Registration

No. 333-_______________

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Riot

Blockchain, Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction

of incorporation number)

|

84-1553387

(I.R.S. Employer

Identification No.)

|

Riot

Blockchain, Inc.

202

6th Street, Suite 401

Castle

Rock, CO 80104

(Address of principal executive offices) (Zip Code)

The

Riot Blockchain, Inc. 2019 Equity Incentive Plan

(Full

title of the plan)

Jeffrey

G. McGonegal

Chief

Executive Officer

202

6th Street, Suite 401

Castle

Rock, CO 80104

(Name and address

of agent for service)

(303)

794-2000

(Telephone number,

including area code, of agent for service)

With

copies to:

|

William

R. Jackman, Esq.

Rogers

Towers, P.A.

1500

Riverplace Blvd., Suite 1500

Jacksonville,

FL 32207

(904)

398-3911

|

Benjamin

W. Kennedy

Dickinson

Wright PLLC

100

W. Liberty St., Suite 940

Reno,

NV 89501

(775)

343-7504

|

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated

filer [_]

|

|

Accelerated filer [X]

|

|

Non-accelerated filer [_]

|

|

Smaller reporting company [X]

|

|

|

|

Emerging Growth Company [_]

|

|

|

|

(Do not check if a smaller reporting company)

|

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [_]

CALCULATION

OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to be registered(1) (2)

|

|

Proposed maximum offering price per share(3)

|

|

Proposed maximum aggregate offering price(3)

|

|

Amount of Registration Fee(4)

|

|

Common Stock,

no par value

|

|

3,930,603 shares

|

|

$

|

1.33

|

|

|

$

|

5,227,701.99

|

|

|

$

|

678.56

|

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”),

this registration statement also covers an indeterminate amount of interests to be offered

or sold in connection with any stock split, stock dividend or similar transaction, or

anti-dilution or other adjustment pursuant to the employee benefit plan described herein.

|

|

|

(2)

|

Includes

330,603 shares available for issuance under the Registrant’s former employee equity

incentive plan, the Bioptix, Inc. 2017 Stock Incentive Plan, which are available for

issuance under the 2019 Plan, of which 120,500 shares are being offered for resale by

the Selling Stockholders listed in Part II, below.

|

|

|

(3)

|

In

accordance with Rule 457(n) under the Securities Act, the maximum offering price per

share and the proposed maximum aggregate offering price are estimated based on the average

of the $1.36 (high) and $1.30 (low) sale price of the Registrant’s Common Stock,

no par value, as reported on the Nasdaq Capital Market on December 2, 2019, which date

is within five business days prior to filing this Registration Statement.

|

|

|

(4)

|

Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(h)

under the Securities Act based on the average of the high and low trading prices of a

share of common stock of the registrant on the Nasdaq Capital Market on December 2, 2019.

|

EXPLANATORY

NOTE

This

registration statement on Form S-8 (this “Registration Statement”) registers shares of common stock, no par value,

(the “Shares”) of Riot Blockchain, Inc. (“Riot,” the “Registrant,” the “Company,”

“we,” “us” or “our”) including:

|

|

(i)

|

3,600,000

Shares that may be granted pursuant to the 2019 Riot Blockchain, Inc. Equity Incentive

Plan (the “2019 Plan”); and

|

|

|

(ii)

|

330,603

Shares (the “Carryover Shares”), formerly available for grant pursuant the

Registrant’s former employee equity incentive plan, the Bioptix, Inc. 2017 Equity

Incentive Plan (the “2017 Plan”), which, by the terms of the 2019 Plan, are

available for issuance under the 2019 Plan. These Carryover Shares include:

|

|

|

a.

|

120,500

Shares held by “affiliates,” which are “control securities,”

issued to the Selling Stockholders listed below pursuant to the 2017 Plan, which are

being registered for resale to the public by the “Selling Stockholders” listed

herein pursuant to this Registration Statement and the accompanying reoffer prospectus

(discussed below); and

|

|

|

b.

|

210,103

Shares issuable in settlement of outstanding restricted stock units and other convertible

rights granted to employees, officers, and directors of the Registrant pursuant to the

2017 Plan to be offered by the Selling Stockholders listed in the reoffer prospectus

below. Under the 2019 Plan, a total of 3,600,000 Shares have been reserved for issuance

upon the settlement of vested stock awards (which may include awards of restricted stock,

restricted stock units, options, or other securities relating to Shares) made to officers,

directors, employees and consultants of the Company, as well as those Shares formerly

available for issuance pursuant to the 2017 Plan. The 2019 Plan provides that, as of

the date of approval of the 2019 Plan by the Registrant’s stockholders, which occurred

on October 23, 2019, no additional grants will be made under the 2017 Plan.

|

This

Registration Statement also includes a reoffer prospectus (the “Reoffer Prospectus”) prepared in accordance with General

Instruction C of Form S-8 and in accordance with the requirements of Part I of Form S-3. The Reoffer Prospectus may be used in

connection with the reoffer and resale of our securities registered hereunder by the Selling Stockholders identified in the Reoffer

Prospectus (the “Selling Stockholders”), some of whom may be considered “affiliates” of the Company, as

defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). The number of Shares included

in the Reoffer Prospectus represents the total number of Shares held by the Selling Stockholders, as well as the those that may

be acquired by the Selling Stockholders pursuant to restricted stock unit awards made to the Selling Stockholders by the Registrant,

and does not necessarily represent a present intention to sell any or all such Shares by the Selling Stockholders.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(A) PROSPECTUS

This

Registration Statement relates to two separate prospectuses.

