Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934

Filed by the Registrant

ý

Filed by a Party other than the Registrant

¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material Pursuant to § 240.14a-12

RADNET,

INC.

(Name of Registrant as Specified in its

Charter)

__________________________________________

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

ý

No fee required

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

(1)

|

Title of each class of securities to which

transaction applies:

|

Not applicable

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

Not applicable

|

|

(3)

|

Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how

it was determined):

|

Not applicable

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

Fee paid previously with preliminary materials:

¨

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement

No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

RADNET, INC.

1510 Cotner Ave.

Los Angeles, CA 90025

April 30, 2019

Dear Stockholder:

On behalf of the Board of Directors and

management, we cordially invite you to attend the 2019 Annual Meeting of Stockholders of RadNet, Inc. (the “Annual Meeting”),

to be held at our principal executive office at 1510 Cotner Avenue, Los Angeles, CA 90025, on Thursday, June 13, 2019, at 10:00

a.m. (Pacific Time) or at any adjournment or postponement thereof. At this meeting, stockholders will vote on matters set forth

in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

We have also enclosed a copy of our annual

report on Form 10-K for our fiscal year ended December 31, 2018 (the “2018 Annual Report”). We encourage you to read

our 2018 Annual Report, which includes information on our business, as well as our audited financial statements for the fiscal

year ended December 31, 2018.

This year we are again taking advantage

of the Securities and Exchange Commission rule that permits us to furnish proxy materials to our stockholders via the Internet.

On or about April 30, 2019, we are mailing a short Notice of Internet Availability of Proxy Materials (the “Notice”)

to most of our stockholders instead of a paper copy of our full proxy materials. The Notice contains instructions on how to cast

your vote online and how to access our proxy materials, including the Notice of Annual Meeting of Stockholders, Proxy Statement,

2018 Annual Report and a Proxy Card or voting instruction form. The Notice also contains instructions on how to request a paper

copy of our proxy materials. All stockholders who do not receive the Notice will receive a paper copy of the proxy materials.

Your vote is very important. Regardless

of the number of shares you own, please vote. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon

as possible.

You may vote by submitting your proxy via the Internet, by phone, or if you have elected to receive printed proxy

materials, by completing, signing, dating and returning the Proxy Card enclosed with your printed proxy materials.

Thank you for your continued support and

ownership of RadNet, Inc. We look forward to seeing you at the Annual Meeting.

|

|

Sincerely,

Norman R. Hames

Corporate Secretary

|

Important

Notice Regarding Availability of Proxy Materials for the 2019 Annual Meeting of Stockholders:

The Proxy Statement for the 2019 Annual

Meeting of Stockholders, the Proxy Card and the 2018 Annual Report are available at

www.proxyvote.com

.

RADNET, INC.

1510 Cotner Ave.

Los Angeles, CA 90025

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

JUNE 13, 2019

RadNet, Inc. will hold

its 2019 Annual Meeting of Stockholders (the “Annual Meeting”) on Thursday, June 13, 2019, at 10:00 a.m. (Pacific Time)

or any adjournment or postponement thereof, at our principal executive office at 1510 Cotner Avenue, Los Angeles, CA 90025.

The following items

are on the agenda and are more fully described in the accompany proxy statement:

|

|

1.

|

The election of seven nominees named in the attached Proxy Statement as directors to hold office until the 2020 Annual Meeting of Stockholders;

|

|

|

2.

|

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019;

|

|

|

3.

|

A non-binding advisory vote to approve executive compensation;

|

|

|

4.

|

A non-binding stockholder proposal requesting that we adopt “majority voting” in uncontested elections of directors, if properly presented at the Annual Meeting; and

|

|

|

5.

|

Other business that may properly come before the Annual Meeting.

|

Our Board of Directors

has fixed April 17, 2019 as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting.

We are mailing to our

stockholders on or about April 30, 2019, a Notice of Internet Availability of Proxy Materials containing instructions on how to

access our Proxy Statement and our annual report on Form 10-K for our fiscal year ended December 31, 2018, via the Internet and

how to vote online. The Notice of Internet Availability of Proxy Materials also contains instructions on how you can receive a

paper copy of the proxy materials.

|

|

By Order of the Board of Directors,

Norman R. Hames

Corporate Secretary

|

|

April 30, 2019

Los Angeles, California

|

|

Whether or not you expect to attend

the Annual Meeting, please vote as soon as possible to ensure your representation at the Annual Meeting. You may vote via the Internet,

by phone, or if you have elected to receive printed proxy materials, by completing, signing, dating and returning the Proxy Card

enclosed with your printed proxy materials. Even if you have given your proxy, you may still vote in person if you attend the meeting.

Please note, however, that if a broker, bank or other nominee holds your shares of record and you wish to vote at the Annual Meeting,

then you must obtain from the record holder a proxy issued in your name.

RADNET, INC.

1510 Cotner Ave.

Los Angeles, CA 90025

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 13, 2019

The Board of Directors

of RadNet, Inc., a Delaware corporation, is providing these proxy materials to you in connection with the solicitation of the accompanying

proxy for use at our 2019 Annual Meeting of Stockholders (the “Annual Meeting”).

The Annual Meeting

will be held at our principal executive office at 1510 Cotner Avenue, Los Angeles, CA 90025, on Thursday, June 13, 2019, at 10:00

a.m. (Pacific Time) or at any adjournment or postponement thereof, for the purposes stated herein.

On or about April 30,

2019 we are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on

how to access our Proxy Statement and our annual report on Form 10-K for our fiscal year ended December 31, 2018 (the “2018

Annual Report”), via the Internet and how to vote online. The Notice also contains instructions on how you can receive a

paper copy of the proxy materials.

This Proxy Statement

summarizes certain information to assist you in voting in an informed manner.

All stockholders are

cordially invited to attend the Annual Meeting in person. Whether you expect to attend the meeting or not, please vote as soon

as possible.

TABLE OF CONTENTS

THE PROXY PROCESS AND THE ANNUAL MEETING

The following questions

and answers are intended to briefly address potential questions that our stockholders may have regarding this Proxy Statement and

the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided

under the rules and regulations of the Securities and Exchange Commission (the “SEC”). These questions and answers

may not address all of the questions that are important to you as a stockholder. If you have additional questions about this Proxy

Statement or the Annual Meeting, please see the response to the question entitled “

Whom should I contact with other questions

?”

below. RadNet, Inc. is sometimes referred to herein as “RadNet”, “we”, “us”, “our”

or the “Company.”

|

Q:

|

Why did I receive these materials?

|

|

A:

|

Our Board of Directors has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Board of Directors’ solicitation of proxies for use at our Annual Meeting, which will take place on June 13, 2019 or any adjournment or postponement thereof. Our stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

|

|

A:

|

Our Board of Directors is asking for your proxy, which is a legal designation of another person to vote the shares you own. We have designated two officers of the Company, Deborah Saly and Mark Stolper, to vote your shares at the meeting in the way you instruct and, with regard to any other business that may properly come before the meeting, as they think best.

|

|

Q:

|

Why haven’t I received a printed copy of the proxy materials and the 2018 Annual Report?

|

|

A:

|

On or about April 30, 2019, we will mail

the Notice to our stockholders who have not previously requested the receipt of paper proxy materials advising them that they can

access this Proxy Statement, the 2018 Annual Report and voting instructions over the Internet at

www.proxyvote.com

.

