Rivian Automotive, Inc. Prices $1.3 Billion Green Convertible Senior Notes Offering

March 08 2023 - 2:15AM

Business Wire

Rivian Automotive, Inc. (Nasdaq: RIVN) (“Rivian”) today

announced the pricing of its offering of $1,300,000,000 aggregate

principal amount of 4.625% green convertible senior notes due 2029

(the “notes”) in a private offering to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”). The issuance and sale of the notes

are scheduled to settle on March 10, 2023, subject to customary

closing conditions. Rivian also granted the initial purchasers of

the notes an option to purchase, for settlement within a period of

13 days from, and including, the date the notes are first issued,

up to an additional $200,000,000 principal amount of notes.

The notes will be senior, unsecured obligations of Rivian and

will accrue interest at a rate of 4.625% per annum, payable

semi-annually in arrears on March 15 and September 15 of each year,

beginning on September 15, 2023. The notes will mature on March 15,

2029, unless earlier repurchased, redeemed or converted. Before

December 15, 2028, noteholders will have the right to convert their

notes only upon the occurrence of certain events. From and after

December 15, 2028, noteholders may convert their notes at any time

at their election until the close of business on the second

scheduled trading day immediately before the maturity date. Rivian

will settle conversions by paying or delivering, as applicable,

cash, shares of its Class A common stock (the “common stock”) or a

combination of cash and shares of its common stock, at Rivian’s

election. The initial conversion rate is 49.6771 shares of common

stock per $1,000 principal amount of notes, which represents an

initial conversion price of approximately $20.13 per share of

common stock. The initial conversion price represents a premium of

approximately 37.5% over the last reported sale price of $14.64 per

share of Rivian’s common stock on March 7, 2023. The conversion

rate and conversion price will be subject to adjustment upon the

occurrence of certain events.

The notes will be redeemable, in whole or in part (subject to

certain limitations), for cash at Rivian’s option at any time, and

from time to time, on or after March 20, 2026 and on or before the

20th scheduled trading day immediately before the maturity date,

but only if the last reported sale price per share of Rivian’s

common stock exceeds 130% of the conversion price for a specified

period of time. The redemption price will be equal to the principal

amount of the notes to be redeemed, plus accrued and unpaid

interest, if any, to, but excluding, the redemption date.

If a “fundamental change” (as defined in the indenture that will

govern the notes) occurs, then, subject to limited exceptions,

noteholders may require Rivian to repurchase their notes for cash.

The repurchase price will be equal to the principal amount of the

notes to be repurchased, plus accrued and unpaid interest, if any,

to, but excluding, the applicable repurchase date.

Rivian estimates that the net proceeds from the offering will be

approximately $1,286.1 million (or approximately $1,484.1 million

if the initial purchasers fully exercise their option to purchase

additional notes), after deducting the initial purchasers’

discounts and commissions and estimated offering expenses. Rivian

intends to allocate an amount equal to the net proceeds from the

offering to finance, refinance, or make direct investments in, in

whole or in part, one or more new or recently completed (within the

24 months prior to the issue date of the notes), current and/or

future eligible green projects, as described in Rivian’s newly

established green financing framework. Eligible green projects are

projects that meet specified eligibility criteria, in alignment

with the guidelines of the Green Bond Principles, 2021, and include

expenditures relating to, investments in, financings of and/or

acquisitions of one or more of the following: (i) clean

transportation, (ii) renewable energy, (iii) circular economy, (iv)

energy efficiency and (v) pollution prevention and control. Pending

allocation of an amount equal to the net proceeds from the offering

to eligible green projects, Rivian may temporarily invest the net

proceeds from the offering in cash, cash equivalents, and/or

high-quality marketable securities, and will not knowingly invest

in operations that result in an overall net increase in greenhouse

gas emissions.

The offer and sale of the notes and any shares of common stock

issuable upon conversion of the notes have not been, and will not

be, registered under the Securities Act or any other securities

laws, and the notes and any such shares cannot be offered or sold

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

any other applicable securities laws. This press release does not

constitute an offer to sell, or the solicitation of an offer to

buy, the notes or any shares of common stock issuable upon

conversion of the notes, nor will there be any sale of the notes or

any such shares, in any state or other jurisdiction in which such

offer, sale or solicitation would be unlawful.

About Rivian

Rivian exists to create products and services that help our

planet transition to carbon neutral energy and transportation.

Rivian designs, develops, and manufactures category-defining

electric vehicles and accessories and sells them directly to

customers in the consumer and commercial markets. Rivian

complements its vehicles with a full suite of proprietary,

value-added services that address the entire lifecycle of the

vehicle and deepen its customer relationships.

Forward-Looking Statements

This press release includes forward-looking statements,

including statements regarding the completion of the offering and

the expected amount and intended use of the net proceeds.

Forward-looking statements represent Rivian’s current expectations

regarding future events and are subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those implied by the forward-looking statements.

Among those risks and uncertainties are market conditions, the

satisfaction of the closing conditions related to the offering and

risks relating to Rivian’s business, including those described in

periodic reports that Rivian files from time to time with the

Securities and Exchange Commission. Rivian may not consummate the

offering described in this press release and, if the offering is

consummated, cannot provide any assurances regarding its ability to

effectively apply the net proceeds as described above. The

forward-looking statements included in this press release speak

only as of the date of this press release, and Rivian does not

undertake to update the statements included in this press release

for subsequent developments, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230307006098/en/

Investor Contact ir@rivian.com

Media Contact Harry Porter media@rivian.com

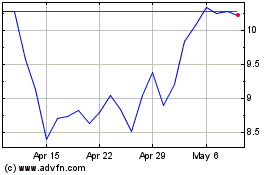

Rivian Automotive (NASDAQ:RIVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

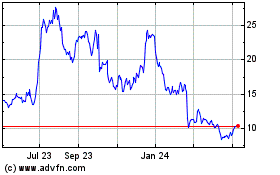

Rivian Automotive (NASDAQ:RIVN)

Historical Stock Chart

From Apr 2023 to Apr 2024