the instructions on the enclosed revised proxy card or a revised voting instruction form.

If you have any questions, please contact Georgeson LLC (“Georgeson”), our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may contact Georgeson toll-free at 866-767-8867.

The time and place of the Annual Meeting have not changed. The enclosed Supplement should be read in conjunction with the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended February 28, 2018, as amended, which were previously made available to stockholders. You should read the entire Proxy Statement and this Supplement and any additional proxy materials carefully before voting your shares.

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. | PROXY STATEMENT SUPPLEMENT | PAGE 1

PROPOSAL 1 — ELECTION OF DIRECTORS

The information set forth under the heading “Proposal 1 — Election of Directors” in the Proxy Statement is amended and restated as set forth below.

Director Nominees

Our Board currently consists of five directors. In connection with our entry into the Cooperation Agreement, the Board increased the size of the Board to seven directors in December 2019. Upon recommendation of the Nominating Committee and pursuant to the terms of the Cooperation Agreement and the Strategic Alliance, the Board has nominated Bryan J. Merryman, Franklin E. Crail, Scott G. Capdevielle, Brett P. Seabert, Andrew T. Berger, Mary K. Thompson and Tariq Farid for election to serve on the Board until the next annual meeting of stockholders and until their respective successors are duly elected and qualified.

Pursuant to the Cooperation Agreement, we are nominating two new independent directors to serve on the Board: Andrew T. Berger and Mary K. Thompson. Additional information regarding Mr. Berger and Ms. Thompson is set forth below. See “Certain Relationship and Related Person Transactions—Cooperation Agreement” in the Proxy Statement for additional information on the Cooperation Agreement.

In addition, pursuant to the Strategic Alliance, we are nominating Tariq Farid to serve on the Board. Additional information regarding Mr. Farid is set forth below. See “Certain Relationship and Related Person Transactions—Strategic Alliance with Edible Arrangements” in this Supplement for additional information on the Strategic Alliance Agreement.

If a proxy is authorized, but voting directions are not made, the proxy will be voted, unless authority to vote is withheld by the stockholder, “FOR” the election of Ms. Thompson and Messrs. Merryman, Crail, Capdevielle, Seabert, Berger and Farid to serve until the next annual meeting of stockholders and until the election and qualification of their respective successors. If any such nominee shall be unable to serve or will not serve for any reason, proxies may be voted for such other person or persons as shall be determined by the proxy holders in their discretion. Each of the nominees has consented to being named in the Proxy Statement and this Supplement.

Set forth below is certain information concerning each nominee for election as a director:

|

Name

|

|

Title/Position

|

|

Age

|

|

Director Since

|

|

Bryan J. Merryman

|

|

Chairman of the Board, Chief Executive Officer and Chief Financial Officer

|

|

59

|

|

1999

|

|

Franklin E. Crail

|

|

Director

|

|

78

|

|

1982

|

|

Scott G. Capdevielle

|

|

Director

|

|

54

|

|

2009

|

|

Brett P. Seabert

|

|

Director

|

|

58

|

|

2017

|

|

Andrew T. Berger

|

|

Director Nominee

|

|

47

|

|

New

|

|

Mary K. Thompson

|

|

Director Nominee

|

|

56

|

|

New

|

|

Tariq Farid

|

|

Director Nominee

|

|

50

|

|

New

|

The Board believes that our current directors, as a whole, provide the diversity of experience and skills necessary for a well-functioning board. All of our directors have substantial senior executive level experience. The Board highly values the ability of individual directors to contribute to a constructive board environment and the Board believes that the current board members, collectively, perform in such a manner.

Set forth below is a more complete description of each director’s background, professional experiences, qualifications and skills.