You may then access these materials and vote your shares over the Internet. Please keep the Notice for your reference through

the meeting date.

Alternatively, you may request that a printed paper copy of the proxy materials be mailed to you. If you want to receive

a paper copy of the proxy materials, you may request one over the Internet at

www.proxyvote.com

, by calling toll-free 1-800-579-1639,

or by sending an email to

sendmaterial@proxyvote.com

. There is no charge to you for requesting a copy. Please

make your request for a copy on or before May 30, 2019 to facilitate timely delivery.

|

|

Q:

|

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or set of proxy materials?

|

|

A:

|

This means you hold shares of the Company in more than one way. For example, you may own some shares directly as a “registered holder” and other shares through a broker, or you may own shares through more than one broker. In these situations, you may receive multiple Notices or, if you request proxy materials to be delivered to you by mail, multiple Proxy Cards. You must follow the instructions on how to vote on each of the Notices you receive in order to vote all of the shares you own. If you request proxy materials to be delivered to you by mail, each Proxy Card you receive will come with its own prepaid return envelope; if you vote by mail, make sure you complete and sign each Proxy Card and return each in the return envelope which accompanied that particular Proxy Card.

|

|

Q:

|

What is the purpose of the Annual Meeting?

|

|

A:

|

At the Annual Meeting, our stockholders will vote on the following items:

|

|

|

1.

|

The election of seven nominees named in the attached Proxy Statement as directors to hold office until the 2020 Annual Meeting of Stockholders;

|

|

|

2.

|

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019;

|

|

|

3.

|

A non-binding advisory vote to approve executive compensation;

|

|

|

4.

|

A non-binding stockholder proposal requesting that we adopt “majority voting” in uncontested elections of directors, if properly presented at the Annual Meeting; and

|

|

|

5.

|

Other business that may properly come before the Annual Meeting.

|

|

Q:

|

Who is entitled to vote at the Annual Meeting?

|

|

A:

|

Only stockholders of record at the close of business on April 17, 2019 (the “Record Date”), are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on the Record Date, you will be entitled to vote all of the shares that you held on that date at the Annual Meeting and at any postponements or adjournments thereof. Stockholders who hold shares of our common stock in “street name,” that is, through an account with a bank, broker or other holder of record, as of the Record Date, may direct the holder of record how to vote their shares at the meeting by following the instructions that the street name holders will receive from the bank, broker or other holder of record.

|

|

Q:

|

What are the voting rights of the holders of common stock?

|

|

A:

|

Each share of our common stock outstanding as of the close of business on the Record Date is entitled to one vote on each matter considered at the Annual Meeting.

|

|

Q:

|

How is a quorum determined?

|

|

A:

|

We will have a quorum to conduct the business of the Annual Meeting if holders of a majority of the shares of our common stock outstanding as of the Record Date are present in person or represented by proxy. On the Record Date 50,081,479 shares of our common stock were issued and outstanding. Consequently, we will need to have 25,040,740 shares present in person or represented by proxy at the Annual Meeting in order to establish a quorum. Abstentions and broker non-votes will be counted in determining whether a quorum is present at the meeting.

|

|

Q:

|

Who will count the votes?

|

|

A:

|

An officer of the Company will count the votes and act as the inspector of elections. The inspector of elections will separately tabulate affirmative and negative votes, abstentions and broker non-votes. The Company has also engaged Broadridge Financial Solutions as its proxy distribution agent and tabulation service provider and they will also be calculating the votes received prior to the Annual Meeting.

|

|

Q:

|

What is the deadline for voting my shares?

|

|

A:

|

If you are a stockholder of record, your proxy must be received by telephone (1-800-690-6903) or via the Internet (

www.proxyvote.com

) by 11:59 p.m. Eastern Time on June 12, 2019 in order for your shares to be voted at the Annual Meeting. However, if you are a stockholder of record and you received a copy of the proxy materials by mail, you may instead mark, sign, date and return the Proxy Card enclosed with your proxy materials, which must be received before the polls close at the Annual Meeting, in order for your shares to be voted at the meeting. If you are a beneficial stockholder, please follow the voting instructions provided by the bank, broker, trustee or other nominee who holds your shares.

|

|

Q:

|

What is a “broker non-vote”?

|

|

A:

|

A “broker non-vote” occurs when a nominee (typically a broker or bank) holding shares for a beneficial owner (typically referred to as shares being held in “street name”) submits a proxy for the Annual Meeting, but does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares with respect to that particular proposal. Shares that constitute broker non-votes will be counted as present for purposes of establishing a quorum, but will not be counted as having voting power to vote on the proposal in question. Under the applicable rules of the exchanges and other self-regulatory organizations, brokers will generally have discretionary authority to vote on routine matters. The ratification of the appointment of Ernst & Young as our independent registered public accounting firm (Proposal No. 2) is generally considered a routine matter, and we do not expect to receive any broker non-votes on that proposal. We believe brokers do not have discretionary authority to vote on the other proposals. You must instruct your bank, broker or nominee on how to vote your shares for all of the proposals other than Proposal No. 2 in order for your vote to count for those proposals.

|

|

Q:

|

What do I need to bring with me in order to attend the Annual Meeting?

|

|

A:

|

If you are a stockholder of record, you will need to bring either the Notice or any Proxy Card that is sent to you to the meeting. Otherwise, you will be admitted only if we can verify your ownership of common stock on the Record Date. If you own shares held in street name, bring with you to the meeting either the Notice or any voting instruction form that is sent to you, or your most recent brokerage statement or a letter from your bank, broker or other record holder indicating that you beneficially owned shares of our common stock on the Record Date. We can use that to verify your beneficial ownership of common stock and admit you to the meeting. Additionally, all persons will need to bring a valid government-issued photo ID to gain admission to the meeting.

|

|

Q:

|

How do I vote my shares in person at the Annual Meeting?

|

|

A:

|

If you are a stockholder of record, you have the right to vote in person at the Annual Meeting. If you choose to do so, you can vote using the ballot provided at the Annual Meeting, or, if you requested and received printed copies of the proxy materials by mail, you can complete, sign and date the Proxy Card enclosed with the proxy materials you received and submit the Proxy Card at the Annual Meeting. If you are a beneficial stockholder, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the bank, broker, trustee or other nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the meeting as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

|

|

Q:

|

How do I vote my shares without attending the Annual Meeting?

|

|

A:

|

Whether you are a stockholder of record

or a beneficial stockholder, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder

of record, you may submit a proxy to authorize how your shares are voted at the Annual Meeting. You can submit a proxy over the

Internet or by telephone by following the instructions provided in the Notice, or, if you requested and received printed copies

of the proxy materials, you can also submit a proxy by mail pursuant to the instructions provided in the Proxy Card enclosed with

the printed proxy materials.