Section

10(a) Prospectus: Items 1 and 2, from this page, and the documents incorporated by reference pursuant to Part II, Item 3 of

this prospectus, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Reoffer

Prospectus: The material that follows Item 2, beginning on Page 1 through Page 10, up to but not including Part II of this

Registration Statement, beginning on Page II-1, of which the Reoffer Prospectus is a part, constitutes a “Reoffer Prospectus,”

prepared in accordance with the requirements of Part I of Form S-3 under the Securities Act. Pursuant to General Instruction C

of Form S-8, the Reoffer Prospectus may be used for reoffers or resales of Shares which are deemed to be “control securities”

or “restricted securities” under the Securities Act that have been acquired by the Selling Stockholders named in the

Reoffer Prospectus.

|

|

Item 1.

|

Plan

Information.

|

The Company

will provide each recipient (the “Recipients”) of a grant under the 2019 Plan with documents that contain information

related to the 2019 Plan, and other information including, but not limited to, the disclosure required by Item 1 of Form S-8,

which information is not required to be and is not being filed as a part of this Registration Statement or as prospectuses or

prospectus supplements pursuant to Rule 424 under the Securities Act. The foregoing information and the documents incorporated

by reference in response to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets

the requirements of Section 10(a) of the Securities Act. A Section 10(a) prospectus will be given to each Recipient who receives

Shares covered by this Registration Statement, in accordance with Rule 428(b)(1) under the Securities Act.

|

|

Item 2.

|

Registrant

Information and Employee Plan Annual Information.

|

We will

provide to each Recipient a written statement advising of the availability of documents incorporated by reference in Item 3 of

Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) prospectus) and of

documents required to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written or oral request

by contacting:

Jeffrey

G. McGonegal

Chief Executive Officer

Riot Blockchain, Inc.

202 6th Street, Suite 401

Castle Rock, CO 80104

Telephone: (303) 794-2000

REOFFER

PROSPECTUS

RIOT

BLOCKCHAIN, INC.

202

6th Street, Suite 401

Castle Rock, CO 80104

Telephone: (303) 794-2000

3,930,603 Shares of Common Stock

This

Reoffer Prospectus relates to 3,930,603 shares of our common stock, no par value (the “Shares”), that may be offered

and resold from time to time by the selling stockholders identified in this Reoffer Prospectus (the “Selling Stockholders”)

for their own account. Some of the Selling Stockholders are “affiliates” of the Company, as defined by Rule 405 under

the Securities Act of 1933, as amended (the “Securities Act”).

The Selling

Stockholders were issued grants of stock, which they hold of their own account, as well as restricted stock, restricted stock

units, options, and other convertible rights (the “Stock Rights”) which were convertible, upon vesting and settlement

by the Company, into Shares pursuant to the 2017 Plan. The Company will issue Shares of our under the Registration Statement of

which this Reoffer Prospectus forms a part to the Selling Stockholders in settlement of the Stock Rights held by the Selling Stockholders

on a one-for-one basis pursuant to the 2019 Plan and the term of their individual award agreements.

It is

anticipated that the Selling Stockholders will offer the Shares issued to them for sale at prevailing prices on The NASDAQ Capital

Market on the date of sale; however, the Selling Stockholders may also sell the Shares issues to them in various other types of

transactions, such as, for example, sales in negotiated transactions through underwriters. For a description of the various methods

by which the Selling Stockholders may offer and sell their Shares described in this Reoffer Prospectus, see the section entitled

“Plan of Distribution” of this Reoffer Prospectus. We will receive no part of the proceeds from sales made under this

Reoffer Prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses incurred

by us in connection with the registration and offering will be borne by us and will not borne by the Selling Stockholders.

Some

of the Shares issued pursuant to the 2019 Plan in settlement of awards granted to the Selling Stockholders will be “control

securities” under the Securities Act before their sale under this Reoffer Prospectus. This Reoffer Prospectus has been prepared

for the purposes of registering the Shares (including the Shares issuable upon settlement of the Stock Rights) under the Securities

Act to allow for future sales by the Selling Stockholders on a continuous or delayed basis to the public without restriction.

The Selling

Stockholders and any brokers executing selling orders on their behalf may be deemed to be “underwriters” within the

meaning of the Securities Act, in which event commissions received by such brokers may be deemed to be underwriting commissions

under the Securities Act.

Our common

stock is traded on The NASDAQ Capital Market under the symbol “RIOT”. On December 3, 2019, the closing price of our

common stock on such market was $1.32 per share.

Our

business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you

should read and carefully consider risks described in the “Risk Factors” section beginning on page 3 of this Reoffer

Prospectus, as well as those disclosed in our most recent annual report on Form 10-K, as amended.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this Reoffer Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date

of this Reoffer Prospectus is December 4, 2019.

TABLE

OF CONTENTS

|

PROSPECTUS SUMMARY

|

1

|

|

ABOUT RIOT BLOCKCHAIN

|

1

|

|

THE OFFERING

|

3

|

|

RISK FACTORS

|

3

|

|

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

|

3

|

|

USE OF PROCEEDS

|

5

|

|

DETERMINATION OF OFFERING

PRICE

|

5

|

|

SELLING STOCKHOLDERS

|

5

|

|

PLAN OF DISTRIBUTION

|

7

|

|

LEGAL MATTERS

|

9

|

|

EXPERTS

|

9

|

|

INTERESTS OF NAMED EXPERTS

AND COUNSEL

|

9

|

|

INCORPORATION OF CERTAIN

DOCUMENTS BY REFERENCE

|

9

|

|

DISCLOSURE OF COMMISSION

POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

10

|

|

WHERE YOU CAN FIND MORE

INFORMATION

|

10

|

You

should rely only on the information contained in this Reoffer Prospectus. We have not authorized any other person to provide you

with information that is different from that contained in this Reoffer Prospectus. If anyone provides you with different or inconsistent

information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of,

any other information that others may give you. You should assume that the information contained in this Reoffer Prospectus is

accurate only as of the date of this Reoffer Prospectus, regardless of the time of delivery of this Reoffer Prospectus or of any

sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not making an offer of any securities PURSUANT TO THIS PROSPECTUS. The Selling Stockholders are offering to sell and seeking

offers to buy these securities only in jurisdictions where offers and sales are permitted.

PROSPECTUS

SUMMARY

The following

summary highlights selected information contained in this Reoffer Prospectus. This summary does not contain all the information

you should consider before investing in the securities. Before making an investment decision, you should read the entire Reoffer

Prospectus carefully, including the section entitled “Risk Factors” before deciding to invest in our common stock.