Bryan J. Merryman. Mr. Merryman joined us in December 1997 as Chief Financial Officer and Vice President - Finance. Since April 1999, Mr. Merryman also served as our Chief Operating Officer and as a director. In February 2019, Mr. Merryman was appointed as our Chief Executive Officer and was elected Chairman of the Board. From January 1997 to December 1997, Mr. Merryman was a principal in Knightsbridge Holdings, Inc., a leveraged buyout firm. Mr. Merryman also served as Chief Financial Officer of Super Shops, Inc., a retailer and manufacturer of after-market auto parts, from July 1996 to November 1997, and prior to July 1996, was employed for more than eleven years by Deloitte & Touche LLP, most recently as a Senior Manager. Mr. Merryman also currently serves as Chief Executive Officer of U-Swirl, Inc. (“U-Swirl”), a consolidated subsidiary of the Company, a position he has held since October 2014, and has served as Chairman of the Board of U-Swirl since January 2013. We believe that Mr. Merryman’s extensive operational, accounting and financial expertise, along with his extensive knowledge of our business and broad industry expertise, provides significant value and insights to the Board.

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. | PROXY STATEMENT SUPPLEMENT | PAGE 2

Franklin E. Crail. Mr. Crail co-founded the first Rocky Mountain Chocolate Factory store in May 1981. He served as our Chief Executive Officer and President from November 1982 until his retirement in February 2019. He has served as a director since November 1982 and served as Chairman of the Board from March 1986 until February 2019. Prior to founding the Company, Mr. Crail was co-founder and President of CNI Data Processing, Inc., a software firm which developed automated billing systems for the cable television industry. Mr. Crail has also served as a director for U-Swirl since January 2013. As our co-founder and as our former Chief Executive Officer and President, and director since 1982, we believe that Mr. Crail brings his leadership, extensive experience and knowledge of the Company, the industry, our customers and the investment community to the Board.

Scott G. Capdevielle. Mr. Capdevielle has served on our Board since June 2009. Mr. Capdevielle founded, and has served as President, Chief Executive Officer and a member of the Board of Directors of, Syndicom, Inc., a software and consulting company, since 2000. Prior to founding Syndicom, Inc., from 1999 to 2000, Mr. Capdevielle was Chief Executive Officer and founder of Untv, Inc., a company pioneering user-generated web video and distribution on the Internet. From 1995 to 1999, Mr. Capdevielle founded and held the position of Chief Technical Officer and a member of the Board of Directors of Andromedia Corporation, a developer of web analytics software to Fortune 1000 companies prior to its sale to Macromedia, Inc. Mr. Capdevielle has been engaged in the software industry since 1993 and has served on several advisory boards and board of directors of technology companies from 1994 to present. Mr. Capdevielle has also served as a director of U-Swirl since January 2013. We believe that Mr. Capdevielle’s extensive executive and board experience brings operational, investment, strategic, technology and industry expertise to the Board.

Brett P. Seabert. Mr. Seabert has served on our Board since April 2017. Mr. Seabert, a Certified Public Accountant (“CPA”), has 30 years of experience in business management, operations, finance and administration. Mr. Seabert currently serves in various capacities, including as a director or executive officer of various companies, including Tanamera Construction, LLC, a high-end real estate development and construction company (since April 2007), TD Construction, LP, a construction company (since September 2009), Caughlin Club Management Partners, LLC, a health and tennis club and preschool owner and operator (since July 2008), and B&L Investments, Inc., a management and holding company (since March 2003). From 2001 to 2008, Mr. Seabert served as Chief Financial and Operating Officer of Tanamera Commercial Development, LLC. Between 1989 and 2001, Mr. Seabert served in various positions at CMS International, an owner and management company operating several casinos, most recently as Executive Vice President and Chief Financial Officer, including oversight of internal audit, risk management and human resource functions. Mr. Seabert has been primarily engaged in commercial and residential real estate development and construction for the past 18 years. From 1984 to 1989, Mr. Seabert was a practicing CPA with Deloitte & Touche LLP. We believe that Mr. Seabert’s extensive management, accounting and financial experience brings operational, investment, and strategic value and insights to the Board.