If you are a stockholder who holds stock in “street name” you will likely receive instructions for voting your shares

from your broker, bank, or other nominee rather than through our voting system. A number of brokers and banks participate in a

program that allows stockholders to grant their proxy to vote shares by means of the telephone or the Internet. If your shares

are held in an account with a broker or bank participating in such a program, then you may vote your shares via the Internet or

telephonically by following the instructions on the form received from your broker or bank.

Stockholders who submit a proxy by Internet or telephone need not return a Proxy Card or the form forwarded by your broker, bank,

trust or other holder of record by mail.

|

|

Q:

|

Can I revoke my proxy or voting instructions later?

|

|

A:

|

If you are a stockholder of record or a beneficial stockholder, then once you have submitted your proxy you may revoke it at any time before it is voted at the Annual Meeting. You may revoke your proxy in one of three ways:

|

|

|

(1)

|

You may submit a duly executed written proxy bearing a date that is later than the date of your original proxy or you can submit a later dated proxy electronically via the Internet or by telephone;

|

|

|

|

|

|

|

(2)

|

You may notify our Corporate Secretary in writing that you wish to revoke your proxy before it is voted at the Annual Meeting; or

|

|

|

|

|

|

|

(3)

|

You may vote in person at the Annual Meeting. However, if your shares are held in “street name” and you wish to vote at the Annual Meeting, you must first obtain from the broker, bank or other nominee record holder a proxy issued in your name.

|

|

Q:

|

What vote is required to approve the proposals?

|

|

A:

|

The election of directors requires a plurality

of votes cast by shares present or represented at the Annual Meeting. Accordingly, if a quorum exists, the directorships to be

filled at the Annual Meeting will be filled by the nominees receiving the highest number of votes in favor of their election. Shares

not present at the Annual Meeting and broker non-votes will have no impact on the election of directors.

The ratification of the appointment of

our independent registered public accounting firm must be approved by a majority of the shares present in person or represented

by proxy and entitled to vote on such matter at the Annual Meeting. With respect to that proposal, abstentions will be included

in the number of shares present and entitled to vote and, accordingly, will have the effect of a vote “AGAINST” the

proposal. However, broker non-votes with respect to that proposal will not be counted as shares entitled to vote and, accordingly,

will not have any effect with respect to the approval of that proposal (other than to reduce the number of affirmative votes required

to approve the proposal).

The advisory votes to (1) approve the compensation

of our Named Executive Officers (Proposal No. 3) and (2) adopt the stockholder proposal for “majority voting” in uncontested

elections of directors (Proposal No. 4) must be approved by a majority of the shares present in person or represented by proxy

and entitled to vote on such matters at the Annual Meeting. With respect to those proposals, abstentions will be included in the

number of shares present and entitled to vote and, accordingly, will have the effect of a vote “AGAINST” the proposal.

However, broker non-votes with respect to that proposal will not be counted as shares entitled to vote and, accordingly, will not

have any effect with respect to the approval of that proposal (other than to reduce the number of affirmative votes required to

approve the proposal).

Although the vote on the compensation of

our Named Executive Officers, Proposal No. 3, is advisory only, meaning that it is not binding on the Company, our Board of Directors

will consider the results of the vote in its future consideration of the compensation of our Named Executive Officers.

Similarly, although the vote on the stockholder

proposal to adopt “majority voting” in uncontested elections of directors, Proposal No. 4, is advisory only, meaning

that it is not binding on the Company, our Board of Directors will consider the results of the vote in its future consideration

of the voting requirements in elections of directors.

|

|

Q:

|

What are my voting choices for each proposal?

|

|

A:

|

With respect to the election of directors, stockholders may vote for all nominees, withhold authority for all nominees or vote for all except for those individual nominees for director for which the stockholder indicates it is withholding authority. With respect to each other proposal, stockholders may vote “for” the proposal, “against” the proposal, or abstain from voting.

|

|

Q:

|

How does the Board of Directors recommend I vote on the proposals?

|

|

A:

|

Our Board of Directors

unanimously recommends

that stockholders vote:

“FOR” all seven director nominees

set forth in Proposal No. 1

“FOR” the ratification of the

appointment of Ernst & Young LLP in Proposal No. 2

“FOR” the approval of our executive

compensation in Proposal No. 3.

Our Board of Directors makes no recommendation

on the advisory stockholder proposal requesting “majority voting” in uncontested elections of directors in Proposal

No. 4.

|

|

Q:

|

How will my shares be voted if I return a blank Proxy Card?

|

|

A:

|

If you are a record holder and submit a valid proxy or voting instruction form but do not indicate your specific voting instructions on one or more of the proposals listed in the Notice, your shares will be voted as recommended by our Board of Directors on those proposals (and will be recorded as “ABSTAIN” for Proposal No. 4) and as the proxyholders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

|

|

Q:

|

Is my vote confidential?

|

|

A:

|

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except: (1) as necessary to meet applicable legal requirements and (2) to allow for the tabulation of votes and certification of the vote. Occasionally, stockholders include additional comments on their Proxy Card or with their voting instruction, which are then forwarded to the Company’s management.

|

|

Q:

|

How will voting on any other business be conducted?

|

|

A:

|

We do not know of any business to be conducted at the Annual Meeting other than the proposals discussed in this Proxy Statement. If any other business comes before the Annual Meeting, the individuals that we have designated as proxies for the Annual Meeting, Deborah Saly and Mark Stolper, will have the discretionary authority to vote for or against any other matter that is properly presented at the Annual Meeting.

|

|

Q:

|

Who will bear the costs of this solicitation?

|

|

A:

|

This solicitation is made by our Board of Directors on behalf of the Company, and we will bear the entire cost of soliciting proxies, including preparation, assembly, posting of this Proxy Statement online, printing and mailing of the Notice and the proxy materials for the Annual Meeting. We will also make available solicitation materials to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our common stock that are beneficially owned by others for forwarding to the beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to the beneficial owners. Solicitations will be made primarily through the mail, but may be supplemented by telephone, facsimile, Internet or personal solicitation by our directors, executive officers and employees. No additional compensation will be paid to these individuals for these services.

|

|

Q:

|

How can I find out the results of the voting at the Annual Meeting?

|

|

A:

|

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a report on Form 8-K within four business days after the Annual Meeting.

|

|

Q:

|

Whom should I contact with other questions?

|

|

A:

|

If you have additional questions about this Proxy Statement or the Annual Meeting, please contact

our Corporate Secretary at: RadNet, Inc., 1510 Cotner Avenue, Los Angeles, CA 90025, Attention: Corporate Secretary, Telephone:

(310) 445-2800.

|

|

Q:

|

When are stockholder proposals due for next year’s annual meeting?

|

|

A:

|

Requirements for Stockholder Proposals to be Considered for Inclusion in RadNet, Inc.’s Proxy Materials

. Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) must be received by us not later than December 31, 2019, in order to be considered for inclusion in our proxy materials for the 2020 Annual Meeting of Stockholders.

|

|

|

|

Requirements for Stockholder

Proposals to be Brought Before an Annual Meeting

. Our bylaws provide that, for stockholder nominations to the Board of Directors

or other proposals to be considered at an annual meeting, the stockholder must have given timely advance notice of the proposal

or nomination in writing to our Corporate Secretary. To be timely for the 2020 Annual Meeting of Stockholders, a stockholder’s

notice must be delivered to or mailed and received by our Corporate Secretary at our principal executive offices between February

14, 2020 and March 15, 2020. A stockholder’s notice to the Corporate Secretary must set forth, as to each matter the stockholder

proposes to bring before the annual meeting, the information required by our bylaws.