In this Reoffer Prospectus, unless otherwise noted, “Riot,” “Company,” “we,” “us,”

and “our” refer to Riot Blockchain, Inc.

ABOUT

RIOT BLOCKCHAIN

Company

Background

The

Company was incorporated on July 24, 2000 in the State of Colorado under the name AspenBio, Inc., which was subsequently changed

to AspenBio Pharma, Inc. In December 2012, we changed our name to Venaxis, Inc. and in 2016, in connection with our acquisition

of BiOptix Diagnostics, Inc., we changed our name to Bioptix, Inc. and, as of October 19, 2017, we changed our name to Riot Blockchain,

Inc., to reflect our new focus on our blockchain business. That operational focus and the Company’s acquisitions of Kairos

Global Technologies, Inc. (“Kairos”) and TessPay, Inc., formerly known as 1172767 B.C. Ltd., and its investments in

Coinsquare, Ltd., formerly known as goNumerical Ltd., and Verady, LLC, as well as the Company’s new name, reflects a strategic

decision by the Company to operate in the blockchain and digital currency related business sector. As of the date of this filing,

the Company’s ownership of TessPay, Inc., has been reduced below 10%. On March 26, 2018, the Company also acquired 92.5%

of Logical Brokerage Corp. (“Logical Brokerage”). Logical Brokerage is a futures introducing broker headquartered

in Ft. Lauderdale, Florida registered with the Commodity Futures Trading Commission, and a member of the National Futures Association.

In

October 2017, we changed our state of incorporation to Nevada from Colorado. Our principal executive offices are located at 202

6th Street, Suite 401, Castle Rock, CO 80104 and our telephone number is (303) 794-2000. Our website address is www.riotblockchain.com.

The information contained on, or accessible through, our website is not part of this Reoffer Prospectus.

Digital

Currency Mining Operations

Overview

of Mining Operations

The Company’s

mining operations focus primarily on bitcoin mining. Bitcoin mining entails solving complex mathematical problems using custom

designed and programmed application-specific integrated circuit computers (referred to as “miners”). Bitcoin miners

provide transaction verification services to a given blockchain by solving complex algorithms to encode additional blocks into

the blockchain, which blocks serve as immutable records of transactions once added to the blockchain. When a miner is successful

in adding a block to the blockchain, it is rewarded with a fixed number of bitcoin. Blocks are added to the blockchain on a first-to-finish

basis, meaning that the first miner to solve an algorithm and verify a given transaction is the only miner to receive a bitcoin

reward. This first-to-finish environment has created a computing power arms race whereby miners are encouraged through competition

to allocate ever-increasing computing power (known as “hash rate”) to solving algorithms. The resulting energy costs

are substantial, and, in light of the recent decline in the market price of bitcoin and other “benchmark” digital

currencies such as bitcoin cash, litecoin, and ethereum, the profitability of mining operations has been reduced as competition

increases to solve each block.

In response

to these factors, the Company has entered into mining pools, whereby multiple miners allocate their collective computing powers

to solving a given algorithm thereby increasing the collective hash rate devoted to a given algorithm. By pooling their efforts,

miners in a pool are more likely to verify a given transaction and add a block to the Blockchain than miners acting individually.

Pool miners are awarded a fractional reward based on the hash rate each contributed to the pool on a given successful transaction,

regardless of whether the individual miner actually solved the applicable algorithm. Miners are allocated a share of every reward

obtained by the pool operator, and thus the risk of not solving the algorithm first is reduced. The Company participates in pools

on an at-will basis, and is under no obligation to remain in a given pool and may terminate its engagement with a given pool at

any time. Presently, management believes participating in mining pools is the most efficient means of mining digital currencies,

but is under no obligation, nor does it provide any assurance that it will continue to do so in the future.

Oklahoma

City Mining Facility

Beginning

in February of 2018, we relocated our mining operations to our Oklahoma City facility, which is leased by our subsidiary, Kairos.

As of the date of this Reoffer Prospectus, our approximate 8,000 digital currency “miners,” which includes 7,500 model

S9 and 500 model L3+ miners operate in our Oklahoma City facility. These miners have been installed and operational since being

deployed in early 2018. In December of 2019, the Company purchased 3,000 Antminer S17 Pro digital currency miners from Bitmaintech

PTE, LTD. (“Bitmain”), which offer substantially improved power usage efficiency in the production of bitcoin

over previous models. The Company expects to begin installation of the new Antminer S17 Pro digital currency miners as soon as

they are delivered to the Oklahoma City facility by Bitmain.

Development

of a U.S.-based Digital Currency Exchange

The Company

has been investigating and pursuing the regulatory pathway for the launch of a digital currency exchange in the United States

since the beginning of 2018. The Company’s planned digital currency exchange under the name “RiotX” is being

developed by and is contemplated to be operated through the Company’s subsidiary, RiotX Holdings, Inc.

THE

OFFERING

|

Shares of common stock outstanding prior to this offering

|

|

|

24,802,116

|

(1)

|

|

|

|

|

|

|

|

Shares being offered by the Selling Stockholders

|

|

|

120,500

|

(2)

|

|

|

|

|

|

|

|

Shares of common stock to be outstanding after the offering

|

|

|

24,922,616

|

(1)(2)

|

|

|

|

|

|

|

(1) As

of December 4, 2019.

(2) Assumes

the settlement of all restricted stock unit grants and options awarded to the Selling Stockholders in shares of our common stock

on a one for one basis and the subsequent sale by the Selling Stockholders of all of the shares of our common stock issued to

them by the Company and registered for resale to the public under the Registration Statement accompanying this Reoffer Prospectus.

|

Use

of proceeds

|

We

will not receive any proceeds from the sale of the shares of common stock offered in this Reoffer Prospectus.

|

|

Risk

Factors

|

The

purchase of our common stock involves a high degree of risk. You should carefully review and consider “Risk Factors”

beginning on page 3 of this Reoffer Prospectus.

|

|

NASDAQ

Symbol

|

RIOT

|

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks,

uncertainties and other factors described under “Risk Factors” in our most recent Annual Report on Form 10-K for the

year ended December 31, 2018, filed with the Securities and Exchange Commission (the “SEC”) on April 2, 2019, as amended

on Form 10-K/A, filed with the SEC on April 23, 2019, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q,

together with the financial or other information contained or incorporated by reference in such reports, and Current Reports on

Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this Reoffer Prospectus.

