UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☒

|

Soliciting Material under §240.14a-12

|

|

Rocky

Mountain Chocolate Factory, Inc.

|

(Name of Registrant as Specified In Its Charter)

ANDREW T. BERGER

MARY K. THOMPSON

AB VALUE PARTNERS, LP

AB VALUE MANAGEMENT LLC

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

September 9, 2019

Board

of Directors

265

Turner Drive

Durango,

CO 81303

Dear

Members of the Board,

AB

Value Management LLC, together with its affiliates (“AB Value”), beneficially owns approximately 7.71% of the outstanding

shares of Rocky Mountain Chocolate Factory, Inc. (NASDAQ: RMCF) (“RMCF” or the “Company”), making us one

of the Company’s largest shareholders.

As

background, AB Value Management invests in undervalued public companies, many of which suffer from suboptimal management. We constructively

engage with managements of these companies as a means of identifying opportunities to improve companies for the benefit of all

shareholders. In the past we have successfully worked with management of many companies to not only enhance their focus on core

value, but also to better align their interests with shareholders, improve capital allocation and increase operational efficiency.

As

you know, on August 28, 2019, the Company announced that its Board of Directors (the “Board”) set Thursday, January

9, 2020 as the date for its next Annual Meeting of Shareholders (the “Annual Meeting”), a date that is more than 16

months since the Company’s last “annual” meeting.

This

startingly long and unnecessary delay not only violates Delaware law, but we believe clearly serves no purpose other than entrenchment

of a board and management team that do not have shareholders’ best interests in mind. As a shareholder who deeply values

the principles of shareholder democracy, we demand that RMCF hold its Annual Meeting soon. The Company cannot afford for this

to be delayed, as the Board obviously needs a shareholder assessment about the Company’s current strategy and path forward.

How

the Board decided to delay this year’s “annual” meeting in the face of last year’s substantial votes withheld

against all directors up for election is beyond us. Compounding matters and without any indication of shareholder input, the Board

recently announced that it has retained strategic advisors, spending what we believe will be at least hundreds of thousands of

dollars of shareholder capital to potentially explore the possible sale of RMCF. The Board made this announcement one week after

we submitted director nominations in connection with the Annual Meeting and barely one month after we filed our Schedule 13D with

the Securities and Exchange Commission (“SEC”). The timing of the Board’s announcement was no coincidence—we

have shockingly learned from RMCF that its strategic review announcement was made directly in response to our nominations and

Schedule 13D filing.

In

our view, all of this points to only one reasonable conclusion—the timing of this announcement was clearly crafted as a

means for the Board to delay a shareholder vote (and referendum on its shareholder value destruction) for as long as possible.

Now that the Annual Meeting has been unduly delayed until next year, our worst fears have now become an unfortunate reality. The

Board has wrongfully and unlawfully interfered with the voting franchise of RMCF shareholders and postponed being held accountable

for its poor performance.

We

have sought additional information through a books and records demand regarding the strategic review process, based on our concerns.

To no surprise, consistent with an entrenchment mindset, the Board rejected our valid demand for information, which has been re-attached

to this letter for your convenience, together with RMCF’s response, which further demonstrates the Board’s entrenchment

and lack of transparency to shareholders. Making matters worse, despite the deliverance of our timely and qualifying nomination

notice originally sent on May 17, 2019, the Board has failed to interview our director nominees even though we have indicated

several opportunities for such interviews to take place.

Radio

silence notwithstanding, it remains our preference to work with the Board to reach a constructive solution that capitalizes on

the unique and proven operational expertise of our director nominees, Andrew T. Berger and Mary K. Thompson, and helps RMCF realize

its full potential for the benefit of all shareholders.

