Amended Statement of Beneficial Ownership (sc 13d/a)

December 05 2019 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 4)1

Rocky Mountain Chocolate Factory, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

774678403

(CUSIP Number)

AB Value Management LLC

Attn: Andrew Berger

200 Sheffield Street, Suite 311

Mountainside, NJ 07092

(855) 228-2583

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 3, 2019

(Date of Event Which Requires Filing of

This Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

|

|

1

|

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in

a prior cover page.

|

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

CUSIP NO. 774678403

|

1

|

NAME OF REPORTING PERSON

AB Value Partners, LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

NEW JERSEY

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

224,855

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

224,855

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

224,855

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.75%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

CUSIP NO. 774678403

|

1

|

NAME OF REPORTING PERSON

AB Value Management LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

460,189*

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

460,189*

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

460,189*

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.68%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

*

|

Consists

of the Shares owned directly by AB Value Partners and the Managed Account.

|

CUSIP NO. 774678403

|

1

|

NAME OF REPORTING PERSON

Andrew Berger

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

PF, AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

460,189*

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

460,189*

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

460,189

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.68%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

*

|

Consists

of the Shares owned directly by AB Value Partners and the Managed Account.

|

CUSIP NO. 774678403

|

1

|

NAME OF REPORTING PERSON

Mary Kennedy Thompson

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

CUSIP NO. 774678403

The following constitutes

amendment number 4 to the Schedule 13D filed by the undersigned (“Amendment No. 4”). This Amendment No. 4 amends the

Schedule 13D, as specifically set forth herein.

Item 4. Purpose of Transaction.

Item 4 is hereby amended to add the following:

On December 3, 2019

(the “Effective Date”), AB Value Management entered into a cooperation agreement (the “Agreement”) with

the Issuer, pertaining to, among other things, the nomination and election of two directors to the Board at the Annual Meeting.

Pursuant to the Agreement, subject to conditions, AB Value Management agreed to customary standstill and voting provisions.

Pursuant to the Agreement,

the Issuer agreed to take appropriate action to nominate Mr. Berger and Ms. Thompson for election to the Board at the Annual Meeting.

The Nominees will have certain Board observer and information rights with respect to the Board, its committees and the Issuer,

as set forth in the Agreement. As a means of accelerating the Nominees’ understanding of any and all significant non-public

circumstances related to the Issuer, the Nominees will also have the right to a detailed session with the Chief Executive Officer

of the Issuer (the “CEO”), in which the CEO will inform the Nominees of the then-present material circumstances of

the Issuer and answer all reasonable questions posed by the Nominees. Further, as part of the Agreement, each of AB Value Management

and the Issuer agreed that the Issuer may amend its organizational documents to provide stockholders proxy access, so long as such

amendment does not constitute an amendment made for the purpose of disqualifying either Nominee or frustrating the purpose of the

Agreement.

If the Nominees are

elected to serve as directors on the Board at the Annual Meeting, the Nominees are expected to serve until the Issuer’s 2020

annual meeting of stockholders (the “2020 Annual Meeting”). The Board agreed to re-nominate the Nominees for election

to the Board at the 2020 Annual Meeting; provided, that Mr. Berger has not previously resigned from the Board. The Issuer will

use the same solicitation efforts on behalf of the Nominees as for all other nominees at the Annual Meeting and the 2020 Annual

Meeting. In addition, subject to certain conditions and requirements described in the Agreement, AB Value Management will have

certain replacement rights in the event Ms. Thompson resigns or either Nominee is otherwise unable to serve as a director during

the Standstill Period (as defined below).

The Issuer and AB

Value Management agreed to a “Standstill Period” commencing on the Effective Date and ending on the date that is the

earliest of (i) the date that is 15 days prior to the beginning of the Issuer’s advance notice period for the nomination

of directors at the Issuer’s 2021 annual meeting of stockholders, (ii) Mr. Berger’s resignation from the Board any

time after the Annual Meeting, and (iii) a material breach by the Issuer of its obligations under the Agreement which (if capable

of being cured) is not cured within 15 days after receipt by the Issuer of written notice from AB Value Management specifying the

material breach.

