Republic Bancorp, Inc. (NASDAQ: RBCAA), headquartered

in Louisville, Kentucky, is the holding company of Republic Bank

& Trust Company (the “Bank”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190719005009/en/

Republic Bancorp, Inc. (“Republic” or the “Company”) is pleased

to report second quarter net income of $18.0 million, a 15%

increase over the second quarter of 2018, resulting in Diluted

Earnings per Class A Common Share (“Diluted EPS”) of $0.86.

Year-to-date net income was $47.5 million, a $4.4 million, or 10%,

increase from the same period in 2018, resulting in return on

average assets (“ROA”) and return on average equity (“ROE”) of

1.73% and 13.24% for the first six months of 2019.

Steve Trager, Chairman & CEO of Republic commented, “We are

pleased to report another solid quarter of net income for the

Company, as continued strong net interest income along with notable

growth in Mortgage Banking income drove our quarterly results.

Within the Republic Processing Group (“RPG”), Republic Credit

Solutions (“RCS”) continued to have strong operating results with a

97% increase in net income for the second quarter of 2019 compared

to the same period in 2018, thanks in large part to a reduction in

provision expense resulting from the discontinuance of the

Company’s subprime credit card portfolio in January of this

year.”

The following table highlights Republic’s financial performance

for the second quarters and six months ended June 30, 2019 and

2018:

Total Company Financial

Performance Highlights

Three Months Ended Jun.

30,

Six Months Ended Jun.

30,

(dollars in thousands, except per share

data)

2019

2018

$ Change

% Change

2019

2018

$ Change

% Change

Income Before Income Taxes*

$

21,183

$

19,816

$

1,367

7

%

$

58,159

$

54,726

$

3,433

6

%

Net Income*

18,007

15,666

2,341

15

47,523

43,135

4,388

10

Diluted Earnings per Class A Common

Stock

0.86

0.74

0.12

16

2.28

2.06

0.22

11

Return on Average Assets

1.31

%

1.23

%

NA

7

1.73

%

1.67

%

NA

4

Return on Average Equity

9.88

9.45

NA

5

13.24

13.22

NA

0

NA – Not applicable *See segment data at the end of this

earnings release

Results of Operations for the Second

Quarter of 2019 Compared to the Second Quarter of

2018

Core Bank(1)

Net income from Core Banking was $13.0 million for the second

quarter of 2019, a $1.4 million, or 12%, increase from the second

quarter of 2018. Core Bank pre-tax net income increased 1% over a

strong second quarter in 2018, with benefits from continued growth

in net interest income and mortgage banking income offset by a

higher provision for loan losses (“Provision”) and higher overhead

costs. As discussed in the section titled “Total Company Income Tax

Expense” later in this release, the Core Bank received the benefit

of certain infrequent income tax items during the second quarter of

2019, positively impacting the net income comparability to the

second quarter of 2018.

Net Interest Income – Core Bank net interest income and net

interest margin were generally impacted in opposite fashion by the

performance of its two major net-interest-income producing segments

during the second quarter of 2019. Within the Traditional Banking

segment, strong year-over-year loan growth primarily drove an

overall increase in net interest income and was complemented by

further margin expansion. Within the Warehouse Lending

(“Warehouse”) segment, however, the benefit of robust

average-balance growth was more than offset by net interest margin

compression during the quarter.

The following tables present by reportable segment the overall

changes in the Core Bank’s net interest income, net interest

margin, as well as average and period-end loan balances:

(dollars in thousands)

Three Months Ended Jun.

30,

2019

2018

Change

Reportable Segment

Net Interest Income

Net Interest Margin

Net Interest Income

Net Interest Margin

Net Interest Income

Net Interest Margin

Traditional Banking

$

41,877

3.75

%

$

39,348

3.71

%

$

2,529

0.04

%

Warehouse Lending

3,957

2.49

4,164

3.08

(207

)

(0.59

)

Mortgage Banking

170

NM

103

NM

67

NM

Total Core Bank

$

46,004

3.62

$

43,615

3.64

$

2,389

(0.02

)

Average Loan Balances

Period-End Loan

Balances

(dollars in thousands)

Three Months Ended Jun.

30,

Jun. 30,

Reportable Segment

2019

2018

$ Change

% Change

2019

2018

$ Change

% Change

Traditional Banking

$

3,651,630

$

3,455,432

$

196,198

6

%

$

3,699,576

$

3,476,426

$

223,150

6

%

Warehouse Lending*

634,688

541,537

93,151

17

737,794

634,841

102,953

16

Mortgage Banking*

12,153

6,752

5,401

80

13,883

12,653

1,230

10

Total Core Bank*

$

4,298,471

$

4,003,721

$

294,750

7

$

4,451,253

$

4,123,920

$

327,333

8

*Includes loans held for sale NM – Not meaningful

The primary drivers of the changes in the Core Bank’s net

interest income for the second quarter of 2019, as compared to the

second quarter of 2018, follow:

Traditional Banking

The Traditional Banking segment’s net interest income increased

$2.5 million, or 6%, over the second quarter of 2018. The rise in

net interest income was generally driven by the following

items:

- Average loans during the second quarter of 2019 were $196

million, or 6%, higher than the comparable period in 2018. The

primary contributors for the increase in the quarter-over-quarter

average balances were commercial and industrial loans, which grew

$80 million, and commercial real estate loans, which grew $56

million.

- Despite a 31-basis-point increase in the Traditional Banking

segment’s cost of interest-bearing liabilities, its net interest

margin continued to expand due to the increased value from its

noninterest-bearing funding. The difference between the Traditional

Banking segment’s net interest margin and net interest spread was

18 basis points during the second quarter of 2019 compared to 14

basis points during the second quarter of 2018, with the

differential representing the increased value to the net interest

margin of noninterest-bearing deposits and stockholders’ equity.

The increase in this value resulted from a 30-basis-point rise in

the yield on the Traditional Banking segment’s interest-earning

assets from period to period.

Warehouse Lending

Despite a 17% increase in average outstanding Warehouse balances

during the second quarter of 2019 compared to the second quarter of

2018, a 59-basis-point compression in its net interest margin

during the same period drove a $207,000 decrease in its net

interest income. The following factors led to the overall changes

in the Warehouse segment’s net interest income and net interest

margin:

- Pricing pressure to the Bank on Warehouse lines of credit

resulting from the negative impact of an inverted yield curve on

Warehouse clients primarily drove the 59-basis-point compression in

the Warehouse segment’s net interest margin.