Further

delay of the Annual Meeting benefits no one and disenfranchises the shareholders to which you are fiduciaries. The matters facing

RMCF are urgent—now is not the time to play games with the election process to avoid accountability. Shareholders deserve

to have their voices heard now, and RMCF’s ongoing attempts to delay the Annual Meeting is a continued failure of corporate

governance for which we demand you rectify promptly.

|

|

Respectfully,

|

|

|

|

|

|

/s/

Andrew T. Berger

|

|

|

Andrew T. Berger

|

|

|

|

|

IMPORTANT INFORMATION

|

|

AB

Value Partners, LP and AB Value Management LLC, Andrew T. Berger and Mary K. Thompson have filed a preliminary proxy statement

and an accompany form of proxy card with the SEC to solicit proxies from shareholders of RMCF for use at the Annual Meeting. THE

PARTICIPANTS STRONGLY ADVISE ALL SHAREHOLDERS OF RMCF TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Such proxy materials will be available at no charge on the SEC’s website

at http://www.sec.gov. In addition, the Participants in this proxy solicitation will provide copies of the proxy statement without

charge, upon request. Requests for copies should be directed to the Participants’ proxy solicitor.

PARTICIPANT

INFORMATION

In

accordance with Rule 14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the Participants in the proxy solicitation

are: AB Value Partners, LP, AB Value Management LLC, Andrew T. Berger, and Mary K. Thompson (collectively, the “Participants”).

As of the date hereof, AB Value Partners, LP directly owns 224,855 shares of common stock, $0.01 par value per share of RMCF (“Common

Stock”). As of the date hereof, AB Value Management LLC directly owns 235,334 shares of Common Stock. As of the date hereof,

neither Mr. Berger nor Ms. Thompson directly own any shares of Common Stock. However, by virtue of the relationship among the

Participants and the formation by them of a Section 13(d) group, all the Participants, individually, are deemed to beneficially

own the 460,189 shares of Common Stock owned in the aggregate by AB Value Partners, LP and AB Value Management LLC.

Appendix A

AB Value Management LLC

200

Sheffield Street

Mountainside, NJ 07092

855-228-2583

August 13, 2019

BY EMAIL, FAX AND OVERNIGHT MAIL

Rocky Mountain Chocolate Factory,

Inc.

265 Turner Drive

Durango, CO 81303

Attn: Tracy D. Wojcik, Corporate Secretary

Dear Ms. Wojcik:

AB Value

Partners, LP, a Delaware limited partnership (“AB Value”), is the direct beneficial owner of 224,855 shares of common

stock, $0.00l par value per share (the “Common Stock”) of Rocky Mountain Chocolate Factory, Inc., a Delaware corporation

(the “Company”), one hundred (100) shares of which are held in record name by AB Value (the “Shares”).

|

|

I.

|

Books and

Records Request to Investigate the Company’s Strategic Review

|

On May

29, 2019, the Company issued an earnings release, filed with Securities and Exchange Commission on a Current Report on Form

8-K (the “Misleading 8-K”), in which it first announced that it is conducting a process to explore and evaluate

strategic alterntives. In reaction to this news, the stock price has dropped from $9.60 on the date of announcement to a

price of $9.05 per share, as of August 12, 2019. As a large stockholder of the Company that has not only suffered losses on

its investment—as have many of the Company’s other stockholders—but that also been told by the Company that

the contested nature of the 2019 annual meeting of stockholders of the Company and any adjournments, postponements,

reschedulings or continuations thereof (the “Annual Meeting”) played a role in the Company’s decision to

explore and evaluate strategic alternatives (and disclose such exploration and evaluation), AB Value has serious concerns

with the Company’s decision to enter into a strategic review process.

Neither the

earnings release nor any other publicly filed document discloses any information as to why such a strategic review is a necessary

preferred course of action. In fact, the earnings release informs stockholders that the “Company does not intend to make

any further comment regarding this process until its Board of Directors (the “Board”) approves a specific course of

action.” The Board apparently made the decision to undertake a strategic review only days after AB Value first submitted

its nomination notice and stockholder proposal to be presented at the Annual Meeting. Indeed, on May 30, 2019, Bryan Merryman,

CEO of the Company, admitted that AB Value’s involvement “was a factor” in its decision to seek strategic alternatives.