During the Standstill Period, the Issuer

and AB Value Management have agreed that they will not disparage each other and that they will not initiate any lawsuit, claim,

or proceeding with respect to any claims (known by the alleging party as of the Effective Date) against the Issuer or AB Value

Management, as applicable, except for any legal proceeding initiated solely to enforce the Agreement.

The Agreement will

remain in effect until the date that is earliest of (i) the date that is 15 days prior to the beginning of the Issuer’s advance

notice period for the nomination of directors at the Issuer’s 2021 annual meeting of stockholders, (ii) Mr. Berger’s

resignation from the Board any time after the Annual Meeting, and (iii) a material breach by either party thereto of its obligations

under the Agreement which (if capable of being cured) is not cured within 15 days after receipt by such breaching party of written

notice from the other party specifying the material breach.

Other elements of

the Agreement include, among others:

|

|

●

|

AB

Value Management’s agreement, subject to certain exceptions including exceptions

related to extraordinary transactions and adverse proxy advisor recommendations, to vote

its shares of common stock as recommended by the Board on any matter to be voted on at

any meetings of stockholders during the Standstill Period, including with respect to

the election of directors;

|

CUSIP NO. 774678403

|

|

●

|

if

the Nominees are elected to the Board at the Annual Meeting, immediately following the

Annual Meeting, the Board’s agreement to take the necessary steps to appoint (i)

each Nominee to the Audit Committee of the Board and (ii) Ms. Thompson to the Nominating

Committee of the Board, in each case, subject to their qualifications to serve on such

committees under Nasdaq Stock Market listing standards and the applicable Securities and Exchange Commission rules and

regulations, and the Nominees will serve on such respective Board committees, and any

related or created subcommittees, for so long as the Nominees serve as directors of the

Board; provided, that during the Standstill Period, each of the Nominees will be considered

by the Board for appointment to any Board committee established as of the Effective Date

on which such respective Nominee will not be appointed pursuant to the terms of the Agreement;

|

|

|

●

|

if,

during the Standstill Period, the Board establishes any new committee, then each of the

Nominees will be appointed to any such new committee and any related subcommittee and

serve on any such new committee, so long as the Nominees serve as directors of the Board;

|

|

|

●

|

following

the Annual Meeting, each Nominee will have observer rights for each of the Board committee

meetings on which he or she does not serve for a period of one year, and such observer

rights include general access to the materials provided to and for the committees and

the ability to fully cooperate in committee discussions; and

|

|

|

●

|

the

Issuer’s agreement not to increase the size of the Board to more than seven directors

from the Effective Date until the end of the Standstill Period.

|

During the term of

the Agreement, AB Value Management agreed, subject to certain exceptions, to comply with certain customary standstill provisions,

including, among other things:

|

|

●

|

not

to, among other things, (i) make, engage in, or in any way participate in, directly or

indirectly, any “solicitation” of “proxies” (as such terms are

defined in Rule 14a-1 under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or consents to vote or advise, (ii) encourage or influence any third party

with respect to the voting of any shares of Voting Securities (as defined in the Agreement)

for the election of individuals to the Board or to approve stockholder proposals, (iii) become a “participant” in any contested “solicitation” for the

election of directors with respect to the Issuer (as such terms are defined in the Exchange

Act), or (iv) make or be the proponent of any stockholder proposal;

|

|

|

●

|

form,

join, encourage, influence, advise or in any way participate in any “group”

(as such term is defined in Section 13(d)(3) of the Exchange Act);

|

|

|

●

|

at

no time beneficially own 12.5% or more of the Common Stock (as defined in the Agreement)

outstanding at such time;

|

|

|

●

|

effect

or seek to effect, offer or propose to effect, cause or participate in, or in any way

assist or facilitate any other person to effect or seek, offer or propose to effect or

participate in, any tender or exchange offer, merger, consolidation, acquisition, sale

of all or substantially all assets or sale, spinoff, split off, or other extraordinary

transaction involving the Issuer or any of its subsidiaries or joint ventures;

|

|

|

●

|

take

any public action, or private action involving any third party, in support of or make

any public proposal, or private proposal involving any third party, or public request,

or private request involving any third party, regarding certain actions related to the