- A sharp decline in long-term fixed mortgage rates drove

increased client usage of the Bank’s Warehouse lines of credit,

driving average outstanding Warehouse balances from $542 million

during the second quarter of 2018 to $635 million during the second

quarter of 2019.

Provision Expense – The Core Bank’s Provision increased to $1.8

million for the second quarter of 2019 from $773,000 for the same

period in 2018. The difference in the Provision between the two

periods was primarily related to a $1.2 million estimated specific

loan loss reserve for one commercial-related client that defaulted

during the second quarter of 2019. Despite personal guarantees

associated with this relationship, the Bank recorded a large

estimated Provision due to the potential for a prolonged workout

horizon and the general uncertainty associated with these types of

circumstances.

The table below presents the Core Bank’s credit quality

metrics:

As of and for the:

Quarters Ended:

Years Ended:

Jun. 30,

Mar. 31,

Dec. 31,

Dec. 31,

Dec. 31,

Core Banking Credit Quality

Ratios

2019

2019

2018

2017

2016

Nonperforming loans to total loans

0.43

%

0.37

%

0.40

%

0.36

%

0.42

%

Nonperforming assets to total loans

(including OREO)

0.46

0.37

0.40

0.36

0.46

Delinquent loans to total loans(2)

0.28

0.18

0.22

0.21

0.18

Net charge-offs to average loans

0.04

0.04

0.06

0.04

0.05

(Quarterly rates annualized)

OREO = Other Real Estate Owned

Noninterest Income – Core Bank noninterest income was $10.3

million during the second quarter of 2019, a $1.2 million, or 14%,

increase from the $9.1 million achieved during the second quarter

of 2018. Driving the increase in noninterest income was a $1.1

million rise in mortgage banking income, which resulted from a $27

million increase in secondary market loans originated from period

to period combined with a $33 million increase in the Bank’s

pipeline of secondary market loans in process from June 30, 2018 to

June 30, 2019. Over the previous 12 months, the Bank has continued

to invest in staffing and other resources for the mortgage banking

function. A sharp decline in long-term mortgage rates during the

quarter, combined with the Bank’s continued investments in mortgage

resources, contributed to the increased quarter-over-quarter

mortgage activity.

Noninterest Expense – Core Bank noninterest expense increased

$2.5 million, or 7%, during the second quarter of 2019 compared to

the second quarter of 2018 resulting primarily from a $2.1 million,

or 10%, increase in salaries and benefits expense. Annual merit

increases and the addition of 79 Core Bank full-time-equivalent

employees (“FTEs”) from June 30, 2018 to June 30, 2019 primarily

drove the increase.

Republic Processing Group(3)

Republic Processing Group (“RPG”) reported net income of $5.1

million for the second quarter of 2019 compared to $4.1 million for

the same period in 2018, with a $2.0 million increase in net income

at RPG’s Republic Credit Solutions (“RCS”) segment partially offset

by a $1.0 million reduction in net income at its Tax Refund

Solutions (“TRS”) segment.

Republic Credit Solutions

RCS’s increase in net income primarily reflects a $2.8 million

reduction in Provision expense resulting from lower Provisions of

$1.2 million and $1.6 million, respectively, for RCS’s

line-of-credit product and its discontinued credit card product.

The overall improvement in the Provision for the line-of-credit

product was driven by a decline in its annualized historical loss

rate combined with a year-to-year decrease in average outstanding

balances. The decrease in losses within the RCS credit-card

portfolio was due to the discontinuance of the program, effective

January of this year.

Tax Refund Solutions

Related to the profitability of TRS, a negative change in

Provision expense from a net credit of $888,000 during the second

quarter of 2018 to a net charge of $392,000 during the second

quarter of 2019 drove the segment’s overall change in net income.

The net credit during the second quarter of 2018 resulted from

better than expected paydowns from the US Treasury on unpaid Easy

Advance (“EA”) loans, allowing the Company to reverse a portion of

the loan loss provisions it recorded during the first quarter of

2018. Conversely, loan paydowns from the US Treasury during the

second quarter of 2019 approximated the Company’s estimate from the

first quarter of 2019, causing the Company’s loan loss reserve for

EA loans to remain materially the same from the first quarter.

With the second quarter EA paydowns, the percent of unpaid EAs

to total EAs originated dropped to 3.45% at June 30, 2019. This

compares to 2.88% at June 30, 2018, a gap of 57 basis points. By

comparison, the unpaid EA percentage was 5.84% at March 31, 2019,

compared to 4.49% at March 31, 2018, representing a gap of 135

basis points. Management remains optimistic that this gap can

continue to shrink through the remainder of 2019. With all unpaid

EAs having been charged off as of June 30, 2019, any EA payments

received throughout the remainder of 2019 will represent recovery

credits directly to income.

Total Company - Income Tax Expense

In April 2019, Kentucky enacted HB458, which allows for combined

filing for Republic Bancorp and the Bank. Republic Bancorp had

previously filed a separate company income tax return for Kentucky

and generated net operating losses, for which it had maintained a

valuation allowance against the related deferred tax asset. HB458

also allows for certain net operating losses to be utilized on a

combined return. Republic Bancorp expects to file a combined return

beginning in 2021 and to utilize these previously generated net

operating losses. The tax benefit to reverse the valuation

allowance on the deferred tax asset for these losses is expected to

be approximately $815,000. This benefit was recorded in the second

quarter of 2019, with 100% of this benefit attributed to the Core

Bank.

In addition to the tax benefit recognized during the quarter

associated with passage of HB458, the Company also received

$388,000 in income tax benefit during the second quarter of 2019

associated with equity compensation. Substantially all of this

benefit was attributed to the Core Bank.

