|

|

Filed

Pursuant to Rule 424(b)(2)

|

|

|

Registration

Statement No. 333-223623

|

PROSPECTUS

SUPPLEMENT DATED JUNE 3, 2019

TO

PROSPECTUS DATED MARCH 13, 2018

RESEARCH

FRONTIERS INCORPORATED

1,276,599

Shares of Common Stock

638,295

Warrants to Purchase Common Stock at $3.384, $3.666 or $4.230 per Share

depending

on the exercise date

Research

Frontiers Incorporated is selling to accredited investors a total of 1,276,599 shares of common stock and warrants expiring May

31, 2024 to purchase 638,295 shares of common stock at an exercise price of $3.384, $3.666 or $4.23 per share depending on the

exercise date. This offering is part of a “shelf” registration statement that we have filed with the Securities and

Exchange Commission which was declared effective by the SEC on April 23, 2018. The shelf registration statement covers the issuance

of up to 6,325,000 shares of common stock, and/or warrants to purchase such common stock. Each time that we sell our securities

under the registration statement, we will issue a prospectus supplement like this one, which includes the terms of the offering

such as the price, terms and amount of securities being sold. We may sell these securities to or through underwriters and also

to other purchasers or through agents. We will set forth the names of any underwriters or agents in the accompanying prospectus

supplement.

Research

Frontiers Incorporated is also selling to Gauzy Ltd. (a licensee of the Company’s SPD technology), at a price of $1.38 per

unit, one share of unregistered common stock and one half of one warrant. The warrant can be converted into one share of unregistered

common stock at an exercise price of $1.656, $1.794 or $2.07 per share depending on the exercise date. Gauzy Ltd. received a

total of 724,638 shares of unregistered common stock and warrants expiring May 31, 2024 to purchase 362,319 shares of common stock.

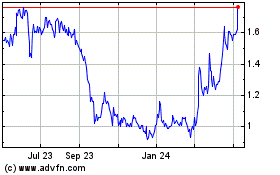

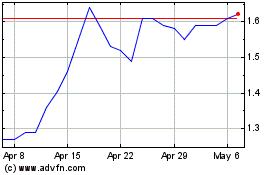

Our common stock is listed on the Nasdaq Capital

Market under the symbol “REFR”. The last reported sale price of our common stock on the Nasdaq Capital Market on May

31, 2019 was $2.93.

Investing in our common stock involves

a high degree of risk. See the “Risk Factors” section in this report for more details.

Neither

the Securities and Exchange Commission nor any State Securities Commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per

Unit (1)

|

|

|

Total

Offering

|

|

|

Public

Offering Price:

|

|

$

|

2.82

|

|

|

$

|

3,600,000

|

|

|

Proceeds,

before expenses, to us:

|

|

$

|

2.82

|

|

|

$

|

3,600,000

|

|

(1)

Each Unit consists of one share and one warrant expiring May 31, 2024 to purchase common stock at an exercise price of $3.384,

$3.666 or $4.23 per share depending on the exercise date.

Delivery

of the shares of common stock and warrants to the purchasers is expected to be made on or about June 3, 2019.

The

date of this prospectus supplement is June 3, 2019.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus dated March 13, 2018 are part of a “shelf” registration

statement that we have filed with the Securities and Exchange Commission, or SEC. Each time we sell securities under the accompanying

base prospectus we will provide a prospectus supplement that will contain specific information about the terms of that offering,

including the price, the amount of common stock being offered and the plan of distribution. The shelf registration statement was

declared effective by the SEC on April 23, 2018. This prospectus supplement describes the specific details regarding this offering,

including the price, the amount of common stock being offered, the risks of investing in our common stock and the plan of distribution.

The accompanying base prospectus provides general information about us, some of which, such as the section entitled “Plan

of Distribution,” may not apply to this offering.

If

information in this prospectus supplement is inconsistent with the accompanying base prospectus or the information incorporated

by reference, you should rely on this prospectus supplement. You should read both this prospectus supplement and the accompanying

base prospectus together with the additional information about Research Frontiers Incorporated to which we refer you in the section

of this prospectus supplement entitled “Available Information.”

SUMMARY

You

should read the entire prospectus, including the section entitled ‘Risk Factors,’ carefully before making an investment

decision.

THE

COMPANY

Research

Frontiers Incorporated (“Research Frontiers” or the “Company”) develops and licenses its suspended particle

technology for controlling the amount of light passing through a device. Such suspended particle devices are often referred to

as “SPDs,” “light valves,” or “SPD-Smart” products.

SPDs

use microscopic light-absorbing particles that are either in a liquid suspension or a film. The microscopic particles align when

an electrical voltage is applied. This permits light to pass through the device and allows the amount of light to be controlled.

Our offices are located at: 240 Crossways Park Drive, Woodbury, NY 11797 (telephone: 516-364-1902).

THE

OFFERING

|

Common

Stock issued by Research Frontiers:

|

|

1,276,599

shares

|

|

Unregistered

Common Stock issued by Research Frontiers to Gauzy Ltd.:

|

|

724,638

shares

|

|

Common

Stock Outstanding after this offering:

|

|

30,991,026

shares

|

|

Warrants

exercisable at $3.384, $3.666 or $4.230 per share (depending on the exercise date):

|

|

620,565

warrants

|

|

Warrants

issued to Gauzy Ltd. exercisable at $1.656, $1.794 or $2.070 per share (depending on the exercise date):

|

|

362,319

warrants

|

|

Use

of Proceeds:

|

|

general

corporate purposes

|

|

Nasdaq

Capital Market Symbol:

|

|

REFR

|

The

number of shares of common stock outstanding after this offering is based upon 28,989,789 shares outstanding as of May 31, 2019.

It includes the 1,276,599 shares being registered hereunder and the 724,638 shares of unregistered common stock being issued

in connection with the offering to Gauzy Ltd. (a licensee of the Company’s SPD technology). It excludes outstanding options

and warrants (not including the warrants issued in this offering as well as the warrants issued with the unregistered shares issued

to Gauzy Ltd. in connection with this offering) to purchase 3,208,433 shares of common stock.

RISK

FACTORS

In

addition to the other information in this prospectus, you should carefully consider the following factors in evaluating us and

our business before purchasing the shares of common stock offered hereby. This prospectus contains, in addition to historical

information, forward-looking statements that involve risks and uncertainties, some of which are beyond our control. Should one

or more of these risks and uncertainties materialize or should underlying assumptions prove incorrect, our actual results could

differ materially. Factors that could cause or contribute to such differences include, but are not limited to, those discussed

below, as well as those discussed elsewhere in this prospectus, including the documents incorporated by reference.