Issuer, subject to certain exceptions;

|

|

|

●

|

make

any public disclosure, announcement or statement regarding any intent, purpose, arrangement,

plan or proposal with respect to the Board, the Issuer, its management, policies or affairs,

any of its securities or assets or the Agreement that is inconsistent with the Agreement;

or

|

|

|

●

|

take

any action which could cause or require the Issuer to make a public announcement regarding

any of the foregoing, publicly seek or request permission to do any of the foregoing.

|

Notwithstanding anything

to the contrary contained in the Agreement, the standstill provisions do not prohibit AB Value Management from (i) commenting publicly

about any publicly disclosed third party proposal to acquire the Issuer so long as AB Value Management has shared its views privately

with the Issuer prior to making such public comments or (ii) having reasonable access to and participating in the Issuer’s

earnings calls, investor calls or investor meetings, in the case of each of clause (i) and (ii), so long as AB Value Management

does not violate the mutual non-disparagement provisions of the Agreement.

The foregoing description

of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement,

a copy of which is filed as Exhibit 99.1 and incorporated herein by reference.

CUSIP NO. 774678403

Item

5. Interest in Securities of the Issuer.

Item 5(a) is hereby amended and restated as follows:

The aggregate percentage

of Shares reported owned by each person named herein is based upon 5,994,997 Shares outstanding as of October 1, 2019, which is

the total number of Shares outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on October 11, 2019.

As of the close of

business on December 3, 2019, AB Value Partners directly owned 224,855 Shares, constituting approximately 3.75% of the

Shares outstanding. By virtue of their relationships with AB Value Partners discussed in further detail in Item 2, each

of AB Value Management and Mr. Berger may be deemed to beneficially own the Shares owned by AB Value Partners.

As of the close of

business on December 3, 2019, AB Value Management had caused the Managed Account to directly own 235,334 Shares, constituting

approximately 3.93% of the Shares outstanding. By virtue of their relationships with AB Value Management discussed in

further detail in Item 2 described in Amendment No. 1, each of AB Value Management and Mr. Berger may be deemed to beneficially

own the Shares owned by the Managed Account. By virtue of his relationship with AB Value Management also discussed in

further detail in Item 2, Mr. Berger may be deemed to beneficially own the Shares beneficially owned by AB Value Management.

Ms. Thompson does not directly own any Shares and may not be deemed to beneficially own any Shares.

Item

7. Material to be Filed as Exhibits.

Item 7 is hereby amended to add the following:

CUSIP NO. 774678403

SIGNATURES

After reasonable inquiry

and to the best of his or her knowledge and belief, each of the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated: December 5, 2019

|

|

AB Value Partners, L.P.

|

|

|

|

|

|

|

|

By:

|

AB Value Management LLC

|

|

|

|

General Partner

|

|

|

|

|

|

|

|

By:

|

/s/ Andrew Berger

|

|

|

|

Name:

|

Andrew Berger

|

|

|

|

Title:

|

Manager

|

|

|

|

|

|

|

|

AB Value Management LLC

|

|

|

|

|

|

By:

|

/s/ Andrew Berger

|

|

|

|

Name:

|

Andrew Berger

|

|

|

|

Title:

|

Manager

|

|

|

|

|

|

|

|

/s/ Andrew Berger

|

|

|

Name:

|

Andrew Berger

|

|

|

|

|

|

|

|

/s/ Mary Kennedy Thompson

|

|

|

Name:

|

Mary Kennedy Thompson

|

9

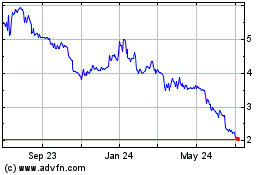

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024