Our business,

affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected

by these risks. For more information about our SEC filings, please see the section entitled “Where You Can Find More Information”

on page 10 of this Reoffer Prospectus.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this Reoffer Prospectus may be forward-looking statements within the meaning of Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and are subject to the safe harbor created thereby. All statements other

than statements of historical fact are statements that could be deemed forward-looking statements. These statements relate to

future events or the Company’s future performance and include statements regarding expectations, beliefs, plans, intentions

and strategies of the Company. In some cases, forward-looking statements can be identified by terminology such as “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,”

“anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential”

or other comparable terminology. These forward-looking statements are made based on management’s expectations and beliefs

concerning future events affecting the Company as of the date of the filing of this Reoffer Prospectus and are subject to uncertainties

and factors relating to operations and the business environment, all of which are difficult to predict and many of which are beyond

management’s control. Accordingly, you should not place undue reliance on these forward-looking statements, as actual results,

performance and achievements could differ materially from those expressed in, or implied by, these forward-looking statements

due to a variety of risks, uncertainties and other factors, including, but not limited to, the following:

|

|

•

|

our

history of operating losses and our ability to achieve or sustain profitability;

|

|

|

•

|

our

recent shift to an entirely new business and our ability to succeed in this new business;

|

|

|

•

|

our

ability to raise additional capital needed to finance our business;

|

|

|

•

|

general

economic conditions in the U.S. and globally;

|

|

|

•

|

our

ability to maintain the value and reputation of our brand;

|

|

|

•

|

our

ability to attract and retain senior management and other qualified personnel;

|

|

|

•

|

cryptocurrency-related

risks, including regulatory changes or actions and uncertainty regarding acceptance and/or

widespread use of virtual currency;

|

|

|

•

|

risks

relating to our virtual currency mining operations, including among others, risks associated

with the need for significant electrical power, cybersecurity risks and risk of increased

world-wide competition for a fixed number of bitcoin reward levels;

|

|

|

•

|

our

dependence in large part upon the value of virtual currencies, especially bitcoin, which

have historically been subject to significant volatility in their market prices;

|

|

|

•

|

risks

relating to our planned establishment of a virtual currency exchange, including, among

others, regulatory requirements and challenges and security threats;

|

|

|

•

|

our

ability to protect our intellectual property rights;

|

|

|

•

|

volatility

in the trading price of our common stock;

|

|

|

•

|

our

ability to maintain the Nasdaq listing of our common stock;

|

|

|

•

|

our

investments in other virtual currency and blockchain focused companies may not be realizable;

|

|

|

•

|

legal

proceedings to which we are subject, or associated with, including actions by private

plaintiffs and the SEC, for which we may face significant potential liability that may

not be adequately covered by insurance or indemnity; and

|

|

|

•

|

the

risks and, uncertainties discussed in Part II. Item 1A. “Risk Factors” included

in this Reoffer Prospectus and Part I, Item 1A. “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on April

2, 2019, as amended on Form 10-K/A, filed with the SEC on April 23, 2019, as supplemented

and updated by subsequent Quarterly Reports on Form 10-Q together with the financial

or other information contained or incorporated by reference in such reports, and Current

Reports on Form 8-K that we have filed or will file with the SEC, which are incorporated

by reference into this Reoffer Prospectus.

|

Accordingly,

you should read this Reoffer Prospectus completely and with the understanding that our actual future results may be materially

different from what we expect. Additional risks and uncertainties not known to us or that we currently believe not to be material

may adversely impact our business, financial condition, results of operations and cash flows. Should any risks or uncertainties

develop into actual events, these developments could have a material adverse effect on our business, financial condition, results

of operations and cash flows. The forward-looking statements contained in this Reoffer Prospectus speak only as of the date of

filing of this Reoffer Prospectus and, unless otherwise required by applicable securities laws, the Company disclaims any intention

or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

USE

OF PROCEEDS

The Shares

offered by the Selling Stockholders pursuant to this Reoffer Prospectus are being registered for the account of the Selling Stockholders

named in this Reoffer Prospectus. As a result, all proceeds from the sales of the Shares will go to the Selling Stockholders and

we will not receive any proceeds from the resale of the Shares by the Selling Stockholders.

DETERMINATION

OF OFFERING PRICE

The Selling

Stockholders may sell their Shares pursuant to this Reoffer Prospectus from time-to-time at prices and at terms according to the

then prevailing market price for shares of our Shares, or in negotiated transactions.

SELLING

STOCKHOLDERS

The table

below sets forth, as of December 4, 2019, (i) the number of Shares held of record or beneficially owned by the Selling Stockholders

as of such date (as determined below) and (ii) the number of Shares that may be sold or otherwise disposed of under this Reoffer

Prospectus by each Selling Stockholder (including those Shares which may be issued in settlement of those Stock Rights held by

the Selling Stockholders). Beneficial ownership includes Shares plus any securities held by the holder exercisable for or convertible

into Shares within sixty (60) days after December 4, 2019, in accordance with Rule 13d-3(d)(1) under the Exchange Act. The inclusion

of any Shares in this table does not constitute an admission of beneficial ownership by the Selling Stockholders named below.

