via NewMediaWire --

Reliance Global Group, Inc. (Nasdaq:

RELI; RELIW) (“Reliance” or the “Company”), which combines

artificial intelligence (AI) and cloud-based technologies with the

personalized experience of a traditional insurance agency, today

provided a business update and reported financial results for the

third quarter ended September 30, 2021.

Ezra Beyman, CEO of Reliance Global Group, commented, “We

continue to generate strong growth, as evidenced by a 54% increase

in revenue to $2.6 million for the third quarter of 2021 versus

$1.7 million for the same period last year, reflecting the solid

performance of our insurance agencies. Given the performance of our

agencies, I’m pleased to report we reduced our consolidated EBITDA*

loss by 88% to approximately $87,000 for the third quarter of 2021,

versus $747,000 for the same period last year, despite our ongoing

investments in the 5MinuteInsure.com platform. The improved

profitability reflects our continued revenue growth and scalability

of the business model. On a standalone basis, these agencies

collectively generated significant cash flow from operations for

both the three and nine months ended September 30, 2021. At the

same time, we continue to explore opportunistic acquisitions of

additional cash flow positive agencies at attractive multiples, to

further expand our national footprint and enhance operating

efficiency. We ended the quarter with over $6.1 million of cash and

restricted cash, which provides us a solid balance sheet to execute

on our near and long-term growth objectives.”

“We are also making progress with the nationwide

rollout of our new 5MinuteInsure.com platform, as evidenced by its

successful launch in the first four states: Ohio, Indiana, Michigan

and Arizona. The goal of this platform is to tap into the growing

number of online shoppers by providing them a seamless one-stop

solution to compare insurance quotes from multiple carriers and

instantly bind a policy. We’ve rolled out a robust and

comprehensive marketing campaign in the aforementioned states and

have witnessed a noticeable increase in daily quote requests.

Further, we’re on track to commercially launch the platform in a

number of additional states in the coming weeks, as we now have

regulatory approval in 46 states and continue to add new insurance

carriers to our network.”

Financial Results

For the three months ended September 30, 2021 as

compared to September 30, 2020, respectively, the Company achieved

revenues of $2,581,636 vs. $1,680,043, commission expense of

$660,708 vs. $399,322 and general and administrative expenses of

$755,130 vs. $1,116,907. Loss from operations for the same periods

respectively was $475,208 vs. $1,092,170 and net loss was $595,233,

or ($0.05) per share, vs. $1,231,567, or ($0.30).

For the nine months ended September 30, 2021 as

compared to September 30, 2020, respectively, the Company had

revenues of $7,096,213 vs. $5,326,375, commission expense of

$1,748,451 vs. $1,178,806 and general and administrative expenses

of $2,961,881 vs. $3,320,779. Loss from operations for the same

periods respectively was $2,064,853 vs. $2,925,131 and net loss was

$2,486,045, or ($0.25) per share vs. to $3,349,778, or ($0.80).

*EBITDA Reconciliation

The Company defines EBITDA as earnings before

interest, taxes, depreciation and amortization. EBITDA is not a

measure of performance calculated in accordance with Generally

Accepted Accounting Principles in the United States of America

(GAAP), and should not be considered in isolation of, or as a

substitute for, earnings as an indicator of operating performance

or cash flows from operating activities as a measure of liquidity.

The Company believes the presentation of EBITDA is relevant and

useful by enhancing the readers’ ability to understand the

Company’s operating performance. The Company’s management utilizes

EBITDA as a means to measure performance. The Company’s

measurements of EBITDA may not be comparable to similar titled

measures reported by other companies. The table below reconciles

EBITDA for income from continuing operations for the three and nine

months ended September 30, 2021 and 2020.

| |

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

$ (475,208) |

|

$ (1,092,170) |

|

$ (2,064,853) |

|

$ (2,925,131) |

| |

|

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

387,729 |

|

344,888 |

|

1,090,183 |

|

1,003,070 |

| |

|

|

|

|

|

|

|

|

|

EBIDTA |

$

(87,479) |

|

$

(747,282) |

|

$

(974,670) |

|

$ (1,922,061) |

The complete financial results will be available

in the Company’s Form 10-Q, which is expected to be filed with

the U.S. Securities & Exchange Commission later

today.

About Reliance Global Group, Inc.

Reliance Global Group, Inc. (NASDAQ: RELI, RELIW)

is combining advanced technologies, with the personalized

experience of a traditional insurance agency model. Reliance Global

Group’s growth strategy includes both an organic expansion,

including through 5minuteinsure.com, as well as acquiring well

managed, undervalued and cash flow positive insurance agencies.

Additional information about the Company is available

at https://www.relianceglobalgroup.com/.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995. Statements

other than statements of historical facts included in this press

release may constitute forward-looking statements and are not

guarantees of future performance, condition or results and involve

a number of risks and uncertainties. Actual results may differ

materially from those in the forward-looking statements as a result

of a number of factors, including those described from time to time

in our filings with the Securities and Exchange Commission and

elsewhere. The Company undertakes no duty to update any

forward-looking statement made herein. All forward-looking

statements speak only as of the date of this press release.

Contact:

Crescendo Communications, LLC Tel: +1 (212)

671-1020 Email: RELI@crescendo-ir.com

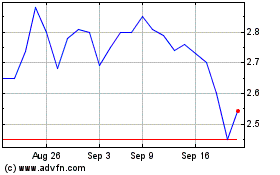

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Apr 2023 to Apr 2024