Amended Statement of Beneficial Ownership (sc 13d/a)

May 06 2019 - 5:32PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No.

5)*

|

Rand

Capital Corporation

|

|

(Name of Issuer)

|

|

Common

Stock, par value $0.10 per share

|

|

(Title of Class of Securities)

|

|

752185108

|

|

(CUSIP Number)

|

|

|

Bruce Howard

User-Friendly Phone Book,

LLC

Chief Executive Officer

10200 Grogan’s Mill

Road, Suite 440

The Woodlands, TX 77380

|

|

with copies to:

Steven

E. Siesser, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

|

|

|

(Name, Address

and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

|

|

May

6, 2019

|

|

(Date of Event Which Requires Filing of this Statement)

|

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §240.13d-1(e), §240.13d-1(f) or §240.13d-1(g), check the following box. ☐

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act

of 1934, as amended (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

CUSIP No.

752185108

|

1.

|

Names of reporting persons

User-Friendly

Phone Book, LLC

|

|

2.

|

Check the appropriate box if a member of a group (see instructions)

|

|

|

(a) [ ] (b) [ ]

|

|

3.

|

SEC Use Only

|

|

4.

|

Source of

funds (see instructions)

WC

|

|

5.

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

|

|

|

[ ]

|

|

|

6. Citizenship or place

of organization

Delaware

|

|

|

|

|

Number of

|

7. Sole voting power

|

0

|

|

|

|

shares beneficially

|

8. Shared voting power

|

1,455,993*

|

|

|

|

owned by

|

|

|

|

|

|

each reporting

|

9. Sole dispositive power

|

0

|

|

|

|

person with

|

10. Shared dispositive power

|

1,455,993*

|

|

|

|

|

|

|

|

11.

|

Aggregate amount beneficially owned by each reporting person

|

1,455,993*

|

|

|

12.

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

|

|

|

[ ]

|

|

|

|

13.

|

Percent of class represented by amount in Row (11)

|

23.0%*

|

|

|

14.

|

Type of reporting person (see instructions)

|

OO

|

|

|

|

|

|

|

|

|

|

|

|

|

*Beneficial ownership percentage is based upon 6,321,988 shares of common stock, par value $0.10 per share

(the “Common Stock”) of Rand Capital Corporation, a New York corporation (the “Issuer”), issued and outstanding as of May 2, 2019, based on information reported in the Issuer’s Quarterly Report on Form 10-Q

filed with the SEC on May 2, 2019. User-Friendly Phone Book, LLC, a Delaware limited liability company (“UFPB”) is a wholly

owned subsidiary of User-Friendly Holding, LLC, a Delaware limited liability company (“UFH” and, together with UFPB, the “Reporting

Persons”). As of the date of the filing of this Schedule 13D (the “Filing Date”), UFPB held 1,455,993 shares

of Common Stock of the Issuer, or approximately 23.0% of the shares of Common Stock of the Issuer deemed to be issued and outstanding

as of the Filing Date. This report shall not be deemed an admission that UFPB, UFH or any other person is the beneficial owner

of the securities reported herein for purposes of Section 13 of this Act, or for any other purpose.

CUSIP No.

752185108

|

1.

|

Names of reporting persons

User-Friendly

Holding, LLC

|

|

2.

|

Check the appropriate box if a member of a group (see instructions)

|

|

|

(a) [ ] (b) [ ]

|

|

3.

|

SEC Use Only

|

|

4.

|

Source of funds (see instructions)

WC

|

|

5.

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

|

|

|

[ ]

|

|

|

6. Citizenship or place

of organization

Delaware

|

|

|

|

|

Number of

|

7. Sole voting power

|

0

|

|

|

|

shares beneficially

|

8. Shared voting power

|

1,455,993*

|

|

|

|

owned by

|

|

|

|

|

|

each reporting

|

9. Sole dispositive power

|

0

|

|

|

|

person with

|

10. Shared dispositive power

|

1,455,993*

|

|

|

|

|

|

|

|

11.

|

Aggregate amount beneficially owned by each reporting person

|

1,455,993*

|

|

|

12.