Republic Bancorp, Inc. (the “Company”) is the parent company of

Republic Bank & Trust Company (the “Bank”). The Bank currently

has 45 full-service banking centers and two loan production offices

throughout five states: 32 banking centers in 11 Kentucky

communities - Covington, Crestview Hills, Elizabethtown, Florence,

Frankfort, Georgetown, Lexington, Louisville, Owensboro,

Shelbyville, and Shepherdsville; three banking centers in southern

Indiana – Floyds Knobs, Jeffersonville, and New Albany; seven

banking centers in six Florida communities (Tampa MSA) – Largo,

Port Richey, St. Petersburg, Seminole, Tampa, and Temple Terrace

and one loan production office in Oldsmar; two banking centers in

Tennessee (Nashville MSA) – Cool Springs (Franklin) and Green Hills

(Nashville), and one loan production office in Brentwood; and one

banking center in Norwood (Cincinnati), Ohio. The Bank offers

internet banking at www.republicbank.com. The Bank also offers

separately branded, nation-wide digital banking at

www.mymemorybank.com. The Company has $5.7 billion in assets and is

headquartered in Louisville, Kentucky. The Company’s Class A Common

Stock is listed under the symbol “RBCAA” on the NASDAQ Global

Select Market.

Republic Bank. It’s just easier here. ®

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The forward-looking statements in the preceding paragraphs

are based on our current expectations and assumptions regarding our

business, the future impact to our balance sheet and income

statement resulting from changes in interest rates, the ability to

develop products and strategies in order to meet the Company’s

long-term strategic goals, the economy, and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. Our actual

results may differ materially from those contemplated by

forward-looking statements. We caution you therefore against

relying on any of these forward-looking statements. They are

neither statements of historical fact nor guarantees or assurances

of future performance. Actual results could differ materially based

upon factors disclosed from time to time in the Company’s filings

with the U.S. Securities and Exchange Commission, including those

factors set forth as “Risk Factors” in the Company’s Annual Report

on Form 10-K for the period ended December 31, 2018. The Company

undertakes no obligation to update any forward-looking statements.

These forward-looking statements are made only as of the date of

this release, and the Company undertakes no obligation to release

revisions to these forward-looking statements to reflect events or

conditions after the date of this release.

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (all amounts other than per share

amounts, number of employees, and number of banking centers are

expressed in thousands unless otherwise noted)

Balance Sheet Data

Jun. 30, 2019

Dec. 31, 2018

Jun. 30, 2018

Assets:

Cash and cash equivalents

$

473,779

$

351,474

$

386,956

Investment securities

447,512

543,771

485,622

Loans held for sale

63,949

21,809

26,337

Loans

4,522,414

4,148,227

4,195,984

Allowance for loan and lease losses

(45,983

)

(44,675

)

(45,047

)

Loans, net

4,476,431

4,103,552

4,150,937

Federal Home Loan Bank stock, at cost

32,242

32,067

32,067

Premises and equipment, net

44,199

44,820

46,485

Right-of-use assets(4)

37,450

—

—

Goodwill

16,300

16,300

16,300

Other real estate owned ("OREO")

1,095

160

—

Bank owned life insurance ("BOLI")

65,642

64,883

64,106

Other assets and accrued interest

receivable

64,535

61,568

57,135

Total assets

$

5,723,134

$

5,240,404

$

5,265,945

Liabilities and Stockholders'

Equity:

Deposits:

Noninterest-bearing

$

1,052,177

$

1,003,969

$

1,061,182

Interest-bearing

2,661,697

2,452,176

2,412,187

Total deposits

3,713,874

3,456,145

3,473,369

Securities sold under agreements to

repurchase and other short-term borrowings

226,002

182,990

175,291

Operating lease liabilities(4)

38,852

—

—

Federal Home Loan Bank advances

915,000

810,000

860,000

Subordinated note

41,240

41,240

41,240

Other liabilities and accrued interest

payable

56,738

60,095

52,037

Total liabilities

4,991,706

4,550,470

4,601,937

Stockholders' equity

731,428

689,934

664,008

Total liabilities and stockholders'

equity

$

5,723,134

$

5,240,404

$

5,265,945

Average Balance Sheet Data

Three Months Ended Jun.

30,

Six Months Ended Jun.

30,

2019

2018

2019

2018

Assets:

Federal funds sold and other

interest-earning deposits

$

297,205

$

276,246

$

293,587

$

279,684

Investment securities, including FHLB

stock

514,366

506,209

538,923

529,356

Loans, including loans held for sale

4,424,905

4,092,388

4,341,254

4,087,247

Total interest-earning assets

5,236,476

4,874,843

5,173,764

4,896,287

Total assets

5,480,525

5,074,781

5,478,609

5,175,927

Liabilities and Stockholders'

Equity:

Noninterest-bearing deposits

$

1,098,817

$

1,146,403

$

1,178,198

$

1,232,652

Interest-bearing deposits

2,588,836

2,410,330

2,609,188

2,413,220

Securities sold under agreements to

repurchase and other short-term borrowings

220,189

178,063

225,864

217,532

Federal Home Loan Bank advances

710,879

593,187

611,695

569,613

Subordinated note

41,240

41,240

41,240

41,240

Total interest-bearing liabilities

3,561,144

3,222,820

3,487,987

3,241,605

Stockholders' equity

728,723

663,077

717,838

652,407

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Income Statement Data

Three Months Ended Jun.

30,

Six Months Ended Jun.

30,

2019

2018

2019

2018

Total interest income(5)

$

65,664

$

58,356

$

148,297

$

132,189

Total interest expense

11,718

7,272

22,052

13,440

Net interest income

53,946

51,084

126,245

118,749

Provision for loan and lease losses

4,460

4,932

21,691

22,187

Noninterest income:

Service charges on deposit accounts

3,598

3,574

6,901

7,129

Net refund transfer fees

3,629

3,473

20,729

19,825

Mortgage banking income

2,416

1,316

3,955

2,336

Interchange fee income

3,257

2,891

6,014

5,558

Program fees

1,037

1,323

2,111

3,019

Increase in cash surrender value of

BOLI

377

379

759

750

Net gains on OREO

90

320

220

452

Other

721

1,020

1,853

2,772

Total noninterest income

15,125

14,296

42,542

41,841

Noninterest expense:

Salaries and employee benefits

25,286

22,766

50,362

46,600

Occupancy and equipment, net

6,472

6,391

13,056

12,612

Communication and transportation

1,071

1,241

2,232

2,623

Marketing and development

1,278

1,283

2,380

2,199

FDIC insurance expense

295

345

743

870

Bank franchise tax expense

935

860

3,431

3,378

Data processing

2,217

2,443

4,313

4,829

Interchange related expense

1,302

1,098

2,617

2,105

Supplies

582

303

1,066

684

OREO expense

148

16

194

61

Legal and professional fees

844

728

1,730

1,771

Other

2,998

3,158

6,813

5,945

Total noninterest expense

43,428

40,632

88,937

83,677

Income before income tax expense

21,183

19,816

58,159

54,726

Income tax expense

3,176

4,150

10,636

11,591

Net income

$

18,007

$

15,666

$

47,523

$

43,135

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Selected Data and Ratios

Three Months Ended Jun.

