Current Report Filing (8-k)

December 05 2019 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2019

Rocky Mountain Chocolate Factory, Inc.

(Exact name of registrant as specified in is charter)

|

Delaware

|

001-36865

|

47-1535633

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

265 Turner Drive

Durango, Colorado 81303

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code: (970) 259-0554

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class registered

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

|

RMCF

|

|

Nasdaq Global Market

|

|

Preferred Stock Purchase Rights

|

|

RMCF

|

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On December 3, 2019 (the "Effective Date"), Rocky Mountain Chocolate Factory, Inc. (the “Company”) entered into a cooperation agreement (the “Agreement”) with AB Value Management LLC (“AB Value”), pertaining to, among other things, the nomination and election of two directors to the Company’s Board of Directors (the “Board”) at the Company’s annual meeting of stockholders to be held on January 9, 2020 (the “2019 Annual Meeting”). Pursuant to the Agreement, subject to conditions, AB Value agreed to customary standstill and voting provisions.

Pursuant to the Agreement, the Company agreed to take appropriate action to nominate Andrew T. Berger and Mary K. Thompson (each, an “AB Value Director” and together, the “AB Value Directors”) for election to the Board at the 2019 Annual Meeting. The AB Value Directors will also have certain board observer and information rights with respect to the Board, its committees and the Company, as set forth in the Agreement.

If the AB Value Directors are elected to serve as directors on the Board at the 2019 Annual Meeting, the AB Value Directors are expected to serve until the Company’s 2020 annual meeting of stockholders (the “2020 Annual Meeting”). The Board agreed to re-nominate the AB Value Directors for election to the Board at the 2020 Annual Meeting; provided, that Mr. Berger has not previously resigned from the Board. The Company will use the same solicitation efforts on behalf of the AB Value Directors as for all other nominees at the 2019 Annual Meeting and the 2020 Annual Meeting. In addition, subject to certain conditions and requirements described in the Agreement, AB Value will have certain replacement rights in the event Ms. Thompson resigns or either AB Value Director is otherwise unable to serve as a director during the Standstill Period (as defined below).

The Company and AB Value agreed to a “Standstill Period” commencing on the Effective Date and ending on the date that is the earliest of (i) the date that is 15 days prior to the beginning of the Company’s advance notice period for the nomination of directors at the Company’s 2021 annual meeting of stockholders, (ii) Mr. Berger’s resignation from the Board any time after the 2019 Annual Meeting, and (iii) a material breach by the Company of its obligations under the Agreement which (if capable of being cured) is not cured within 15 days after receipt by the Company of written notice from AB Value specifying the material breach.

The Company and AB Value further agreed to customary mutual non-disparagement provisions during the Standstill Period.

The Agreement will remain in effect until the date that is earliest of (i) the date that is 15 days prior to the beginning of the Company’s advance notice period for the nomination of directors at the Company’s 2021 annual meeting of stockholders, (ii) Mr. Berger’s resignation from the Board any time after the 2019 Annual Meeting, and (iii) a material breach by either party thereto of its obligations under the Agreement which (if capable of being cured) is not cured within 15 days after receipt by such breaching party of written notice from the other party specifying the material breach.

Other elements of the Agreement include, among others:

|

|

●

|

AB Value’s agreement, subject to certain exceptions, including exceptions related to extraordinary transactions and adverse proxy advisor recommendations, to vote its shares of common stock as recommended by the Board on any matter to be voted on at any meetings of stockholders during the Standstill Period, including with respect to the election of directors;

|

|

|

●

|

if the AB Value Directors are elected to the Board at the 2019 Annual Meeting, immediately following the 2019 Annual Meeting, the Board's agreement to take the necessary steps to appoint (i) each AB Value Director to the Audit Committee of the Board and (ii) Ms. Thompson to the Nominating Committee of the Board, in each case, subject to their qualifications to serve on such committees under Nasdaq Stock Market listing standards and the applicable U.S. Securities and Exchange Commission rules and regulations, and the AB Value Directors will serve on such respective Board committees, and any related or created subcommittees, for so long as the AB Value Directors serve as directors of the Board;

|

|

|

●

|

if, during the Standstill Period, the Board establishes any new committee, then each of the AB Value Directors will be appointed to any such new committee and any related subcommittee and serve on any such new committee, so long as the AB Value Directors serve as directors of the Board;

|

|

|

●

|

following the 2019 Annual Meeting, each AB Value Director will have observer rights for each of the Board committee meetings on which he or she does not serve for a period of one year, and such observer rights include general access to the materials provided to and for the committees and the ability to fully cooperate in committee discussions; and

|

|

|

●

|

the Company’s agreement not to increase the size of the Board to more than seven directors from the Effective Date until the end of the Standstill Period.

|

During the term of the Agreement, AB Value agreed, subject to certain exceptions, to comply with certain customary standstill provisions, including, among other things:

|

|

●

|

not to, among other things, (i) make, engage in, or in any way participate in, directly or indirectly, any “solicitation” of “proxies” (as such terms are defined in Rule 14a-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or consents to vote or advise, (ii) encourage or influence any third party with respect to the voting of any shares of Voting Securities (as defined in the Agreement) for the election of individuals to the Board or to approve stockholder proposals, (iii) become a “participant” in any contested “solicitation” for the election of directors with respect to the Company (as such terms are defined in the Exchange Act), or (iv) make or be the proponent of any stockholder proposal;

|

|

|

●

|

form, join, encourage, influence, advise or in any way participate in any “group” (as such term is defined in Section 13(d)(3) of the Exchange Act);

|

|

|

●

|

at no time beneficially own 12.5% or more of the Common Stock (as defined in the Agreement) outstanding at such time;

|

|

|

●

|

effect or seek to effect, offer or propose to effect, cause or participate in, or in any way assist or facilitate any other person to effect or seek, offer or propose to effect or participate in, any tender or exchange offer, merger, consolidation, acquisition, sale of all or substantially all assets or sale, spinoff, split off, or other extraordinary transaction involving the Company or any of its subsidiaries or joint ventures;

|

|

|

●

|

take any public action, or private action involving any third party, in support of or make any public proposal, or private proposal involving any third party, or public request, or private request involving any third party, regarding certain actions related to the Company, subject to certain exceptions;

|

|

|

●

|

make any public disclosure, announcement or statement regarding any intent, purpose, arrangement, plan or proposal with respect to the Board, the Company, its management, policies or affairs, any of its securities or assets or the Agreement that is inconsistent with the Agreement; or

|

|

|

●

|

take any action which could cause or require the Company to make a public announcement regarding any of the foregoing, publicly seek or request permission to do any of the foregoing.

|

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: December 5, 2019

|

By:

|

/s/ Bryan J. Merryman

|

|

|

|

Name:

|

Bryan J. Merryman

|

|

|

|

Title:

|

Chief Executive Officer, Chief Financial Officer, and Chairman of the Board of Directors

|

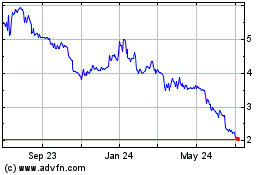

|

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024