Current Report Filing (8-k)

May 31 2019 - 4:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 29, 2019

REPLIGEN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-14656

|

|

04-2729386

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

41 Seyon Street, Bldg. 1, Suite 100, Waltham, MA 02453

(Address of Principal Executive Offices) (Zip Code)

(781)

250-0111

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

RGEN

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 29, 2019, Repligen Corporation (the “

Company

”) and

HRE-S

Centerpoint, LLC (the

“

Landlord

”) entered into a Fifth Amendment (the “

Amendment

”) to the lease agreement dated October 10, 2001, as amended, for the leased premises located at 41 Seyon Street, Waltham, Massachusetts. This facility

currently serves as the corporate headquarters for the Company and primary location for all manufacturing, research and development, sales and marketing and administrative operations.

Under the terms of the Amendment, the Company and Landlord have mutually agreed to expand the leased premises within this facility to add an additional 32,541

square feet of space (the “

Expansion Premises

”) to the existing premises of 75,594 square feet of space (the “

Initial Premises

”). The term of the lease for the portion of the Expansion Premises consisting of 17,680

square feet of space (the “

Phase 1 Expansion Space

”) is expected to commence no later than November 1, 2019 (the “

Phase 1 Expansion Commencement Date

”). The term for the remaining 14,861 square feet of the

Expansion Premises (the “

Phase 2 Expansion Space

”) is expected to commence no later than August 1, 2020 (the “

Phase 2 Expansion Commencement Date

”). The term of the Expansion Premises will continue for ten

years following the Phase 2 Expansion Commencement Date, and is expected to expire July 31, 2030. Per the Amendment, the Company has the option to extend the term of the Initial Premises, expected to expire on May 31, 2023, for two

additional periods of five years each.

The initial fixed rental rate is $29.00 per rentable square foot of the Expansion Premises per annum, and will

increase at a rate of $1.00 per annum. Fixed rent with respect to 10,000 square feet of the Phase 1 Expansion Space will commence on the Phase 1 Expansion Commencement Date, and rent for the full 17,680 square feet of the Phase 1 Expansion Space

will commence on November 1, 2020. Fixed rent with respect to the full 14,861 square feet of the Phase 2 Expansion Space will commence on the Phase 2 Expansion Commencement Date. Under the terms of the Amendment, the Company will receive an

allowance from the Landlord of up to approximately $2.0 million to help fund tenant improvements.

The Amendment is filed as Exhibit 10.1 to this

Current Report on Form

8-K,

and the description of the Amendment is qualified in its entirety by reference to such exhibit.

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

On May 31, 2019, pursuant to the Stock Purchase Agreement, dated as of April 25, 2019 (the “

Purchase Agreement

”), by and among the

Company, C Technologies, Inc., a New Jersey corporation (the “

Seller

”) and Craig Harrison, an individual and the sole stockholder of the Seller (the “

Stockholder

”), the Company completed its previously announced

purchase of all of the issued and outstanding capital stock of the Seller (the “

Share Purchase

”).

At the closing of the Share Purchase,

the Company paid approximately $195 million in cash (the “

Cash Consideration

”) and issued 779,221 unregistered shares of the Company’s common stock (the “

Consideration Shares

”) as consideration for all of

the issued and outstanding shares of capital stock of the Seller. Pursuant to the Purchase Agreement, approximately $3.4 million of the Cash Consideration was placed into a third party escrow account to satisfy any payments due to the Company

for certain adjustments to the calculation of the working capital of the Seller and certain indemnification obligations of the Stockholder.

A copy of the

Purchase Agreement is attached as Exhibit 2.1 to the Company’s Current Report on Form

8-K

filed on April 26, 2019, and certain financial information relating to the Share Purchase has been filed as

Exhibits 99.2, 99.3 and 99.4 to the Company’s Current Report on Form

8-K/A

filed on April 29, 2019. The foregoing description of the Purchase Agreement is not complete and is qualified in its

entirety by reference to the full text of the Purchase Agreement.

|

Item 3.02.

|

Unregistered Sale of Equity Securities.

|

The description of the Consideration Shares in Item 2.01 of this Current Report on Form

8-K

is incorporated herein by

reference. The issuance of the Consideration Shares will not be registered under the Securities Act of 1933, as amended (the “

Securities Act

”), in reliance upon the exemption from registration provided by Rule 506 of Regulation

D promulgated under the Securities Act.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(a)

Financial statements of business acquired.

The Company intends to file the financial statements relating to the closing of the Share Purchase described in Item 2.01 above under cover of

Form 8-K/A

with the Commission no later than 71 calendar days after the date of this Current Report on Form

8-K

was required to be filed.

(b)

Pro forma financial information.

The Company intends to furnish pro forma financial information relating to the closing of the Share Purchase described in Item 2.01 above under cover of

Form

8-K/A

with the Commission no later than 71 calendar days after the date of this Current Report on Form

8-K

was required to be filed.

(d)

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION

|

|

|

|

|

|

|

Date: May 31, 2019

|

|

|

|

By:

|

|

/s/ Tony J. Hunt

|

|

|

|

|

|

|

|

Tony J. Hunt

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

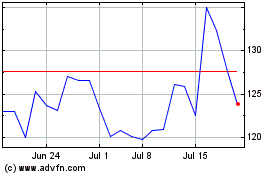

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024