AB Value had discussions with the Company over the past year. At no point during any of these discussions did the Company indicate

or imply that it was open to, or would even consider initiating, an exploration and evaluation of strategic alternatives. The

Company’s express confirmation that the contested nature of the Annual

Meeting factored into its decision now to explore and evaluate strategic alternatives establishes more than a credible

basis from which fiduciary misconduct can be inferred. There is little, if any, evidence that could possibly be stronger in supporting

corporate mismanagement than this express, unambiguous confirmation by the Company. Furthermore, as the Misleading 8-K failed

to disclose the role that the contested nature of the Annual Meeting played in the decision for the Company now to explore and

evaluate strategic alternatives, AB Value is concerned that the decision-making process of the Board was defective, resulting

in the Misleading 8-K’s material omissions. Given these facts and

absent evidence to the contrary, AB Value believes that the Board has determined to engage in a strategic review of alternatives

as a means of further entrenching itself.

Accordingly,

as a record holder of the Shares, AB Value hereby demands pursuant to Section 220 of the Delaware General Corporation Law (“DGCL”),

during the usual hours for business, to inspect the following books, records and documents of the Company and to make and/or receive

copies or extracts therefrom, except for such books, records and documents that would constitute material non-public information

that would preclude AB Value from trading the Common Stock:

|

|

(a)

|

Any information or records relating to, concerning,

or reflecting the Company’s actual, projected, expected or forecasted revenues and bookings;

|

|

|

(b)

|

Any information or records relating to, concerning,

or reflecting any projections, estimates or forecasts and any variances therefrom prepared by or for the Company’s management;

|

|

|

(c)

|

Any information or records, including D&O questionnaires,

relating to, concerning, or reflecting on the Board’s assessment of its members’ independence;

|

|

|

(d)

|

Any minutes of meetings of the Board or any of its

committees, together with the Board or committee packages and any other documents used at or in connection with the Board meetings;

|

|

|

(e)

|

Any information or records, whether in written form

or otherwise, relating to, concerning, or reflecting the Company’s past review of strategic alternatives and the process

leading up to such review, or the Company’s announcement of its plan now to explore and evaluate strategic alternatives,

including any information on the scope of any strategic alternatives that have been or may be explored and evaluated; and

|

|

|

(f)

|

Any information or records, whether in written form

or otherwise, that have already been produced or which the Company is planning or intending to produce to any other stockholder

making similar demand for inspection of books and records under Section 220 of the DGCL (or any analogous statute).

|

The

purpose of the demand in this paragraph I is not to enable AB Value to determine whether the Board’s decision to

explore and evaluate strategic alternatives was just risky, but instead to assess (i) whether the Board or certain of its

members has or have engaged in corporate waste, misuse or mismanagement; (ii) whether the Board or certain of its members

sufficiently informed itself or themselves of the strategic review alternatives; and (iii) whether the Board or certain of

its members have breached their fiduciary duties in concluding a strategic review was warranted. As any decision resulting

from this exploration and evaluation of strategic alternatives will likely affect the Annual Meeting and stockholder value,

the necessity of this demand and its urgency are clear.

AB Value

demands that modifications, additions or deletions to any and all information referred to in paragraphs I.(a) through I.(f) be

immediately furnished as such modifications, additions or deletions become available to the Company or its agents or representatives.

It is

requested that the information identified above be produced to the designated parties no later than August 21, 2019. Pursuant to

Section 220 of the DGCL, you are required to respond to this demand and make available the requested materials within five (5)

business days of the date hereof.

AB Value will bear the reasonable

costs incurred by the Company, including those of its transfer agent(s) or registrar(s), in connection with the production of the

information demanded.

Signature page follows.

AB

Value hereby designates and authorizes David Polonitza of AB

Value and John Glenn Grau of InvestorCom, LLC, and any other persons designated by them or by AB

Value, acting singly or in any combination, to conduct the inspection and copying herein requested. Pursuant to Section 220 of

the DGCL, you are required to respond to this demand within five (5) business days of the date hereof. Accordingly, please advise

Mr. Polonitza at (855) 228-2583 as promptly as practicable within the requisite timeframe, when and where the items requested above

will be made available to AB Value. If the Company

contends that this demand is incomplete or is otherwise deficient in any respect, please notify AB Value immediately in writing,

setting forth the facts that the Company contends

support its position and specifying any additional information believed to be required. In the absence of such prompt notice, AB

Value will assume that the Company agrees that this demand complies in all respects with the requirements of the DGCL. AB