There

are risks associated with investing in companies such as ours who are engaged in research and development. Because of these risks,

you should only invest if you are able to bear the risk of losing your entire investment. Before investing, in addition to risks

which could apply to any issuer or offering, you should also consider the business we are in and the following:

Source

and Need for Capital.

As

of December 31, 2018, we had approximately $3.0 million in cash and cash equivalents. As of March 31, 2019, we had approximately

$3.3 million in cash and cash equivalents.

As

we take steps in the commercialization and marketing of our technology or respond to potential opportunities and/or adverse events,

our working capital needs may change. We anticipate that if our cash and cash equivalents are insufficient to satisfy our liquidity

requirements, we will require additional funding to sustain our ongoing operations and to continue our SPD technology research

and development activities.

We

have funded most of our activities through sales of our common stock to investors, and upon the exercise of options and warrants.

Eventual success of the Company and generation of positive cash flow will be dependent upon the extent of commercialization of

products using the Company’s technology by the Company’s licensees and payments of continuing royalties on account

thereof. We can give no assurances that we will generate sufficient revenues in the future (through sales of our common stock,

exercise of options and warrants, royalty fees, or otherwise) to satisfy our liquidity requirements or sustain future operations,

or that additional funding, if required, will be available when needed or, if available, on favorable terms.

History

of Operating Losses.

We

have experienced net losses from operations, and we may continue to incur net losses from operations in the future. We have incurred

substantial costs and expenses in researching and developing our SPD technology. As of December 31, 2018, we had a cumulative

net loss of $111,690,934 since our inception. Our net loss was $2,686,128 in 2018, $2,413,859 in 2017 and $4,238,410 in 2016,

(which includes non-cash accounting charges in 2018, 2017, and 2016 and of $69,309, $76,299, and $67,531 respectively, resulting

from the expensing of grants of restricted stock and stock options).

We

may not generate sufficient cash flows to cover our operating expenses.

As

noted above, we have incurred recurring losses since inception and expect to continue to incur losses as a result of costs and

expenses related to our research and continued development of our SPD technology and our corporate general and administrative

expenses. Our limited capital resources and operations to date have been substantially funded through sales of our common stock,

exercise of options and warrants and royalty fees collected. As of December 31, 2018, we had working capital of approximately

$3.3 million, cash of approximately $3.0 million, shareholders’ equity of approximately $3.1 million and an accumulated

deficit of approximately $111.7 million. In the event that we are unable to generate sufficient cash from our operating activities

or raise additional funds, we may be required to delay, reduce or severely curtail our operations or otherwise impede our on-going

business efforts, which could have a material adverse effect on our business, operating results, financial condition and long-term

prospects.

We

have never declared a cash dividend and do not intend to declare a cash dividend in the foreseeable future.

We

have never declared or paid cash dividends on our common stock. Payment of dividends on our common stock is within the discretion

of our Board of Directors and will depend upon our future earnings, capital requirements, financial condition and other relevant

factors. We do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future.

We

do not directly manufacture products using SPD technology. We currently depend upon the activities of our licensees and their

customers in order to be profitable.

We

do not directly manufacture products using SPD technology. We currently depend upon the activities of our licensees in order to

be profitable. Although a variety of products have been sold by our licensees, and because it is up to our licensees to decide

when and if they will introduce products using SPD technology, we cannot predict when and if our licensees will generate substantial

sales of such products. Our SPD technology is currently licensed to over 40 companies. Other companies are also evaluating SPD

technology for use in various products. In the past, some companies have evaluated our technology without proceeding further.

While we expect that our licensees would be primarily responsible for manufacturing and marketing SPD-Smart products and components,

we are also engaging in market development activities to support our licensees and build the smart glass industry. We cannot control

whether or not our licensees will develop SPD products. Some of our licensees appear to be more active than others, some appear

to be better capitalized than others, and some licensees appear to be inactive. There is no guarantee when or if our licensees

will successfully produce any commercial product using SPD technology in sufficient quantities to make the Company profitable.

SPD-Smart

products have only recently been introduced.

Products

using SPD technology have only recently begun to be introduced into the marketplace. Developing products using new technologies

can be risky because problems, expenses and delays frequently occur, and costs may or may not come down quickly enough for such

products using new technologies to rapidly penetrate mass market applications.

SPD-Smart

products face intense competition, which could affect our ability to increase our revenues.

The

market for SPD-Smart products is intensely competitive and we expect competition to increase in the future. We compete based on

the functionality and the quality of our product. Many of our current and potential competitors have significantly greater financial,

technical, marketing and other resources than we have. In addition, many of our competitors have well-established relationships

with our current and potential customers and have extensive knowledge of our industry. If our competitors develop new technologies

or new products, improve the functionality or quality of their current products, or reduce their prices, and if we are unable

to respond to such competitive developments quickly either because our research and development efforts do not keep pace with

our competitors or because of our lack of financial resources, we may be unable to compete effectively.

Declining

production of automobiles, airplanes, boats and real estate could harm our business.

Our

licensees’ commercialization efforts of SPD-Smart products could be negatively impacted if the global production of automobiles,

airplanes, boats and real estate construction declines significantly. If such commercialization is reduced, our revenues, results

of operations and financial condition could be negatively impacted.

Limited

source of SPD film.

Our

end-product licensees require a source of SPD film to manufacture finished products. Currently, Hitachi Chemical and Gauzy Ltd.

are the sole source of commercial quantities of SPD-film. There are several other companies that are licensed to manufacture SPD-film,

but they have not begun commercial production of this film. Our end-product licensees’ ability to sell SPD products could

be negatively impacted if there was a prolonged disruption in SPD-film availability. Such a disruption could also negatively impact

our revenues, results of operations and financial condition.

We

are dependent on key personnel.

Our

continued success will depend, to a significant extent, on the services of our directors, executive management team, key personnel

and certain key scientists. If one or more of these individuals were to leave the Company, there is no guarantee that we could

replace them with qualified individuals in a timely or economically satisfactory manner or at all. The loss or unavailability

of any or all of these individuals could harm our ability to execute our business plan, maintain important business relationships

and complete certain product development initiatives, which would have a material adverse effect on our business, results of operations

and financial conditions.

Dependence

on SPD-Smart technology.

Because

SPD technology is the only technology we work with, our success depends upon the viability of SPD technology which has yet to

be fully proven. We have not fully ascertained the performance and long-term reliability of our technology, and therefore there

is no guarantee that our technology will successfully be incorporated into all of the products which we are targeting for use

of SPD technology. We expect that different product applications for SPD technology will have different performance and reliability

specifications. We expect that our licensees will primarily be responsible for reliability testing, but that we may also continue

to do reliability testing so that we can more effectively focus our research and development efforts towards constantly improving

the performance characteristics and reliability of products using SPD technology.

