|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

|

SCHEDULE 14A INFORMATION

|

|

|

|

|

|

|

|

|

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant

|

[ x ]

|

|

|

|

|

|

Filed by a party other than the Registrant

|

[ ]

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ x ]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Under Rule 14a-12

|

|

|

|

|

|

|

|

|

|

RENASANT CORPORATION

|

|

|

|

|

|

|

|

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

[ x ]

|

No fee required.

|

|

|

|

|

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of filing.

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

RENASANT CORPORATION

209 Troy Street

Tupelo, Mississippi 38804-4827

March 14, 2019

Dear Shareholder:

On behalf of the board of directors, we cordially invite you to attend the

2019

Annual Meeting of Shareholders of Renasant Corporation. The annual meeting will be held beginning at 1:30 p.m., Central time, on Tuesday,

April 23, 2019

at the principal offices of Renasant Bank, 209 Troy Street, Tupelo, Mississippi 38804-4827. The formal notice of the annual meeting appears on the next page.

At the annual meeting, you will be asked to (1) elect one Class 1 director, to serve a two-year term expiring in 2021, (2) elect five Class 2 directors, each to serve a three-year term expiring in 2021, (3) adopt, in a non-binding advisory vote, a resolution approving the compensation of our named executive officers, as described in the proxy statement, (4) ratify the appointment of HORNE LLP as our independent registered public accountants for

2019

, and (5) transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof.

The accompanying proxy statement provides detailed information concerning the matters to be acted upon at the annual meeting. We urge you to review this proxy statement and each of the proposals carefully. It is important that your views be represented at the annual meeting regardless of the number of shares you own or whether you are able to attend the annual meeting in person.

On

March 14, 2019

, we posted on our internet website, http://www.envisionreports.com/RNST,

a copy of our proxy statement and proxy card for the 2019 Annual Meeting of Shareholders and our Annual Report on Form 10-K for the year ended December 31, 2018 (which serves as our Annual Report to Shareholders), and we mailed these materials to our shareholders who are individuals and owners of record of our stock. On the same date, institutional shareholders who are owners of record of our stock and other shareholders who previously elected to receive our proxy materials over the internet were mailed a notice containing instructions on how to access our proxy materials and vote online.

You may vote your shares via a toll-free telephone number or on the internet. If you received a paper copy of the proxy card, you may vote by signing, dating and mailing the accompanying proxy card in the envelope provided. Further voting instructions can be found beginning on page 52

of the proxy statement. As always, if you are the record owner of our stock, you may vote in person at the annual meeting.

On behalf of our board of directors, I would like to express our appreciation for your continued interest in Renasant Corporation.

Sincerely,

E. Robinson McGraw

Chairman of the Board and

Executive Chairman

RENASANT CORPORATION

209 Troy Street

Tupelo, Mississippi 38804-4827

NOTICE OF ANNUAL MEETING

|

|

|

|

TIME AND PLACE

|

1:30 p.m., Central time, on Tuesday,

April 23, 2019

|

Renasant Bank

209 Troy Street

Tupelo, Mississippi 38804-4827

|

|

|

|

ITEMS OF BUSINESS

|

1. To elect one Class 1 director who will serve a two-year term expiring in 2021;

|

|

|

|

|

2.

|

To elect five Class 2 directors who will each serve a three-year term expiring in 2022;

|

|

|

|

|

3.

|

To adopt, in a non-binding advisory vote, a resolution approving the compensation of our named executive officers;

|

|

|

|

|

4.

|

To ratify the appointment of HORNE LLP as our independent registered public accountants for 2019; and

|

|

|

|

|

5.

|

To transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof.

|

|

|

|

|

RECORD DATE

|

You can vote if you were a shareholder of record as of the close of business on

February 22, 2019

.

|

|

|

|

|

ANNUAL REPORT

|

If you received a paper copy of the proxy statement and proxy card, our Annual Report on Form 10-K for the year ended

December 31, 2018

, which serves as our Annual Report to Shareholders but is not part of our solicitation materials, is also enclosed. Our proxy statement, proxy card and Annual Report are also accessible at http://www.envisionreports.com/RNST

.

|

|

|

|

|

PROXY VOTING

|

It is important that your shares be represented and voted at the annual meeting. You may vote your shares via a toll-free telephone number or on the internet. If you received a paper copy of the proxy statement, you may vote your shares by signing, dating and mailing the accompanying proxy card in the envelope provided. Instructions about the three methods of voting are contained in the proxy statement. Any proxy may be revoked at any time prior to its exercise at the annual meeting.

|

By Order of the Board of Directors,

C. Mitchell Waycaster

President and Chief Executive Officer

Tupelo, Mississippi

March 14, 2019

Important Notice Regarding the Availability of Proxy Materials for

the Shareholders Meeting to be held on April 23, 2019:

Renasant's 2019 proxy statement and proxy card and its Annual Report on Form 10-K for the year

ended December 31, 2018 are available at http://www.envisionreports.com/RNST

|

|

|

|

|

|

|

|

Page

|

|

|

PROXY SUMMARY

|

1

|

|

|

Voting

|

1

|

|

|

Completion of Our Succession Plan

|

1

|

|

|

2018 Financial Performance and Relationship to Compensation

|

2

|

|

|

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

|

4

|

|

|

Governing Documents and Practices

|

4

|

|

|

Board Governance

|

5

|

|

|

Board of Directors

|

6

|

|

|

Board Leadership Structure

|

6

|

|

|

Board Committees

|

7

|

|

|

Role of the Board in Risk Oversight

|

8

|

|

|

Director Selection

|

10

|

|

|

Director Independence

|

10

|

|

|

Indebtedness of Directors and Executive Officers

|

11

|

|

|

Other Related Person Transactions

|

11

|

|

|

Legal Proceedings Involving a Director or Executive Officer and the Company or the Bank