30,

Six Months Ended Jun.

30,

2019

2018

2019

2018

Per Share Data:

Basic weighted average shares

outstanding

21,016

21,187

20,997

20,939

Diluted weighted average shares

outstanding

21,138

21,331

21,125

21,072

Period-end shares outstanding:

Class A Common Stock

18,740

18,677

18,740

18,677

Class B Common Stock

2,208

2,215

2,208

2,215

Book value per share(6)

$

34.92

$

31.78

$

34.92

$

31.78

Tangible book value per share(6)

33.87

30.73

33.87

30.73

Earnings per share ("EPS"):

Basic EPS - Class A Common Stock

$

0.86

$

0.75

$

2.29

$

2.08

Basic EPS - Class B Common Stock

0.79

0.68

2.08

1.89

Diluted EPS - Class A Common Stock

0.86

0.74

2.28

2.06

Diluted EPS - Class B Common Stock

0.78

0.68

2.07

1.88

Cash dividends declared per Common

share:

Class A Common Stock

$

0.264

$

0.242

$

0.528

$

0.484

Class B Common Stock

0.240

0.220

0.480

0.440

Performance Ratios:

Return on average assets

1.31

%

1.23

%

1.73

%

1.67

%

Return on average equity

9.88

9.45

13.24

13.22

Efficiency ratio(7)

63

62

53

52

Yield on average interest-earning

assets(5)

5.02

4.79

5.73

5.40

Cost of average interest-bearing

liabilities

1.32

0.90

1.26

0.83

Cost of average deposits(8)

0.75

0.44

0.72

0.40

Net interest spread(5)

3.70

3.89

4.47

4.57

Net interest margin - Total Company(5)

4.12

4.19

4.88

4.85

Net interest margin - Core Bank(1)

3.62

3.64

3.69

3.60

Other Information:

End of period FTEs(9) - Total Company

1,089

1,013

1,089

1,013

End of period FTEs - Core Bank

1,012

933

1,012

933

Number of full-service banking centers

45

45

45

45

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Credit Quality Data and Ratios

As of and for the

As of and for the

Three Months Ended Jun.

30,

Six Months Ended Jun.

30,

2019

2018

2019

2018

Credit Quality Asset Balances:

Nonperforming Assets - Total

Company:

Loans on nonaccrual status

$

19,238

$

17,502

$

19,238

$

17,502

Loans past due 90-days-or-more and still

on accrual

166

858

166

858

Total nonperforming loans

19,404

18,360

19,404

18,360

OREO

1,095

—

1,095

—

Total nonperforming assets

$

20,499

$

18,360

$

20,499

$

18,360

Nonperforming Assets - Core

Bank(1):

Loans on nonaccrual status

$

19,238

$

17,502

$

19,238

$

17,502

Loans past due 90-days-or-more and still

on accrual

—

22

—

22

Total nonperforming loans

19,238

17,524

19,238

17,524

OREO

1,095

—

1,095

—

Total nonperforming assets

$

20,333

$

17,524

$

20,333

$

17,524

Delinquent loans:

Delinquent loans - Core Bank

$

12,524

$

8,703

$

12,524

$

8,703

Delinquent loans - RPG(3)

6,802

4,429

6,802

4,429

Total delinquent loans - Total Company

$

19,326

$

13,132

$

19,326

$

13,132

Credit Quality Ratios - Total

Company:

Nonperforming loans to total loans

0.43

%

0.44

%

0.43

%

0.44

%

Nonperforming assets to total loans

(including OREO)

0.45

0.44

0.45

0.44

Nonperforming assets to total assets

0.36

0.35

0.36

0.35

Allowance for loan and lease losses to

total loans

1.02

1.07

1.02

1.07

Allowance for loan and lease losses to

nonperforming loans

237

245

237

245

Delinquent loans to total loans(2)

0.43

0.31

0.43

0.31

Net charge-offs to average loans

(annualized)

1.49

1.19

0.94

0.97

Credit Quality Ratios - Core

Bank:

Nonperforming loans to total loans

0.43

%

0.43

%

0.43

%

0.43

%

Nonperforming assets to total loans

(including OREO)

0.46

0.43

0.46

0.43

Nonperforming assets to total assets

0.37

0.34

0.37

0.34

Allowance for loan and lease losses to

total loans

0.75

0.76

0.75

0.76

Allowance for loan and lease losses to

nonperforming loans

171

179

171

179

Delinquent loans to total loans

0.28

0.21

0.28

0.21

Net charge-offs to average loans

(annualized)

0.04

—

0.04

0.03

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Balance Sheet Data

Quarterly Comparison

Jun. 30, 2019

Mar. 31, 2019

Dec. 31, 2018

Sep. 30, 2018

Jun. 30, 2018

Assets:

Cash and cash equivalents

$

473,779

$

345,512

$

351,474

$

365,512

$

386,956

Investment securities

447,512

498,318

543,771

513,766

485,622

Loans held for sale

63,949

24,177

21,809

28,899

26,337

Loans

4,522,414

4,298,710

4,148,227

4,136,195

4,195,984

Allowance for loan and lease losses

(45,983)

(57,961)

(44,675)

(43,824)

(45,047)

Loans, net

4,476,431

4,240,749

4,103,552

4,092,371

4,150,937

Federal Home Loan Bank stock, at cost

32,242

29,965

32,067

32,067

32,067

Premises and equipment, net

44,199

43,527

44,820

45,945

46,485

Right-of-use assets(4)

