Republic Bank Hires Regional Vice President for New York

July 29 2020 - 11:19AM

Republic First Bancorp, Inc. (NASDAQ: FRBK), the parent company of

Republic Bank, today announced the hiring of Daniel Markus as

Regional Vice President for the New York market. In his new

position, Markus will be responsible for managing customer

relationships and driving loan and deposit growth in the New York

Market.

“Daniel is a strong addition to our rapidly

expanding New York-based team,” said Vernon Hill, Chairman of

Republic Bank. “His lending track record and deep business

relationships throughout the New York metropolitan area will help

propel our continued growth in the region. After recently being

named America’s #1 Bank for Service, we are confident that Daniel

will help us turn even more Republic Bank customers into FANS.”

Markus brings significant experience to this

role having managed a broad spectrum of industries in the Long

Island, New York City and New Jersey Markets. He previously served

as a First Vice President of Commercial Lending for Valley National

Bank, where he led a team which closed on $300 million in new

loans. Prior to this position, he was a Senior Associate at Marks

Paneth for several years. Markus holds an MBA from Providence

College.

“In a short period of time, Republic Bank has

established itself as best in class in the New York City market,”

said Markus. “I’m thrilled to help build on this momentum,

introducing more New Yorkers to the best banking experience across

every channel.”

The bank’s New York City stores at 14th Street

and 5th Avenue and 51st Street and 3rd Avenue opened in July and

November 2019, respectively. A third location in the city is

planned for 2021.

In 2020, Republic Bank was named America’s #1

Bank for Service in a national consumer satisfaction survey.

Whether banking in-person, online, via mobile or over the phone,

the bank delivers an unmatched customer experience and its modern

stores, long hours, dog-friendly policies and free services such as

coin counting set it apart from competitors large and small.

Republic Bank continues to expand its footprint throughout

Philadelphia, Southern New Jersey and New York City as part of its

“The Power of Red is Back” growth plan. Republic Bank’s 30 stores

are open seven days a week, 361 days a year, with extended lobby

and drive-thru hours, providing customers incredible convenience

and flexibility. The bank also offers absolutely free checking,

ATM/Debit cards and credit cards issued on the spot and access to

more than 55,000 surcharge free ATMs worldwide via the Allpoint

network.

About Republic Bank

Republic Bank is the operating name for Republic

First Bank. Republic First Bank is a full-service, state-chartered

commercial bank, whose deposits are insured up to the applicable

limits by the Federal Deposit Insurance Corporation (FDIC). The

Bank provides diversified financial products through its 30 offices

located in Atlantic, Burlington, Camden and Gloucester Counties in

New Jersey; Bucks, Delaware, Montgomery and Philadelphia Counties

in Pennsylvania and New York County in New York. The bank also

offers a wide range of residential mortgage products through its

mortgage division, Oak Mortgage Company. For more information about

Republic Bank, please visit www.myrepublicbank.com.

Forward Looking Statements

Republic First Bancorp, Inc. ("the Company") may

from time to time make written or oral "forward-looking

statements", including statements contained in this release and in

the Company's filings with the Securities and Exchange

Commission. These forward-looking statements include

statements with respect to the Company's beliefs, plans,

objectives, goals, expectations, anticipations, estimates, and

intentions that are subject to significant risks and uncertainties

and are subject to change based on various factors, many of which

are beyond the Company's control. These factors include

competition, timing, credit risks of lending activities, changes in

general economic conditions, price pressures on loan and deposit

products, and other factors detailed from time to time in the

Company's filings with the Securities and Exchange Commission. The

words "may", "could", "should", "would", "believe", "anticipate",

"estimate", "expect", "intend", "plan", and similar expressions are

intended to identify forward-looking statements. All such

statements are made in good faith by the Company pursuant to the

"safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. The Company does not undertake to update any

forward-looking statement, whether written or oral that may be made

from time to time by or on behalf of the Company, except as may be

required by applicable law or regulations.

SOURCE: Republic First Bancorp, Inc.

CONTACTCarly

Colomboccolombo@briancom.com

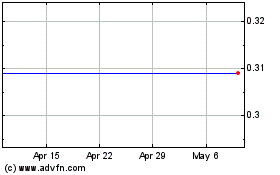

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

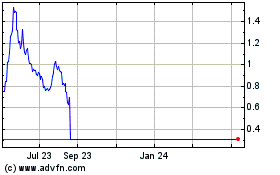

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Apr 2023 to Apr 2024