|

12

|

|

|

Shareholder Communications

|

12

|

|

|

BOARD MEMBERS AND COMPENSATION

|

15

|

|

|

Members of the Board of Directors

|

15

|

|

|

Director Compensation

|

19

|

|

|

EXECUTIVE OFFICERS

|

22

|

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

24

|

|

|

Say-on-Pay

|

24

|

|

|

Changes to Our Performance Incentives

|

24

|

|

|

Features and Objectives of Our 2018 Compensation Program

|

25

|

|

|

Risk Mitigation Practices and Compensation Committee Process

|

27

|

|

|

Compensation Decisions Made for 2018

|

31

|

|

|

COMPENSATION COMMITTEE REPORT

|

35

|

|

|

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

|

35

|

|

|

COMPENSATION TABLES

|

36

|

|

|

2018 Summary Compensation Table

|

36

|

|

|

Grants of Plan-Based Awards

|

39

|

|

|

Outstanding Equity Awards as of December 31,2018

|

40

|

|

|

Option Exercises and Vested Restricted Stock

|

40

|

|

|

Pension and SERP Benefits

|

41

|

|

|

Non-Qualified Deferred Compensation

|

41

|

|

|

CEO Pay Ratio

|

42

|

|

|

Payments and Rights on Termination or Change in Control

|

43

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

REPORT OF THE AUDIT COMMITTEE

|

50

|

|

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

|

51

|

|

|

VOTING YOUR SHARES

|

52

|

|

|

Record Date; Shares Outstanding

|

52

|

|

|

Voting

|

52

|

|

|

Quorum

|

52

|

|

|

How Votes are Counted

|

52

|

|

|

Required Vote for Each Proposal

|

53

|

|

|

Shares Held by Renasant 401(k) Plan

|

53

|

|

|

Solicitation and Revocation of Proxies

|

53

|

|

|

|

54

|

|

|

Proposal 1 - Election of One Class 1 Director

|

54

|

|

|

Proposal 2 - Election of Five Class 2 Directors

|

54

|

|

|

Proposal 3 - Advisory Vote on Executive Compensation

|

55

|

|

|

Proposal 4 - Ratification of the Appointment of HORNE LLP as Independent Registered Public Accountants for 2019

|

55

|

|

|

|

55

|

|

|

STOCK OWNERSHIP

|

56

|

|

|

Common Stock Ownership Greater than 5%

|

56

|

|

|

Beneficial Ownership of Common Stock by Directors and Executive Officers

|

56

|

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

59

|

|

|

|

60

|

|

In this proxy statement, Renasant Corporation is referred to as “Renasant,” “we,” “our,” “us” or the “Company,” and Renasant Bank is referred to as the “Bank.”

We are providing this proxy statement to the shareholders of Renasant Corporation in connection with the solicitation of proxies by its board of directors for use at the 2019 Annual Meeting of Shareholders of Renasant Corporation to be held at 1:30 p.m., Central time, on Tuesday,

April 23, 2019

at the principal offices of Renasant Bank, 209 Troy Street, Tupelo, Mississippi 38804-4827, including any adjournments or postponements of the meeting.

As permitted by Securities and Exchange Commission, or SEC, rules, we are making this proxy statement, our proxy card and our Annual Report on Form 10-K for the year ended

December 31, 2018

, which serves as our Annual Report to Shareholders, available to our shareholders electronically. On

March 14, 2019

, we posted these materials on our internet website, http://www.envisionreports.com/RNST, and we mailed a notice (the “Notice”) containing instructions on how to access our proxy materials and vote online to institutional and other shareholders who previously elected to receive our proxy materials over the internet. We also mailed this proxy statement, our proxy card and our Annual Report on Form 10-K for the year ended

December 31, 2018

, to individual shareholders on the same date.

This section of our proxy statement is a summary of the proposals to be voted on at our annual meeting and our voting procedures. This section also describes the completion of our succession plan and provides select 2018 financial information that is intended to illustrate our ongoing commitment to link our performance and executive pay. More information about these and other matters is contained in the remainder of this proxy statement. Please review the entire proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2018 before you vote.

VOTING

Proposals.

Four proposals will be voted on at our annual meeting of shareholders:

|

|

|

|

|

|

|

|

More Information

|

Board Recommendation

|

|

Proposal 1

|

Page 54

|

FOR the nominee

|

|

Election of Class 1 Director (one nominee)

|

|

|

|

|

|

|

|

Proposal 2

|

Pages 54-55

|

FOR each nominee

|

|

Election of Class 2 Directors (five nominees)

|

|

|

|

|

|

|

|

Proposal 3

|

Page 55

|

FOR

|

|

Approval of an advisory resolution approving the compensation of our named executive officers

|

|

|

|

|

|

|

|

Proposal 4

|

Page 55

|

FOR

|

|

Ratification of the appointment of HORNE LLP as our independent registered public accountants for 2019

|

|

|

Voting Procedures.

Votes may be cast in any of the following ways:

|

|

|

|

•

|

Using the internet, at www.envisionreports.com/RNST. To vote via the internet, you will need the control number that is included on your proxy card or in the Notice, which was furnished to our institutional shareholders and shareholders who elected to receive proxy materials over the internet on March 14, 2019.

|

|

|

|

|

•

|

Using a toll-free telephone number, at 1-800-652-VOTE (8683). You will need the control number that is included on your proxy card or in the Notice.

|

|

|

|

|

•

|

By completing and mailing your proxy card to the address included on the card, if you received a paper copy of the proxy statement and proxy card.

|

|

|

|

|

•

|

In person, if you attend our annual meeting and are the record owner of our common stock or you obtain a broker representation letter from your bank, broker or other holder of our common stock.

|

It is important that your shares be represented and voted at our annual meeting. More information about our voting procedures, attendance at our meeting and revoking a proxy previously given may be found below in the “

Voting Your Shares

” section below.

COMPLETION OF OUR SUCCESSION PLAN

One of the Company’s most important strategic objectives has been the orderly succession of Mr. McGraw as our chief executive officer. The succession was completed as of May 1, 2018, when Mr. McGraw transitioned to the position of executive chairman, and C. Mitchell Waycaster assumed the position of our chief executive officer, and our chief financial officer, Kevin D. Chapman, fully assumed the position as our chief operating officer.

2018 FINANCIAL PERFORMANCE AND RELATIONSHIP TO COMPENSATION

Maintaining the Link Between Pay and Performance.

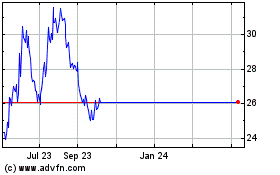

Like his predecessor, Mr. Waycaster has continued to drive increases in shareholder value. As the tables below indicate, in 2018 our diluted earnings per share again increased compared to the prior year. Total shareholder return decreased from 2017 to 2018, but we believe this decline is attributable to the decline in the market price of our common stock over the course of 2018, similar to the decline in financial institution stock prices generally during 2018. The compensation paid to our chief executive officer has remained relatively stable, with the amount of compensation we paid to Mr. Waycaster during 2018 somewhat below that paid to his predecessor, Mr. McGraw, in 2017.