Value reserves the right to withdraw or modify this demand at any time.

|

|

Very truly yours,

|

|

|

|

|

|

AB VALUE PARTNERS, LP

|

|

|

|

|

|

|

By:

|

/s/

Andrew Berger

|

|

|

|

Name: Andrew Berger

|

|

|

|

Title:

|

ANDREW BERGER, being sworn, states under oath: I executed the

foregoing letter, and the information and facts stated therein regarding AB

Value Partners, LP’s ownership and the purpose of this demand for inspection

are true and correct. Such inspection is reasonably related to AB Value Partners, LP’s

interest as a stockholder and is not desired for a purpose which is in the interest of a

business or object other than the business of Rocky Mountain Chocolate Factory, Inc.

|

|

|

/s/

Andrew Berger

|

|

|

|

Andrew

Berger

|

Subscribed and sworn to

before me this 14 day of August, 2019.

|

/s/ Brandy K Berger

|

|

|

Notary Public

|

|

|

My commission expires:

|

BRANDY K BERGER

Notary Public -

State of New Jersey

My Commission Expires Aug 23, 2022

|

Appendix B

|

1201 Third Avenue

Suite 4900

Seattle, WA 98101-3099

|

+1.206.359.8000

+1.206.359.8000

+1.206.359.9000

+1.206.359.9000

perkinscoie.com

|

|

August 22, 2019

VIA EMAIL AND OVERNIGHT MAIL

Andrew Berger

AB Value Partners, LP

200 Sheffield Street

Mountainside, NJ 07092

|

Ronald L. Berenstain

RBerenstain@perkinscoie.com

D. + 1.206.359.8477

F.

+ 1.206.359.9477

|

|

|

Re:

|

AB Value Management LLC Request to Inspect Books and

Records of Rocky Mountain Chocolate Factory, Inc.

|

Dear Mr. Berger:

We

have been engaged to represent Rocky Mountain Chocolate Factory, Inc. (“RMCF”) in connection with its response to

AB Value Partners, LP’s (“AB Value”) August 13, 2019 letter seeking to inspect certain books and records

of RMCF under Delaware General Corporation Law § 220 (the “Demand”). As set forth in further detail below,

RMCF rejects the Demand as deficient because (1) AB Value has failed to provide credible evidence of actual mismanagement at

RMCF, and (2) the categories of documents identified for inspection are not necessary and essential to the Demand’s

purported purpose and are thus not appropriate for inspection in response to the Demand.

|

|

I.

|

AB Value Fails to Meet its Burden of Providing Credible

Evidence of any Misconduct.

|

When a

stockholder seeks to inspect a corporation’s books and records, Delaware’s stockholder inspection statute, 8 Del.

G.C.L. § 220 (“§ 220”), requires, among other things, that the stockholder have a “proper

purpose” for the requested inspection. AB Value’s stated purpose for the Demand is “to assess (i) whether

the Board or certain of its members has or have engaged in corporate waste, misuse or mismanagement; (ii) whether the Board

or certain of its members sufficiently informed itself or themselves of the strategic review alternatives; and (iii)

whether the Board or certain of its members have breached their fiduciary duties in concluding a strategic review was

warranted.”

Where,

as here, a stockholder’s stated purpose is to investigate potential mismanagement or breach of fiduciary duty, the stockholder

carries the burden to show “by a preponderance of the evidence” a “credible basis to find probable wrongdoing”

by the corporation’s board or management. Sec. First Corp. v. U.S. Die Casting & Dev.

Co., 687 A.2d 563, 567 (Del. 1997). “A mere statement of a purpose to investigate possible general mismanagement, without

more, will not entitle a shareholder to broad § 220 inspection relief.” Id. at 568 (quoting Helmsman Mgmt.

Servs. v. A & S

Consultants, Inc., 525 A.2d 160, 164 (Del. Ch. 1987)).

Andrew Berger

August 22, 2019

Page 2

This

burden “is not insubstantial,” and the stockholder must put forth affirmative, cognizable evidence giving

rise to a credible basis to infer actionable mismanagement by those the stockholder seeks to investigate. Seinfeld v.