37,450

38,738

—

—

—

Goodwill

16,300

16,300

16,300

16,300

16,300

Other real estate owned

1,095

216

160

70

—

Bank owned life insurance

65,642

65,265

64,883

64,491

64,106

Other assets and accrued interest

receivable

64,535

63,001

61,568

62,933

57,135

Total assets

$

5,723,134

$

5,365,768

$

5,240,404

$

5,222,354

$

5,265,945

Liabilities and Stockholders'

Equity:

Deposits:

Noninterest-bearing

$

1,052,177

$

1,184,480

$

1,003,969

$

1,103,461

$

1,061,182

Interest-bearing

2,661,697

2,589,836

2,452,176

2,463,224

2,412,187

Total deposits

3,713,874

3,774,316

3,456,145

3,566,685

3,473,369

Securities sold under agreements to

repurchase and other short-term borrowings

226,002

173,168

182,990

163,768

175,291

Operating lease liabilities(4)

38,852

40,203

—

—

—

Federal Home Loan Bank advances

915,000

560,000

810,000

715,000

860,000

Subordinated note

41,240

41,240

41,240

41,240

41,240

Other liabilities and accrued interest

payable

56,738

59,750

60,095

58,851

52,037

Total liabilities

4,991,706

4,648,677

4,550,470

4,545,544

4,601,937

Stockholders' equity

731,428

717,091

689,934

676,810

664,008

Total liabilities and stockholders'

equity

$

5,723,134

$

5,365,768

$

5,240,404

$

5,222,354

$

5,265,945

Average Balance Sheet Data

Quarterly Comparison

Jun. 30, 2019

Mar. 31, 2019

Dec. 31, 2018

Sep. 30, 2018

Jun. 30, 2018

Assets:

Federal funds sold and other

interest-earning deposits

$

297,205

$

289,928

$

199,134

$

265,111

$

276,246

Investment securities, including FHLB

stock

514,366

563,752

579,429

530,468

506,209

Loans, including loans held for sale

4,424,905

4,256,673

4,092,004

4,112,926

4,092,388

Total interest-earning assets

5,236,476

5,110,353

4,870,567

4,908,505

4,874,843

Total assets

5,480,525

5,476,671

5,070,845

5,101,286

5,074,781

Liabilities and Stockholders'

Equity:

Noninterest-bearing deposits

$

1,098,817

$

1,258,461

$

1,050,236

$

1,076,967

$

1,146,403

Interest-bearing deposits

2,588,836

2,629,765

2,477,962

2,476,088

2,410,330

Securities sold under agreements to

repurchase and other short-term borrowings

220,189

231,602

252,073

213,195

178,063

Federal Home Loan Bank advances

710,879

511,408

515,413

574,130

593,187

Subordinated note

41,240

41,240

41,240

41,240

41,240

Total interest-bearing liabilities

3,561,144

3,414,015

3,286,688

3,304,653

3,222,820

Stockholders' equity

728,723

706,833

687,156

675,470

663,077

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Income Statement Data

Three Months Ended

Jun. 30, 2019

Mar. 31, 2019

Dec. 31, 2018

Sep. 30, 2018

Jun. 30, 2018

Total interest income(5)

$

65,664

$

82,633

$

62,902

$

61,090

$

58,356

Total interest expense

11,718

10,334

8,626

8,057

7,272

Net interest income

53,946

72,299

54,276

53,033

51,084

Provision for loan and lease losses

4,460

17,231

5,104

4,077

4,932

Noninterest income:

Service charges on deposit accounts

3,598

3,303

3,565

3,579

3,574

Net refund transfer fees

3,629

17,100

55

149

3,473

Mortgage banking income

2,416

1,539

1,129

1,360

1,316

Interchange fee income

3,257

2,757

2,844

2,757

2,891

Program fees

1,037

1,074

1,520

1,686

1,323

Increase in cash surrender value of

BOLI

377

382

392

385

379

Net gains on OREO

90

130

29

248

320

Other

721

1,132

585

1,301

1,020

Total noninterest income

15,125

27,417

10,119

11,465

14,296

Noninterest expense:

Salaries and employee benefits

25,286

25,076

21,743

22,846

22,766

Occupancy and equipment, net

6,472

6,584

6,474

6,279

6,391

Communication and transportation

1,071

1,161

1,115

1,047

1,241

Marketing and development

1,278

1,102

784

1,449

1,283

FDIC insurance expense

295

448

264

360

345

Bank franchise tax expense

935

2,496

863

710

860

Data processing

2,217

2,096

2,434

2,350

2,443

Interchange related expense

1,302

1,315

1,237

1,138

1,098

Supplies

582

484

446

314

303

OREO expense

148

46

31

2

16

Legal and professional fees

844

886

753

935

728

Other

2,998

3,815

2,819

3,782

3,158

Total noninterest expense

43,428

45,509

38,963

41,212

40,632

Income before income tax expense

21,183

36,976

20,328

19,209

19,816

Income tax expense

3,176

7,460

3,022

1,798

4,150

Net income

$

18,007

$

29,516

$

17,306

$

17,411

$

15,666

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Selected Data and Ratios

As of and for the Three Months

Ended

Jun. 30, 2019

Mar. 31, 2019

Dec. 31, 2018

Sep. 30, 2018

Jun. 30, 2018

Per Share Data:

Basic weighted average shares

outstanding

21,016

20,973

20,975

20,962

21,187

Diluted weighted average shares

outstanding

21,138

21,106

21,113

21,120

21,331

Period-end shares outstanding:

Class A Common Stock

18,740

18,698

18,675

18,682

18,677

Class B Common Stock

2,208

2,213

2,213

2,213

2,215

Book value per share(6)

$

34.92

$

34.29

$

33.03

$

32.39

$

31.78

Tangible book value per share(6)

33.87

33.25

31.98

31.34

30.73

Earnings per share ("EPS"):

Basic EPS - Class A Common Stock

$

0.86

$

1.42

$

0.83

$

0.84

$

0.75

Basic EPS - Class B Common Stock

0.79

1.29

0.76

0.76

0.68

Diluted EPS - Class A Common Stock

0.86

1.41

0.83

0.83

0.74

Diluted EPS - Class B Common Stock

0.78

1.28

0.75

0.76

0.68

Cash dividends declared per Common

share:

Class A Common Stock

$

0.264

$

0.264

$

0.242

$

0.242

$

0.242

Class B Common Stock

0.240

0.240

0.220

0.220

0.220

Performance Ratios:

Return on average assets

1.31

%

2.16

%

1.37

%

1.37

%

1.23

%

Return on average equity

9.88

16.70

10.07

10.31

9.45

Efficiency ratio(7)

63

46

61

64

62

Yield on average interest-earning

assets(5)

5.02

6.47

5.17

4.98

4.79

Cost of average interest-bearing

liabilities

1.32

1.21

1.05

0.98

0.90

Cost of average deposits(8)

0.75

0.69

0.59

0.51

0.44

Net interest spread(5)

3.70

5.26

4.12

4.00

3.89

Net interest margin - Total Company(5)

4.12

5.66

4.46

4.32

4.19

Net interest margin - Core Bank(1)

3.62

3.76

3.85

3.76

3.64

Other Information:

End of period FTEs(9) - Total Company

1,089

1,073

1,051

1,034

1,013

End of period FTEs - Core Bank

1,012

997

968

953

933

Number of full-service banking centers

45

45

45

45

45

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued) (all amounts other

than per share amounts, number of employees, and number of banking

centers are expressed in thousands unless otherwise noted)

Credit Quality Data and Ratios

As of and for the Three Months

Ended

Jun. 30, 2019

Mar. 31, 2019

Dec. 31, 2018

Sep. 30, 2018

Jun. 30, 2018

Credit Quality Asset Balances:

Nonperforming Assets - Total

Company:

Loans on nonaccrual status

$

19,238

$

15,361

$

15,993

$

17,015

$

17,502

Loans past due 90-days-or-more and still

on accrual

166

199

145

254

858

Total nonperforming loans

19,404

15,560

16,138

17,269

18,360

OREO

1,095

216

160

70

—

Total nonperforming assets

$

20,499

$

15,776

$

16,298

$

17,339

$

18,360

Nonperforming Assets - Core

Bank(1):

Loans on nonaccrual status

$

19,238

$

15,361

$

15,993

$

17,015

$

17,502

Loans past due 90-days-or-more and still

on accrual

—

4

13

5

22

Total nonperforming loans

19,238

15,365

16,006

17,020

17,524

OREO

1,095

216

160

70

—

Total nonperforming assets

$

20,333

$

15,581

$

16,166

$

17,090

$

17,524

Delinquent Loans:

Delinquent loans - Core Bank

$

12,524

$

7,727

$

8,875

$

11,840

$

8,703

Delinquent loans - RPG(3)(10)

6,802

26,460

7,087

5,986

4,429

Total delinquent loans - Total Company

$

19,326

$

34,187

$

15,962

$

17,826

$

13,132

Credit Quality Ratios - Total

Company:

Nonperforming loans to total loans

0.43

%

0.36

%

0.39

%

0.42

%

0.44

%

Nonperforming assets to total loans

(including OREO)

0.45

0.37

0.39

0.42

0.44

Nonperforming assets to total assets

0.36

0.29

0.31

0.33

0.35

Allowance for loan and lease losses to

total loans

1.02

1.35

1.08

1.06

1.07

Allowance for loan and lease losses to

nonperforming loans

237

373

277

254

245

Delinquent loans to total loans(2)(10)

0.43

0.80

0.38

0.43

0.31

Net charge-offs to average loans

(annualized)

1.49

0.37

0.42

0.52

1.19

Credit Quality Ratios - Core

Bank:

Nonperforming loans to total loans

0.43

%

0.37

%

0.40

%

0.42

%

0.43

%

Nonperforming assets to total loans

(including OREO)

0.46

0.37

0.40

0.42

0.43

Nonperforming assets to total assets

0.37

0.31

0.31

0.33

0.34

Allowance for loan and lease losses to

total loans

0.75

0.75

0.78

0.78

0.76

Allowance for loan and lease losses to

nonperforming loans

171

205

197

184

179

Delinquent loans to total loans

0.28

0.18

0.22

0.29

0.21

Net charge-offs to average loans

(annualized)

0.04

0.04

0.12

0.04

—

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued)

Segment Data:

Reportable segments are determined by the type of products and

services offered and the level of information provided to the chief

operating decision maker, who uses such information to review

performance of various components of the business (such as banking

centers and business units), which are then aggregated if operating

performance, products/services, and clients are similar.

As of June 30, 2019, the Company was divided into five

reportable segments: Traditional Banking, Warehouse Lending

(“Warehouse”), Mortgage Banking, Tax Refund Solutions (“TRS”), and

Republic Credit Solutions (“RCS”). Management considers the first

three segments to collectively constitute “Core Bank” or “Core

Banking” operations, while the last two segments collectively

constitute Republic Processing Group (“RPG”) operations. The Bank’s

Correspondent Lending channel and the Company’s national branchless

banking platform, MemoryBank®, are considered part of the

Traditional Banking segment.

The nature of segment operations and the primary drivers of net

revenues by reportable segment are provided below:

Reportable Segment:

Nature of Operations:

Primary Drivers of Net

Revenue:

Core Banking:

Traditional Banking

Provides traditional banking products to

clients in its market footprint primarily via its network of

banking centers and to clients outside of its market footprint

primarily via its Digital and Correspondent Lending delivery

channels.

Loans, investments, and deposits.

Warehouse Lending

Provides short-term, revolving credit

facilities to mortgage bankers across the United States.

Mortgage warehouse lines of credit.

Mortgage Banking

Primarily originates, sells and services

long-term, single family, first lien residential real estate loans

primarily to clients in the Bank's market footprint.

Loan sales and servicing.

Republic Processing Group:

Tax Refund Solutions

TRS offers tax-related credit products and

facilitates the receipt and payment of federal and state tax

refunds through Refund Transfer products. The RPS division of TRS

offers general-purpose reloadable cards. TRS and RPS products are

primarily provided to clients outside of the Bank’s market

footprint.

Loans, refund transfers, and prepaid

cards.

Republic Credit Solutions

Offers consumer credit products. RCS

products are primarily provided to clients outside of the Bank’s

market footprint, with a substantial portion of RCS clients

considered subprime or near-prime borrowers.

Unsecured, consumer loans.

