Innovative Healthcare Investment Firm Proposes Dynamic New Directors With Worldwide Reach Who Can Implement Progressive Strat...

March 16 2020 - 8:00AM

Medical Resource Acquisition Group, LLC (MRAG) an investment

company focused on facilitating the advancement of innovative

healthcare companies, announces that it has been receiving

overwhelming support from Rockwell shareholders who are in favor of

Rockwell Medical (RMTI; NASDAQ) receiving $15 million in funding

and having three new Directors with successful experience and

worldwide global, financial, and strategic contacts replace

Directors Lisa Colleran, John Cooper and Mark Ravich. In light of

the tremendous support for MRAG a weblink has been set up on the

MRAG website. We encourage all shareholders to place their support

and be able to stay further informed by going to

www.MRAGWORLD.COM and click

ROCKWELL OFFER.

MRAG is backed by Canadian, UAE based

businessman Khurram Shroff, who is an award- winning, global

banking and finance leader, featured in the prestigious list of the

“Top 100 Most Powerful and Influential Muslims in Great Britain and

the World” by Power100. Mr. Shroff, an energetic entrepreneur with

diverse interests has turned his attention to bringing the finest

in global bio-pharma expertise to the Middle and Far East,

beginning with an initiative that seeks to address a growing

regional need for end-stage kidney disease management.

MRAG has proposed funding of USD15 million, as

well as new directors for Rockwell Medical Inc., in a bid to

restructure and reinvigorate the company. Mr. Shroff believes that

MRAG and its advisers can bring new opportunities to the company,

both in terms of an expansion of its business interests and in

terms of finance. Mr. Shroff believes that the funding offered by

MRAG will empower Rockwell to make great strides into huge, new

markets which lay beyond those currently being considered and

serviced.

Mr. Shroff is driving an initiative to introduce

much needed, state of the art, dialysis solutions and expertise in

the Middle East and Far East markets, where there is growing

demand. According to the Global Kidney Health Atlas, 14.5 million

people will require treatment for end-stage kidney disease

worldwide by 2030, with such conditions also emerging as a major

healthcare concern in the Middle and Far East. A substantive effect

of MRAG’s offer of equity funding to RMTI, made on February 25,

2020, will be the introduction of appropriate healthcare

innovations to the Middle and Far East market that target current

needs and future projections.

MRAG’s advisors include:

- Dr. Dominic Man-Kit Lam (-founder

of the Hong Kong Institute of Biotechnology, former Assistant

Professor at Harvard Medical School, former Professor of

Biotechnology, Cell Biology and Ophthalmology at Baylor College of

Medicine, Houston, Texas and currently the Chairman and Chief

Biomedical Officer of Rejuve Longevity Network;

- Dr. Reinhard R. Glück (-President

of the Swiss Biotech Association, Chief Scientific Officer of Berna

Biotech Ltd, Berne, Switzerland, President of Etna Biotech Srl,

Catania, Sicily, Executive Vice President R&D, Vaccine

Discovery, Crucell, Scientific Advisor of Redbiotech, Zurich,

Switzerland; and Chief Scientific Officer, Vaccines, Cadila

Healthcare (Zydus);

- Mr. Arthur S. Reynold (-a former

Chairman of the Board of ThermoEnergy Corporation, who has more

than 35 years’ experience raising capital and whose career included

working for W.R. Grace and Co., which sold National Medical Care,

the world's largest operator of kidney disease treatment centers in

1996, to Fresenius A.G. for $4.4 billion);

- Mr. Markus Müller (-a member of the

Board of Directors of Arundel AG, a Swiss corporation whose shares

are listed on the SIX Swiss Exchange and whose Valor Symbol is:

ARON. The Arundel Group provides specialist investment banking

services to public and private companies. It has offices in Zurich,

London, New York and Mauritius);

- Mr. Numair Ali Osman (-a

former Chief Operating Officer of BioVance, a contract

research organization for UK-based pharmaceutical companies, a

former CEO of Hye Noon Technologies which provided IT products and

solutions to the pharmaceutical sector and Head of Corporate

Affairs for Pharmatec, a contract manufacturer for multinational

pharmaceutical companies); and

- Mr. Peter Kaiser (-a Swiss

Financial Analyst & Portfolio Manager as well as Certified

International Investment Analyst who has headed up various fund

management and administration companies, including acting as head

of fund management at a major Liechtenstein bank).