Verizon Commc’ns, Inc., 909 A.2d 117, 123 (Del. 2006); City of Westland Police & Fire

Ret. Sys. v. Axcelis Techs., Inc., I A.3d 281, 287–88 (Del. 2010) (“any reduction of that burden would

be tantamount to permitting inspection based on the plaintiff-stockholder’s mere suspicion of wrongdoing.”); Beatrice

Corwin Living Irrevocable Tr. v. Pfizer, Inc., No. 10425-JL, 2016 WL 4548101, at *4 (Del. Ch. Sept. 1, 2016) (a

stockholder must “present some evidence from which the Court may infer possible mismanagement or

wrongdoing.”).

A stockholder can only satisfy this “credible

basis” standard “through documents, logic, testimony, or otherwise.” Seinfeld, 909 A.2d at 123; Louisiana

Mun. Police Emps.’ Ret. Sys. v. Lennar Corp., CIV.A. 7314-VCG, 2012 WL 4760881, *3–5 (Del. Ch. Oct. 5, 2012) (noting

that “[t]o permit stockholders to demand corporate books and records based on the ‘mere suspicion’ of wrongdoing

would ‘invite mischief’ and expose companies to ‘indiscriminate fishing expeditions.”’). A stockholder

cannot satisfy this burden through a mere “subjective belief” that wrongdoing has occurred, Thomas &

Betts Corp. v. Leviton Mfg. Co., 681 A.2d 1026, 1032 (Del. 1996).

Moreover, a stockholder’s

disagreement with a corporate decision that complies with the business judgment rule is insufficient to form a “credible

basis” for inspecting corporate books and records. Marathon Partners, 2004 WL

1728604, at *4. Instead, a stockholder must put forth actual evidence that supports an inference that management acted with self-interest

or failed to exercise due care in making the decision at issue. Id.; City of Westland, 1

A.3d at 288 (no “credible basis” where board’s decisions to reject an acquisition proposal were “good

faith business decisions”); Everett v. Hollywood Park, Inc., Civ. A. No. 14556,

1996 WL 32171, *5–6 (Del. Ch. Jan. 19, 1996) (rejecting § 220 inspection requests premised

on challenges to business judgments when plaintiff failed to establish a credible basis from which the court could infer self-dealing

or failure to exercise due care); Weiland v. Cent. S.W

Corp., Civ. A. No. 9769, 1989 WL 48740, *2 (Del. Ch. May 9, 1989) (dismissing §

220 action for failing to allege sufficient “factual basis” from which court could infer a lack of independence

or failure to exercise due care). “[I]n the absence of evidence of a fiduciary duty breach, the investigation of a decision

that falls squarely within the business judgment rule cannot be a proper purpose as it provides no claim against corporate fiduciaries

for the stockholder to pursue (i.e., no ‘end’ to the investigation).” Hoeller

v. Tempur Sealy Int’l, Inc., No. 2018-0336-JRS, 2019 WL 551318, at *7 (Del. Ch. Feb. 12, 2019) (citing Seinfeld,

909 A.2d at 120; Marathon Partners, 2004 WL 1728604, at *4).

AB Value’s

Demand fails to provide the required “credible basis” of any actual wrongdoing by the RMCF Board for multiple reasons.

First, the premise of the Demand—AB Value’s assertion that “the decision-making process of [RMCF’s] Board was defective”—is

speculation. AB Value’s subjective belief that the Board’s decision-making was impaired is insufficient to meet the evidentiary

burden necessary to inspect books and records. Leviton Mfg. Co., 681 A.2d at 1032.

Nor is a bald assertion of company mismanagement sufficient to meet this burden. Sec. First Corp.,