The accounting policies used for Republic’s reportable segments

are the same as those described in the summary of significant

accounting policies in the Company’s 2018 Annual Report on Form

10-K. Republic evaluates segment performance using operating

income. The Company allocates goodwill to the Traditional Banking

segment. Republic generally allocates income taxes based on income

before income tax expense unless reasonable and specific segment

allocations can be made. The Company makes transactions among

reportable segments at carrying value.

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued)

Segment information for the quarters and six months ended June

30, 2019 and 2018 follows:

Three Months Ended June 30,

2019

Core Banking

Republic Processing Group

("RPG")

Total

Tax

Republic

Traditional

Warehouse

Mortgage

Core

Refund

Credit

Total

Total

(dollars in thousands)

Banking

Lending

Banking

Banking

Solutions

Solutions

RPG

Company

Net interest income

$

41,877

$

3,957

$

170

$

46,004

$

710

$

7,232

$

7,942

$

53,946

Provision for loan and lease losses

1,427

417

—

1,844

392

2,224

2,616

4,460

Net refund transfer fees

—

—

—

—

3,629

—

3,629

3,629

Mortgage banking income

—

—

2,416

2,416

—

—

—

2,416

Program fees

—

—

—

—

50

987

1,037

1,037

Other noninterest income

7,853

13

56

7,922

89

32

121

8,043

Total noninterest income

7,853

13

2,472

10,338

3,768

1,019

4,787

15,125

Total noninterest expense

37,764

792

1,354

39,910

2,849

669

3,518

43,428

Income before income tax expense

10,539

2,761

1,288

14,588

1,237

5,358

6,595

21,183

Income tax expense

744

621

270

1,635

288

1,253

1,541

3,176

Net income

$

9,795

$

2,140

$

1,018

$

12,953

$

949

$

4,105

$

5,054

$

18,007

Period-end assets

$

4,805,449

$

738,300

$

20,568

$

5,564,317

$

36,834

$

121,983

$

158,817

$

5,723,134

Net interest margin

3.75

%

2.49

%

NM

3.62

%

NM

NM

NM

4.12

%

Net-revenue concentration*

72

%

6

%

4

%

82

%

6

%

12

%

18

%

100

%

Three Months Ended June 30,

2018

Core Banking

Republic Processing Group

("RPG")

Total

Tax

Republic

Traditional

Warehouse

Mortgage

Core

Refund

Credit

Total

Total

(dollars in thousands)

Banking

Lending

Banking

Banking

Solutions

Solutions

RPG

Company

Net interest income

$

39,348

$

4,164

$

103

$

43,615

$

328

$

7,141

$

7,469

$

51,084

Provision for loan and lease losses

523

250

—

773

(888)

5,047

4,159

4,932

Net refund transfer fees

—

—

—

—

3,473

—

3,473

3,473

Mortgage banking income

—

—

1,316

1,316

—

—

—

1,316

Program fees

—

—

—

—

124

1,199

1,323

1,323

Other noninterest income

7,725

11

49

7,785

80

319

399

8,184

Total noninterest income

7,725

11

1,365

9,101

3,677

1,518

5,195

14,296

Total noninterest expense

35,415

850

1,176

37,441

2,273

918

3,191

40,632

Income before income tax expense

11,135

3,075

292

14,502

2,620

2,694

5,314

19,816

Income tax expense

2,168

702

62

2,932

609

609

1,218

4,150

Net income

$

8,967

$

2,373

$

230

$

11,570

$

2,011

$

2,085

$

4,096

$

15,666

Period-end assets

$

4,501,539

$

634,452

$

17,998

$

5,153,989

$

27,192

$

84,764

$

111,956

$

5,265,945

Net interest margin

3.71

%

3.08

%

NM

3.64

%

NM

NM

NM

4.19

%

Net-revenue concentration*

73

%

6

%

2

%

81

%

6

%

13

%

19

%

100

%

*Net revenues represent total net interest income plus

noninterest income.

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued)

Six Months Ended June 30,

2019

Core Banking

Republic Processing Group

("RPG")

Total

Tax

Republic

Traditional

Warehouse

Mortgage

Core

Refund

Credit

Total

Total

(dollars in thousands)

Banking

Lending

Banking

Banking

Solutions

Solutions

RPG

Company

Net interest income

$

83,224

$

6,852

$

272

$

90,348

$

21,148

$

14,749

$

35,897

$

126,245

Provision for loan and lease losses

1,616

642

—

2,258

13,826

5,607

19,433

21,691

Net refund transfer fees

—

—

—

—

20,729

—

20,729

20,729

Mortgage banking income

—

—

3,955

3,955

—

—

—

3,955

Program fees

—

—

—

—

196

1,915

2,111

2,111

Other noninterest income

14,749

23

96

14,868

220

659

879

15,747

Total noninterest income

14,749

23

4,051

18,823

21,145

2,574

23,719

42,542

Total noninterest expense

73,314

1,550

2,674

77,538

9,963

1,436

11,399

88,937

Income before income tax expense

23,043

4,683

1,649

29,375

18,504

10,280

28,784

58,159

Income tax expense

2,509

1,054

346

3,909

4,318

2,409

6,727

10,636

Net income

$

20,534

$

3,629

$

1,303

$

25,466

$

14,186

$

7,871

$

22,057

$

47,523

Period-end assets

$

4,805,449

$

738,300

$

20,568

$

5,564,317

$

36,834

$

121,983

$

158,817

$

5,723,134

Net interest margin

3.81

%

2.63

%

NM

3.69

%

NM

NM

NM

4.88

%

Net-revenue concentration*

58

%

4

%

3

%

65

%

25

%

10

%

35

%

100

%

Six Months Ended June 30,

2018

Core Banking

Republic Processing Group

("RPG")

Total

Tax

Republic

Traditional

Warehouse

Mortgage

Core

Refund

Credit

Total

Total

(dollars in thousands)