During the same period, in addition to our diluted EPS growth, our return on assets and return on equity have also increased, as demonstrated in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

Diluted EPS (GAAP)

|

$2.79

|

|

$1.96

|

|

$2.17

|

|

$1.88

|

|

$1.88

|

|

Diluted EPS, with exclusions (non-GAAP)

(1)(2)

|

$3.00

|

|

$2.42

|

|

$2.31

|

|

$2.11

|

|

$1.89

|

|

Return on Average Assets (GAAP)

|

1.32

|

%

|

|

0.97

|

%

|

|

1.08

|

%

|

|

0.99

|

%

|

|

1.02

|

%

|

|

Return on Average Tangible Assets, with exclusions (non-GAAP)

(1)(2)

|

1.58

|

%

|

|

1.32

|

%

|

|

1.28

|

%

|

|

1.23

|

%

|

|

1.16

|

%

|

|

Return on Average Shareholders’ Equity (GAAP)

|

8.64

|

%

|

|

6.68

|

%

|

|

8.15

|

%

|

|

7.76

|

%

|

|

8.61

|

%

|

|

Return on Average Tangible Shareholders' Equity, with exclusions (non-GAAP)

(1)(2)

|

17.14

|

%

|

|

14.48

|

%

|

|

16.23

|

%

|

|

16.10

|

%

|

|

16.37

|

%

|

|

|

|

|

(1)

|

Exclusions include charges with respect to which we are unable to accurately predict when these charges will be incurred or, when incurred, the amount of the charge. For 2018, these charges were merger and conversion expenses on an after-tax basis.

|

|

|

|

|

(2)

|

Diluted EPS, with exclusions, return on average tangible assets, with exclusions, and return on average tangible shareholders’ equity, with exclusions, are non-GAAP financial measures used by management to evaluate ongoing operating results and to assess ongoing profitability. For a reconciliation of these measures to their most comparable GAAP measures, please see (a) with respect to 2016, 2017 and 2018, as to diluted EPS, the “Results of Operations-Net Income” section and, as to return on average tangible assets and return on average tangible shareholders’ equity, the “Non-GAAP Financial Measures” section, each in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in our Annual Report on Form 10-K for the year ended December 31, 2018, and (b) with respect to 2014 and 2015, as to diluted EPS, the “Results of Operations-Net Income” section and, as to return on average tangible assets and return on average tangible shareholders’ equity, the “Non-GAAP Financial Measures” section, each in Item 7, Management’s Discussion and

|

Analysis of Financial Condition and Results of Operations, in our Annual Report on Form 10-K for the year ended December 31, 2016.

Additional 2018 Results

. In 2018, the Company also completed certain strategic objectives and achieved favorable operational and financial results:

|

|

|

|

a

|

We recorded our highest level of annual earnings in 2018, with net income of $146.9 million, marking our sixth consecutive year of record net income. Our diluted EPS of $2.79 represented an $0.83 improvement over 2017. Our 2017 diluted EPS was impacted by our writedown of our net deferred tax assets stemming from changes in tax rates effected by the Tax Cuts and Jobs Act enacted in December 2017. However, even excluding the $0.31 reduction to diluted EPS as a result of the deferred tax asset writedown, our 2018 diluted EPS grew approximately 23% from 2017.

|

|

|

|

|

a

|

We completed our acquisition of Brand Group Holdings, Inc. and its subsidiary The Brand Banking Company (which we refer to collectively as “Brand” in this proxy statement) on September 1, 2018. By acquiring Brand, we added 13 locations throughout the greater Atlanta area, one of our strategic growth markets. Also, as of the acquisition date (and prior to purchase accounting adjustments), we acquired $2.0 billion in assets, including $1.6 billion in loans, and $1.7 billion in deposits.

|

|

|

|

|

a

|

We increased our annual dividend twice in 2018. The annual dividend now stands at $0.84 per share, an approximately 10% increase from 2017.

|

|

|

|

|

a

|

In 2018, in addition to the new locations added in the Brand merger, we expanded our geographic footprint in Tennessee and Georgia through new branch openings, and we also added market leaders and producers throughout our footprint, which, together with production from our existing locations, contributed to our non-purchased loan growth of over 14% from 2017.

|

|

|

|

|

a

|

Our asset quality metrics continued to remain strong in 2018. Total non-purchased non-performing assets remained flat from December 31, 2017 to December 31, 2018 even as our total assets increased. Net loan charge-offs were 0.05% of average loans for 2018 compared to 0.06% of average loans for 2017. As a percentage of total assets, all credit metrics, including nonperforming assets, loans 30-89 days past due and our internal watch list were at or near historical lows at the end of 2018.

|

|

|

|

|

|

|

|

|

|

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

|

GOVERNING DOCUMENTS AND PRACTICES

Code of Ethics.

We expect our directors, officers and employees to act and make decisions that are in our best interests, and we discourage situations which present a conflict between our interests and their own personal interests. Under our Code of Business Conduct and Ethics, our “Code of Ethics,” our directors, officers and employees may not engage in any business or conduct, or enter into any contract or arrangement, that would give rise to an actual or potential conflict of interest without the prior approval of our board or other appropriate supervisor. We require our directors, officers and employees to annually certify that they have read and understand their obligations under the Code of Ethics. A copy of our Code of Ethics is available at www.renasant.com by clicking on “Corporate Overview” under the “Investor Relations” tab, then clicking on “Governance Documents” and then “Code of Ethics.”

Committee Charters.

The board of directors has five standing committees: an executive committee, an audit committee, a compensation committee, an enterprise risk management committee, or “ERM committee,” and a nominating and corporate governance committee, or “nominating committee.” Each committee is governed by a written charter, copies of which are available at www.renasant.com, by clicking on “Corporate Overview” under the “Investor Relations” tab, then on “Governance Documents” and then selecting the desired charter.

Insider Trading Policy.

The board of directors has adopted a policy designed to prevent insider trading of our securities. Our insider trading policy generally prohibits our directors, officers and employees, their immediate family members and entities that they control from purchasing or selling our securities while in possession of material nonpublic information and from disclosing material nonpublic information to third parties. An additional restriction applies to our directors, senior executive officers and certain other individuals, such as senior accounting staff: these individuals may trade in our securities only during a “trading window” (and provided that he or she is not otherwise in possession of material nonpublic information). The trading window opens two trading days after our quarterly earnings release and closes early in the last month of each quarter. Annually our directors, officers and employees must certify that they have reviewed our insider trading policy and understand their obligations under the policy.

In 2018, the board approved updates to our insider trading policy. The board added a “pre-clearance” requirement, applicable to those individuals who may trade only during a trading window, whom we refer to as “covered persons.” Under this requirement, a covered person may not trade in our securities, even during an open trading window, unless a committee made up of our chief operating officer, our chief accounting officer and our governance counsel approves the transaction. This pre-clearance requirement enhances our efforts to prevent insider trading by giving us the opportunity to evaluate a proposed trade in advance and independently decide whether the covered person possesses material nonpublic information even though the trading window is open. The insider trading policy was also updated to clarify that a significant cybersecurity incident or disruption to our information technology infrastructure constitutes a “material” event that precludes trading in our securities until appropriate disclosures have been made.

Review and Approval of Related Person Transactions.

The board of directors is responsible for reviewing and approving or ratifying all material transactions between us or our subsidiaries and any of our directors or executive officers, their immediate family members and businesses with which they are associated (we refer to these persons and entities as “related persons”). The board reviews transactions involving related persons to ensure that the terms of any such transaction are substantially the same as the terms that would be expected if the transaction were with a person or entity that is not related to us or the Bank. To identify related person transactions, each year we require our directors and executive officers to complete Director and Officer Questionnaires. These questionnaires require our directors and executive officers to list all related persons and any transactions with us in which a related person has an interest. In addition, we review loan and deposit balances as well as accounts payable to our vendors to identify relationships with related persons. When the board reviews and approves or ratifies related person transactions, the director or executive officer associated with the matter is not present while discussions and deliberations are held and, if the transaction involves a director, this director must abstain from voting on the matter. The types of transactions that must be reviewed and approved or ratified include extensions of credit, real property leases and other business relationships.