687 A.2d at 568. AB Value presents no evidence, through “documents, logic, testimony, or otherwise,” Seinfeld,

909 A.2d at 123, to support its suggestion that the Board’s decision to consider strategic alternatives was improper.

Andrew Berger

August 22, 2019

Page 3

Second, AB

Value’s assertion that the temporal proximity of its communications with RMCF regarding issues for RMCF’s next

annual meeting and the date on which AB Value believes the Board decided to consider strategic alternatives is purported

evidence of Board wrongdoing is speculative, conclusory, and insufficient to provide the required credible basis to

investigate potential wrongdoing in connection with the Board’s decision to consider strategic alternatives. Just

because RMCF publicly disclosed the strategic review process “only days after” AB Value submitted its request for

additions to RMCF’s proxy materials does not mean that the Board’s decision to undertake the strategic review was

improper. Nor does it reflect anything about when the Board began its evaluation process. AB Value presents no authority to

support the notion that temporal proximity between these two events constitutes a “credible basis” of corporate

misconduct—because no such authority exists. Moreover, and contrary to AB Value’s speculative conclusion that its

submission of a shareholder proposal and director nominations was a factor in RMCF’s decision to engage in a strategic

review, the Board’s decision was actually made much earlier and well before AB Value submitted its request for a

shareholder proposal and director nominations in RMCF’s proxy materials for the next annual meeting of the

stockholders. Here, not only does speculation about Board wrongdoing based on the temporal proximity of two events provide an

insufficient credible basis to investigate alleged wrongdoing, but the conclusion drawn from the proximity is factually

incorrect.

Third,

and independent of the Demand’s other shortcomings, the Board’s decision to explore and evaluate strategic alternatives falls squarely

within the business judgment rule and is therefore an impermissible basis on which to inspect RMCF’s books and records. Hoeller,

2019 WL 551318, at *7, 10. Thus, AB Value must put forth evidence that RMCF’s fiduciaries acted with gross negligence before

it is entitled to investigate a possible breach of the duty of care. Id. at* 10 (citing In re Lear Corp. S’holder Litig.,

967 A.2d 640, 651–52 (Del. Ch. 2008)). The Demand presents no such evidence. Additionally, AB Value’s assertion that it “believes

that the Board has determined to engage in a strategic review of alternatives as a means of further entrenching itself’ is also

speculative and does not offer any credible evidence of wrongdoing. There is no basis to conclude that the Board’s decision to

engage in a strategic review of alternatives is based on some entrenchment effort by the Board.

Finally,

under Delaware law, “a stockholder ‘must do more than state, in a conclusory manner, a generally accepted proper purpose’—the

investigation of corporate mismanagement ‘must be to some end.’” Graulich v. Dell Inc., No. 5846–CC, 2011 WL 1843813,

at *5 (Del. Ch. May 16, 2011) (quoting West Coast Mgmt. & Cap., LLC v. Carrier Access Corp., 914 A.2d 636,646

(Del. Ch. 2006)). Here, the Demand does not specify what AB Value intends to do with the requested information or articulate where

the investigation may ultimately lead. The Demand thus fails to identify “what [AB Value] will do with the information or

an end to which that investigation may lead.” Graulich, 2011 WL 1843813, at *5 (quoting West Coast Mgmt., 914

A.2d at 646).

In sum,

the Demand is deficient because it presents no credible basis (let alone a preponderance of the evidence) warranting an

inspection of RMCF’s books and records for AB Value’s stated purpose to investigate wrongdoing.

Andrew Berger

August 22, 2019

Page 4

|

|

II.

|

AB Value Fails to Demonstrate That the Requested Information

and Records are Essential to Accomplishing its Stated Purpose.

|

Even if AB Value had

a credible basis to investigate alleged wrongdoing—and it does not—the Demand fails for another

independent reason: the categories of documents identified are overbroad and are not “essential to the accomplishment

of [AB Value’s] articulated purpose for the inspection.” Espinoza v.

Hewlett-Packard, Co., 32 A.3d 365, 371 (Del. 2011) (quoting Leviton Mfg. Co., 681

A.2d at 1035). Section 220 inspection requests must be precisely tailored to the purpose of the inspection. A

stockholder “must justify each category of the requested production,” and “[must] make specific and

discrete identification, with rifled precision . . . [to] establish that each category of books and records is essential to

the accomplishment of [the Demand’s] articulated purpose.” Brehm v. Eisner, 746

A.2d 244, 266–67 (Del. 2000). A document is “essential” under§ 220 if it addresses

the crux of the shareholder’s purpose and if the information is unavailable from another source. Id. at

371–72; see also Norfolk Cty. Ret. Sys. v. Jos. A. Bank Clothiers, Inc., No.