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

|

|

|

[ ]

|

|

|

|

13.

|

Percent of class represented by amount in Row (11)

|

23.0%*

|

|

|

14.

|

Type of reporting person (see instructions)

|

OO

|

|

|

|

|

|

|

|

|

|

|

|

|

*Beneficial ownership percentage is based upon 6,321,988 shares of Common Stock of the Issuer issued and outstanding

as of May 2, 2019, based on information reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on May 2,

2019. As of the Filing Date, UFPB held 1,455,993 shares of Common Stock of the Issuer. As a result of the foregoing, for purposes

of Reg. Section 240.13d-3, UFH may be deemed to beneficially own the 1,455,993 shares of Common Stock of the Issuer held by UFPB,

or approximately 23.0% of the shares of Common Stock of the Issuer deemed to be issued and outstanding as of the Filing Date. This

report shall not be deemed an admission that UFPB, UFH or any other person is the beneficial owner of the securities reported herein

for purposes of Section 13 of this Act, or for any other purpose

.

Explanatory

Note

This Amendment No. 5 (“Amendment No. 5”) relates to the common stock, par value $0.10 per share (the “Common Stock”), of Rand Capital Corporation

(the “Issuer”). This Amendment No. 5 amends and supplements the Statement on Schedule 13D filed with the Securities and Exchange

Commission (the “SEC”) on June 21, 2018 (the “Initial Schedule 13D”), as amended and supplemented by Amendment No. 1, filed

June 22, 2018 (“Amendment No. 1”), Amendment No. 2, filed March 27, 2019 (“Amendment No. 2”), Amendment No. 3, filed April

10, 2019 (“Amendment No. 3”), and Amendment No. 4, filed April 25, 2019 (“Amendment No. 4”). The Initial Schedule 13D, as amended

and supplemented by Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment No. 4, and this Amendment No. 5, is referred

to herein as the “Schedule 13D.” Capitalized terms used and not otherwise defined herein shall have the meanings ascribed

to such terms in the Schedule 13D. Except as otherwise

provided herein, each Item of the Schedule 13D remains unchanged.

|

Item

2.

|

Identity

and Background

|

Item 2(e) is hereby amended and restated in its entirety to read as follows:

On September 7, 2018, VSS Fund Management LLC (“VSS”) and Jeffrey T. Stevenson entered into a settlement order (the “Settlement

Order”) with the U.S. Securities and Exchange Commission (the “SEC”), without admitting or denying the findings, regarding

violations of the Investment Advisers Act of 1940 (the “Investment Advisers Act”). Mr. Stevenson is the managing partner of

VSS and the manager and chairman of UFH. The Settlement Order states that preliminary valuation information of certain assets

of a private equity fund managed by VSS was not disclosed to the fund’s limited partners in 2015. Pursuant to the Settlement

Order, VSS and Mr. Stevenson were ordered to cease and desist from future violations of the Investment Advisers Act and were

required to pay a civil penalty of $200,000, which was paid.

|

Item

4.

|

Purpose of the Transaction

|

Item 4 of

the Schedule 13D is hereby amended by adding the following immediately after the last paragraph of the Item 4 of the

Schedule 13D:

On May 6, 2019,

UFPB delivered a letter to shareholders of the Issuer explaining the reasons for UFPB's belief that the transaction with East is

not in the best interests of Issuer's shareholders.

|

Item

7.

|

Material

to Be Filed as Exhibits

|

Exhibit A: Press

Release dated May 6, 2019.

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

May

6, 2019

|

|

|

|

|

|

(Date)

|

|

|

|

|

|

|

|

|

|

|

USER-FRIENDLY PHONE BOOK,

LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

Bruce Howard

|

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USER-FRIENDLY HOLDING,

LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

Bruce Howard

|

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

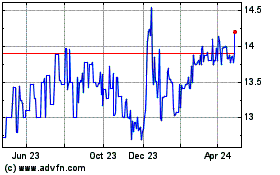

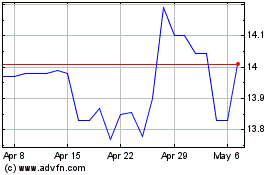

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Apr 2023 to Apr 2024