Andrew T. Berger. Mr. Berger is being nominated to the Board pursuant to the Cooperation Agreement. Mr. Berger has two decades of experience in investment analysis, investment management and business consulting. From March 1998 through January 2002, Mr. Berger served as Equity Analyst for Value Line, Inc. Since February 2002, Mr. Berger has served as President of Walker’s Manual, Inc., an investment publisher that he transformed into a business consulting company whose clients have included public and private companies. Since 2011, Mr. Berger has been the Managing Member of AB Value Management LLC, which serves as the General Partner of AB Value Partners, LP, an investment partnership which focuses on long-term investments in undervalued equities. Mr. Berger has been a director of Image Sensing Systems, a Nasdaq listed company that engages in the development and marketing of video and radar image processing products for use in traffic applications, since October 2015. Mr. Berger was appointed Executive Chairman of the Board of Directors of Image Sensing Systems in June 2016. Mr. Berger is also Chair of the Nominating and Corporate Governance Committee and a member of the Audit Committee and Compensation Committee of Image Sensing Systems. Since May 2017, Mr. Berger has been Chief Executive Officer of Cosi, Inc., a fast-casual restaurant chain that operates more than 60 domestic and international company-owned and franchised restaurants. He earned a B.S. in Business Administration with a concentration in finance from Monmouth University. We believe that Mr. Berger’s investment management experience, specifically experience within the food and franchising industry, qualify him to serve as a director of the Company.

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. | PROXY STATEMENT SUPPLEMENT | PAGE 3

Mary K. Thompson. Ms. Thompson is being nominated to the Board pursuant to the Cooperation Agreement. Ms. Thompson is a veteran of the franchising industry. Since 2015, she has served as the Chief Operating Officer of Neighborly Brands (“Neighborly”), a service provider focused on repairing, maintaining and enhancing customers’ homes and businesses, where she oversees the ongoing business operations within the company. Neighborly is the holding company for 22 service-based franchise organizations focused on repairing, maintaining and enhancing homes and business properties. Neighborly provides a diverse array of specialty services through more than 3,700 franchised locations in ten countries with system-wide revenue of $1.8 billion in 2018. Prior to her appointment as Neighborly’s Chief Operating Officer, Ms. Thompson served as the President of Mr. Rooter Plumbing Corporation, a franchisor focused on independently owned and operated plumbing franchisees, from October 2006 to July 2015. From December 1994 to October 2006, Ms. Thompson served as the President of and held other various leadership positions (including being a multi-unit franchisee) with Cookies by Design, a franchise concept specializing in customized cookie gifts produced at mall-based retail locations. Ms. Thompson served as an Officer in the United States Marine Corps from December 1985 to April 1993. She earned her B.A. in English from the University of Texas at Austin and completed the mini MBA Program in franchise management at the University of St. Thomas College of Business. We believe that Ms. Thompson’s extensive business experience, especially with franchised companies, qualifies her to serve as a director of the Company.

Tariq Farid. Mr. Farid being nominated to the Board pursuant to the Strategic Alliance. Mr. Farid is the founder of Edible Arrangements, LLC, a global franchise organization whose headquarters are in Atlanta, Georgia. Edible Arrangements, LLC specializes in fresh fruit arrangements and specialty fruit gift items. Mr. Farid has served as its Chief Executive Officer from March 1999 until July 2018 and then again since Nov 2019. In July 2019, Mr. Farid also founded and is the Chief Executive Officer of Incredible Edibles, LLC., a retail superfood treats and gifting concept featuring hemp extract CBD & other wellness products. Mr. Farid also founded Farids & Co. LLC, a family office aggregator of consumer brands and other strategic investments since November 2018. Mr. Farid has also served as Chief Executive Officer of Naranga, LLC. an industry leading provider of franchise operations software-as-a-service (SaaS), since January 2014. Mr. Farid attended Albertus Magnus College from 1989 until 1991 and completed the Executive Education Program, Executive Education at Harvard Business School in 2015. We believe that Mr. Farid’s extensive business, e-commerce and strategic growth experience, especially within the franchise industry, qualifies him to serve as a director of the Company.