We do not know when or in what amounts a Selling Stockholder may sell or otherwise dispose of the Shares covered hereby. The Selling

Stockholders identified below may have sold, transferred or otherwise disposed of some or all of their Shares in transactions

exempt from or not subject to the registration requirements of the Securities Act since the date on which the information in the

following table was provided to us. Information concerning the Selling Stockholders may change from time to time and, we will,

as appropriate, supplement this Reoffer Prospectus in order to reflect grants under the 2019 Plan and/or to update the list of

Selling Stockholders and the number of Shares being offered. The Selling Stockholders may not sell or otherwise dispose of any

or all of the Shares offered pursuant to this Reoffer Prospectus and they may sell or otherwise dispose of shares covered hereby

in transactions exempt from the registration requirements of the Securities Act. Because the Selling Stockholders may sell or

otherwise dispose of some, all or none of the Shares covered hereby, and because there are currently no agreements, arrangements

or understandings with respect to the sale of any of the Shares, we cannot estimate the number of the Shares that will be held

by the Selling Stockholders after completion of the offering contemplated by this Reoffer Prospectus. However, for purposes of

the following table, we have assumed that all of the Shares covered hereby are sold by the Selling Stockholders pursuant to this

Reoffer Prospectus. We will not receive any proceeds from the resale of the Shares by the Selling Stockholders.

All Selling

Stockholders named are current officers or directors of the Company. All of the Selling Stockholders received their Shares being

offered pursuant to this Reoffer Prospectus in return for services rendered to the Company. Unless otherwise indicated below,

to our knowledge, all persons named in the table have sole voting and investment power with respect to their Shares, except to

the extent authority is shared by their spouses under applicable law. Unless otherwise indicated below, to our knowledge, no persons

named in the table are a broker-dealer or affiliate of a broker-dealer. Unless otherwise indicated, each Selling Shareholder’s

mailing address is: c/o Riot Blockchain, Inc., 202 6th Street, Suite 401, Castle Rock, CO 80104.

|

Name

|

Number of Shares

Beneficially Owned Prior to Offering

|

Percentage of Common Stock

Beneficially Owned Before Resale(1)**

|

Shares Offered in this Offering(2)(3)

|

Number of Shares Beneficially

Owned After this Offering(1)

|

Percentage of Shares

Beneficially

Owned After this Offering**

|

|

Remo Mancini

|

76,500

|

*

|

76,500

|

-

|

*

|

|

Jason Les

|

42,000

|

*

|

27,000

|

15,000

|

*

|

|

Benjamin Yi

|

-

|

*

|

-

|

-

|

*

|

|

Jeffrey G. McGonegal

|

38,701

|

*

|

17,000

|

21,701

|

*

|

|

Total

|

|

|

120,500

|

|

|

|

|

|

|

|

|

|

*Less

than 1%

** Based

upon 24,802,116 shares of Shares issued and outstanding as of December 4, 2019.

(1) Beneficial

ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect

to securities. Shares of Common Stock underlying options currently exercisable, or exercisable, or restricted stock units that

vest, within 60 days after December 4, 2019, (as used in this section, the “Determination Date”), are deemed outstanding

for purposes of computing the beneficial ownership of the person holding such options and/or restricted stock units but are not

deemed outstanding for computing the beneficial ownership of any other person. Except where we had knowledge of such ownership,

the number presented in this column may not include shares held in street name or through other entities over which the selling

stockholder has voting and dispositive power.

(2) Assumes

the exercise and sale of all Shares issues in the settlement of all Stock Rights held by the Selling Stockholders.

(3) Includes

(i) 108,187 Shares issuable in settlement of 108,187 vested restricted stock units held by the Selling Stockholders, (ii) 12,000

Shares issuable upon the exercise of 12,000 vested stock options, and (iii) 313 Shares issuable in settlement of 313 restricted

stock units which vest within sixty (60) days of the filing of this Reoffer Prospectus, which vest in December 2019.

PLAN

OF DISTRIBUTION

Timing of Sales

The Selling

Stockholders may offer and sell the Shares covered by this Reoffer Prospectus at various times while the Registration Statement

to which this Reoffer Prospectus relates remain effective. The Selling Stockholders will act independently of the Company with

respect to the timing, manner and size of each sale.

No Known Agreements to

Resell the Shares

To our

knowledge, no Selling Stockholder has any agreement or understanding, directly or indirectly, with any person to resell the Shares

covered by this Reoffer Prospectus.

Offering Price

The sales

price offered by the Selling Stockholders to the public may be:

1. the

market price prevailing at the time of sale;

2. a

price related to such prevailing market price;

3. a

price negotiated by such Selling Stockholder in a negotiated sale; or

4. such

other price as the Selling Stockholders determine from time to time.

Manner of Sale

The Shares

may be sold by whatever permissible means selected by the Selling Stockholders, including by one or more of the following methods:

|

|

1.

|

a

block trade in which the broker-dealer so engaged will attempt to sell the Shares as

agent, but may position and resell a portion of the block as principal to facilitate

the transaction;

|

|

|

2.

|

Purchases

by a broker-dealer as principal and resale by that broker-dealer for its account pursuant

to this Reoffer Prospectus;

|

|

|

3.

|

ordinary

brokerage transactions in which the broker solicits purchasers;

|

|

|

4.

|

directly

to purchasers at prevailing market prices or in negotiated sales;

|

|

|

5.

|

through options, swaps or derivatives;

|

|

|

6.

|

in

transactions to cover short sales;

|

|

|

7.

|

privately negotiated transactions; or

|

|

|

8.

|

on

a combination of any of the above methods.

|

The Selling

Stockholders may sell their Shares directly to purchasers or they may use brokers, dealers, underwriters or agents to sell their

Shares. Brokers or dealers engaged by the Selling Stockholders may arrange for other brokers or dealers to participate in such

sales. Brokers or dealers may receive commissions, discounts or concessions from the Selling Stockholders, or, if any such broker-dealer

acts as agent for the purchaser of the Shares, from the purchaser in amounts to be negotiated immediately prior to the sale. The

compensation received by brokers or dealers may, but is not expected to, exceed that which is customary for the types of transactions

involved. The Company will bear none of the costs associated with such broker-dealer relationships on behalf of the Selling Stockholders,

except with regard to those costs we may incur from time to time to update this Reoffer Prospectus, if required.

Broker-dealers

may agree with a Selling Stockholder to sell a specified number of their Shares at a stipulated price per Share, and, to the extent

the broker-dealer is unable to do so acting as agent for a Selling Stockholder, to purchase as principal any unsold Shares at

the price required to fulfill the broker-dealer commitment to the Selling Stockholder.