Other than our Code of Ethics, our related person transaction policy is not in writing. However, we have adopted written policies to comply with regulatory requirements and restrictions applicable to us, including Sections 23A and 23B of the Federal Reserve Act (which govern certain transactions by the Bank with its affiliates) and the Federal Reserve’s Regulation O (which governs loans by the Bank to its executive officers, directors and principal shareholders).

BOARD GOVERNANCE

Retirement Policy.

Our Amended and Restated Bylaws, which we refer to as our “Bylaws,” include a written retirement policy applicable to our board of directors:

|

|

|

|

•

|

A director may not stand for election after reaching age 72; and

|

|

|

|

|

•

|

Any director who attains age 72 during his or her elected term may serve only until the next regular meeting of our shareholders.

|

The board may waive the requirement and permit a director to stand for reelection after he or she reaches the age of 72, or the board may waive the requirement that a director who has attained 72 resign at the next regular meeting of shareholders. To be effective, a waiver must be approved by the affirmative vote of at least two-thirds of the directors then in office, excluding the director to whom the waiver vote applies. Mr. McGraw is age 72. At its January 2019 meeting, our board unanimously voted to nominate Mr. McGraw for election as a Class 2 director. Accordingly, assuming Mr. McGraw is elected at the annual meeting, he may serve as a director until the 2020 annual meeting (rather than the 2022 annual meeting, as is the case for our other Class 2 director nominees), subject to his receipt of a waiver from the board allowing him to serve an additional year.

A waiver applies only until the next regular meeting of our shareholders, when the board may again waive the requirement that a director who has attained age 72 resign from the board. In no event may a director receive more than three waivers, with the result that all of our directors must cease to serve as of the regular meeting of shareholders that follows the attainment of age 75.

Director Stock Ownership Guidelines.

Our board has adopted stock ownership guidelines that require our non-employee directors to own a substantial number of shares of Renasant common stock. The board believes that ownership of our stock achieves two important goals: (1) it demonstrates to our shareholders and the investing public the directors’ commitment to and belief in the long-term value of our stock and (2) it enhances the alignment of our directors’ financial interests with those of our shareholders.

The stock ownership guidelines were most recently updated in February 2019. Under the current guidelines, within five years of becoming a director, each non-employee director must own stock with a value equal to at least three times the annual cash retainer. In addition, within the first year of his or her election or appointment to the board, a director must own at least 500 shares of common stock, regardless of value. Shares that a director has pledged do not count toward his or her required minimum ownership levels.

Based on an annual cash retainer of $40,000 (the retainer for 2019), the guidelines require directors with at least five years of service to own Renasant common stock with a value of at least $120,000. Using our stock price as of March 4, 2019, all of our directors own at least $192,130 of our common stock, except for Sean M. Suggs and Connie L. Engel, who joined the board in May and September 2018, respectively. Mr. Suggs and Ms. Engel both own at least 500 shares of our stock.

Board, Committee and Director Performance Assessments.

As part of its effort to ensure that the Company has a high-functioning board with the collective knowledge, experience and skills necessary to guide a financial institution such as Renasant, our nominating committee annually conducts a board assessment that has been developed and is administered by an independent third party. As part of the assessment, each director is asked to provide, on an anonymous basis, his or her opinions on various topics, including: (1) the interaction between the board and management, (2) the organization of the board, (3) the conduct of board and committee meetings, (4) each director’s fulfillment of his or her responsibilities as a director and (5) director compensation. After analyzing the results, the nominating committee makes recommendations to improve the operations of the board and to address any deficiencies that have been identified during the assessment process.

In addition to the assessment of the entire board, the nominating committee facilitates a peer assessment of each director whose term in office is expiring at the next annual meeting. For this assessment, the nominating committee asks each director to assess the individual contribution to the board and participation in board and committee meetings and other board activities, among other things, of each director whose term in office is expiring. The committee uses this information as one tool in determining whether a director whose term is expiring should be nominated for reelection.

Finally, most committees of the board annually perform a self-assessment. These committee self-assessments are designed to elicit input from committee members regarding the efficiency of the committee’s operations and ways that the committee can better fulfill its particular obligations. We expect the committees that do not already conduct annual

self-assessments to have an assessment process in place before the end of 2019.

BOARD OF DIRECTORS

Structure.

There are currently 15 members of our board of directors, divided into three classes:

|

|

|

|

|

|

|

Class 1

|

Class 2

|

Class 3

|

|

Donald Clark, Jr.

|

John M. Creekmore

|

Marshall H. Dickerson

|

|

Albert J. Dale, III

|

Jill V. Deer

|

R. Rick Hart

|

|

John T. Foy

|

Neal A. Holland, Jr.

|

Richard L. Heyer, Jr.

|

|

C. Mitchell Waycaster

|

E. Robinson McGraw

|

J. Niles McNeel

(1)

|

|

Connie L. Engel

|

Sean M. Suggs

|

Michael D. Shmerling

|

|

|

|

|

(1)

|

Mr. McNeel will retire effective as of the annual meeting, as required pursuant to our retirement policy.

|

The current term of office for our Class 1 directors expires at the 2021 annual meeting; the current term of office for our Class 2 directors expires at the 2019 annual meeting; and the current term of office for our Class 3 directors expires at the 2020 annual meeting.

After our annual meeting and assuming that all of our nominees are elected, the board will have 14 members, which the board has determined is an appropriate number to fulfill its responsibilities in light of our current and anticipated size and nature of operations. The board will remain divided into three classes, with five Class 1 directors, five Class 2 directors and four Class 3 directors.

Meetings.

Our board held 13 meetings in 2018. All directors attended at least 75% of the total number of board meetings and the meetings of the committees on which they served. The members of the board who are “independent directors” under the Listing Rules of the NASDAQ Stock Market, LLC, or Nasdaq, met in executive session six times during 2018. We do not have a policy requiring director attendance at our annual meeting. All of our current directors attended the 2018 annual meeting, and we expect our entire board to attend this year’s annual meeting.

BOARD LEADERSHIP STRUCTURE

Our executive chairman serves as chairman of the board, and the board has appointed a lead director.

Chairman.