CORPORATE GOVERNANCE

Role of the Board of Directors

Our business is managed

under the direction of our Board of Directors. Our Board of Directors provides oversight, strategic direction and counsel to our

management. In addition, our Board of Directors elects our officers, delegates responsibilities for the conduct of our operations

to those officers, and evaluates their performance.

Our Board of Directors

held five meetings during 2018. Each of the current directors serving in 2018 attended at least 75% of the total number of meetings

of the Board of Directors and applicable committees that each director was eligible to attend.

Board Leadership Structure

Our Chairman of the

Board of Directors, Dr. Berger, also serves as our Chief Executive Officer. Our Board of Directors has determined that this leadership

structure is appropriate and effective for our Company at this time. This structure effectively utilizes Dr. Berger’s knowledge

of our Company and the industry in which we operate, as well as fostering greater communication and producing a greater degree

of transparency between management and our directors. Dr. Berger co-founded RadNet in 1980 and has served as Chairman of the Board

and Chief Executive Officer for over 30 years.

Mr. Swartz serves as

Lead Independent Director of the Board of Directors. In this capacity, Mr. Swartz serves as Chairman of meetings of the Board of

Directors in the absence of the Chairman of the Board, calls, sets the agenda and chairs the executive sessions of the independent

directors, works collaboratively with the Chairman of the Compensation and Management Development Committee to oversee the evaluation

of our Chief Executive Officer and serves as the liaison between the independent directors and the Chairman of the Board.

Director Independence

Four of the seven members

of our Board of Directors are independent directors and only those individuals may serve on the committees of our Board of Directors.

Our Chairman and Chief Executive Officer does not serve on any committee. Our Board of Directors holds regular executive sessions

outside the presence of the Chief Executive Officer and other management, which our Board of Directors believes promotes appropriate

independent leadership.

Our Board of Directors

annually determines the independence of our directors in accordance with the independence requirements under the NASDAQ Stock Market

LLC (“NASDAQ”) and the SEC rules which require at least a majority of the directors to be independent. As a result

of this review, our Board of Directors has determined that Marvin S. Cadwell, Lawrence L. Levitt, Michael L. Sherman, M.D. and

David Swartz each qualifies as an independent director in accordance with the NASDAQ and the SEC rules. Each of Howard G. Berger,

M.D., John V. Crues, III M.D., and Norman R. Hames is an executive officer of our Company and therefore does not qualify as an

independent director under the NASDAQ and the SEC rules.

Committees of the Board of Directors

We have three standing

committees: the Audit Committee, the Compensation and Management Development Committee and the Nominating and Governance Committee.

The committees are comprised entirely of independent directors. Each committee operates under a written charter adopted by the

Board of Directors which is available at

www.radnet.com

under Investor Relations – Corporate Governance.

The composition of

those committees is as set forth below:

|

Director

|

|

Audit Committee

|

|

Compensation and Management

Development Committee

|

|

Nominating and Governance Committee

|

|

Independent Director

|

|

Lawrence L. Levitt

|

|

X

|

|

C

|

|

X

|

|

X

|

|

Marvin S. Cadwell

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Michael Sherman, M.D.

|

|

–

|

|

X

|

|

C

|

|

X

|

|

David L. Swartz

|

|

C

|

|

X

|

|

X

|

|

X

|

|

Howard G. Berger, M.D.

|

|

–

|

|

–

|

|

–

|

|

–

|

|

John V. Crues, III, M.D.

|

|

–

|

|

–

|

|

–

|

|

–

|

|

Norman R. Hames

|

|

–

|

|

–

|

|

–

|

|

–

|

________________________

“C” denotes chair of committee

Audit Committee

The Audit Committee’s

responsibilities include, among other things:

|

|

·

|

overseeing our accounting and financial reporting processes and the audits of our financial statements;

|

|

|

·

|

overseeing, along with management, the reliability and integrity of our accounting policies and financial reporting and disclosure practices;

|

|

|

·

|

serving as an independent and objective party to monitor our financial reporting processes and internal controls systems;

|

|

|

·

|

retaining our independent registered public accounting firm, reviewing and evaluating their independence, qualifications and performance, approving the terms of the annual engagement letter and approving all audit and non-audit services to be performed by our independent registered public accounting firm; and

|

|

|

·

|

providing independent, direct, and open communications among our independent registered public accounting firm, financial and senior management and the full Board of Directors.

|

The Board of Directors

has determined that each of Mr. Swartz and Mr. Levitt qualifies as an “audit committee financial expert” as defined

under the applicable SEC rules and that each member of the Audit Committee meets the additional criteria for independence of Audit

Committee members under Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The

Audit Committee held four meetings in 2018.

Compensation and Management

Development Committee

The Compensation and

Management Development Committee’s responsibilities include, among other things:

|

|

·

|

reviewing and determining the base salary of executive officers and certain other senior management and setting the maximum bonus amount that each executive officer (other than the Chief Executive Officer) and certain other senior management is entitled to receive, which may be in the form of cash or equity incentive awards, as ultimately determined by our Chief Executive Officer;

|

|

|

·

|

reviewing and administering our equity

incentive plans, including any amendments thereto;

|

|

|

·

|

reviewing and recommending amounts and types of compensation for the Company’s directors;

|

|

|

·

|

overseeing the compensation philosophy and strategy of the Company;

|

|

|

·

|

monitoring the Company’s compliance with rules and regulations relating to compensation arrangements for directors and executive officers; and

|

|

|

·

|

reviewing and approving our Company’s corporate goals and objectives relevant to Chief Executive Officer compensation and evaluating the Chief Executive Officer’s performance in light of those goals and determining the Chief Executive Officer’s compensation levels and bonus based on such evaluation.

|

The Compensation and

Management Development Committee held two meetings and took action by written consent on one occasion in 2018.

Nominating

and Governance Committee

The Nominating and

Governance Committee’s responsibilities include, among other things:

|

|

·

|

developing and recommending the criteria to be used in screening and evaluating potential candidates or nominees for election or appointment as director;

|

|

|

·

|

establishing and overseeing a policy for considering stockholder nominees for directors, and developing the procedures that must be followed by stockholders in submitting recommendations;

|

|

|

·

|

monitoring and reviewing any issues regarding the independence of directors or involving potential conflicts of interest and evaluating any change of status or circumstances with respect to a director;

|

|

|

·

|

evaluating all nominees for election of directors;

|

|

|

·

|

developing and recommending to the Board of Directors, as necessary, corporate governance policies to be adopted and maintained;

|

|

|

·

|

identifying committee member qualifications and recommending appropriate committee member appointments to the Board of Directors; and

|

|

|

·

|

establishing and reviewing annually with the Board of Directors the procedures for stockholders to send communications to the Board of Directors.

|

The Nominating and

Governance Committee held one meeting during 2018.