Broker-dealers

who acquire stock as principal may thereafter resell the Shares they acquire from time to time in transactions, which may involve

block transactions and sales to and through other broker-dealers, including transactions of the nature described above, on The

NASDAQ Capital Market or otherwise at prices and on terms then prevailing at the time of sale, at prices related to the then-current

market price or in negotiated transactions. In connection with resales of the Shares, broker-dealers may pay to or receive from

the purchasers of Shares commissions as described above. If our Selling Stockholders enter into such arrangements with brokers-dealers

as described above, we will file a post-effective amendment to this registration statement disclosing such arrangements, including

the names of any broker-dealers acting as underwriters, and will update this Reoffer Prospectus, as required.

The Selling

Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the sale of the Shares may be

deemed to be “underwriters” within the meaning of the Securities Act. In that event, any commissions received by broker-dealers

or agents and any profit on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act.

We will

make copies of this Reoffer Prospectus available to the Selling Stockholders for the purpose of satisfying the Reoffer Prospectus

delivery requirements of the Securities Act and we have notified the Selling Stockholders of the need to deliver a copy of this

Reoffer Prospectus in connection with any sale of the Shares pursuant to this Registration Statement.

Sales Pursuant to Rule

144

Any Shares

covered by this Reoffer Prospectus which qualifies for sale pursuant to Rule 144 under the Securities Act may be sold in compliance

with Rule 144 rather than pursuant to this Reoffer Prospectus.

Regulation M

Each

Selling Stockholder will be subject to the applicable provisions of the Exchange Act and the associated rules and regulations

under the Exchange Act, including Regulation M. The anti-market manipulation rules of Regulation M may limit the timing of purchases

and sales of the Shares by the Selling Stockholders. Regulation M may also restrict the ability of any person engaged in the distribution

of the Shares pursuant to this Reoffer Prospectus to engage in passive market-making activities with respect to such Shares. Passive

market-making involves transactions in which a market maker acts as both the underwriter and as a purchaser of the Shares in the

secondary market. All of the foregoing may limit the marketability of the Shares offered pursuant to this Reoffer Prospectus by

the Selling Stockholders and may also limit the ability of any person to engage in market-making activities with respect to such

Shares.

Accordingly,

during such times as a Selling Stockholder may be deemed to be engaged in a distribution of the Shares, and therefore be considered

to be an underwriter, the Selling Stockholder must comply with applicable law and, among other things:

|

|

1.

|

may

not engage in any stabilization activities in connection with our Securities;

|

2. may

not cover short sales by purchasing Shares while the distribution is taking place; and

|

|

3.

|

may

not bid for or purchase any of our securities or attempt to induce any person to purchase

any of our securities other than as permitted under the Exchange Act.

|

Once

sold under the Registration Statement of which this Reoffer Prospectus forms a part, the Shares will be freely tradable by any

person other than our affiliates (including affiliates of our affiliates).

State Securities Laws

Under

the securities laws of some states, the Shares may be sold in such states only through registered or licensed brokers or dealers.

In addition, in some states the Shares may not be sold unless the Shares have been registered or qualified for sale in the state

or an exemption from registration or qualification is available and is complied with. If a Selling Stockholder intends to offer

our Shares in such a jurisdiction, the Selling Stockholder must do so in compliance with applicable law.

Expenses of Registration

We are

bearing all costs relating to the registration of the Shares. These expenses are estimated to be $10,000 including, but not limited

to, legal, accounting, printing and mailing fees. The Selling Stockholders, however, will pay any commissions or other fees payable

to brokers or dealers in connection with any sale of the Shares.

LEGAL

MATTERS

The validity

of the issuance of the securities offered hereby has been passed upon for us by Dickinson Wright PLLC of Reno, Nevada as stated

in their opinion, which is incorporated by reference herein. Additional legal matters may be passed upon for us or any underwriters,

dealers or agents, by counsel that we will name in the applicable Reoffer Prospectus supplement.

EXPERTS

The audited

financial statements of Riot Blockchain, Inc. and its consolidated subsidiaries, incorporated herein by reference, for the year

ended December 31, 2018, and the related consolidated statements of operations, stockholders’ equity, and cash flows for

the year then ended, and management’s assessment of the effectiveness of internal control over financial reporting as of

December 31, 2018 have been audited by the Company’s independent registered public accounting firm, Marcum, LLP, as stated

in their report, which is incorporated herein by reference. Such financial statements have been incorporated herein by reference

in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

The audited

financial statements of Riot Blockchain, Inc. and its consolidated subsidiaries, incorporated herein by reference, for the year

ended December 31, 2017, and the related consolidated statements of operations, stockholders’ equity, and cash flows for

the year then ended, have been audited by our former independent registered public accounting firm, MNP LLP, for the period and

to the extent set forth in their report. Such financial statements have been so incorporated herein by reference in reliance upon

the report of such firm given upon the firm’s authority as an expert in auditing and accounting.

INTERESTS

OF EXPERTS

No expert

or counsel named in this Reoffer Prospectus as having prepared or certified any part of this Reoffer Prospectus or having given

an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration

or offering of the Shares was employed on a contingency basis or had, or is to receive, in connection with the offering, a substantial

interest, directly or indirectly, in the registrant or any of its parents or subsidiaries.

MATERIAL

CHANGES

There

have been no material changes in our affairs since the end of our last fiscal year on December 31, 2018, other than those changes

that have been described in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K filed with the SEC. See the

section below under the heading, “Where You Can Find More Information.”