E. Robinson McGraw, our executive chairman, serves as chairman of the board of the Company and the board of the Bank. We have retained Mr. McGraw as chairman of the board following his transition from our chief executive officer to our executive chairman because we believe this structure continues to enhance the board’s operations. Mr. McGraw serves as an effective bridge between our non-employee directors and management. As executive chairman, Mr. McGraw remains significantly involved, with Mr. Waycaster and the rest of Renasant’s senior executive management, in developing Renasant’s strategic plan and implementing the steps needed to achieve the goals set forth in the strategic plan. In addition, Mr. McGraw is able to provide critical insight on the current state of our overall operations, future prospects and the risks faced by the Company and the Bank. With such a deep knowledge of the Company and the Bank, Mr. McGraw is ideally suited to leading the board’s discussions.

Lead Director.

John M. Creekmore serves as “lead director” of our board of directors and is a member of the board’s executive committee. The members of the board who meet the definition of “independent director” under the Nasdaq Listing Rules select our lead director; no lead director is required if the chairman qualifies as an “independent director.”

The lead director serves as an independent counterbalance to the chairman of the board and essentially as a co-equal. Mr. Creekmore has been a director since 1997, predating Mr. McGraw’s (and Mr. Waycaster’s) service on the board, which we believe adds weight to his independent voice on the board. The duties of the lead director are described in our Bylaws and include the following:

|

|

|

|

•

|

With the chairman, scheduling and setting the agenda for board meetings;

|

|

|

|

|

•

|

Scheduling, setting the agenda for, and chairing all executive sessions of the “independent directors” of the board;

|

|

|

|

|

•

|

Determining the appropriate materials to be sent to directors for all meetings;

|

|

|

|

|

•

|

Acting as a liaison between the board and the chief executive officer and our other executive officers;

|

|

|

|

|

•

|

Assisting the compensation committee in evaluating the chief executive officer’s performance;

|

|

|

|

|

•

|

Assisting the nominating and corporate governance committee in its annual assessment of the board’s committee structure and each committee’s performance; and

|

|

|

|

|

•

|

Overseeing the board’s communications with our shareholders.

|

In addition, the lead director may call the board into executive session (that is, a meeting of only those directors who are “independent directors”) to discuss matters outside the presence of the chairman and other non-independent directors. The lead director is also expected to familiarize himself with the Company, the Bank and the banking industry in general. He also is expected to keep abreast of developments in the principles of good corporate governance.

BOARD COMMITTEES

The current members of each of our Executive, Audit, Nominating and Corporate Governance, Compensation and Enterprise Risk Management Committees, and a brief description of each committee’s function, are discussed below:

|

|

|

|

|

|

Executive Committee

|

|

John M. Creekmore, Chair

|

The executive committee exercises the power and authority of the full board of directors between scheduled board meetings. Among other things, the executive committee takes a lead role in succession planning for our senior management. The ability of the executive committee to act is subject to limitations imposed under Mississippi law and the committee’s charter.

The executive committee is comprised of the chairman of the board, the lead director, the chief executive officer and three additional directors who are “independent directors” as defined in the Nasdaq Listing Rules. During 2018, the committee held 15 meetings.

|

|

Neal A. Holland, Jr., Vice-Chair

|

|

Albert J. Dale, III

|

|

John T. Foy

|

|

E. Robinson McGraw

|

|

C. Mitchell Waycaster

|

|

|

|

|

|

|

|

|

Audit Committee

|

|

|

John T. Foy, Chair

|

The audit committee's responsibilities include the following:

|

|

Marshall H. Dickerson, Vice-Chair

|

Ÿ

|

Appointing, compensating and overseeing our independent registered public accountants;

|

|

Jill V. Deer

|

|

Connie L. Engel

|

Ÿ

|

Monitoring the integrity of our financial reporting process and system of internal controls;

|

|

J. Niles McNeel

|

|

Michael D. Shmerling

|

Ÿ

|

Monitoring the independence and performance of our independent registered public accountants and internal auditing department;

|

|

|

|

|

|

|

Ÿ

|

Pre-approving all auditing and permitted non-audit services provided by our independent registered public accountants;

|

|

|

|

|

|

|

Ÿ

|

Facilitating communication among our independent registered public accountants, management, the internal auditing department and the board of directors; and

|

|

|

|

|

|

|

Ÿ

|

Establishing procedures for (1) the receipt, retention and treatment of complaints we receive regarding accounting, internal accounting controls or auditing matters, and (2) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

|

|

|

|

|

|

|

|

|

|

The sections below titled “

Report of the Audit Committee

” and “

Independent Registered Public Accountants

” describe the actions taken in 2018 and the committee's processes.

|

|

|

|

|

|

|

Each member of our audit committee is an “independent director” within the meaning of the Nasdaq Listing Rules, satisfies the other requirements for audit committee membership under the Nasdaq Listing Rules and meets all independence requirements under SEC regulations. The board has determined that Mr. Shmerling qualifies as an “audit committee financial expert” under applicable SEC regulations and satisfies the financial sophistication requirements under the Nasdaq Listing Rules. During 2018, the committee held 18 meetings.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominating and Corporate Governance Committee

|

|

Neal A. Holland, Jr., Chair

|

The nominating committee evaluates, nominates and recommends individuals for membership on our board of directors and the board’s committees. Specific information about our director selection process is below under the heading “

Director Selection

.” In addition, the committee oversees the formation and implementation of our governance policies, including our stock ownership guidelines and the annual board and director performance assessments. More information about our stock ownership guidelines and these assessments may be found above under the “

Board Governance

” heading in the paragraphs titled “

Director Stock Ownership Requirements

” and “

Board and Director Performance Assessments

,” respectively.

Each member of the nominating committee is an “independent director” under the Nasdaq Listing Rules. During 2018, the committee held 11 meetings.

|

|

John M. Creekmore, Vice-Chair

|

|

Marshall H. Dickerson

|

|

John T. Foy

|

|

Michael D. Shmerling

|

|

|

|

|

|

|

|

|

|

|

Compensation Committee

|

|

Albert J. Dale, III, Chair

|

The compensation committee’s primary functions are setting our compensation strategy and administering the compensation of our named executive officers. The “

Compensation Discussion and Analysis

,” or CD&A, section below explains the compensation committee’s processes and procedures and discusses its specific decisions with respect to 2018 compensation.

Each member of the committee is an “independent director” within the meaning of the Nasdaq Listing Rules and a “non-employee director” under SEC regulations. In determining independence, the board considered each member’s ability to be independent from management in light of his relationships with us and the Bank

,

including any compensation (such as consulting, advisory or other compensatory payments), received from us or the Bank, whether the member is considered our affiliate and additional relevant factors. The committee met six

times during 2018.

|

|

Richard L. Heyer, Jr., Vice-Chair

|

|

J. Niles McNeel

|

|

John M. Creekmore

|

|

Neal A. Holland, Jr.

|

|

|

|

|

|

|

|

|

|

|

|

|

Enterprise Risk Management (ERM) Committee

|

|

Michael D. Shmerling, Chair

|

The ERM committee has overall responsibility for our enterprise-wide risk assessment management and oversight process. More information about the Company’s risk assessment process and the role of the committee may be found below under the heading “

Role of the Board in Risk Oversight

.