Family Relationships

No family relationships exist between any director or executive officer and any other of our directors or executive officers.

Director Independence of Mr. Farid

The Board has determined that Mr. Farid is not an independent director under applicable Nasdaq listing rules as a result of the transactions contemplated by the Strategic Alliance. See “Certain Relationship and Related Person Transactions—Strategic Alliance with Edible Arrangements” in this Supplement for additional information on the Strategic Alliance.

|

BOARD RECOMMENDATION: The Board unanimously recommends that the stockholders vote “FOR” the election of each of the seven director nominees to the Board.

|

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. | PROXY STATEMENT SUPPLEMENT | PAGE 4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table supplements the table set forth under the heading “Security Ownership of Certain Beneficial Owners and Management” in the Proxy Statement and describes as of the date of this Supplement the beneficial ownership of the Company’s common stock held by Mr. Farid. The address of Mr. Farid is: c/o Rocky Mountain Chocolate Factory, Inc., 265 Turner Drive, Durango, Colorado 81303.

|

Name of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percent of Class

|

|

Directors, Director Nominees and Named Executive Officers:

|

|

|

|

Tariq Farid

|

—

|

(1)

|

*

|

* Less than 1%

|

|

(1)

|

See “Certain Relationship and Related Person Transactions—Strategic Alliance with Edible Arrangements.”

|

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Related Person Transactions

The following information supplements the information set forth under the heading “Certain Relationships and Related Person Transactions” in the Proxy Statement.

Strategic Alliance with Edible Arrangements

As described above, on December 23, 2019, the Company announced that it had entered into the Strategic Alliance with Edible Arrangements, pursuant to which, among other things, the Company will become the exclusive provider of certain branded chocolate products to Edible Arrangements, its affiliates and its franchisees. In connection with the Strategic Alliance, the Company entered into a strategic alliance agreement, an exclusive supplier operating agreement and a warrant agreement with Edible Arrangements, LLC (“EA”) and Farids & Co. LLC (“Farids”), as described further below.

Exclusive Supplier Agreement

On December 20, 2019, the Company entered into an Exclusive Supplier Operating Agreement (the “Exclusive Supplier Agreement”) with EA, pursuant to which the Company will be EA’s exclusive supplier for chocolates, candies and/or other confectionery products. In addition, the Company granted to EA a non-exclusive, worldwide right to market, offer for sale, sell and distribute such products, including through (i) retail stores and (ii) on-line distribution channels such as Internet websites and applications for personal computing devices, as an authorized and independent distributor of such products.

The Exclusive Supplier Agreement has an initial term of five years (the “Initial Term”). After the Initial Term, the Exclusive Supplier Operating Agreement will automatically renew for an additional term of three years, unless either party gives the other at least 24 months’ written notice of non-renewal prior to the end of the Initial Term. Thereafter, the Exclusive Supplier Agreement will continue until either party gives the other at least 24 months’ written notice of termination. Notwithstanding the foregoing, following any change of control of the Company, neither party will issue a notice of non-renewal within four additional years following such change of control.

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. | PROXY STATEMENT SUPPLEMENT | PAGE 5

Strategic Alliance Agreement

On December 20, 2019, the Company entered into a Strategic Alliance Agreement (the “Strategic Alliance Agreement”) with EA and Farids, pursuant to which, among other things, the Company will issue and sell 126,839 shares (the “Purchased Shares”) of the Company’s common stock to Farids at a price of $7.884 per share, which represents a 10% discount to the 20-day volume-weighted average price of the Company’s common stock on the Nasdaq Global Market as of December 19, 2019. The issuance and sale of the Purchased Shares is required to close within 90 days, subject to the satisfaction of certain customary closing conditions. The Purchased Shares may not be transferred within the first two years following the date of the Strategic Alliance Agreement, subject to certain limited exceptions. In addition, the Company has certain rights of first offer and rights of first refusal with respect to the Purchased Shares or the Warrants Shares (as defined below), and the Company also granted certain registration rights to Edible Arrangements with respect to the Purchased Shares and the Warrants Shares. Subject to certain limited exceptions, Edible Arrangements is also prohibited from beneficially owning 19.99% or more of the fully diluted number of shares of Common Stock outstanding at any time.