3443–VCP, 2009 WL 353746, at *6 (Del. Ch. Feb. 12, 2009) (“Delaware courts repeatedly have held that’

[t]he scope of inspection should be circumscribed with precision and limited to those documents that are necessary, essential

and sufficient to the stockholder’s purpose.”), aff’d, 977

A.2d 899 (Del. 2009).

AB Value’s

request to inspect six sweeping categories of “books, records and documents,” identified in Paragraphs (a) through (f)

of the Demand, is impermissibly overbroad. See Paul v. China MediaExpress Holdings, Inc.,

No. 6570–VCP, 2012 WL 28818, at *6 (Del. Ch. Jan. 5, 2012) (“Inspection under §

220 is not discovery, but rather is a limited form of document production narrowly tailored to the express purposes of the

shareholder requesting access to the company’s books and records.”); Robotti & Co. v.

Gulfport Energy Corp., No. Civ.A. 1811-VCN, 2007 WL 2019796, at *5–6 (Del. Ch. July 3, 2007) (denying five demand categories

that were not “necessary” or “suffer[ed] from the absence of any recognizable relationship” to a proper purpose);

Mattes v. Checkers Drive-In Rests., Inc., No. C.A. 17775, 2001 WL 337865, at *5 (Del.

Ch. Mar. 28, 2001) (noting that courts are skeptical of demands where there is an “incongruity between the narrow scope of

the evidence of mismanagement or waste . . . and the broad scope of the inspection” sought).

AB Value fails to

meet its burden of showing that the categories of documents it identifies are necessary and essential to its stated purpose.

Meeting minutes, information, or records pertaining to projections or forecasts, along with any variations therefrom

(Paragraphs (a), (b), and (d)), have no bearing on whether the Board acted improperly when it decided to consider strategic

alternatives. See, e.g., Robotti, 2007 WL 2019796, at *5–6. Likewise,

information or records relating to the “Board’s assessment of its members’ independence” (Paragraph

(c)) or information produced (or to be produced) in response to other § 220

demands (Paragraph (f)) have

absolutely nothing to do with AB Value’s articulated purpose—and fall well short of the “rifled

precision” required under Delaware law. See, e.g., Brehm, 746 A.2d at

266–67. Similarly, the categories of documents listed in Paragraph (e) are overbroad because those documents include

“information or records, . . . relating to, concerning, or reflecting the Company’s past

review of strategic alternatives and the process leading up to such review” (emphasis added). Such documents

are not necessary or essential to investigating potential misconduct concerning the Board’s decision to consider

strategic alternatives.

Andrew Berger

August 22, 2019

Page 5

Nowhere

does the Demand reconcile these broad requests with the requirement that documents requested via a § 220 demand be

narrowly tailored to the stated purpose. To the contrary, it appears from the face of the Demand that AB Value requests to

inspect these documents solely to satisfy its apparent curiosity. Permitting AB Value to demand these broad categories of

books and records on the mere basis of unbridled interest would expose RMCF to the “indiscriminate fishing

expedition” that Delaware courts routinely deny. See Louisiana Mun. Police Emps.’ Ret. Sys., 2012

WL 4760881, at *3–5. These documents are not necessary or essential to AB Value’s stated purpose. Norfolk

Cty. Ret. Sys., 2009 WL 353746, at *6. Thus, the Demand is deficient on this additional,

independent basis.

* * *

Although this letter

identifies multiple deficiencies in the Demand, it is not intended to be an exhaustive list of the Demand’s

shortcomings. RMCF reserves the right to assert additional objections to the form and content of the Demand, and expressly

reserves all of its rights, defenses, and claims, including the right to argue that AB Value’s stated purpose is not

its actual purpose or that AB Value is not entitled to the requested inspection for any other reason.

Very truly yours,

|

/s/ Ronald L. Berenstain

|

|

|

Ronald L. Berenstain

|

|

RLB

Tracy

Wojcik

Sonny Allison

Ned Prusse

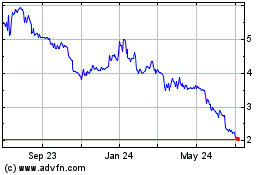

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024