”

Each member of the ERM committee is an “independent director” as defined under the Nasdaq Listing Rules. During 2018, the committee held four meetings.

|

|

John T. Foy, Vice-Chair

|

|

John M. Creekmore

|

|

Albert J. Dale, III

|

|

Marshall H. Dickerson

|

|

Richard L. Heyer, Jr.

|

|

Neal A. Holland, Jr.

|

We update our corporate website, www.renasant.com, to reflect any changes in the membership of these committees. You can find this information by clicking on “Corporate Overview” under the “Investor Relations” tab, then clicking on “Committee Charting.”

ROLE OF THE BOARD IN RISK OVERSIGHT

Our full board of directors is ultimately responsible for the oversight and management of our risk management and mitigation functions. To identify and mitigate risk, the board primarily acts through a committee structure, as detailed below. At least annually the full board receives presentations from management on the processes and procedures that we have implemented to identify and mitigate various risks facing the Company. These presentations assist our directors not only in performing their risk-oversight responsibilities on various committees but also reviewing on an informed basis the work of committees on which they do not serve. In 2018, among other topics, our chief risk officer detailed our enterprise risk management program, our chief credit officer outlined our credit underwriting and administration program and our chief technology officer gave a presentation on our current cybersecurity infrastructure and the planned enhancements thereto.

The board’s ERM committee is primarily responsible for identifying enterprise-wide risks (including cyber-security risks), assessing how each risk might affect other risks and facilitating the Company’s operations within risk tolerance levels that are established by management and reviewed by the board. The committee oversees and assists management in the risk assessment process and the implementation of comprehensive risk management processes and procedures, it validates risk tolerance levels suggested by management, and it reviews and adopts policies, procedures and controls

that are intended to mitigate risk.

The ERM committee generally addresses enterprise-wide risk. Other standing committees, working with management committees that report to these committees, are used to identify and mitigate more specific risks, including:

|

|

|

|

•

|

The audit committee, which focuses on financial reporting and operational risk. This committee meets regularly with management, our independent registered public accountants and our internal auditors to discuss the integrity of our financial reporting processes and internal controls and the steps taken to monitor and control related risks. In addition, at almost every meeting the committee receives a management presentation designed to give the committee a better understanding of our operations and how the subject of the presentation impacts our overall operational risk. More information about the audit committee can be found above under the heading “

Board Committees

”

and below in the

“

Report of the Audit Committee

” and “

Independent Registered Public Accountants

” sections.

|

|

|

|

|

•

|

The compensation committee, which evaluates risks associated with our executive compensation programs. The compensation committee is assisted by the incentive compensation committee, which is comprised of senior management and reports directly to the compensation committee. The incentive compensation committee reviews our cash and equity incentive compensation arrangements (for both executive and non-executive employees) to ensure that these arrangements appropriately balance risks and financial rewards in a manner that does not encourage or expose the Bank or the Company to imprudent risks, whether financial, credit, regulatory or otherwise. The steps we have taken to address risks associated with our executive compensation program are described in the CD&A section below. Other risk mitigation practices apply to specific groups of employees. For example, our lenders may be eligible for incentives based on their loan production. This creates a risk that a lender may try to make riskier loans to boost his or her incentive. We have addressed this risk by, among other things, requiring that a lender satisfy loan quality thresholds consistent with our overall goals for loan portfolio performance as a condition to his or her eligibility to receive an incentive payment. As another example, mortgage originators are compensated on a commission basis, based on the volume of loans originated. This creates a risk that employees may focus on higher income, non-minority areas, exposing us to criticism from a fair lending perspective, among other things. We have addressed this risk by imposing goals for low income and minority lending. On an ongoing basis, the incentive compensation committee monitors our incentive compensation arrangements to determine whether additional risk mitigants are necessary. The CD&A section provides more information about the activities of the compensation committee.

|

|

|

|

|

•

|

The loan committee, which is primarily responsible for credit and other risks arising in connection with our lending activities and overseeing management committees that also address these risks. The loan committee’s work is supplemented by a number of management committees that report to it on various aspects of our lending activities, such as loss management.

|

|

|

|

|

•

|

The investment committee, which monitors our interest rate and liquidity risk. The committee has two primary goals with respect to risk oversight: (1) to structure our asset-liability composition in a way that maximizes our net interest income while minimizing the adverse impact of changes in interest rates on interest income and capital; and (2) to ensure that we have adequate sources of short and long-term liquidity both under the current interest rate environment and under various hypothetical interest rate scenarios. The asset/liability committee, a management committee reporting to the investment committee, monitors our interest rate sensitivity and makes decisions relating to that process.

|

At each board meeting, each committee chair provides a report to the full board of directors on the committee’s specific risk oversight and mitigation responsibilities. To the extent that any risk reported to the full board needs to be addressed outside the presence of management, the board may call an executive session to discuss the issue.

In addition to our full board of directors and committee structure, Mr. Waycaster, as chief executive officer, oversees management’s role in the implementation of our risk management processes by ensuring access to adequate and timely reports and information, access to our employees and the prompt implementation of recommendations by our committees. Mr. Creekmore, as our lead director, is able to lead an independent review of the risk assessments developed by management and reported to the committees. Finally, we have a chief risk officer who leads management’s assessment of the risks we face, the determination of our risk tolerance levels and the implementation of effective risk management processes and procedures.

DIRECTOR SELECTION

The nominating committee evaluates and recommends potential new directors based upon the needs of the board and the Company. The committee’s objective is to craft a board composed of individuals with a broad mix of backgrounds and experiences and possessing, as a whole, the knowledge, skills and experience necessary to guide a publicly-traded financial institution like Renasant in the prevailing business environment.

Although there is no formal policy, the board and nominating committee, as well as our management, believe that board membership should reflect diversity in its broadest sense. The nominating committee considers a candidate’s gender, ethnicity, experience, education, geographic location and difference of viewpoint when evaluating his or her qualifications for election to the board.

In addition to the eligibility requirements included in our Bylaws, the following qualifications and qualities, among others, are evaluated by the nominating committee:

|

|

|

|

•

|

“Independence” within the meaning of the Nasdaq Listing Rules and SEC rules and regulations;

|

|

|

|

|

•

|

Experience in banking or in marketing, finance, legal, accounting or other professional disciplines;

|

|

|

|

|

•

|

Diversity of background and other characteristics that are reflective of our shareholders;

|

|

|

|

|

•

|

Familiarity with and participation in the local communities in which we do business;

|

|

|

|

|

•

|

Prominence and a highly-respected reputation in his or her profession;

|

|

|

|

|

•

|

A proven record of honest and ethical conduct, personal integrity and independent judgment;

|

|

|

|

|

•

|

Ability to represent the interests of our shareholders; and

|

|

|

|

|

•

|

Ability to devote time to fulfill the responsibilities of a director and to enhance their knowledge of our industry.

|

Usually, nominees for election to the board are proposed by the current members of the board or executive management. For example, Mr. Suggs, who joined the board in May 2018, was recommended by Messrs. McGraw and Waycaster. As to Ms. Engel, as part of our merger agreement with Brand, we agreed to appoint one Brand director to our board upon completion of the merger. After reviewing the qualifications of the members of Brand’s board and interviewing certain candidates, the nominating committee recommended the appointment of Ms. Engel to our board upon completion of the merger. The nominating committee will also consider candidates that shareholders and others recommend, and the committee uses the same criteria in assessing shareholder-recommended candidates as it does for candidates proposed by the committee or another board member. More information about the process for shareholder recommendations may be found below under the heading “

Shareholder Communications

” in the paragraph titled “

Process for Shareholder Recommendations.