Under the Strategic Alliance Agreement, the Company agreed to nominate Tariq Farid for election to the Board of Directors of the Company at the Annual Meeting. In addition, only at such time that Edible Arrangements owns more than 5% of the outstanding common stock of the Company, Edible Arrangements will have the right to nominate Tariq Farid, or in the event of Mr. Farid’s death or permanent disability, another individual that is reasonably acceptable to the Company, as a director of the Company (the “Springing Nomination Right”). The Springing Nomination Right will terminate at such time that Edible Arrangements owns less than 5% of the outstanding common stock of the Company and if EA does not achieve certain revenue thresholds.

Warrant

In consideration of EA entering into the Exclusive Supplier Agreement and the performance of its obligations therein, on December 20, 2019, the Company issued EA a warrant (the “Warrant”) to purchase up to 960,677 shares of Common Stock (the “Warrant Shares”) at an exercise price of $8.76 per share, which represents the 20-day volume-weighted average price of the Company’s common stock on the Nasdaq Global Market as of December 19, 2019. The Warrant Shares vest in annual tranches in varying amounts following each contract year under the Exclusive Supplier Agreement, subject to, and only upon, EA’s achievement of certain revenue thresholds on an annual or cumulative five-year basis in connection with its performance under the Exclusive Supplier Agreement. The Warrant expires six months after the final and conclusive determination of revenue thresholds for the fifth contract year and the cumulative revenue determination in accordance with the terms of the Warrant. The vesting of the Warrant Shares will accelerate under certain circumstances upon a change of control of the Company.

Other Matters at the Annual Meeting

As of the date of this Supplement, management knows of no matters not described herein to be brought before the stockholders at the Annual Meeting. Should any other matters properly come before the Annual Meeting, it is intended that the persons named in the accompanying proxy will vote thereon according to their best judgment in the interest of the Company and its stockholders.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

/s/ Bryan J. Merryman

|

|

|

|

|

|

Bryan J. Merryman

|

|

|

Chairman of the Board, Chief Executive Officer

|

|

|

and Chief Financial Officer

|

December 23, 2019

IT IS VERY IMPORTANT THAT YOU SHARES BE REPRESENTED AND VOTED AT THE ANNUAL MEETING. STOCKHOLDERS ARE URGED TO PROMPTLY VOTE THEIR SHARES AS DIRECTED IN THE PROXY CARD AS SOON AS POSSIBLE, REGARDLESS OF WHETHER THEY PLAN TO ATTEND THE ANNUAL MEETING.

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. | PROXY STATEMENT SUPPLEMENT | PAGE 6

EVERY VOTE IS IMPORTANT

|

|

EASY VOTING OPTIONS:

|

|

|

|

|

|

|

|

VOTE ON THE INTERNET

|

|

|

|

Log on to:

|

|

|

www.proxy-direct.com

|

|

|

or scan the QR code

|

|

|

Follow the on-screen instructions

|

|

|

available 24 hours

|

|

|

|

|

|

|

|

|

|

|

VOTE BY PHONE

|

|

|

Call 1-800-337-3503

|

|

|

Follow the recorded instructions

|

|

|

available 24 hours

|

|

|

|

|

|

|

|

|

|

|

VOTE BY MAIL

|

|

|

Vote, sign and date this Proxy

|

|

|

Card and return in the

|

|

|

postage-paid envelope

|

Please detach at perforation before mailing.

