Biotech Stocks Stumble Despite Broad Market Rally

March 10 2020 - 6:21PM

Dow Jones News

By Caitlin McCabe

Biotech stocks were expected to be a bright spot in a stock

market battered by worries over the coronavirus.

The shares initially surged when the rest of the market tumbled

as companies raced to develop vaccines and treatments for the

virus. But investors may be realizing that the path to containing

the pathogen is more complicated than originally thought.

Shares of biotech and pharmaceutical companies working on

coronavirus medications tumbled Tuesday despite gains across the

broader U.S. market. Drugmaker Gilead Sciences Inc. fell as much as

6.4% shortly after the market opened, before ending the day down

1.6%. In contrast, the benchmark S&P 500 jumped 4.9%.

Moderna Inc. also retreated, falling 8%. Inovio Pharmaceuticals

Inc. fell 42%, Vir Biotechnology Inc. slumped 23% and Regeneron

Pharmaceuticals ended the session up a mere 0.1% after spending

much of the day in negative territory.

Analysts said some of the declines across the sector could be

tied to lingering questions about how successfully coronavirus

treatments could be monetized amid rising political pressure to

keep virus medications affordable. There are also worries about how

long development of treatments will take. Some research trials for

drugs aren't expected to be completed for several years, long after

the coronavirus has done its damage.

"We've seen this in the past with other pandemics historically,"

said Brian Abrahams, senior biotech analyst at RBC Capital Markets,

noting that biotech stocks can rise sharply "just on pandemic

potentials."

For weeks, large, well-entrenched drugmakers and smaller

startups have been jostling to find treatments for the coronavirus,

which has killed more than 3,800 people and infected more than

109,000 world-wide. No treatment or vaccine currently exists for

the virus, which has spread quickly, in part, because many people

don't begin showing symptoms until several days after exposure.

Gilead and Moderna are widely considered to be leaders in

developing vaccines and treatments for the virus, with products

from both companies already in the early stages of trials.

Researchers at the University of Nebraska started testing Gilead's

experimental treatment, called remdesivir, in February. The

National Institutes of Health is also expected by the end of April

to start testing a vaccine developed by Moderna.

Smaller companies including Vir Biotechnology, Inovio

Pharmaceuticals, Novavax Inc. and Altimmune Inc. are also all

working to develop medical solutions to the coronavirus.

Investors since late February have rewarded these biotech

companies by piling into the stocks while the broader market was

tumbling. On Feb. 25, for example, Moderna's share price

skyrocketed 28%. On Feb. 28, Novavax, jumped 36%.

Other companies, including iBio Inc., which in early February

announced a partnership with Beijing CC-Pharming Ltd. to develop a

plant-based coronavirus vaccine, have seen their shares rise by an

eye-popping amount this year. Delaware-based iBio's stock price is

up 474% year-to-date.

Analysts said Tuesday's declines may have also been spurred by

broader gains in U.S. stocks, which surged as investors took

comfort in U.S. government officials' plans to try to offset any

economic slowdown from the coronavirus.

"It seems like you have this coronavirus basket of stocks

inversely trading to market performance," said Edward Tenthoff, a

senior biotechnology analyst at Piper Sandler Cos. "When the market

does a little bit better, coronavirus fears [may be] subsiding a

little bit."

Within the biotech sector specifically, Dr. Abrahams, of RBC

Capital, noted investors may also be reacting to concerns about how

the coronavirus will affect company operations.

"It could be difficult to enroll clinical trials when mobility

and travel is limited," he said. "And from a regulatory standpoint,

with the [U.S. Food and Drug Administration] potentially being

preoccupied with management and containment of the coronavirus

outbreak, they could have less resources for the review of new drug

applications."

Write to Caitlin McCabe at caitlin.mccabe@wsj.com

(END) Dow Jones Newswires

March 10, 2020 18:06 ET (22:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

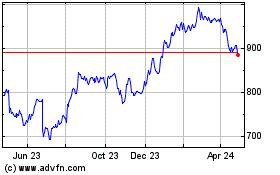

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

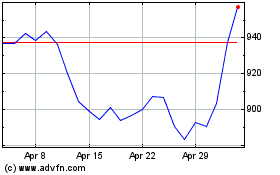

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Apr 2023 to Apr 2024