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The Securities

and Exchange Commission permits us to “incorporate by reference” the information contained in documents we file with

the Securities and Exchange Commission, which means that we can disclose important information to you by referring you to those

documents rather than by including them in this Reoffer Prospectus. Information that is incorporated by reference herein is considered

to be part of this Reoffer Prospectus and you should read it with the same care that you read this Reoffer Prospectus. Information

that we file later with the Securities and Exchange Commission will automatically update and supersede the information that is

either contained, or incorporated by reference, in this Reoffer Prospectus, and will be considered to be a part of this Reoffer

Prospectus from the date those documents are filed. We have filed with the Securities and Exchange Commission, and incorporate

by reference in this Reoffer Prospectus the following filed with the SEC:

|

|

·

|

Our

Annual Report on Form 10-K for the year ended December 31, 2018, filed on April 2, 2019,

and the amendment thereto on Form 10-K/A, filed on April 23, 2019;

|

|

|

·

|

Our

Quarterly Reports on Form 10-Q for the quarterly periods ended: March 31, 2019, filed

on May 5, 2019; June 30, 2019, filed on August 8, 2019; and September 30, 2019, filed

on November 12, 2019;

|

|

|

·

|

Our

Definitive Proxy Statement on Form DEF-14A, filed on September 20, 2019;

|

|

|

·

|

Our

Current Reports on Form 8-K (excluding any reports or portions thereof that are deemed

to be furnished and not filed) filed on February 1, 2019; February 11, 2019; February

22, 2019; April 4, 2019; May 3, 2019; May 24, 2019; July 25, 2019; August 15, 2019; September

30, 2019; October 28, 2019; and December 4, 2019, as well as amendments thereto on Form 8-K/A filed on

March 20, 2019 and October 28, 2019; and

|

|

|

·

|

The

description of our common stock contained in our registration statement on Form 8-A,

filed pursuant to Section 12(b) of the Exchange Act on August 27, 2007, including any

amendment or report filed for the purpose of updating that description.

|

We

also incorporate by reference all additional documents that we file with the Securities and Exchange Commission under the terms

of Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the date of effectiveness Registration Statement

and after the date of this Reoffer Prospectus but prior to the termination of the offering of the securities covered by this Reoffer

Prospectus. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not

file in accordance with Securities and Exchange Commission rules.

You

may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (303) 794-2000 or by writing

to us at the following address: Riot Blockchain, Inc., Attn: Jeffrey G. McGonegal, CEO, 202 6th Street, Suite 401 Castle

Rock, CO 80104.

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

As permitted

by the Nevada Business Company Act, we have adopted provisions in our restated certificate of incorporation and restated by-laws

that limit or eliminate the personal liability of our directors and certain executive officers and employees of the Company. We

also maintain general liability insurance that covers certain liabilities of our directors and officers arising out of claims

based on acts or omissions in their capacities as directors or officers, including liabilities under the Securities Act. These

limitations of liability do not alter director liability under the federal securities laws and do not affect the availability

of equitable remedies such as an injunction or rescission.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and Riot controlling

persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by us of expenses incurred or paid

by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion

of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may also obtain this information from the SEC at the address

listed above or from the SEC’s internet site, SEC.gov. Please call the SEC at 1-800-SEC-0330 for further information on

the Public Reference Room. Our SEC filings are also available on our website, https://ir.riotblockchain.com/under the heading

“Investors.” The information on this website is expressly not incorporated by reference into, and does not constitute

a part of, this Reoffer Prospectus.

REOFFER

PROSPECTUS

RIOT BLOCKCHAIN, INC.

202 6th

Street, Suite 401

Castle Rock,

Colorado 80104

(303) 794-2000

3,930,603 SHARES

OF COMMON STOCK

December

4, 2019

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION

OF DOCUMENTS BY REFERENCE

The Securities

and Exchange Commission permits us to “incorporate by reference” the information contained in documents we file with

the Securities and Exchange Commission, which means that we can disclose important information to you by referring you to those

documents rather than by including them in this Registration Statement and the accompanying prospectus. Information that is incorporated

by reference herein is considered to be part of this Registration Statement and you should read it with the same care that you

read this Reoffer Prospectus. Information that we file later with the Securities and Exchange Commission will automatically update

and supersede the information that is either contained, or incorporated by reference, in this Registration Statement, and will

be considered to be a part of this Registration Statement from the date those documents are filed. We have filed with the Securities

and Exchange Commission, and incorporate by reference herein the following documents filed with the SEC:

|

|

·

|

Our

Annual Report on Form 10-K for the year ended December 31, 2018 filed on April 2, 2019

and the amendment thereto on Form 10-K/A, filed on April 23, 2019;

|

|

|

·

|

Our

Quarterly Reports on Form 10-Q for the quarterly periods ended: March 31, 2019, filed

on May 5, 2019; June 30, 2019, filed on August 8, 2019; and September 30, 2019, filed

on November 12, 2019;

|

|

|

·

|

Our

Definitive Proxy Statement on Form 14A DEF, filed on September 20, 2019;

|

|

|

·

|

Our

Current Reports on Form 8-K (excluding any reports or portions thereof that are deemed

to be furnished and not filed) filed on February 1, 2019; February 11, 2019; February

22, 2019; April 4, 2019; May 3, 2019; May 24, 2019; July 25, 2019; August 15, 2019; September

30, 2019; October 28, 2019; and December 4, 2019, as well as amendments thereto on Form 8-K/A filed on

March 20, 2019 and October 28, 2019, as well as amendments thereto on Form 8-K/A filed on

March 20, 2019 and October 28, 2019; and

|

|

|

·

|

The

description of our common stock contained in our registration statement on Form 8-A filed

pursuant to Section 12(b) of the Exchange Act on August 27, 2007, including any amendment

or report filed for the purpose of updating that description.

|

We

also incorporate by reference all additional documents that we file with the Securities and Exchange Commission under the terms

of Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the date of effectiveness of this Registration Statement

and after the date of the prospectus accompanying it but prior to the termination of the offering of the securities covered by

such prospectuses. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish

and not file in accordance with Securities and Exchange Commission rules.

You

may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (303) 794-2000 or by writing

to us at the following address: Riot Blockchain, Inc., Attn: Jeffrey McGonegal, CEO, 202 6th Street, Suite 401 Castle

Rock, CO 80104.

ITEM 4. DESCRIPTION OF

SECURITIES

Not applicable.

ITEM 5. INTERESTS OF

NAMED EXPERTS AND COUNSEL

No expert

or counsel named in this Registration Statement as having prepared or certified any part of this Registration Statement or having

given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration

or offering of the Shares was employed on a contingency basis or had, or is to receive, in connection with the offering, a substantial

interest, directly or indirectly, in the registrant or any of its parents or subsidiaries.