|

PROXY CARD

|

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

|

|

|

|

PROXY FOR THE ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

TO BE HELD ON JANUARY 9, 2020

|

|

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS. The undersigned stockholder of Common Stock of ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. (the “Company”), hereby appoints BRYAN J. MERRYMAN and TRACY D. WOJCIK, and each of them, as Proxies for the undersigned, with full power of substitution, to attend the Annual Meeting of Stockholders of the Company to be held on January 9, 2020, at 10:00 a.m. MST, at The DoubleTree Hotel, 501 Camino Del Rio, Durango, Colorado 81301 (the "Annual Meeting"), to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at the Annual Meeting and otherwise to represent the undersigned at the Annual Meeting with all powers possessed by the undersigned if personally present at the Annual Meeting. The undersigned hereby acknowledges receipt of the accompanying Proxy Statement, the terms of which are incorporated by reference, and revokes any proxy heretofore given with respect to the Annual Meeting.

This proxy, when properly executed, will be voted as specified. If this Proxy is executed but no specification is made, the votes entitled to be cast by the undersigned will be voted in accordance with the Board of Director’s recommendations. The votes entitled to be cast by the Proxy holder(s) will be cast in the discretion of the Proxy holder(s) on any other matter that may properly come before the Annual Meeting.

|

|

VOTE VIA THE INTERNET: www.proxy-direct.com

|

|

|

VOTE VIA THE TELEPHONE: 1-800-337-3503

|

|

|

|

|

|

|

|

|

|

|

|

|

To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. ☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE.

RMC_31036_121919

EVERY VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. Annual Meeting of Stockholders to Be Held on January 9, 2020.

The Proxy Statement, Annual Report on Form 10-K and Proxy Card for this meeting are available at:

https://www.proxy-direct.com/geo-31036

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: ☒

|

A

|

Proposals – THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” PROPOSALS 1, 2, 3 AND 1 YEAR ON PROPOSAL 4.

|

|

1.

|

Elect seven directors to the Board of Directors to serve until the next annual meeting of stockholders and until their respective successors are elected and qualified:

|

|

|

|

FOR

|

WITHHOLD

|

|

FOR

|

WITHHOLD

|

|

FOR

|

WITHHOLD

|

|

|

|

01. Franklin E. Crail

|

☐

|

☐

|

04. Tariq Farid

|

☐

|

☐

|

07. Mary K. Thompson

|

☐

|

☐

|

|

|

|

02. Bryan J. Merryman

|

☐

|

☐

|

05. Scott G. Capdevielle

|

☐

|

☐

|

|

|

|

|

|

|

03. Brett P. Seabert

|

☐

|

☐

|

06. Andrew T. Berger

|

☐

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.

|

Ratify the appointment of Plante & Moran PLLC as the Company’s independent registered public accounting firm for the fiscal year ending February 29, 2020.

|

FOR AGAINST ABSTAIN

☐ ☐ ☐

|

|

|

|

|

|

|

|

3.

|

Advisory vote to approve the compensation of the Company’s named executive officers.

|

FOR AGAINST ABSTAIN

☐ ☐ ☐

|

|

|

|

|

|

|

|

4.

|

Advisory vote on the frequency of future advisory votes to approve the compensation of the Company’s named executive officers.

|

1YEAR 2YEARS 3YEARS ABSTAIN

☐ ☐ ☐ ☐

|

|

|

|

|

|

|

|

5.

|

Transact such other business as may properly come before the meeting.

|

|

|

|

|

|

|

|

|

B

|

Authorized Signatures ─ This section must be completed for your vote to be counted. ─ Sign and Date Below

|

|

Note:

|

Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature.

|

|

Date (mm/dd/yyyy) ─ Please print date below

|

|

Signature 1 ─ Please keep signature within the box

|

|

Signature 2 ─ Please keep signature within the box

|

|

/ /

|

|

|

|

|

|

|

xxxxxxxxxxxxxx

|

RMC 31036

|

M xxxxxxxxxxxxxx

|

+

|

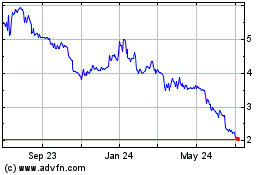

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024