Board Role in Risk Oversight

Our Board of Directors

performs an oversight role in managing the Company’s risk. In reviewing our strategy, business plan, budgets and historical

and anticipated future major transactions, the Board of Directors considers, among other factors, the risks our Company faces,

and how such risks can be appropriately managed. While our Board of Directors oversees risk management strategy, our management

is responsible for implementing and supervising day to day risk management processes. Our senior management regularly reports to

the Board of Directors on areas of material risk, including operational, financial, legal and strategic risks, which enables the

Board of Directors to understand management’s views and strategies regarding risk identification, risk management and risk

mitigation.

In addition to the

oversight role assumed by the full Board of Directors, various committees of the Board of Directors also have responsibility for

risk management. The Director of Internal Audit reports directly to our Audit Committee on areas of material financial risk, including

internal controls, and the Audit Committee reports to the full Board of Directors on risks identified by the Director of Internal

Audit that the Audit Committee believes to be material. In addition, the Compensation and Management Development Committee oversees

the risks associated with our compensation policies and practices to ensure that the compensation programs and incentives do not

encourage short term risk taking at the expense of long term results or create risks that may have a material adverse effect on

the Company.

Code of Financial Ethics

We have adopted a written

Code of Financial Ethics that is applicable to our directors, officers and employees and is designed to deter wrongdoing and to

promote:

|

|

·

|

honest and ethical conduct;

|

|

|

·

|

full, fair, accurate, timely and understandable disclosure in reports and documents that we file with the SEC and in other public communications;

|

|

|

·

|

compliance with applicable laws, rules and regulations, including insider trading compliance; and

|

|

|

·

|

accountability for adherence to the code and prompt internal reporting of violations of the code, including illegal or unethical behavior regarding accounting or auditing practices.

|

You may obtain a copy

of our Code of Financial Ethics on our website at

www.radnet.com

under Investor Relations – Corporate Governance.

The Board of Directors has designated the Audit Committee to be responsible for reviewing the Code of Financial Ethics and making

any appropriate updates or amendments. We intend to disclose any changes in this code or waivers from this code that apply to our

principal executive officer, principal financial officer, or principal accounting officer by posting such information to our website

or by filing with the SEC a Current Report on Form 8-K, in each case if such disclosure is required by SEC or Nasdaq rules.

Review and Approval of Related Party Transactions

As a matter of policy,

the Board of Directors reviews and determines whether or not to approve any transaction between the Company and its directors,

director nominees, executive officers and greater than 5% beneficial owners and each of their respective immediate family members

where the amount involved in the transaction exceeds or is expected to exceed $120,000 in a single year and the related party has

or will have a direct or indirect interest in the transaction.

Related Party Transactions

Howard G. Berger, M.D.,

is our President and Chief Executive Officer, a member of our Board of Directors, and also owns, indirectly, 99% of the equity

interests in BRMG. BRMG is responsible for all of the professional medical services at nearly all of our facilities located in

California under a management agreement with us, and employs physicians or contracts with various other independent physicians

and physician groups to provide the professional medical services at most of our California facilities. We generally obtain professional

medical services from BRMG in California, rather than provide such services directly or through subsidiaries, in order to comply

with California’s prohibition against the corporate practice of medicine. We have a management agreement with BRMG, that

expires on January 1, 2024 but includes an automatic renewal for consecutive 10-year periods. Under our management agreement, BRMG

pays us, as compensation for the use of our facilities and equipment and for our services, a percentage of the gross amounts collected

for the professional services it renders. The percentage, which was 79% at December 31, 2018, is adjusted, if necessary, to ensure

that the parties receive fair value for the services they render. In operation and historically, the annual revenue of BRMG from

all sources closely approximates its expenses, including Dr. Berger’s compensation, fees payable to us and amounts payable

to third parties.

Dr. Berger also owns a controlling interest in two medical

groups that provide professional medical services to one of our imaging facilities located in New York. In 2018, Dr. Berger received

$500,000 of his salary and his entire bonus payment from an affiliate of BRMG, a consolidated entity.

John V. Crues III,

M.D. is our Medical Director, a member of our Board of Directors and a 1% owner of BRMG. Dr. Crues receives all of his salary from

BRMG. Dr. Crues also owns a controlling interest in four medical groups that provide professional medical services to some of our

imaging facilities located in Manhattan and Brooklyn, New York.

Jeffrey L. Linden was

our Executive Vice President and General Counsel until his death in October 2018. Joseph Berman, the brother-in-law of Mr. Linden,

has an interest in a property in Delaware that the Company leases. The monthly rent under this lease is approximately $36,000.

We believe that the monthly lease amounts are commensurate with available leases with similar lease terms for comparable buildings

in the area. Mr. Linden did not have any interest in this property or this transaction.

Board Attendance at Annual Meetings

of Stockholders

We, as a matter of

policy, encourage our directors to attend meetings of stockholders but we do not require attendance. Two of the seven directors

attended the 2018 Annual Meeting of Stockholders.

Compensation Committee Interlocks and Insider

Participation

Messrs. Levitt, Cadwell,

Sherman and Swartz were members of the Compensation and Management Development Committee in 2018. No member of the Compensation

and Management Development Committee has had a relationship with our Company or any of our subsidiaries other than as a director

and stockholder and no member has been an officer or employee of our Company or any of our subsidiaries, a participant in a “related

person” transaction or an executive officer of another entity where one of our executive officers serves on the Board of

Directors.

Communication with our Board of Directors

Stockholders may communicate

with our Board of Directors through the Corporate Secretary by writing to the following address: Board of Directors, c/o Corporate

Secretary, RadNet, Inc., 1510 Cotner Avenue, Los Angeles, CA 90025. The envelope containing such communication should contain a

clear notation that the letter is “Stockholder-Board Communication” or “Stockholder-Director Communication”

or a similar statement to indicate it is intended for the Board of Directors. All such communications must clearly indicate the

author as a stockholder and state whether the intended recipients are all members of the Board of Directors or just certain specified

directors.

DIRECTORS

Nomination Process

Our Nominating and

Governance Committee recommends nominees to the Board of Directors for election after carefully considering all candidates, taking

into account all factors the Committee considers appropriate, which may include career specialization, relevant technical skills

or financial acumen, diversity of viewpoint, industry knowledge and the qualifications set forth in the Nominating and Governance

Committee Charter. Our Nominating and Governance Committee does not have a formal policy with regard to the consideration of diversity

in the identification of director nominees. However, as part of its evaluation of Board composition, the Nominating and Governance

Committee considers the diversity of candidates to ensure that our Board of Directors is comprised of individuals with a broad

range of experiences and backgrounds (including, among other things, career specialization, relevant technical skills or financial

acumen, diversity of viewpoint and industry knowledge) who can contribute to the Board’s overall effectiveness in carrying

out its responsibilities and can represent diverse viewpoints on our Board of Directors. The Nominating and Governance Committee

assesses the effectiveness of these efforts when evaluating the composition of the Board of Directors as part of the annual nomination

process.