”

DIRECTOR INDEPENDENCE

The board has determined that each of our directors (including Mr. McNeel, whose service on the board will cease after the annual meeting) is an “independent director” as defined under Rule 5605(a)(2) of the Nasdaq Listing Rules, with the exception of Messrs. McGraw, Hart and Waycaster who are not independent directors because they are Renasant employees. In addition, the board previously determined that Hollis C. Cheek and Fred F. Sharpe, whose terms as directors ended as of the 2018 annual meeting, were independent directors under Rule 5605(a)(2) while they served on our board. When determining each director’s status as an “independent director,” the board evaluated the following relationships involving Renasant or the Bank:

|

|

|

|

•

|

Transactions involving a director, members of his or her immediate family and business with which they are associated and the Company or the Bank (more information about these transactions may be found below under the headings “

Indebtedness of Directors and Executive Officers

”

and “

Other Related Person Transactions

”).

|

|

|

|

|

•

|

The Bank employs the sons of three of our directors: (1) Mr. Creekmore’s son works as a portfolio manager in the Bank's corporate banking department; (2) Dr. Heyer’s son is employed as an investment officer in the Bank’s wealth management division; and (3) Mr. Holland's son is a trainee in the Bank's wealth management division. None of these employees is considered an “executive officer” of the Company, nor did any of them receive compensation for 2018 at a level that would cause his employment to constitute a “related person” transaction under applicable SEC regulations. The compensation paid to each employee was consistent with the

|

compensation paid to similarly-situated employees of the Bank.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

Certain of our directors and executive officers, members of their immediate families and businesses with which they are associated are customers of the Bank and have entered into loan transactions with the Bank. These transactions were made in the ordinary course of the Bank’s business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Company or the Bank, and did not involve more than the normal risk of collectability or present other unfavorable features. The Bank’s board of directors approved all such loans in accordance with the Federal Reserve’s Regulation O and other bank regulatory requirements.

OTHER RELATED PERSON TRANSACTIONS

In addition to the loan transactions described above, we have deposit and other financial services-related relationships in the ordinary course of the Bank’s business with our directors and executive officers, members of their immediate families and businesses with which they are associated, and we expect to engage in similar transactions with these persons in the future. All certificates of deposit and depository relationships with these persons were made in the ordinary course of the Bank’s business and involved substantially the same terms, including interest rates, as those prevailing at the time for comparable depository relationships with persons not related to the Company or the Bank.

In addition, in 2018 we entered into transactions in which Bartow Morgan, Jr., our chief commercial banking officer, has a direct or indirect material interest, or we became a party to transactions in which Mr. Morgan has a material interest as a result of the completion of the Brand acquisition on September 1, 2018. Our related person transactions involving Mr. Morgan are described below:

|

|

|

|

•

|

Brand was party to real estate leases with entities owned by a trust of which Mr. Morgan is a trustee and an approximate 25% beneficiary (taking into account the interest of Mr. Morgan and his children) (together with his siblings) (this trust is referred to as the “Morgan Family Trust”), under which Brand leased from the entities owned by the Morgan Family Trust real estate on which a Brand branch was located. Upon the completion of the Brand acquisition, Renasant assumed these leases. The following table sets forth (1) the location of each of these branches; (2) the lease payments made in 2018; and (3) the payments due over the remaining terms of each of the leases, which expire at various times between 2022 and 2025 (amounts in the columns below include, to the extent known, triple net charges):

|

|

|

|

|

|

|

|

Branch Address

|

Lease payments in 2018

(1)

|

Lease payments due from January 1, 2019 through remaining term of lease

|

|

2255 Buford Highway Buford, Georgia 30518

|

$407,549 (138,121)

|

$1,373,255

|

|

6224 Sugarloaf Parkway, 1st floor Duluth, Georgia 30097

|

$444,378 (139,713)

|

$1,493,860

|

|

6224 Sugarloaf Parkway, 2nd and 3rd floors Duluth, Georgia 30097

|

$500,172 (173,895)

|

$2,264,810

|

|

6515 Sugarloaf Parkway, Suites 150 and 160 Duluth, Georgia 30097

|

$68,106 (34,069)

|

$301,280

|

|

1255 Lakes Parkway, Buildings 100 and 200 Lawrenceville, Georgia 30043

|

$523,891 (175,641)

|

$2,656,121

|

|

1255 Lakes Parkway, Suites 110 and 180 Lawrenceville, Georgia 30043

|

$237,180 (79,750)

|

$1,206,131

|

|

480 Peachtree Industrial Boulevard Suwanee, Georgia 30024

|

$197,788 (67,309)

|

$560,319

|

|

|

|

|

(1)

|

Amounts in parenthesis represent the portion of the lease payments paid after September 1, 2018, the date on which we completed the Brand acquisition. The balance was paid by Brand prior to September 1, 2018.

|

On account of his understanding of the markets in which the above-listed branches operate, Mr. Morgan will likely play a role in determining whether the Bank should continue to maintain a branch in the market generally. He will not, however, participate in discussions as to whether to renew any expiring lease or find another location

for the branch within the market. If management elects to renew an expiring lease, Mr. Morgan will not participate in the negotiations regarding the rent or the other terms and conditions of the lease renewal, which will ultimately be subject to final approval by our board.

|

|

|

|

•

|

Brand Properties, LLC and Brand Real Estate Services, Inc., both of which are owned by the Morgan Family Trust, provided property management services for the above-listed branch locations and our Dacula, Georgia branch location to Brand, prior to September 1, 2018, and to us, after the completion of the Brand acquisition. In 2018, these entities were paid $33,358 in the aggregate for property management services, and we expect to pay an aggregate of approximately $139,000 to these entities over the remaining terms of the above leases for such services (these entities do not provide property management services with respect to any of our other locations). Additionally, Brand had contracted with Brand Properties, LLC to develop and construct its Dacula branch, which construction was completed in the summer of 2018. Brand Properties was paid an aggregate of $2,252,152 under this contract, of which $464,439 was paid after September 1, 2018.