Our

patents and other protective measures may not adequately protect our proprietary intellectual property, and we may be infringing

on the rights of others.

Our

intellectual property, particularly our proprietary rights in our SPD technology, is critical to our success. We have received

various patents, and filed other patent applications, for various applications and aspects of our SPD technology. In addition,

we generally enter into confidentiality and invention agreements with our employees and consultants. Such patents and agreements

and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons

generally applicable to patents and their granting and enforcement. In addition, the costs associated with enforcing patents,

confidentiality and invention agreements or other intellectual property rights may be expensive. Our inability to protect our

proprietary intellectual property rights or gain a competitive advantage from such rights could harm our ability to generate revenues

and, as a result, our business and operations.

An

unremediated material weakness in our internal control over financial reporting could adversely affect our reputation, business

or stock price.

We

previously identified a control deficiency constituting a material weakness in our internal control over financial reporting related

to our controls over the method for accounting for warrants issued in connection with a registered offering of common stock. This

control deficiency did not result in a material adjustment to our financial statements for the period ended September 30, 2018.

Management is in the process of implementing remediation procedures to address the control deficiency that led to the material

weakness. The remediation plan includes, but is not limited to, the implementation of additional review procedures regarding the

method for accounting for warrants issued in connection with a registered offering of common stock. The enhanced review/evaluation

procedures and documentation standards were put in place starting in the fourth quarter of 2018.

We

have broad discretion in the use of the proceeds of this offering.

All

of our net proceeds from this offering will be used, as determined by management in its sole discretion, for working capital and

other general corporate purposes. Our management will have broad discretion over the use and investment of the net proceeds of

this offering and there is no assurance that management’s chosen application of proceeds will yield intended results. You

will not have the opportunity, as part of your investment decision, to assess whether our proceeds are being used appropriately.

Pending application of our proceeds, they might be placed in investments that do not produce income or that lose value.

Future

sales of our securities could cause our stock price to decline.

If

we or our stockholders sell substantial amounts of our common stock in the public market, the market price of our common stock

could decrease. The perception in the public market that we or our stockholders might sell shares of our common stock could also

depress the market price of our common stock. A decline in the price of shares of our common stock might impede our ability to

raise capital through the issuance of additional shares of our common stock or other equity securities.

Our

common stock has historically experienced low trading volume.

Our

common stock is listed on the Nasdaq Capital Market and has historically experienced low trading volume and there is no assurance

that the increased trading volume will continue or be maintained. Reported average daily trading volume in our common stock for

2019 through May 24, 2019 was approximately 149,529 shares. Limited trading volume subjects our common stock to greater price

volatility and may make it difficult for you to sell your shares at a particular price.

Our

ability to use net operating loss carryforwards might be limited.

At

December 31, 2018, the Company had a net operating loss carry-forward for federal income tax purposes of approximately $72,562,000,

of which a total of $70,180,000 will expire in varying amounts from 2019 through 2037. To the extent these net operating loss

carryforwards are available, we intend to use them to reduce any corporate income tax liability associated with our operations

we might have in the future. Section 382 of the Internal Revenue Code generally imposes an annual limitation on the amount of

net operating loss carryforwards that might be used to offset taxable income when a corporation has undergone significant changes

in stock ownership. As a result, prior or future changes in ownership could put limitations on the availability of our net operating

loss carryforwards. In addition, our ability to utilize the current net operating loss carryforwards might be further limited

by the issuance of securities in this offering or future offerings. To the extent our use of our net operating loss carryforwards

or tax losses is limited, our income could be subject to corporate income tax earlier than it would if we were able to use net

operating loss carryforwards, which could result in lower profits.

Our

organizational documents, stockholders’ rights plan and Delaware law make a takeover of our company more difficult, which

may prevent certain changes in control and limit the market price of our common stock.

Our

certificate of incorporation, bylaws, stockholders’ rights plan and Section 203 of the Delaware General Corporation Law

contain provisions that may have the effect of deterring or delaying attempts by our stockholders to remove or replace management,

engage in proxy contests and effect changes in control. These provisions of our certificate of incorporation and bylaws include:

|

|

●

|

the

authority for our board of directors to issue without stockholder approval up to 100,000,000 shares of common stock, that,

if issued, would dilute the ownership of our stockholders;

|

|

|

|

|

|

|

●

|

the

advance notice requirement for director nominations or for proposals that can be acted upon at stockholder meetings;

|

|

|

|

|

|

|

●

|

a

classified board of directors, which may make it more difficult for a person who acquires control of a majority of our outstanding

voting stock to replace all or a majority of our directors;

|

|

|

|

|

|

|

●

|

the

ability of our directors to fill any vacancy on our board of directors by the affirmative vote of a majority of the directors

then in office under certain circumstances;

|

|

|

|

|

|

|

●

|

limitations

on the ability of our stockholders to act by written consent;

|

|

|

|

|

|

|

●

|

limitations

on who may call a special meeting of stockholders;

|

|

|

|

|

|

|

●

|

the

prohibition on stockholders accumulating their votes for the election of directors;

|

|

|

●

|

the

limitation on the removal of any of our directors by either an affirmative vote of the continuing directors (as defined in

our certificate of incorporation) other than the subject director or by the affirmative vote of the holders of 80% of our

outstanding shares of each class of stock having the power to vote in a director election;

|

|

|

|

|

|

|

●

|

the

requirement of the affirmative vote of the holders of at least 80% of our outstanding shares of each class of stock having

the power to vote in a director election in order for stockholders to adopt, amend or repeal any provision of our certificate

of incorporation or bylaws, unless the adoption, amendment or repeal is approved by a majority of the continuing directors

(as defined in our certificate of incorporation) present at a meeting at which a quorum of the continuing directors are present;

and

|

|

|

|

|

|

|

●

|

the

requirement, subject to limited exceptions, of the affirmative vote of the holders of at least 80% of our outstanding shares

of each class of stock having the power to vote in a director election in order for us to complete certain business combination

transactions with interested stockholders.

|

We

also have adopted a stockholders’ rights plan designed to deter stockholders from acquiring shares of stock in excess of

15%. In addition, as a Delaware corporation, we are subject to Delaware law, including Section 203 of the Delaware General Corporation

Law. In general, Section 203 prohibits a Delaware corporation from engaging in any business combination with any interested stockholder

for a period of three years following the date that the stockholder became an interested stockholder unless certain specific requirements

are met as set forth in Section 203.

