Statement of Changes in Beneficial Ownership (4)

September 23 2020 - 7:07PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

DIAS FIONA P |

2. Issuer Name and Ticker or Trading Symbol

Qurate Retail, Inc.

[

QRTEA

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

12300 LIBERTY BOULEVARD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/17/2020 |

|

(Street)

ENGLEWOOD, CO 80112

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| 8% Series A Cumulative Redeemable Preferred Stock | 9/14/2020 | | J |

V

| 239.0000 (1) | A | $0.0000 | 239.0000 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units - QRTEP | (2) | 9/14/2020 | | J |

V

| 269.0000 (3) | | (4) | (5) | 8% Series A Cumulative Redeemable Preferred Stock | 269.0000 (3) | $0.0000 | 269.0000 (3) | D | |

| Restricted Stock Units - QRTEP | (6) | 9/14/2020 | | J |

V

| 373.0000 (3) | | 12/9/2020 | 12/9/2020 | 8% Series A Cumulative Redeemable Preferred Stock | 373.0000 (3) | $0.0000 | 373.0000 (3) | D | |

| Dividend Equivalent Rights - QRTEA | (7) | 9/17/2020 | | A | | 2130.0000 | | (8) | (9) | Series A Common Stock | 2130.0000 | $0.0000 | 2130.0000 | D | |

| Explanation of Responses: |

| (1) | On August 21, 2020, the Issuer announced that an authorized committee of the Issuer's board of directors declared a special dividend on each outstanding share of its common stock payable on September 14, 2020 to all holders of record as of 5:00 p.m., New York City time, on August 31, 2020 consisting of (i) a special cash dividend in the amount of $1.50 per common share and (ii) a special dividend of 0.03 shares of newly issued 8.0% Series A Cumulative Redeemable Preferred Stock (the "Preferred Shares"), having an initial liquidation price of $100 per Preferred Share (the "Dividend"). As a result of the Dividend, the reporting person directly received 239 Preferred Shares. The receipt of Preferred Shares in the Dividend was approved by the Issuer's board of directors pursuant to Rule 16b-3 under the Securities Exchange Act of 1934, as amended ("Rule 16b-3"). |

| (2) | Each restricted stock unit ("RSU") represents a contingent right to receive one Preferred Share. |

| (3) | In connection with the Dividend, all RSUs with respect to the Issuer's common stock ("Original RSUs") were adjusted pursuant to the anti-dilution provisions of the incentive plans under which RSU awards held by the reporting person were granted. Each holder of an Original RSU was entitled to receive an RSU with respect to a number of Preferred Shares equal to 0.03 multiplied by the number of shares of common stock underlying the Original RSU, subject to the same terms and conditions as the Original RSU. These adjustments were approved by the Issuer's board of directors pursuant to Rule 16b-3. |

| (4) | Each RSU vests upon the reporting person's termination of service to the Issuer's board of directors. |

| (5) | Each RSU expires upon the reporting person's termination of service to the Issuer's board of directors. |

| (6) | Each RSU represents a contingent right to receive one Preferred Share. |

| (7) | The dividend equivalent rights accrued on Original RSUs (as defined above) held by the reporting person as a result of the Cash Dividend and are subject to the same terms and conditions (including vesting and expiration) as the Original RSUs to which they relate. Each dividend equivalent right entitles the reporting person to receive one share of the Issuer's Series A common stock. The grant of dividend equivalent rights was approved by the Issuer's board of directors pursuant to Rule 16b-3. |

| (8) | Each dividend equivalent right vests upon the reporting person's termination of service to the Issuer's board of directors. |

| (9) | Each dividend equivalent right expires upon the reporting person's termination of service to the Issuer's board of directors. |

Remarks:

The Reporting Person is voluntarily including on this Form 4 the receipt of Preferred Shares in the Dividend and the equity award adjustments as described in Footnote 3 above. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

DIAS FIONA P

12300 LIBERTY BOULEVARD

ENGLEWOOD, CO 80112 | X |

|

|

|

Signatures

|

| /s/ Craig Troyer as Attorney-in-Fact for Fiona P. Dias | | 9/23/2020 |

| **Signature of Reporting Person | Date |

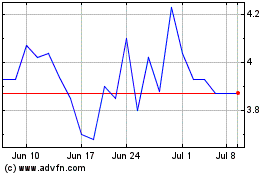

Qurate Retail (NASDAQ:QRTEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

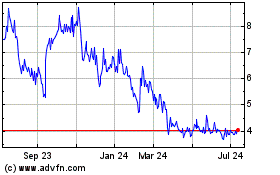

Qurate Retail (NASDAQ:QRTEB)

Historical Stock Chart

From Apr 2023 to Apr 2024