|

|

|

|

|

•

|

Brand maintained “split-dollar” insurance arrangements for the benefit of life insurance trusts established by Mr. Morgan and certain of his siblings, which we assumed upon the completion of the Brand acquisition. Under these arrangements, the trusts (whose beneficiaries were parties related to Mr. Morgan or his siblings) acquired and owned life insurance policies on the lives of Mr. Morgan and the siblings, and Brand was contractually obligated to pay the premiums. Upon the insured’s death or the earlier termination of the split dollar arrangements, each trust is obligated to repay to Brand (and now to us) the aggregate amount of the premium payments made on behalf of the trust or, under some of the arrangements, the cash surrender value of policy, if greater than the aggregate premiums paid. We intend to terminate these split-dollar insurance arrangements in a manner that avoids loss to the Company. In 2018, premium payments in the aggregate amount of $335,362 were made by Brand (prior to September 1, 2018) and Renasant (after the completion of the Brand acquisition), and we have made premium payments in the aggregate amount of $158,662 in the first two months of 2019.

|

|

|

|

|

•

|

Upon the completion of our acquisition of Brand, GardenBrand, LLC, previously a wholly-owned subsidiary of The Brand Banking Company, became a wholly-owned subsidiary of the Bank. GardenBrand, LLC is party to a purchase and sale agreement with two entities owned by the Morgan Family Trust. Under this agreement, GardenBrand, LLC has agreed to sell a vacant lot in Atlanta, Georgia, to one of the entities owned by the Morgan Family Trust in exchange for the real estate, owned by the other entity owned by the Morgan Family Trust, on which the Bank’s branch in Suwanee, Georgia, is located and cash. The purchase and sale agreement was entered into in 2015; in November 2018 we agreed to extend the deadline for closing the transaction for six months. As a condition of the extension, $150,000 in earnest money was irrevocably released to us. Our executive committee reviewed and approved the terms of the proposed extension before we amended the purchase sale and agreement to provide for the extension.

|

|

|

|

|

•

|

Brand owned warrants to purchase the common stock of a “fintech” company, and the Bank acquired these warrants upon the completion of the Brand acquisition. Our management decided to sell these warrants, which Mr. Morgan offered to purchase for their book value, which was $603,009. To evaluate Mr. Morgan’s offer, the board directed management to ascertain whether (1) there were any other parties interested in acquiring the warrants and (2) the Bank would be likely to obtain a better price than the price offered by Mr. Morgan. Management contacted investment bankers with knowledge of the industry in which this fintech company operates and was advised that, due to the speculative nature of the warrants and the fintech company’s operating results to date, the Bank was unlikely to find any other buyer for the warrants at all, much less a buyer willing to pay more than book value for the warrants. After receiving this advice, the board approved the sale of the warrants for $603,009 to an entity of which Mr. Morgan is a 50% owner. The sale was completed in December 2018.

|

LEGAL PROCEEDINGS INVOLVING A DIRECTOR OR EXECUTIVE OFFICER AND THE COMPANY OR THE BANK

We are not aware of any current legal proceedings where any of our directors, executive officers or other affiliates, any holder of more than 5% of our common stock, or any of their respective associates, is a party adverse to, or has a material interest adverse to, us, the Bank or any of our other subsidiaries.

SHAREHOLDER COMMUNICATIONS

Receipt of Proxy Materials.

If you received a paper copy of this proxy statement, you can elect to receive future proxy materials over the internet. Please refer to your proxy card for instructions for requesting electronic delivery of our

proxy materials. If you received the Notice of the electronic availability of our proxy materials, you may obtain a paper copy of the materials. Please refer to the Notice for instructions for ordering a paper copy of the proxy materials and selecting a future delivery preference.

Shareholder Questions.

Although we have no formal policy, shareholders may send communications to the board and individual directors by contacting Kevin D. Chapman, our Chief Financial and Operating Officer, in one of the following ways:

|

|

|

|

•

|

By writing to Renasant Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, Attention: Chief Financial Officer;

|

|

|

|

|

•

|

By e-mail to KChapman@renasant.com; or

|

|

|

|

|

•

|

By phone at (662) 680-1450.

|

Mr. Chapman will forward to the audit committee any communication concerning employee fraud or accounting matters, and he will forward to the full board any communication relating to corporate governance or requiring action by the board of directors. Mr. Chapman will respond to communications that may be addressed most effectively by management.

Process for Shareholder Recommendations.

Shareholders may recommend candidates for election to the board of directors. Recommendations should be addressed to Renasant Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, Attention: Secretary. Recommendations must be submitted to us no earlier than December 25, 2019, and no later than January 24, 2020, for consideration as a possible nominee for election to the board at our 2020 annual meeting.

The advance notice and eligibility provisions that apply to shareholder recommendations of director candidates are set forth in Article III, Section 9, of our Bylaws, a copy of which is available upon request. Among other things, a shareholder's notice must include the following information as to each nominee:

|

|

|

|

•

|

The reason for making the nomination;

|

|

|

|

|

•

|

All arrangements or understandings between or among the recommending shareholder(s) and the nominee, as well as any information that would have to be disclosed under Item 404 of Regulation S-K if the recommending shareholder (and any beneficial owner on whose behalf the recommendation has been made) were the registrant;

|

|

|

|

|

•

|

All information relating to the nominee that is required to be disclosed in solicitations of proxies for the election of directors in a contested election pursuant to the Exchange Act and the rules and regulations promulgated thereunder; and

|

|

|

|

|

•

|

The nominee’s written consent to being named in the proxy statement and to serve as a director if elected.

|

A shareholder's notice must also include the name and address of the nominating shareholder and information relating to, among other things: (1) all direct and indirect ownership interests (including hedges, short positions and derivatives) and economic interest in our stock (such as rights to dividends) and all proxies and other arrangements to vote our stock held by the nominating shareholder; and (2) all other information that the shareholder would be required to disclose under Section 14 of the Exchange Act in connection with the solicitation of proxies by a shareholder in a contested election. If a shareholder intends to recommend a nominee for election as director on behalf of the beneficial owner of the shares that the recommending shareholder is the record owner of, the recommending shareholder must also provide the information described above with respect to the beneficial owner.

Shareholder Proposals for the 2020 Annual Meeting.

At the annual meeting each year, the board of directors submits to shareholders its nominees for election as directors, a non-binding advisory resolution relating to our executive compensation and a proposal to ratify the audit committee’s appointment of our independent registered public accountants for the upcoming fiscal year. In addition, the board may submit other matters to the shareholders for action at the annual meeting. Shareholders may also submit proposals for action at the annual meeting.

Shareholders interested in submitting a proposal for inclusion in our proxy materials for the 2020 Annual Meeting of Shareholders may do so by following the procedures described in Rule 14a-8 of the Exchange Act. If the 2020 annual meeting is held within 30 days of April 23, 2019, shareholder proposals must be received by our Secretary at 209 Troy Street, Tupelo, Mississippi 38804-4827, no later than the close of business on

November 15, 2019, in order for such

proposals to be considered for inclusion in the proxy statement and form of proxy relating to such meeting.