These

provisions could discourage proxy contests and make it more difficult for you and other stockholders to elect directors, replace

incumbent management and take other corporate actions. Some provisions in our certificate of incorporation and bylaws may deter

third parties from acquiring us, which may limit the market price of our common stock or prevent us from consummating a proposed

transaction that our stockholders find to be in their best interests.

AVAILABLE

INFORMATION

Research

Frontiers files reports, proxy statements and other information with the Securities and Exchange Commission. You may read and

copy such reports, proxy statements and other information at the public reference room maintained by the SEC at 100 F Street,

N.E., Washington, D.C. 20549 and you can obtain information on the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. The SEC also maintains an internet web site at http://www.sec.gov that contains reports, proxy and information

statements and other information regarding issuers, such as Research Frontiers, that file electronically with the SEC. Additional

information about us can also be found at our web site at http://www.SmartGlass.com.

The

SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus,

and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference

into this prospectus our:

|

|

●

|

annual

report on Form 10-K for the fiscal year ended December 31, 2018;

|

|

|

|

|

|

|

●

|

the

portions of the proxy statement dated April 29, 2019 for our annual meeting of stockholders held on June 13, 2019 that have

been incorporated by reference into our report on Form 10-K for the fiscal year ended December 31, 2018;

|

|

|

|

|

|

|

●

|

quarterly

reports on Form 10-Q for the fiscal quarters ended March 31, 2019;

|

|

|

|

|

|

|

●

|

current

reports on Form 8-K filed with the SEC on April 1, 2019, February 4, 2019 and January 11, 2019.

|

|

|

|

|

|

|

●

|

the

description of the capital stock contained in the Research Frontiers registration statements on Form 8-A under the Securities

Exchange Act of 1934 dated July 31, 1995, February 24, 2003 and February 13, 2013.

|

All

filings filed by Research Frontiers with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act subsequent to the

initial filing of this prospectus and prior to the termination of the offering or sale of all of common stock offered under this

prospectus shall be deemed to be incorporated by reference into this prospectus.

This

prospectus is part of a registration statement we filed with the SEC. As permitted by the SEC, this prospectus does not contain

all of the information set forth in the registration statement and the exhibits and schedules thereto. The statements contained

in this prospectus as to the contents of any contract or any other document are not necessarily complete. In each case you should

refer to the copy of such contract or document filed as an exhibit to the registration statement.

We

will provide each person to whom this prospectus is delivered, a copy of any information we have incorporated by reference but

have not delivered along with this prospectus. If you would like a copy of any document incorporated herein by reference, other

than exhibits unless such exhibits are specifically incorporated by reference in any such document, you can call or write to us

at our principal executive offices: 240 Crossways Park Drive, Woodbury, New York 11797-2033, Attention: Corporate Secretary (telephone:

(516) 364-1902). We will provide this information without charge to any person, including a beneficial owner, to whom a copy of

this prospectus is delivered upon written or oral request.

No

dealer, salesperson or other individual has been authorized to give any information or to make any representation not contained

in or incorporated by reference in this prospectus or in any supplement to this prospectus. If given or made, you must not rely

on such information or representation as having been authorized by Research Frontiers. Neither the delivery of this prospectus

nor any sale made hereunder will, under any circumstances, create an implication that there has not been any change in the affairs

of Research Frontiers since the date of this prospectus or that the information contained herein is correct or complete as of

any time after the date of this prospectus.

This

prospectus and any supplement to this prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities

offered hereby to any person, or by anyone, in any jurisdiction in which such offer or solicitation may not lawfully be made.

The

information set forth herein and in all publicly disseminated information about Research Frontiers, includes “forward-looking

statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the

safe harbor created by that section. Readers are cautioned not to place undue reliance on these forward-looking statements as

they speak only as of the date of this prospectus and are not guaranteed

DIVIDENDS

Research

Frontiers has never paid any cash dividends and does not expect to pay any cash dividends for the foreseeable future.

USE

OF PROCEEDS

Unless

we indicate otherwise in the applicable prospectus supplement, we currently intend to use the net proceeds from this offering

for general corporate purposes, including our internal research and development programs, general working capital and possible

future acquisitions.

We

have not determined the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. As a result,

our management will have broad discretion to allocate the net proceeds from this offering. Pending application of the net proceeds

as described above, we intend to invest the net proceeds of the offering in money market funds and other interest-bearing investments.

DESCRIPTION

OF SECURITIES

We

may sell from time to time, in one or more offerings common stock and/or warrants to purchase common stock.

DESCRIPTION

OF COMMON STOCK

We

can issue 100,000,000 shares of common stock, $0.0001 par value per share. As of May 31, 2019, 28,989,789 shares were issued and

outstanding prior to this offering. Holders of our common stock are entitled to one vote per share on matters submitted to shareholders

for their approval, to dividends if declared by us, and to share in any distribution of our assets. All outstanding shares of

common stock are fully paid for and non-assessable. Holders of our common stock do not have cumulative voting rights or preemptive

rights. Therefore, a minority stockholder may be less able to gain representation on our board of directors.

Listing

Our

common stock is listed on the Nasdaq Capital Market under the symbol “REFR.”

Transfer

Agent and Registrar

Continental

Stock Transfer and Trust Company is the transfer agent and registrar for our common stock.

DESCRIPTION

OF WARRANTS

Each

purchaser in this offering will receive a warrant to purchase one share of our common stock for every share of common stock purchased

in this offering. The warrants will be issued pursuant to warrant agreements executed by us.

Each

warrant will entitle the holder to purchase one share of common stock at an exercise price of $3.384 per share for warrant exercises

from December 1, 2019 (the date that the Warrant first becomes exercisable) through May 31, 2020, $3.666 per share for warrant

exercises occurring from June 1, 2020 through May 31, 2021, and $4.23 per share for warrant exercises occurring from June 1, 2021 through the warrant expiration date of May 31, 2024. Holders of the warrants may exercise the warrants at any time

up until 4:30 P.M. New York time on May 31, 2024, after which unexercised warrants will become void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together

with specified information and paying the required amount to the Company in immediately available cash funds. Upon receipt of

the required payment and the warrant certificate properly completed and duly executed, we will issue and deliver the number of

shares of common stock purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate

are exercised, then we will issue a new warrant certificate for the remaining amount of warrants.

The

exercise price and the number and type of securities purchasable upon exercise of warrants are subject to adjustment upon certain

corporate events, including certain combinations, consolidations, liquidations, mergers, recapitalizations, reclassifications,

reorganizations, stock dividends and stock splits, a sale of all or substantially all of our assets and certain other events.

No

fractional warrant shares will be issued upon exercise of the warrants. Before exercising their warrants, holders of warrants

will not have any of the rights of holders of common stock, including the right to receive dividends, if any, or, payments upon

our liquidation, dissolution or winding up or to exercise voting rights, if any.