Banking

Lending

Banking

Banking

Solutions

Solutions

RPG

Company

Net interest income

$

77,536

$

7,755

$

175

$

85,466

$

19,014

$

14,269

$

33,283

$

118,749

Provision for loan and lease losses

1,462

271

—

1,733

12,501

7,953

20,454

22,187

Net refund transfer fees

—

—

—

—

19,825

—

19,825

19,825

Mortgage banking income

—

—

2,336

2,336

—

—

—

2,336

Program fees

—

—

—

—

183

2,836

3,019

3,019

Other noninterest income

14,727

19

87

14,833

1,190

638

1,828

16,661

Total noninterest income

14,727

19

2,423

17,169

21,198

3,474

24,672

41,841

Total noninterest expense

68,807

1,689

2,380

72,876

8,798

2,003

10,801

83,677

Income before income tax expense

21,994

5,814

218

28,026

18,913

7,787

26,700

54,726

Income tax expense

3,940

1,329

46

5,315

4,463

1,813

6,276

11,591

Net income

$

18,054

$

4,485

$

172

$

22,711

$

14,450

$

5,974

$

20,424

$

43,135

Period-end assets

$

4,501,539

$

634,452

$

17,998

$

5,153,989

$

27,192

$

84,764

$

111,956

$

5,265,945

Net interest margin

3.65

%

3.13

%

NM

3.60

%

NM

NM

NM

4.85

%

Net-revenue concentration*

57

%

5

%

2

%

64

%

25

%

11

%

36

%

100

%

*Net revenues represent total net interest income plus

noninterest income.

Republic Bancorp, Inc. Financial Information Second

Quarter 2019 Earnings Release (continued)

1) “Core Bank” or “Core Banking” operations consist of the

Traditional Banking, Warehouse Lending, and Mortgage Banking

segments.

2) The delinquent loans to total loans ratio equals loans

30-days-or-more past due divided by total loans. Depending on loan

class, loan delinquency is determined by the number of days or the

number of payments past due.

3) Republic Processing Group operations consist of the Tax

Refund Solutions and Republic Credit Solutions segments.

4) The Company adopted Accounting Standard Update 2016-02,

effective January 1, 2019. ASU 2016-02 requires the Company, as

lessee, record the present value of its expected operating lease

payments on its balance sheet as operating lease liabilities, with

offsetting right-of-use assets for the respective leased property.

Prior to January 1, 2019, operating leases were not recorded on a

lessee’s balance sheets in this manner.

5) The amount of loan fee income can meaningfully impact total

interest income, loan yields, net interest margin, and net interest

spread. The amount of loan fee income included in total interest

income was $8.4 million and $8.5 million for the quarters ended

June 30, 2019 and 2018. The amount of loan fee income included in

total interest income was $37.0 million and $35.4 million for the

six months ended June 30, 2019 and 2018.

The amount of loan fee income included in total interest income

per quarter was as follows: $8.4 million (quarter ended June 30,

2019); $28.6 million (quarter ended March 31, 2019); $9.4 million

(quarter ended December 31, 2018); $9.0 million (quarter ended

September 30, 2018); and $8.5 million (quarter ended June 30,

2018).

Interest income for Easy Advances (“EAs”) is composed entirely

of loan fees. The loan fees disclosed above included EA fees of

$19.1 million and $17.8 million for the first six months ended June

30, 2019 and 2018. EAs are only offered during the first two months

of each year.

6) The following table provides a reconciliation of total

stockholders’ equity in accordance with U.S. Generally Accepted

Accounting Principles (“GAAP”) to tangible stockholders’ equity in

accordance with applicable regulatory requirements, a non-GAAP

disclosure. The Company provides the tangible book value per share,

a non-GAAP measure, in addition to those defined by banking

regulators, because of its widespread use by investors as a means

to evaluate capital adequacy.

Quarterly Comparison

(dollars in thousands, except per share

data)

Jun. 30, 2019

Mar. 31, 2019

Dec. 31, 2018

Sep. 30, 2018

Jun. 30, 2018

Total stockholders' equity - GAAP (a)

$

731,428

$

717,091

$

689,934

$

676,810

$

664,008

Less: Goodwill

16,300

16,300

16,300

16,300

16,300

Less: Mortgage servicing rights

5,158

4,935

4,919

4,925

4,914

Less: Core deposit intangible

562

608

654

705

756

Tangible stockholders' equity - Non-GAAP

(c)

$

709,408

$

695,248

$

668,061

$

654,880

$

642,038

Total assets - GAAP (b)

$

5,723,134

$

5,365,768

$

5,240,404

$

5,222,354

$

5,265,945

Less: Goodwill

16,300

16,300

16,300

16,300

16,300

Less: Mortgage servicing rights

5,158

4,935

4,919

4,925

4,914

Less: Core deposit intangible

562

608

654

705

756

Tangible assets - Non-GAAP (d)

$

5,701,114

$

5,343,925

$

5,218,531

$

5,200,424

$

5,243,975

Total stockholders' equity to total assets

- GAAP (a/b)

12.78

%

13.36

%

13.17

%

12.96

%

12.61

%

Tangible stockholders' equity to tangible

assets - Non-GAAP (c/d)

12.44

%

13.01

%

12.80

%

12.59

%

12.24

%

Number of shares outstanding (e)

20,948

20,911

20,888

20,895

20,892

Book value per share - GAAP (a/e)

$

34.92

$

34.29

$

33.03

$

32.39

$

31.78

Tangible book value per share - Non-GAAP

(c/e)

33.87

33.25

31.98

31.34

30.73

7) The efficiency ratio, a non-GAAP measure, equals total

noninterest expense divided by the sum of net interest income and

noninterest income. The ratio excludes net gains (losses) on sales,

calls, and impairment of investment securities, if applicable.

8) The cost of average deposits ratio equals annualized total

interest expense on deposits divided by total average

interest-bearing deposits plus total average noninterest-bearing

deposits.

9) FTEs – Full-time-equivalent employees.

10) Delinquent loans for the RPG segment included $19 million of

EAs at March 31, 2019. EAs are only offered during the first two

months of each year. EAs do not have a contractual due date but are

eligible for delinquency consideration three weeks after the

taxpayer-customer’s tax return is submitted to the applicable tax

authority. All unpaid EAs are charged-off by the end of the second

quarter of each year.

NM – Not meaningful

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190719005009/en/

Republic Bancorp, Inc. Kevin Sipes Executive Vice President

& Chief Financial Officer (502) 560-8628

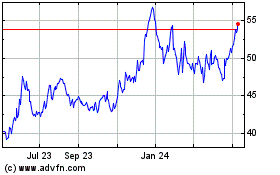

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Apr 2023 to Apr 2024