MRAG has nominated Mr. Khurram Shroff, Mr.

Arthur S. Reynolds and Mr. Markus Müller for election as directors

at the Rockwell annual shareholder meeting and believes that they

have much more to offer Rockwell than the directors currently on

the Board.

Mr. Khurram Shroff, General Partner of MRAG

stated: “Along with our generous offer to fund Rockwell with $15

million, we have filed our slate of three high-quality directors

with Rockwell Medical and, as confirmed by Rockwell management via

their written correspondence, we met all the requirements of

demonstrating our share ownership in the allotted time to do so. We

have been taking a significant ownership position in Rockwell and

we plan to acquire approximately an additional five million shares.

We prefer to acquire those shares direct from Rockwell for $15

million for the three board seats,” Mr. Shroff added, “Other than

director Ravich, we do not believe that the directors of Rockwell

have used one dollar of their own to buy shares in Rockwell. Not

only is MRAG willing to invest significant sums into Rockwell to

transform our vision for the company into a reality, but advisers

of MRAG have also personally invested monies and bought shares in

the company. I believe that this demonstrates our genuine

motivation and sincere long-term intentions with regard to

Rockwell.”

Forward Looking Statements

Certain information set forth in this

presentation contains “forward-looking information”, including

“future oriented financial information” and “financial outlook”,

under applicable securities laws (collectively referred to herein

as forward looking statements). These forward-looking statements

are based on current expectations, estimates, forecasts and

projections. Words such as “expect,” “anticipate,” “should,”

“believe,” “hope,” “target,” “project,” “goals,” “estimate,”

“potential,” “predict,” “may,” “will,” “might,” “could,” “intend,”

“shall” and variations of these terms or the negative of these

terms and similar expressions are intended to identify these

forward-looking statements. Forward looking statements are subject

to a number of risks and uncertainties, many of which involve

factors or circumstances that are beyond MRAG’s control.

These statements are not guarantees of future

performance and undue reliance should not be placed on them. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause events to differ

materially from any expectations or projections of future

performance or result expressed or implied by such forward looking

statements. These risks include, among other things: (i) market

perception regarding MRAG and the viability of the proposed

transactions; (ii) the availability of financing for the proposed

transaction with Rockwell Medical; and (iii) the recent outbreak of

the novel coronavirus and the global impact it may have on

financial markets and the life sciences sector.

Although forward-looking statements contained in

this presentation are based upon what management of MRAG believes

are reasonable assumptions, there can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. MRAG undertakes no obligation to

update forward-looking statements if circumstances or management’s

estimates or opinions should change except as required by

applicable securities laws. The reader is cautioned not to place

undue reliance on forward-looking statements.

Additional Information and Where to Find It

This communication may be deemed to be

solicitation material in respect of the 2020 Annual Meeting of

Rockwell Medical, Inc. In connection with the 2020 Annual Meeting,

MRAG intends to file relevant materials with the SEC, including a

proxy statement on Schedule 14A. STOCKHOLDERS OF ROCKWELL ARE URGED

TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING MRAG’S

PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED CANDIDATES. Investors and security holders will

be able to obtain the documents free of charge at the SEC’s web

site. Such documents are not currently available.

Participants in Solicitation

For further information please contact Medical

Resource Acquisition Group LLC | https://www.mragworld.com/ or

email connect@mragworld.com

CONTACT:Tien Mac/o Redhill Communications011 49

163 835 8774

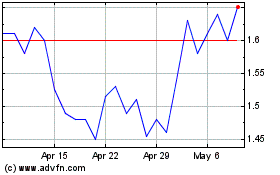

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Apr 2023 to Apr 2024