PLAN

OF DISTRIBUTION

The

Company directly placed the Units with the purchasers without a placement agent.

Each Unit consists of one share and one

warrant to purchase common stock at an exercise price of $3.384, $3.666 or $4.23 per share depending on the date of exercise.

Assuming that the warrants are not exercised, the Company will receive gross proceeds of $3,600,000 from the sale

of 1,276,599 shares of Common Stock at a price of $2.82 per share. Investors also received 638,295 Warrants in this

offering.

The

form of Subscription Agreement and Warrant Agreement used in this offering are included as exhibits to our Current Report on Form

8-K that was filed with the Securities and Exchange Commission on June 3, 2019.

The

transfer agent for our common stock is Continental Stock Transfer & Trust Company.

Our

common stock is traded on the Nasdaq Capital Market under the symbol “REFR”

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

SUBJECT

TO COMPLETION, DATED MARCH 13, 2018

RESEARCH

FRONTIERS INCORPORATED

6,325,000

Shares

Common

Stock

Research

Frontiers Incorporated may from time to time issue up to 6,325,000 shares of common stock, and/or warrants to purchase such common

stock. A general description of the known material terms of the securities we are offering is included herein. We will specify

in an accompanying prospectus supplement any specific material terms of the securities offered which are unknown as of the date

of this prospectus. We may sell these securities to or through underwriters and also to other purchasers or through agents. We

will set forth the names of any underwriters or agents in the accompanying prospectus supplement.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “REFR.” The last reported sale price of our common

stock on the Nasdaq Capital Market on March 9, 2018 was $0.97.

The

securities offered in this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 2 for a

discussion of the information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

The

date of this prospectus is March 13, 2018

TABLE

OF CONTENTS

You

should rely only on the information contained in or incorporated by reference in this prospectus. We have not authorized anyone

to provide you with different information. We are not making an offer of these securities in any state where the offer is not

permitted. You should not assume that the information contained in or incorporated by reference in this prospectus is accurate

as of any date other than the date of such document. Our business, financial condition, results of operations and prospects may

have changed materially since those dates.

SUMMARY

You

should read the entire prospectus, including the section entitled ‘Risk Factors,’ carefully before making an investment

decision.

The

Company

We

develop and license our suspended particle device light-control technology for controlling the amount of light passing through

a device to other companies that manufacture and market either the SPD-Smart chemical emulsion, light-control film made from the

chemical emulsion, lamination services, electronics to power end-products incorporating the film, or the end-products themselves

such as “smart” windows, skylights and sunroofs. Such suspended particle devices are often referred to as “SPDs,”

“light valves,” or “SPD-Smart” products.

SPD-Smart

products use microscopic light-absorbing nanoparticles that are typically suspended in a film. These particles align when an electrical

voltage is applied, thus permitting light to pass through the film. Adjustment of the voltage to the SPD film gives users the

ability to quickly, precisely and consistently regulate the amount of light, glare and heat passing through the window, skylight,

sunroof, window shade or other SPD-Smart end-product. This SPD film can be incorporated between two layers of glass or plastic,

or combinations of both, to produce a laminate that has enhanced energy efficiency, light-control and security performance properties.

Our offices are located at: 240 Crossways Park Drive, Woodbury, NY 11797 (telephone: 516-364-1902).

RISK

FACTORS

In

addition to the other information in this prospectus, you should carefully consider the following factors in evaluating us and

our business before purchasing the shares of common stock offered hereby. This prospectus contains, in addition to historical

information, forward-looking statements that involve risks and uncertainties, some of which are beyond our control. Should one

or more of these risks and uncertainties materialize or should underlying assumptions prove incorrect, our actual results could

differ materially. Factors that could cause or contribute to such differences include, but are not limited to, those discussed

below, as well as those discussed elsewhere in this prospectus, including the documents incorporated by reference.

There

are risks associated with investing in companies such as ours who are engaged in research and development. Because of these risks,

you should only invest if you are able to bear the risk of losing your entire investment. Before investing, in addition to risks

which could apply to any issuer or offering, you should also consider the business we are in and the following:

Source

and Need for Capital.

As

of December 31, 2017, we had approximately $1.7 million in cash and cash equivalents. In February 2018, a small group of long-time

shareholders of the Company made an interest-free five-year loan of $1.25 million to the Company which, upon the occurrence of

certain conditions, is expected to convert into common stock at a price equal to the market price of the Company’s common

stock when the loan was made, plus warrants exercisable at a premium to such market price. No payments are due on this note during

its five-year term.

As

we take steps in the commercialization and marketing of our technology, or respond to potential opportunities and/or adverse events,

our working capital needs may change. We anticipate that if our cash and cash equivalents are insufficient to satisfy our liquidity

requirements, we will require additional funding to sustain our ongoing operations and to continue our SPD technology research

and development activities.

We

have funded most of our activities through sales of our common stock to investors, and upon the exercise of options and warrants.

Eventual success of the Company and generation of positive cash flow will be dependent upon the extent of commercialization of

products using the Company’s technology by the Company’s licensees and payments of continuing royalties on account

thereof. We can give no assurances that we will generate sufficient revenues in the future (through sales of our common stock,

exercise of options and warrants, royalty fees, or otherwise) to satisfy our liquidity requirements or sustain future operations,

or that additional funding, if required, will be available when needed or, if available, on favorable terms.

History

of Operating Losses.

We

have experienced net losses from operations, and we may continue to incur net losses from operations in the future. We have incurred

substantial costs and expenses in researching and developing our SPD technology. As of December 31, 2017, we had a cumulative

net loss of $109,062,827 since our inception. Our net loss was $2,413,859 in 2017, $4,238,410 in 2016 and $4,279,856 in 2015,

(which includes non-cash accounting charge in 2017, 2016 and 2015 of $76,299, $67,531 and $725,016 respectively, resulting from

the expensing of grants of restricted stock and stock options).

We

may not generate sufficient cash flows to cover our operating expenses.

As

noted above, we have incurred recurring losses since inception and expect to continue to incur losses as a result of costs and

expenses related to our research and continued development of our SPD technology and our corporate general and administrative

expenses. Our limited capital resources and operations to date have been substantially funded through sales of our common stock,

exercise of options and warrants and royalty fees collected. As of December 31, 2017, we had working capital of approximately

$2.1 million, cash and cash equivalents of approximately $1.7 million, shareholders’ equity of approximately $2.6 million

and an accumulated deficit of approximately $109.1 million. In the event that we are unable to generate sufficient cash from our

operating activities or raise additional funds, we may be required to delay, reduce or severely curtail our operations or otherwise

impede our on-going business efforts, which could have a material adverse effect on our business, operating results, financial

condition and long-term prospects.

We

have never declared a cash dividend and do not intend to declare a cash dividend in the foreseeable future.

We

have never declared or paid cash dividends on our common stock. Payment of dividends on our common stock is within the discretion

of our Board of Directors and will depend upon our future earnings, capital requirements, financial condition and other relevant

factors. We do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future.

We

do not directly manufacture products using SPD technology. We currently depend upon the activities of our licensees and their

customers in order to be profitable.

We

do not directly manufacture products using SPD technology. We currently depend upon the activities of our licensees in order to

be profitable. Although a variety of products have been sold by our licensees, and because it is up to our licensees to decide

when and if they will introduce products using SPD technology, we cannot predict when and if our licensees will generate substantial

sales of such products. Our SPD technology is currently licensed to over 40 companies. Other companies are also evaluating SPD

technology for use in various products. In the past, some companies have evaluated our technology without proceeding further.

While we expect that our licensees would be primarily responsible for manufacturing and marketing SPD-Smart products and components,

we are also engaging in market development activities to support our licensees and build the smart glass industry. We cannot control

whether or not our licensees will develop SPD products. Some of our licensees appear to be more active than others, some appear

to be better capitalized than others, and some licensees appear to be inactive. There is no guarantee when or if our licensees

will successfully produce any commercial product using SPD technology in sufficient quantities to make the Company profitable.

SPD-Smart

products have only recently been introduced.

Products

using SPD technology have only recently begun to be introduced into the marketplace. Developing products using new technologies

can be risky because problems, expenses and delays frequently occur, and costs may or may not come down quickly enough for such

products using new technologies to rapidly penetrate mass market applications.

SPD-Smart

products face intense competition, which could affect our ability to increase our revenues.

The

market for SPD-Smart products is intensely competitive and we expect competition to increase in the future. We compete based on

the functionality and the quality of our product. Many of our current and potential competitors have significantly greater financial,

technical, marketing and other resources than we have. In addition, many of our competitors have well-established relationships

with our current and potential customers and have extensive knowledge of our industry. If our competitors develop new technologies

or new products, improve the functionality or quality of their current products, or reduce their prices, and if we are unable

to respond to such competitive developments quickly either because our research and development efforts do not keep pace with

our competitors or because of our lack of financial resources, we may be unable to compete effectively.

Declining

production of automobiles, airplanes, boats and real estate could harm our business.

Our

licensees’ commercialization efforts of SPD-Smart products could be negatively impacted if the global production of automobiles,

airplanes, boats and real estate construction declines significantly. If such commercialization is reduced, our revenues, results

of operations and financial condition could be negatively impacted.

Single

source of SPD film.

Our

end-product licensees require a source of SPD film to manufacture finished products. Currently, Hitachi Chemical is the sole source

of commercial quantities of SPD-film. There are several other companies that are licensed to manufacture SPD-film, but they have

not begun commercial production of this film. Our end-product licensees’ ability to sell SPD products could be negatively

impacted if there was a prolonged disruption in SPD-film availability. Such a disruption could also negatively impact our revenues,

results of operations and financial condition.

We

are dependent on key personnel.

Our

continued success will depend, to a significant extent, on the services of our directors, executive management team, key personnel

and certain key scientists. If one or more of these individuals were to leave the Company, there is no guarantee that we could

replace them with qualified individuals in a timely or economically satisfactory manner or at all. The loss or unavailability

of any or all of these individuals could harm our ability to execute our business plan, maintain important business relationships

and complete certain product development initiatives, which would have a material adverse effect on our business, results of operations

and financial conditions.

Dependence

on SPD-Smart technology.

Because

SPD technology is the only technology we work with, our success depends upon the viability of SPD technology which has yet to

be fully proven. We have not fully ascertained the performance and long-term reliability of our technology, and therefore there

is no guarantee that our technology will successfully be incorporated into all of the products which we are targeting for use

of SPD technology. We expect that different product applications for SPD technology will have different performance and reliability

specifications. We expect that our licensees will primarily be responsible for reliability testing, but that we may also continue

to do reliability testing so that we can more effectively focus our research and development efforts towards constantly improving

the performance characteristics and reliability of products using SPD technology.

Our

patents and other protective measures may not adequately protect our proprietary intellectual property, and we may be infringing

on the rights of others.

Our

intellectual property, particularly our proprietary rights in our SPD technology, is critical to our success. We have received

various patents, and filed other patent applications, for various applications and aspects of our SPD technology. In addition,

we generally enter into confidentiality and invention agreements with our employees and consultants. Such patents and agreements

and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons

generally applicable to patents and their granting and enforcement. In addition, the costs associated with enforcing patents,

confidentiality and invention agreements or other intellectual property rights may be expensive. Our inability to protect our

proprietary intellectual property rights or gain a competitive advantage from such rights could harm our ability to generate revenues

and, as a result, our business and operations.

An

unremediated material weakness in our internal control over financial reporting could adversely affect our reputation, business

or stock price.

We

previously identified a control deficiency constituting a material weakness in our internal control over financial reporting related

to our controls over the determination of our allowance for doubtful accounts in 2016. We developed and implemented a plan to

remediate this material weakness and based on our evaluation have concluded that this material weakness has been remediated during

2017.

We

have broad discretion in the use of the proceeds of this offering.

All

of our net proceeds from this offering will be used, as determined by management in its sole discretion, for working capital and

other general corporate purposes. Our management will have broad discretion over the use and investment of the net proceeds of

this offering and there is no assurance that management’s chosen application of proceeds will yield intended results. You

will not have the opportunity, as part of your investment decision, to assess whether our proceeds are being used appropriately.

Pending application of our proceeds, they might be placed in investments that do not produce income or that lose value.

Future

sales of our securities could cause our stock price to decline.

If

we or our stockholders sell substantial amounts of our common stock in the public market, the market price of our common stock

could decrease. The perception in the public market that we or our stockholders might sell shares of our common stock could also

depress the market price of our common stock. A decline in the price of shares of our common stock might impede our ability to

raise capital through the issuance of additional shares of our common stock or other equity securities.

Our

common stock has historically experienced low trading volume.

Our

common stock is listed on the Nasdaq Capital Market and has historically experienced low trading volume and there is no assurance

that the increased trading volume will continue or be maintained. Reported average daily trading volume in our common stock for

2017 was approximately 53,644 shares. Limited trading volume subjects our common stock to greater price volatility and may make

it difficult for you to sell your shares at a particular price.

Our

ability to use net operating loss carryforwards might be limited.

At

December 31, 2017, we had a net operating loss carryforward for federal income tax purposes of $73 million, varying amounts of

which will expire in each year from 2018 through 2037. To the extent these net operating loss carryforwards are available, we

intend to use them to reduce any corporate income tax liability associated with our operations we might have in the future. Section

382 of the Internal Revenue Code generally imposes an annual limitation on the amount of net operating loss carryforwards that

might be used to offset taxable income when a corporation has undergone significant changes in stock ownership. As a result, prior

or future changes in ownership could put limitations on the availability of our net operating loss carryforwards. In addition,

our ability to utilize the current net operating loss carryforwards might be further limited by the issuance of securities in

this offering or future offerings. To the extent our use of our net operating loss carryforwards or tax losses is limited, our

income could be subject to corporate income tax earlier than it would if we were able to use net operating loss carryforwards,

which could result in lower profits.

Our

organizational documents, stockholders’ rights plan and Delaware law make a takeover of our company more difficult, which

may prevent certain changes in control and limit the market price of our common stock.

Our

certificate of incorporation, bylaws, stockholders’ rights plan and Section 203 of the Delaware General Corporation Law

contain provisions that may have the effect of deterring or delaying attempts by our stockholders to remove or replace management,

engage in proxy contests and effect changes in control. These provisions of our certificate of incorporation and bylaws include:

|

|

●

|

the

authority for our board of directors to issue without stockholder approval up to 100,000,000 shares of common stock, that,

if issued, would dilute the ownership of our stockholders;

|

|

|

|

|

|

|

●

|

the

advance notice requirement for director nominations or for proposals that can be acted upon at stockholder meetings;

|

|

|

|

|

|

|

●

|

a

classified board of directors, which may make it more difficult for a person who acquires control of a majority of our outstanding

voting stock to replace all or a majority of our directors;

|

|

|

|

|

|

|

●

|

the

ability of our directors to fill any vacancy on our board of directors by the affirmative vote of a majority of the directors

then in office under certain circumstances;

|

|

|

|

|

|

|

●

|

limitations

on the ability of our stockholders to act by written consent;

|

|

|

|

|

|

|

●

|

limitations

on who may call a special meeting of stockholders;

|

|

|

|

|

|

|

●

|

the

prohibition on stockholders accumulating their votes for the election of directors;

|

|

|

|

|

|

|

●

|

the

limitation on the removal of any of our directors by either an affirmative vote of the continuing directors (as defined in

our certificate of incorporation) other than the subject director or by the affirmative vote of the holders of 80% of our

outstanding shares of each class of stock having the power to vote in a director election;

|

|

|

|

|

|

|

●

|

the

requirement of the affirmative vote of the holders of at least 80% of our outstanding shares of each class of stock having

the power to vote in a director election in order for stockholders to adopt, amend or repeal any provision of our certificate

of incorporation or bylaws, unless the adoption, amendment or repeal is approved by a majority of the continuing directors

(as defined in our certificate of incorporation) present at a meeting at which a quorum of the continuing directors are present;

and

|

|

|

|

|

|

|

●

|

the

requirement, subject to limited exceptions, of the affirmative vote of the holders of at least 80% of our outstanding shares

of each class of stock having the power to vote in a director election in order for us to complete certain business combination

transactions with interested stockholders.

|

We

also have adopted a stockholders’ rights plan designed to deter stockholders from acquiring shares of stock in excess of

15%. In addition, as a Delaware corporation, we are subject to Delaware law, including Section 203 of the Delaware General Corporation

Law. In general, Section 203 prohibits a Delaware corporation from engaging in any business combination with any interested stockholder

for a period of three years following the date that the stockholder became an interested stockholder unless certain specific requirements

are met as set forth in Section 203.

These

provisions could discourage proxy contests and make it more difficult for you and other stockholders to elect directors, replace

incumbent management and take other corporate actions. Some provisions in our certificate of incorporation and bylaws may deter

third parties from acquiring us, which may limit the market price of our common stock or prevent us from consummating a proposed

transaction that our stockholders find to be in their best interests.

AVAILABLE

INFORMATION

Research

Frontiers files reports, proxy statements and other information with the Securities and Exchange Commission. You may read and

copy such reports, proxy statements and other information at the public reference room maintained by the SEC at 100 F Street,

N.E., Washington, D.C. 20549 and you can obtain information on the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. The SEC also maintains an internet web site at http://www.sec.gov that contains reports, proxy and information

statements and other information regarding issuers, such as Research Frontiers, that file electronically with the SEC. Additional

information about us can also be found at our web site at http://www.SmartGlass.com.

The

SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus,

and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference

into this prospectus our:

|

|

●

|

annual

report on Form 10-K for the fiscal year ended December 31, 2017;

|

|

|

|

|

|

|

●

|

the

portions of the proxy statement dated April 26, 2017 for our annual meeting of stockholders held on June 8, 2017 that have

been incorporated by reference into our report on Form 10-K for the fiscal year ended December 31, 2016;

|

|

|

|

|

|

|

●

|

quarterly

reports on Form 10-Q for the fiscal quarters ended March 31, 2017, June 30, 2017, and September 30, 2017;

|

|

|

|

|

|

|

●

|

current

reports on Form 8-K filed with the SEC on October 11, 2017, September 1, 2017, August 22, 2017, July 27, 2017, June 12, 2017,

May 22, 2017, March 14, 2017, and January 10, 2017.

|

|

|

|

|

|

|

●

|

the

description of the capital stock contained in the Research Frontiers registration statements on Form 8-A under the Securities

Exchange Act of 1934 dated July 31, 1995, February 24, 2003 and February 13, 2013.

|

All

filings filed by Research Frontiers with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act subsequent to the

initial filing of this prospectus and prior to the termination of the offering or sale of all of common stock offered under this

prospectus shall be deemed to be incorporated by reference into this prospectus.

This

prospectus is part of a registration statement we filed with the SEC. As permitted by the SEC, this prospectus does not contain

all of the information set forth in the registration statement and the exhibits and schedules thereto. The statements contained

in this prospectus as to the contents of any contract or any other document are not necessarily complete. In each case you should

refer to the copy of such contract or document filed as an exhibit to the registration statement.

We

will provide each person to whom this prospectus is delivered, a copy of any information we have incorporated by reference but

have not delivered along with this prospectus. If you would like a copy of any document incorporated herein by reference, other

than exhibits unless such exhibits are specifically incorporated by reference in any such document, you can call or write to us

at our principal executive offices: 240 Crossways Park Drive, Woodbury, New York 11797-2033, Attention: Corporate Secretary (telephone:

(516) 364-1902). We will provide this information without charge to any person, including a beneficial owner, to whom a copy of

this prospectus is delivered upon written or oral request.

No

dealer, salesperson or other individual has been authorized to give any information or to make any representation not contained

in or incorporated by reference in this prospectus or in any supplement to this prospectus. If given or made, you must not rely

on such information or representation as having been authorized by Research Frontiers. Neither the delivery of this prospectus

nor any sale made hereunder will, under any circumstances, create an implication that there has not been any change in the affairs

of Research Frontiers since the date of this prospectus or that the information contained herein is correct or complete as of

any time after the date of this prospectus.

This

prospectus and any supplement to this prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities

offered hereby to any person, or by anyone, in any jurisdiction in which such offer or solicitation may not lawfully be made.

The

information set forth herein and in all publicly disseminated information about Research Frontiers, includes “forward-looking

statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the

safe harbor created by that section. Readers are cautioned not to place undue reliance on these forward-looking statements as

they speak only as of the date of this prospectus and are not guaranteed.

DIVIDENDS

Research

Frontiers has never paid any cash dividends and does not expect to pay any cash dividends for the foreseeable future.

USE

OF PROCEEDS

Unless

we indicate otherwise in the applicable prospectus supplement, we currently intend to use the net proceeds from this offering

for general corporate purposes, including our internal research and development programs, general working capital and possible

future acquisitions.

We

have not determined the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. As a result,

our management will have broad discretion to allocate the net proceeds from this offering. Pending application of the net proceeds

as described above, we intend to invest the net proceeds of the offering in money market funds and other interest-bearing investments.

DESCRIPTION

OF SECURITIES

We

may sell from time to time, in one or more offerings common stock and/or warrants to purchase common stock.

DESCRIPTION

OF COMMON STOCK

We

can issue 100,000,000 shares of common stock, $0.0001 par value per share. As of March 5, 2018, 24,043,846 shares were issued

and outstanding. Holders of our common stock are entitled to one vote per share on matters submitted to shareholders for their

approval, to dividends if declared by us, and to share in any distribution of our assets. All outstanding shares of common stock

are fully paid for and non-assessable. Holders of our common stock do not have cumulative voting rights or preemptive rights.

Therefore, a minority stockholder may be less able to gain representation on our board of directors.

Listing

Our

common stock is listed on the Nasdaq Capital Market under the symbol “REFR.”

Transfer

Agent and Registrar

Continental

Stock Transfer and Trust Company is the transfer agent and registrar for our common stock.

DESCRIPTION

OF WARRANTS

The

following description sets forth certain general terms and provisions of the warrants offered by us to which any prospectus supplement

may relate. The particular terms of the warrants offered, the extent, if any, to which the general terms set forth below apply

to the warrants offered, and any modifications or additions to the general terms as they relate to the warrants offered will be

described in a prospectus supplement.

We

may issue warrants for the purchase of common stock from time to time, and we may issue warrants independently or together with

common stock, and the warrants may be attached to or separate from these securities.

We

will describe in the applicable prospectus supplement the terms of the series of warrants, including:

|

|

●

|

the

offering price and aggregate number of warrants offered;

|

|

|

|

|

|

|

●

|

the

number of shares of common stock purchasable upon the exercise of one warrant and the price at which these shares may be purchased

upon such exercise;

|

|

|

|

|

|

|

●

|

the

dates on which the right to exercise the warrants will commence and expire;

|

|

|

|

|

|

|

●

|

the

effect of any merger, consolidation, sale or other disposition of our business on the warrant agreement and the warrants;

|

|

|

|

|

|

|

●

|

the

terms of any rights to redeem or call the warrants;

|

|

|

|

|

|

|

●

|

any

provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants;

|

|

|

|

|

|

|

●

|

to

the extent material, federal income tax consequences of holding or exercising the warrants; and

|

|

|

|

|

|

|

●

|

any

other specific terms, preferences, rights or limitations of or restrictions on the warrants.

|

Before

exercising their warrants, holders of warrants will not have any of the rights of holders of common stock, including the right

to receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to exercise voting rights, if any.

Each

warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise

price that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement,

holders of the warrants may exercise the warrants at any time up to 6:00 P.M. Woodbury, New York time on the expiration date that

we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants

will become void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together

with specified information and paying the required amount to the company in immediately available funds. Upon receipt of the required

payment and the warrant certificate properly completed and duly executed, we will issue and deliver the number of shares of common

stock purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised,

then we will issue a new warrant certificate for the remaining amount of warrants. Unless we indicate otherwise in the applicable

prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for warrants.

PLAN

OF DISTRIBUTION

We

may offer and sell all or a portion of the securities registered pursuant to this prospectus from time to time, in one or more

or any combination of the following transactions:

-

through dealers or agents to the public or to investors;

-

to underwriters for resale to the public or to investors;

-

directly to investors; or

-

through a combination of such methods.

We

will set forth in a prospectus supplement the terms of the offering of securities, including:

-

the name or names of any agents, dealers or underwriters;

-

the purchase price of the securities being offered and the proceeds we will receive from the sale;

-

any over-allotment options under which underwriters may purchase additional securities from us;

-

any agency fees or underwriting discounts and other items constituting agents’ or underwriters’ compensation;

-

any initial public offering price;

-

any discounts or concessions allowed or reallowed or paid to dealers; and

-

any securities exchanges on which the securities may be listed if it is other than the Nasdaq Capital Market.

Underwriters,

dealers and agents that participate in the distribution of the securities may be deemed to be underwriters as defined in the Securities

Act and any discounts or commissions they receive from us and any profit on their resale of the securities may be treated as underwriting

discounts and commissions under the Securities Act. We will identify in the applicable prospectus supplement any underwriters,

dealers or agents and will describe their compensation. We may have agreements with the underwriters, dealers and agents to indemnify

them against specified civil liabilities, including liabilities under the Securities Act. Underwriters, dealers and agents may

engage in transactions with or perform services for us or our subsidiaries in the ordinary course of their businesses. Certain

persons that participate in the distribution of the securities may engage in transactions that stabilize, maintain or otherwise

affect the price of the securities, including over-allotment, stabilizing and short-covering transactions in such securities,

and the imposition of penalty bids, in connection with an offering. Certain persons may also engage in passive market making transactions

as permitted by Rule 103 of Regulation M. Passive market makers must comply with applicable volume and price limitations and must

be identified as passive market makers. In general, a passive market maker must display its bid at a price not in excess of the

highest independent bid for such security; if all independent bids are lowered below the passive market maker’s bid, however,

the passive market maker’s bid must then be lowered when certain purchase limits are exceeded.

EXPERTS

The

consolidated financial statements and schedule of Research Frontiers as of December 31, 2017 and 2016, and for each of the three