The Nominating

and Governance Committee considers stockholder nominees made in accordance with our bylaws, and evaluates candidates recommended

by stockholders in the same manner as all other candidates brought to the attention of the Nominating and Governance Committee.

Stockholder recommendations may be submitted to the Nominating and Governance Committee in care of the Corporate Secretary at the

address set forth under “Communication with Our Board of Directors.”

Nominees for Election

The names of the director

nominees, their ages as of March 31, 2019, and other information about them are set forth below. Each of the seven nominees currently

serves on the Board.

|

Name of Director Nominee

|

|

Age

|

|

Position

|

|

Our

Director Since

|

|

Howard G. Berger, M.D.

|

|

73

|

|

Chief Executive Officer and Chairman of the Board

|

|

1992

|

|

Marvin S. Cadwell

|

|

75

|

|

Director

|

|

2007

|

|

John V. Crues, III, M.D.

|

|

69

|

|

Director, Vice President, Medical Director

|

|

2000

|

|

Norman R. Hames

|

|

63

|

|

Director, President, Chief Operating Officer-Western Operations, Secretary

|

|

1996

|

|

Lawrence L. Levitt

|

|

76

|

|

Director

|

|

2005

|

|

Michael L. Sherman, M.D.

|

|

76

|

|

Director

|

|

2007

|

|

David L. Swartz

|

|

75

|

|

Director

|

|

2004

|

The following biographies

describe the skills, qualities, attributes, and experience of the nominees that led the Board of Directors and the Nominating and

Governance Committee to determine that it is appropriate to nominate these directors for election to the Board of Directors.

Howard G. Berger,

M.D.

has served as President and Chief Executive Officer of our Company and its predecessor entities since 1987. Dr. Berger

received his M.D. at the University of Illinois Medical School, is Board Certified in Nuclear Medicine and trained in an Internal

Medicine residency, as well as in a master’s program in medical physics in the University of California system. Dr. Berger

is also the president or co-president of the entities that own Beverly Radiology Medical Group, or BRMG. Dr. Berger brings senior

business leadership skills to our Board of Directors and deep industry knowledge derived from his more than 30 years of experience

in the development and management of the Company.

Marvin S. Cadwell

has been a member of our Audit Committee since 2007, a member of our Nominating and Governance Committee since 2011 and a member

of our Compensation and Management Development Committee since 2014. Mr. Cadwell served as a director of Radiologix, Inc. between

June 2002 and November 2006, until its acquisition by the Company. He was appointed Chairman of the Board of Radiologix in December

2002 and served as Chairman of the Nominations and Governance Committee of the Board of Radiologix. He was the Radiologix interim

Chief Executive Officer from September 2004 until November 2004. From December 2001 until November 2002, Mr. Cadwell served as

Chief Executive Officer of SoftWatch, Ltd., an Israeli based company that provided Internet software. Mr. Cadwell previously served

as a director of ChartOne, Inc., a private company that provides patient chart management services to the healthcare industry,

from 2003 until its acquisition in September 2008. Mr. Cadwell has served as an executive officer and consultant for several companies

in the healthcare industry. He brings to our Board of Directors a strong background in operating management of various organizations.

John V. Crues, III,

M.D.

is a world-renowned radiologist. Dr. Crues has served as our Vice President and Medical Director since 2000. Dr. Crues

received his M.D. at Harvard University, completed his internship at the University of Southern California in Internal Medicine,

and completed a residency at Cedars-Sinai in Internal Medicine and Radiology. Dr. Crues has authored numerous publications while

continuing to actively participate in radiological societies such as the Radiological Society of North America, American College

of Radiology, California Radiological Society, International Society for Magnetic Resonance Medicine and the International Skeletal

Society. Dr. Crues is also currently Co-President of Pronet Imaging Medical Group, a director of BRMG and owns a controlling interest

in four medical groups which provide professional medical services at our imaging facilities located in New York, New York. Dr.

Crues plays a significant role as a musculoskeletal specialist for many of our patients as well as a resource for physicians providing

services at our facilities. His active participation in radiological societies gives our Board of Directors access to thought leadership

in the field of radiology.

Norman R. Hames

has served as an executive officer of the Company since 1996 and currently serves as our President, Chief Operating Officer-Western

Operations and Corporate Secretary. Applying his more than 20 years of experience in the industry, Mr. Hames oversees all aspects

of our California facility operations. His management team, comprised of regional directors, managers and sales managers, is responsible

for responding to all of the day-to-day concerns of our California facilities, patients, payors and referring physicians. Prior

to joining our Company, Mr. Hames was President and Chief Executive Officer of his own company, Diagnostic Imaging Services, Inc.

(which we acquired), which owned and operated 14 multi-modality imaging facilities throughout Southern California. Mr. Hames gained

his initial experience in operating imaging centers for American Medical International, or AMI, and was responsible for the development

of AMI’s single and multi-modality imaging centers. Mr. Hames brings business leadership skills from his experience as President

and Chief Executive Officer of his own company and has a 20-year background in the day-to-day operations of imaging centers.

Lawrence L. Levitt

has been a member of our Audit Committee since March 2005 and a member of our Nominating and Governance Committee since 2011. Mr.

Levitt has served as the Chair of our Compensation and Management Development Committee since 2007. Mr. Levitt is a certified public

accountant and received his MBA in Accounting from the University of California Los Angeles. Since 1987, Mr. Levitt has been the

President and Chief Financial Officer of Canyon Management Company, a company which manages a privately held investment fund. Mr.

Levitt brings to our Board of Directors extensive financial accounting experience and is an audit committee financial expert under

the SEC rules.

Michael L. Sherman,

M.D., F.A.C.R.

, has been a member of our Compensation and Management Development Committee since 2007 and was elected to serve

as the chair of our Nominating and Governance Committee in 2011. Dr. Sherman served as a director of Radiologix between 1997 and

November 2006, until its acquisition by the Company. He founded and served as President of Advanced Radiology, P.A., a 90-person

radiology practice located in Baltimore, Maryland, from its inception in 1995 to 2001, and subsequently as its board chairman and

a consultant until his retirement from active clinical practice in 2005. In addition, Dr. Sherman was a director of MedStar Health,

a ten-hospital system in the Baltimore-Washington, D.C. area from 1998 until 2006 and served as a director of Medstar’s captive

insurance company until 2011. Dr. Sherman has trained as a mediator and since 2006 has served as president of Medical Mediation,

LLC through which he has mediated professional liability and business cases. He was a director of HX Technologies, a healthcare

IT private company, from 2006 until its sale in 2010. Dr. Sherman has broad experience in the medical and business aspects of radiology

as a board member and chairman of various companies in the healthcare industry.