ITEM 6. INDEMNIFICATION

OF DIRECTORS AND OFFICERS

Nevada

Revised Statutes Sections 78.7502 and 78.751 provide us with the power to indemnify any of our directors and officers. The director

or officer must have conducted himself/herself in good faith and reasonably believe that his/her conduct was in, or not opposed

to, our best interests. In a criminal action, the director, officer, employee or agent must not have had reasonable cause to believe

his/her conduct was unlawful.

Under

Nevada Revised Statutes Section 78.751, advances for expenses may be made by agreement if the director or officer affirms in writing

that he/she believes he/she has met the standards and will personally repay the expenses if it is determined such officer or director

did not meet the standards.

Our

Articles of Incorporation provide that our officers and directors shall be indemnified and held harmless to the fullest extent

legally permissible under the laws of the State of Nevada against all expenses, liability and loss (including attorneys’

fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by them in connection with

any civil, criminal, administrative or investigative action, suit or proceeding related to their service as an officer or director.

Such right of indemnification shall be a contract right which may be enforced in any manner desired by such person. We must pay

the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred

and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the

director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled

to be indemnified by us. Such right of indemnification shall not be exclusive of any other right which such directors or officers

may have or hereafter acquire.

Our

Articles of Incorporation provide that we may adopt bylaws to provide at all times the fullest indemnification permitted by the

laws of the State of Nevada, and may purchase and maintain insurance on behalf of any of officers and directors. The indemnification

provided in our Articles of Incorporation shall continue as to a person who has ceased to be a director, officer, employee or

agent, and shall inure to the benefit of the heirs, executors and administrators of such person.

Our

Bylaws provide that a director or officer shall have no personal liability to us or our stockholders for damages for breach of

fiduciary duty as a director or officer, except for damages for breach of fiduciary duty resulting from (a) acts or omissions

which involve intentional misconduct, fraud, or a knowing violation of law, or (b) the payment of dividends in violation of Nevada

Revised Statutes Section 78.300.

ITEM 7. EXEMPTION FROM

REGISTRATION CLAIMED

Not applicable.

ITEM 8. EXHIBITS

|

Exhibit

|

|

|

|

Number

|

|

Description of Document

|

|

|

|

|

|

4.1

|

|

Articles of Incorporation

filed September 20, 2017 (Incorporated by reference from the Registrant’s Current Report on Form 8-K, filed September

25, 2017)

|

|

4.2

|

|

Bylaws, effective September

20, 2017 (Incorporated by reference from the Registrant’s Current Report on Form 8-K, filed September 25, 2017)

|

|

4.3

|

|

Amendment to Bylaws (incorporated

by reference to 8-K filed March 12, 2018)

|

|

4.4

|

|

Form of Certificate of Designation

|

|

4.5

|

|

The Riot Blockchain, Inc. 2019 Equity Incentive Plan, as approved by the Registrant’s stockholders on October 23, 2019, as reported on the Registrant’s current report on Form 8-K filed October 28, 2019, as amended.

|

|

5.1

|

|

Opinion of Dickinson Wright, PLLC

|

|

23.1

|

|

Consent of Marcum LLP

|

|

23.2

|

|

Consent of MNP LLP

|

|

23.3

|

|

Consent of Dickinson Wright, PLLC (contained in Exhibit 5.1)

|

|

24.1

|

|

Power of Attorney (included on the signature

page of this registration statement).

|

ITEM 9. UNDERTAIKNGS

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”);

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high

end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

provided,

however, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form

S-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed

with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as

of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of

the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of

securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

or

(5)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if

the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant

will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant

to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred

to by the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

registrant’s annual report pursuant to section 13(a) or section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and

is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by

the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense

of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

(d)

The registrant hereby undertakes that:

(1)

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed

as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant

pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement

as of the time it was declared effective.

(2)

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized, in the City of Castle Rock, and State of Colorado, on the 4th day of December,

2019.

|

|

Riot Blockchain, Inc.

|

|

|

|

|

|

By:

|

/s/ Jeffrey G. McGonegal

|

|

|

|

Jeffrey G. McGonegal

Chief

Executive Officer and Chief Financial Officer (Principal Executive Officer and Principal Financial and Accounting Officer)

|

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that the registrant and each person whose signature appears below constitutes and appoints Jeffrey

G. McGonegal his, her, or its true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution,

for him, her or it and in his, her or its name, place and stead, in any and all capacities, to sign and file any and all amendments

(including post-effective amendments) to this registration statement on Form S-8, with all exhibits thereto, and other documents

in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each

of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about

the premises, as fully to all intents and purposes as he, she, or it might or could do in person, hereby ratifying and confirming

all that said attorneys-in-fact and agents or any of them, or their or his substitute or substitutes, may lawfully do or cause

to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed below by the following

persons in the capacities and on the date indicated.

|

Name

|

Title

|

Date

|

/s/

Jeffrey G. McGonegal

Jeffrey G. McGonegal

|

Chief

Executive Officer,

(Principal Executive Officer)

|

December

4, 2019

|

/s/

Jeffrey G. McGonegal

Jeffrey G. McGonegal

|

Chief

Financial Officer

(Principal Financial and Accounting Officer)

|

December

4, 2019

|

/s/

Remo Mancini

Remo Mancini

|

Director

and Chairman

|

December

4, 2019

|

/

/s/ Jason Les

Jason Les

|

Director

|

December

4, 2019

|

/s/

Benjamin Yi

Benjamin Yi

|

Director

|

December

4, 2019

|

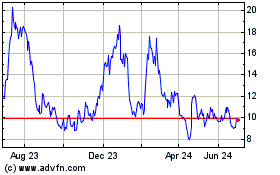

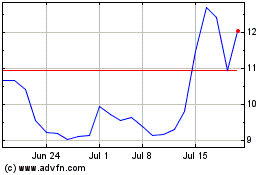

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Apr 2023 to Apr 2024