David L. Swartz

has been chair of our Audit Committee since 2004, has been a member of our Nominating and Governance Committee since 2007 and was

appointed as Lead Independent Director in 2011. Mr. Swartz is a certified public accountant with experience providing accounting

and advisory services to clients. Since 2010, Mr. Swartz has owned and continues to operate his own consulting services firm. Mr.

Swartz served as a member of the Board of Directors of the California State Board of Accountancy until November 2012 and previously

served as its president. Prior to 1988, Mr. Swartz served as managing partner and was on the national Board of Directors of a 50

office international accounting firm. Between 1990 and 2008, Mr. Swartz served as the managing partner of Good, Swartz, Brown &

Berns LLP which was acquired by J.H. Cohn LLP in 2008. From 2008 to 2010, Mr. Swartz served as a partner at J.H. Cohn LLP. Mr.

Swartz also served as chief financial officer of a publicly held shopping center and development company from 1988 to 2000. Mr.

Swartz brings to our Board of Directors extensive public financial accounting experience and is an audit committee financial expert

under the SEC rules.

COMPENSATION OF DIRECTORS

Overview of Director Compensation

We use cash and stock

based incentive compensation to attract and retain qualified candidates to serve on our Board of Directors. In setting director

compensation, we consider the significant amount of time that our directors expend in fulfilling their duties to our Company as

well as the skill level required by the members of our Board of Directors. The Compensation and Management Development Committee

considers and evaluates compensation arrangements and makes recommendations to the Board of Directors, which has ultimate authority

to approve such compensation. In addition, our certificate of incorporation and bylaws include indemnification provisions for our

directors and executive officers and we maintain liability insurance for our directors and executive officers. Employee directors

do not receive any compensation for their service as a director.

Cash Compensation Paid to Non-Employee

Board Members

Based on the recommendation

of the Compensation and Management Development Committee’s independent compensation consultant Pearl Meyer & Partners

LLC (“Pearl Meyer”) and a review of peer group data, the Compensation and Management Development Committee elected

in 2018 to keep the existing cash compensation structure in place as is for non-employee directors to continue to align our director

compensation structure with general market practices. The 2018 cash compensation structure for non-employee directors is set forth

below:

|

Annual cash compensation

|

|

$

|

55,000

|

|

|

Audit Committee Chair annual cash compensation

|

|

$

|

20,000

|

|

|

Compensation and Management Development Committee Chair annual cash compensation

|

|

$

|

10,000

|

|

|

Nominating and Governance Committee Chair annual cash compensation

|

|

$

|

10,000

|

|

|

Lead Director annual cash compensation

|

|

$

|

10,000

|

|

|

Committee Meeting Attendance (per meeting)

|

|

$

|

1,500

|

|

Equity Compensation in 2018

In 2018, non-employee

directors each received a restricted stock award of 9,728 common shares under our 2006 Equity Incentive Plan, as amended (the “Restated

2006 Plan”), with a grant date value of approximately $125,000 based on the $12.85 per-share closing price of the Company’s

common stock on June 7, 2018. Subject to continued service, vesting of the equity grant will occur at the end of each non-employee

director’s current term which coincides with the Annual Meeting.

Nonqualified Deferred Compensation Arrangements

Non-employee directors

are eligible to participate in our Nonqualified Deferred Compensation Plan. No non-employee

directors elected to defer any portion of their equity compensation granted in 2018.

Non-Employee Director Compensation

- 2018

The table below summarizes

the compensation received for the fiscal year ended December 31, 2018 by each of our non-employee directors.

|

Name

|

|

Fees Earned or Paid in Cash ($)

|

|

|

Stock Awards

($)

(1)(2)

|

|

|

Total ($)

|

|

|

Marvin S. Cadwell

(3)

|

|

|

64,000

|

|

|

|

125,000

|

|

|

|

189,000

|

|

|

Lawrence L. Levitt

(3)

|

|

|

75,500

|

|

|

|

125,000

|

|

|

|

200,500

|

|

|

Michael L. Sherman, M.D.

(3)

|

|

|

68,750

|

|

|

|

125,000

|

|

|

|

193,750

|

|

|

David L. Swartz

(3)

|

|

|

94,000

|

|

|

|

125,000

|

|

|

|

219,000

|

|

______________________

|

|

(1)

|

In accordance with SEC rules, the amounts shown reflect the aggregate grant date fair value of stock awards granted in 2018 computed in accordance with FASB ASC Topic 718. The grant date value is measured based on the closing price of Radnet’s common stock on the date of grant. These are not amounts actually paid to or realized by the non-employee director.

|

|

|

(2)

|

Reflects the restricted stock awards described above in “Equity Compensation in 2018” section above.

|

|

|

|

|

|

|

(3)

|

As of December 31, 2018, each of Messrs. Cadwell, Levitt,

Sherman and Swartz held 9,728 shares of unvested restricted stock. None of the non-employee directors held any stock options.

|

EXECUTIVE OFFICERS

The names of our current

executive officers, their ages as of March 31, 2019, and their positions are shown below.

|

Name of Executive Officer

|

|

Age

|

|

Position

|

|

Executive Officer

Since

|

|

Howard G. Berger, M.D.

|

|

73

|

|

President, Chief Executive Officer and Chairman of the Board

|

|

1992

|

|

John V. Crues, III, M.D.

|

|

69

|

|

Vice President and Medical Director

|

|

2000

|

|

Stephen M. Forthuber

|

|

58

|

|

President and Chief Operating Officer – Eastern Operations

|

|

2006

|

|

Norman R. Hames

|

|

63

|

|

President, Secretary, Chief Operating Officer – Western Operations

|

|

1996

|

|

Michael M. Murdock

|

|

64

|

|

Executive Vice President and Chief Development Officer

|

|

2007

|

|

Mital Patel

|

|

33

|

|

Executive Vice President of Financial Planning and Analysis

|

|

2016

|

|

Mark D. Stolper

|

|

47

|

|

Executive Vice President and Chief Financial Officer

|

|

2004

|

Biographical summaries of each of our executive

officers who are not also members of our Board of Directors are included below.

Stephen M. Forthuber

has served as an executive officer of the Company since our acquisition of Radiologix, Inc. and currently serves as our President

and Chief Operating Officer-Eastern Operations. He joined Radiologix in January 2000 as Regional Director of Operations, Northeast.

From July 2002 until January 2005 he served as Regional Vice President of Operations, Northeast and from February 2005 until December

2005 he was Senior Vice President and Chief Development Officer for Radiologix. Prior to working at Radiologix, Mr. Forthuber was

employed from 1982 until 1999 by Per-Se Technologies, Inc. and its predecessor companies, where he had significant physician practice

management and radiology operations responsibilities. Mr. Forthuber received a B.A. in Business Administration from the College

of William and Mary in Virginia.

Michael Murdock

has served as our Executive Vice President and Chief Development Officer since 2007. Mr. Murdock has spent the majority of his

career in senior financial positions with healthcare companies, ranging in size from venture-backed startups to multi-billion dollar

corporations, including positions with American Medical International and its successor American Medical Holding, Inc., a publicly

traded owner and operator of acute care facilities that was acquired by National Medical Enterprises, now Tenet Healthcare (NYSE:

THC). From 1999 through 2004, Mr. Murdock served as Chief Financial Officer of Dental One, a venture capital-backed owner and operator

of 48 dental practices in Texas, Arizona, Colorado and Utah. From 2005 to 2006, Mr. Murdock served as Chief Financial Officer of

Radiologix and joined us following the Radiologix acquisition. Mr. Murdock began his career in 1978 as an auditor with Arthur Andersen

after receiving a B.S. degree from California State University, Northridge.

Mital Patel

has

served as our Executive Vice President of Financial Planning and Analysis since 2016. Mr. Patel has over a decade of senior healthcare

management experience. Mr. Patel started his career at Truxtun Radiology and served as part of the Management team before the acquisition

to RadNet. At Truxtun, Mr. Patel increased practice revenue, managed operation initiatives and quality compliance measures, and

managed Truxtun’s acquisition by RadNet. Mr. Patel began his career at RadNet in 2010 where he applied his extensive healthcare

industry experience to drive profitability and market share for RadNet. Mr. Patel received a B.A. degree in Business Administration

from California State University in Bakersfield. Mr. Patel has also been very active in the community, having held board seats

in several non-profit organizations.

Mark D. Stolper

has served as our Executive Vice President and Chief Financial Officer since July 2004 and prior to that was an independent member

of our Board of Directors. Prior to joining us, he had diverse experiences in investment banking, private equity, venture capital

investing and operations. Mr. Stolper began his career as a member of the corporate finance group at Dillon, Read and Co., Inc.,

executing mergers and acquisitions, public and private financings, and private equity investments with Saratoga Partners LLP, an

affiliated principal investment group of Dillon Read. After Dillon Read, Mr. Stolper joined Archon Capital Partners, which made

private equity investments in media and entertainment companies. Mr. Stolper also worked for Eastman Kodak, where he was responsible

for business development for Kodak’s Entertainment Imaging subsidiary ($1.5 billion in sales). Mr. Stolper was also co-founder

of Broadstream Capital Partners, a Los Angeles-based investment banking firm focused on advising middle market companies engaged

in financing and merger and acquisition transactions. Mr. Stolper has been a member of the board of directors of RTI Surgical,

Inc. (NASDAQ: RTIX) since March 2017. He was a member of the board of directors and audit committee for On Track Innovations, Ltd.

(NASDAQ: OTIV) from December 2012 until December 2016. He was previously a member of the board of directors and audit committee

for Metropolitan Health Networks, Inc. (NYSE: MDF) from April 2010 until its sale in December 2012, was a member of the board of

directors for a privately held entertainment company providing discount ticketing services and branded event merchandising and

was Chairman of the board for a private telemedicine and eHealth provider. Mr. Stolper graduated with a liberal arts degree from

the University of Pennsylvania and a finance degree from the Wharton School. Additionally, Mr. Stolper earned a postgraduate Award

in Accounting from the University of California, Los Angeles.

Our officers are elected

annually and serve at the discretion of the Board of Directors. There are no family relationships among any of our executive officers

and directors.

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT*

The Compensation and

Management Development Committee of the Board of Directors is comprised of independent non-employee directors and operates pursuant

to a written charter. A copy of the charter can be viewed by visiting our website at

www.radnet.com

and clicking on “Investor

Relations” and then on “Corporate Governance.” The Compensation and Management Development Committee is responsible

for setting and overseeing the administration of the policies governing annual compensation of the Company’s executive officers.

The Compensation and Management Development Committee reviews the performance and compensation levels for executive officers, including

the Chief Executive Officer, and sets salary levels.

The Compensation and

Management Development Committee has reviewed and discussed with RadNet’s management the “Compensation Discussion and

Analysis” included below in this Proxy Statement. Based upon that review and analysis, the Compensation and Management Development

Committee unanimously recommended to the Board of Directors that the “Compensation Discussion and Analysis” be included

in this Proxy Statement.

Submitted by the Compensation

and Management Development Committee:

|

|

Lawrence L. Levitt, Chair

Marvin S. Cadwell

Michael L. Sherman, M.D.

David L. Swartz

|

_______________

* The material in this report is not “soliciting

material,” is not deemed filed with the SEC and is not to be incorporated by reference into any of our filings under the

Securities Act or the Exchange Act whether made before or after the date of this Proxy Statement and irrespective of any general

incorporation language therein.

COMPENSATION DISCUSSION AND ANALYSIS

Our executive compensation

program is designed to attract, retain and motivate talented executive officers who are capable of providing leadership, vision

and execution necessary to achieve our business objectives. We actively seek to foster an environment that aligns the interests

of our Named Executive Officers with the creation of stockholder value through our equity compensation program.

During 2018 we completed

several important transactions within existing core markets. In April, we completed the acquisition of five imaging centers in

Fresno, California. In October, we completed our first acquisition in Long Island, New York (Medical Arts Radiology) to coincide

with becoming operational with our first east coast capitation contract with Emblem Health.

|

|

·

|

2018 Revenue of $975.1 million reflects a 5.7% increase over 2017.

|

|

|

·

|

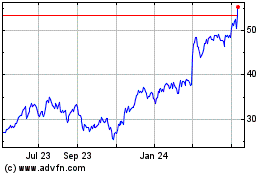

Our annualized total return to our stockholders over the most recent five completed calendar years was 43.5% and this means

that our stockholders would have sextupled their investment over this five year period. As shown in the following graph, our cumulative

stockholder return has outperformed both the S&P 500 Index and S&P Health Care Sector return during this period. This graph

compares the cumulative five-year total return provided to stockholders on the Company’s common stock relative to the S&P

500 Index and S&P Health Care Sector and assumes a $100 initial investment and the reinvestment of dividends in each of the

indices.

|

We believe the compensation

paid to our Named Executive Officers for 2018 appropriately reflects and rewards their contribution to our performance.

This Compensation Discussion

and Analysis explains the guiding principles and practices upon which our executive compensation program is based and the compensation

paid to our 2018 Named Executive Officers:

Howard G. Berger, M.D.

– President and Chief Executive Officer (our principal executive officer)

Mark D. Stolper –

Executive Vice President and Chief Financial Officer (our principal financial officer)

Jeffrey L. Linden –

Former Executive Vice President and General Counsel

Norman R. Hames –

President and Chief Operating Officer – Western Operations

Stephen M. Forthuber

– President and Chief Operating Officer – Eastern Operations

Mital Patel – Executive Vice President of Financial

Planning and Analysis

Under the SEC Rules

Jeffrey Linden is considered a Named Executive Officer despite his death in October 2018 based on the level of compensation that

he received. Mr. Linden served as our Executive Vice President and General Counsel from 2001 until his death in October 2018.

Compensation Philosophy

The following principles

influence and guide the compensation decisions of the Compensation and Management Development Committee: