As

filed with the Securities and Exchange Commission on June 17, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Qualigen

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

26-3474527 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

2042

Corte Del Nogal

Carlsbad,

California 92011

(760)

918-9165

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

Michael

S. Poirier

Chief

Executive Officer

Qualigen

Therapeutics. Inc.

2042

Corte Del Nogal

Carlsbad,

California 92011

(760)

918-9165

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Wendy

Grasso

Reed

Smith LLP

599

Lexington Avenue

New

York, NY 10022-7650

(212)

521-5400

From

time to time after the effective date of this Registration Statement

(Approximate

date of commencement of proposed sale to the public)

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| |

|

|

|

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

|

|

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities or accept an offer to

buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where such offer or sale

is not permitted.

SUBJECT

TO COMPLETION, DATED JUNE 17, 2022

PRELIMINARY

PROSPECTUS

8,161,312

Shares

Common

Stock

This

prospectus relates to the proposed resale from time to time of up to 8,161,312 shares of our common stock, par value $0.001 per share

(the “Resale Shares”), consisting of 3,500,000 shares of common stock (the “Consideration Shares”) and 4,661,312

shares (the “Warrant Shares”) that are issuable upon the exercise of certain warrants to purchase shares of common stock

(the “Warrants”) held by the selling stockholders named herein, together with any additional selling stockholders listed

in a prospectus supplement (together with any of such stockholders’ transferees, pledgees, donees or successors).

We

are registering the offer and sale of the Resale Shares from time to time by the selling stockholders to satisfy the registration rights

they were granted in connection with the issuance of the Consideration Shares and the Warrants. We will not receive any proceeds from

the sale of the Resale Shares by the selling stockholders.

The

selling stockholders may offer and sell or otherwise dispose of the Resale Shares described in this prospectus from time to time through

public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated

prices. The selling stockholders will bear all underwriting fees, commissions and discounts, if any, attributable to the sales of Resale

Shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the Resale Shares.

See “Plan of Distribution” for more information on how the selling stockholders may sell or dispose of their Resale Shares.

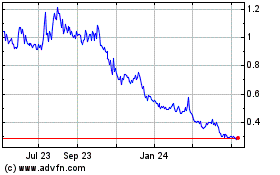

Our

common stock is listed on The Nasdaq Capital Market under the trading symbol “QLGN.” On June 16, 2022, the closing

price of our common stock was $0.58 per share.

Investing

in shares of our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described in the

section titled “Risk Factors” on page 4 of this prospectus and any similar section contained in the applicable prospectus

supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar

headings in the documents that are incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”).

The selling stockholders referred to in this prospectus may from time to time sell the shares of common stock described in this prospectus

in one or more offerings or otherwise as described under “Plan of Distribution.”

Neither

we nor the selling stockholders have authorized anyone to provide any information other than that contained or incorporated by reference

in this prospectus or in any related prospectus supplement or any free writing prospectus that we have authorized. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. The shares are not being

offered in any jurisdiction where the offer is not permitted. You should not assume that the information contained in or incorporated

by reference in this prospectus is accurate as of any date other than the respective dates of such document. Our business, financial

condition, results of operations and prospects may have changed since those dates.

Throughout

this prospectus, the terms “we,” “us,” “our,” and our “company” refer to Tempest Therapeutics,

Inc. and its subsidiaries.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). These statements relate to future events or to our future operating or financial

performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

Forward-looking statements may include, but are not limited to, statements about:

| |

● |

our

ability to successfully develop any drugs or therapeutic devices; |

| |

|

|

| |

● |

our

ability to progress our drug candidates or therapeutic devices through preclinical and clinical development; |

| |

|

|

| |

● |

our

ability to obtain the requisite regulatory approvals for our clinical trials and to begin and complete such trials according to any

projected timeline; |

| |

|

|

| |

● |

our

ability to complete enrollment in our clinical trials as contemplated by any projected timeline; |

| |

|

|

| |

● |

the

likelihood that future clinical trial data will be favorable or that such trials will confirm any improvements over other products

or lack negative impacts; |

| |

|

|

| |

● |

our

ability to successfully commercialize any drugs or therapeutic devices; |

| |

|

|

| |

● |

our

ability to procure or earn sufficient working capital to complete the development, testing and launch of our prospective therapeutic

products; |

| |

|

|

| |

● |

the

likelihood that patents will issue on our owned and in-licensed patent applications; |

| |

|

|

| |

● |

our

ability to protect our intellectual property; |

| |

|

|

| |

● |

our

ability to compete; |

| |

|

|

| |

● |

our

ability to maintain or expand market demand and/or market share for our diagnostic products generally, particularly in light of COVID-19-related

deferral of patients’ physician-office visits and in view of FastPack reimbursement pricing challenges; and |

| |

|

|

| |

● |

our

ability to maintain our diagnostic sales and marketing engine without interruption following the expiration of our distribution agreement

with Sekisui. |

In

some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,”

“estimates,” “intends,” “may,” “plans,” “potential,” “will,”

“would,” or the negative of these terms or other similar expressions. These statements reflect our current views with respect

to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place

undue reliance on these forward-looking statements as predictions of future events. We discuss in greater detail many of these risks

in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto

reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these

forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future

events or developments.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These

statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms

a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate

that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are

inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You

should read this prospectus, together with the documents we have filed with the SEC that are incorporated by reference, any prospectus

supplement and any free writing prospectus that we may authorize completely and with the understanding that our actual future results

may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these

cautionary statements.

THE

COMPANY

Overview

We

are a diversified life sciences company focused on developing treatments for adult and pediatric cancers with potential for Orphan Drug

designation, while also commercializing diagnostics. Our cancer therapeutics pipeline includes QN-302, QN-247 and RAS-F. Our investigational

QN-302 compound is a small molecule G4 selective transcription inhibitor with strong binding affinity to G4s prevalent in cancer cells.

Such binding could, by stabilizing the G4s against “unwinding,” help inhibit cancer cell proliferation. QN-247 is a DNA coated

gold nanoparticle cancer drug candidate that has the potential to target various types of cancer; the nanoparticle conjugate technology

is similar to the core nanoparticle coating technology used in our blood-testing diagnostic products. The foundational aptamer of QN-247

is QN-165 (formerly referred to as AS1411), which the Company has deprioritized as a drug candidate for treating COVID-19 and other viral-based

infectious diseases. RAS-F is a family of RAS oncogene protein-protein interaction inhibitor small molecules for preventing mutated RAS

genes’ proteins from binding to their effector proteins; preventing this binding could stop tumor growth, especially in RAS-driven

tumors such as pancreatic, colorectal and lung cancers. We are also identifying strategic partnering opportunities for STARS, a DNA/RNA-based

therapeutic device product concept for removing precisely targeted tumor-produced and viral compounds from circulating blood.

Our

FastPack System diagnostic instruments and test kits are sold commercially primarily in the United States, as well as certain European

countries. The FastPack System menu includes a rapid, highly accurate immunoassay diagnostic testing system for cancer, men’s health,

hormone function, and vitamin D status. We provide analyzers to our customers (physician offices, clinics and small hospitals) at low

cost in order to increase sales volumes of higher-margin test kits. Prior to March 31, 2022, most of our FastPack product sales were

through our partner Sekisui Diagnostics, LLC (“Sekisui”) pursuant to a distribution agreement, but we maintained direct distribution

for certain house accounts, including selling our total testosterone test kits to Low T Center, Inc., the largest men’s health

group in the United States, with 40 locations. The distribution agreement with Sekisui expired on March 31, 2022, at which time the services

provided by Sekisui reverted to us and as of April 1, 2022 we recognize 100% of the revenue from the sales of our FastPack diagnostic

instruments and test kits. We have licensed and technology-transferred our FastPack System technology to Yi Xin Zhen Duan Jishu (Suzhou)

Ltd. for the China diagnostics market and other markets outside of the United States in which the Company does not currently sell.

Transaction

with NanoSynex Ltd.

On

May 26, 2022, we acquired an approximate 53% interest in the voting securities of NanoSynex Ltd.

(“NanoSynex”), an Israeli-based developer of next generation diagnostics technology.

NanoSynex’s

technology is an Antimicrobial Susceptibility Testing (AST) platform that aims to provide clinical laboratories worldwide with a rapid,

accurate and personalized test for bacterial infections, with the goal of quickly matching the correct antibiotics to treat a patient’s

particular infection. Antibiotic misuse and overuse have given rise to antibiotic resistant bacteria, commonly known as superbugs, which

the World Health Organization has called one of the top ten global public health threats facing humanity. NanoSynex’s AST platform

aims to enable better targeting of antibiotics for their most suitable uses to ultimately result in faster and more efficacious treatment,

hence reducing hospitals mortality and morbidity rates.

Consideration

Shares and Pre-Funded Warrants Issued to Alpha Capital Anstalt

As

part of the transaction with NanoSynex, we entered into a Share Purchase Agreement, dated April 29, 2022 (the “Series A-1 Purchase

Agreement”) with Alpha Capital Anstalt (“Alpha”), pursuant to which we acquired 2,232,861 Series A-1 preferred shares,

nominal value NIS 0.01 each of NanoSynex from Alpha in exchange for 3,500,000 shares of our common stock (the “Consideration Shares”)

and pre-funded warrants to purchase 3,314,641 shares of our common stock (the “Alpha Warrants”), at an exercise price of

$0.001 per share, subject to limitations on beneficial ownership set forth therein. The

Alpha Warrants may also be exercised on a cashless basis pursuant to their terms. Pursuant to the terms of the Series-A-1 Purchase Agreement,

we agreed to file the registration statement, of which this prospectus forms a part, to register the resale by Alpha of the Consideration

Shares and the shares of common stock issuable to Alpha upon the exercise of the Alpha Warrants (the “Alpha Warrant Shares”).

We

also agreed to register the resale by Alpha of 70,477 shares of common stock (the “Alpha Pre-Merger Warrant Shares”) issuable

upon the exercise of certain other warrants held by Alpha (the “Alpha Pre-Merger Warrants”).

Warrants

Issued to GreenBlock, LLC and Christopher Nelson

In

connection with the transaction with NanoSynex, we engaged GreenBlock Capital, LLC (“GreenBlock”) to act as a consultant.

On December 3, 2021, we issued a common stock warrant to GreenBlock, entitling GreenBlock to purchase up to 600,000 shares of our common

stock at an exercise price of $1.32 per share, subject to adjustment and beneficial ownership limitations set forth therein (the “GreenBlock

Warrants”). The GreenBlock Warrants may also be exercised on a cashless basis if at the time of exercise there is no effective

registration statement registering the shares of common stock issuable upon the exercise of the GreenBlock Warrants (the “GreenBlock

Warrant Shares”), or the prospectus contained in such registration statement is not available for the issuance of the GreenBlock

Warrant Shares. The GreenBlock Warrants were fully earned upon issuance prior to the Company entering into definitive agreements with

NanoSynex, and were not contingent on the closing of the NanoSynex transaction. On April 25, 2022, we amended the terms of GreenBlock

Warrants (300,000 of which had been transferred to Mr. Nelson, an employee of GreenBlock), to reduce the exercise price of such warrants

to $0.60 per share and extend the expiration date to September 14, 2023. Pursuant to the terms of the GreenBlock Warrants, we agreed

to register the resale by GreenBlock and Mr. Nelson of the GreenBlock Warrant Shares issuable to GreenBlock and Mr. Nelson upon exercise

of such warrants. Mr. Nelson has no voting control or other beneficial interest in any warrants or other securities held by GreenBlock,

and GreenBlock has no voting control or other beneficial interest in any warrants or other securities held by Mr. Nelson.

We

also agreed to register the resale by GreenBlock of 459,812 shares of common stock (the “GreenBlock Pre-Merger Warrant Shares”)

and by Mr. Nelson of 216,382 shares of common stock (the “Nelson Pre-Merger Warrant Shares”) issuable upon the exercise of

certain other warrants held by GreenBlock (the “GreenBlock Pre-Merger Warrants”) and Mr. Nelson (the “Nelson Pre-Merger

Warrants”), respectively.

The

Alpha Warrants, the Alpha Pre-Merger Warrants, the GreenBlock Warrants, the GreenBlock Pre-Merger Warrants, and the Nelson Pre-Merger

Warrants are referred to herein collectively as the “Warrants,” and the Alpha Warrant Shares, the Alpha Pre-Merger Warrant

Shares, the GreenBlock Warrant Shares, the GreenBlock Pre-Merger Warrant Shares and the Nelson Pre-Merger Warrant Shares are referred

to herein collectively as the “Warrant Shares.”

Corporate

Background

Ritter

Pharmaceuticals, Inc. (our predecessor) was formed as a Nevada limited liability company on March 29, 2004 under the name Ritter Natural

Sciences, LLC. In September 2008, this company converted into a Delaware corporation under the name Ritter Pharmaceuticals, Inc. On May

22, 2020, upon completing a “reverse recapitalization” transaction with Qualigen, Inc., Ritter Pharmaceuticals, Inc. was

renamed Qualigen Therapeutics, Inc. Qualisys Diagnostics, Inc. was formed as a Minnesota corporation in 1996, reincorporated to become

a Delaware corporation in 1999, and then changed its name to Qualigen, Inc. in 2000. Qualigen, Inc. is now a wholly-owned subsidiary

of the Company.

Our

principal executive offices are located at 2042 Corte Del Nogal, Carlsbad, CA 92011. Our telephone number is (760) 918-9165.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the risks described in the documents incorporated by

reference in this prospectus and any prospectus supplement, as well as other information we include or incorporate by reference into

this prospectus and any applicable prospectus supplement, before making an investment decision. Our business, financial condition or

results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities

could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and

the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results

could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks

described in the documents incorporated herein by reference, including (i) our Annual Report on Form 10-K for the fiscal year ended December

31, 2021, filed with the SEC on March 31, 2022, as amended on April 29, 2022, and incorporated herein by reference, and (ii) our most

recent quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2022 filed with the SEC on May 13, 2022 and incorporated

herein by reference, our current reports on Form 8-K and other documents we file with the SEC from time to time that are deemed incorporated

by reference into this prospectus.

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale of shares of our common stock in this offering. The selling stockholders will receive

all of the proceeds from the sale of shares of common stock hereunder.

We

may, however, receive cash proceeds equal to the exercise price of the Warrants that a selling stockholder may exercise, to the extent

any such Warrants are exercised for cash. The Warrants may be exercised for cash or by means of cashless exercise. If all of the Warrants

are exercised for cash, then we will receive gross proceeds of approximately $750,000, subject to any adjustments. We expect to use any

proceeds received by us from the cash exercise of these Warrants for general corporate purposes.

DESCRIPTION

OF SECURITIES

The

following summary description of our common stock is based on the provisions of our amended and restated certificate of incorporation

and amended and restated bylaws and the applicable provisions of the Delaware General Corporation Law. This information is qualified

entirely by reference to the applicable provisions of our amended and restated certificate of incorporation and bylaws. For information

on how to obtain copies of our amended and restated certificate of incorporation and bylaws, which are exhibits to the registration statement

of which this prospectus is a part, see the sections titled “Where You Can Find Additional Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

General

Our

authorized capital stock consists of 225,000,000 shares of our common stock, $0.001 par value per share, and 15,000,000 shares of preferred

stock, $0.001 par value per share, including 7,000 shares that have been designated as Series Alpha Preferred Stock. As of June 15,

2022, there were 38,795,541 shares of our common stock outstanding and no shares of our Series Alpha Preferred Stock outstanding.

Common

Stock

The

last reported sale price of our common stock on The Nasdaq Capital Market on June 16, 2022 was $0.58 per share.

Pursuant

to the terms of our amended and restated certificate of incorporation, the holders of common stock are entitled to one vote per share

on all matters to be voted upon by the stockholders, except on matters relating solely to terms of preferred stock. Subject to preferences

that may be applicable to any outstanding preferred stock, the holders of common stock will be entitled to receive ratably such dividends,

if any, as may be declared from time to time by our Board of Directors out of funds legally available therefor. In the event of liquidation,

dissolution or winding up, the stockholders will be entitled to share ratably in all assets remaining after payment of liabilities, subject

to prior distribution rights of preferred stock, if any, then outstanding. The holders of our common stock will have no preemptive or

conversion rights or other subscription rights. There will be no redemption or sinking fund provisions applicable to our common stock.

Warrants

The

Alpha Warrants

The

Alpha Warrants may be exercised by Alpha or its assigns, in whole or in part, at any time after May 26, 2022 and until the Alpha Warrants

have been exercised in full, at an exercise price of $0.001 per share. The

Alpha Warrants may also be exercised on a cashless basis pursuant to their terms.

The

terms of the Alpha Warrant provide that such warrants may not be exercised to the extent such exercise would cause Alpha and its affiliates

to beneficially own more than 9.99% of the number of shares of our common stock outstanding immediately after giving effect to such exercise

(the “Alpha Beneficial Ownership Limitation”). Alpha may, upon 61 days’ notice to us, increase or decrease the Alpha

Beneficial Ownership Limitation, provided that the Alpha Beneficial Ownership Limitation in no event exceeds 9.99% of the number of shares

of our common stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of the Alpha

Warrant.

The

Alpha Warrants provide for certain adjustments to be made to such warrants in connection with stock dividends, stock splits, fundamental

transactions and similar events.

The

GreenBlock Warrants

The

GreenBlock Warrants may be exercised by GreenBlock and Mr. Nelson or their assigns, in whole or in part, at any time after January 26,

2022 and before September 14, 2023, at an exercise price of $0.60 per share. The

GreenBlock Warrants may also be exercised on a cashless basis if at the time of exercise there is no effective registration statement

registering the GreenBlock Warrant Shares, or the prospectus contained in such registration statement is not available for the issuance

of the GreenBlock Warrant Shares.

The

terms of the GreenBlock Warrants provide that such warrants may not be exercised to the extent such exercise would cause the holder and

its affiliates to beneficially own more than 9.99% of the number of shares of our common stock outstanding immediately after giving effect

to such exercise (the “GreenBlock Beneficial Ownership Limitation”). The holder may, upon 61 days’ notice to us, increase

or decrease the GreenBlock Beneficial Ownership Limitation, provided that the holder in no event exceeds 9.99% of the number of shares

of our common stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of the GreenBlock

Warrants.

The

GreenBlock Warrants provide for certain adjustments to be made to such warrants in connection with stock dividends, stock splits, fundamental

transactions and similar events.

The

Pre-Merger Warrants

The

Alpha Pre-Merger Warrants may be exercised by Alpha, or its assigns, in whole or in part, at any time after May 22, 2020 and before May

22, 2025, at an exercise price of $0.5136 per share, subject to the adjustments described therein.

The

GreenBlock Pre-Merger Warrants and Nelson Pre-Merger Warrants may be exercised by their respective holder, or its assigns, in whole or

in part, at any time after November 21, 2020 and before May 22, 2025, at an exercise price of $0.5136 per share, subject to the adjustments

described therein.

The

Pre-Merger Warrants may also be exercised on a cashless basis if at the time of exercise there is no effective registration statement

registering the Pre-Merger Warrant Shares or the prospectus contained in such registration statement is not available for the issuance

of such shares.

The

terms of the Pre-Merger Warrants provide that such warrants may not be exercised to the extent such exercise would cause the holder and

its affiliates to beneficially own more than 9.99% of the number of shares of our common stock outstanding immediately after giving effect

to such exercise (the “Pre-Merger Warrants Beneficial Ownership Limitation”). The holder may, upon 61 days’ notice

to us, increase or decrease the Pre-Merger Warrants Beneficial Ownership Limitation, provided that the holder in no event exceeds 9.99%

of the number of shares of our common stock outstanding immediately after giving effect to the issuance of shares of common stock upon

exercise of the Pre-Merger Warrants.

Anti-Takeover

Effects of Delaware Law and Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

The

provisions of Delaware law and our amended and restated certificate of incorporation and amended and restated bylaws, could discourage

or make it more difficult to accomplish a proxy contest or other change in our management or the acquisition of control by a holder of

a substantial amount of our voting stock. It is possible that these provisions could make it more difficult to accomplish, or could deter,

transactions that stockholders may otherwise consider to be in their best interests or in our best interests. These provisions are intended

to enhance the likelihood of continuity and stability in the composition of our board of directors and in the policies formulated by

the board of directors and to discourage certain types of transactions that may involve an actual or threatened change of our control.

These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal and to discourage certain tactics that

may be used in proxy fights. Such provisions also may have the effect of preventing changes in our management.

Delaware

Statutory Business Combinations Provision. We are subject to the anti-takeover provisions of Section 203 of the Delaware General

Corporation Law (the “DGCL”). Section 203 prohibits a publicly-held Delaware corporation from engaging in a “business

combination” with an “interested stockholder” for a period of three years after the date of the transaction in which

the person became an interested stockholder, unless the business combination is, or the transaction in which the person became an interested

stockholder was, approved in a prescribed manner or another prescribed exception applies. For purposes of Section 203, a “business

combination” is defined broadly to include a merger, asset sale or other transaction resulting in a financial benefit to the interested

stockholder, and, subject to certain exceptions, an “interested stockholder” is a person who, together with his or her affiliates

and associates, owns, or within three years prior, did own, 15% or more of the corporation’s voting stock.

Election

and Removal of Directors. Except as may otherwise be provided by the DGCL, any director or the entire board of directors may be removed,

with or without cause, at an annual meeting or a special meeting called for that purpose, by the affirmative vote of the majority of

the votes cast by the shares of our capital stock present in person or represented by proxy at such meeting and entitled to vote thereon,

provided a quorum is present. Vacancies on our board of directors resulting from the removal of directors and newly created directorships

resulting from any increase in the number of directors may be filled solely by the affirmative vote of a majority of the remaining directors

then in office (although less than a quorum) or by the sole remaining director. This system of electing and removing directors may discourage

a third party from making a tender offer or otherwise attempting to obtain control of us, because it generally makes it more difficult

for stockholders to replace a majority of our directors. Our amended and restated certificate of incorporation and amended and restated

bylaws do not provide for cumulative voting in the election of directors.

Advance

Notice Provisions for Stockholder Proposals and Stockholder Nominations of Directors. Our amended and restated bylaws provide that,

for nominations to the board of directors or for other business to be properly brought by a stockholder before a meeting of stockholders,

the stockholder must first have given timely notice of the proposal in writing to our Secretary. For an annual meeting, a stockholder’s

notice generally must be delivered not less than 90 days or more than 120 days before the anniversary of the previous year’s annual

meeting.

Special

Meetings of Stockholders. Special meetings of the stockholders may be called at any time only by the board of directors, the Chairman

of the board of directors, the Chief Executive Officer or the President, subject to the rights of the holders of any series of preferred

stock then outstanding.

Blank-Check

Preferred Stock. Our board of directors is authorized to issue, without stockholder approval, preferred stock, the rights of which

will be determined at the discretion of the board of directors and that, if issued, could operate as a “poison pill” to dilute

the stock ownership of a potential hostile acquirer to prevent an acquisition that our board of directors does not approve.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Equiniti Trust Company.

Listing

on Nasdaq

Our

common stock is listed on the Nasdaq Capital Market under the symbol “QLGN.”

Holders

As

of June 15, 2022, there were approximately 694 holders of record of our common stock. The actual number of common stockholders

is greater than the number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street

name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust

by other entities.

SELLING

STOCKHOLDERS

We

have prepared this prospectus to allow the selling stockholders to offer and sell from time to time up to 8,161,312 shares of our common

stock, par value $0.001 per share (the “Resale Shares”) for their own account, consisting of (i) the 3,500,000 Consideration

Shares held by Alpha, (ii) the 3,314,641 Alpha Warrant Shares issuable to Alpha upon exercise of the Alpha Warrants, (iii) the 600,000

GreenBlock Shares issuable to GreenBlock and Mr. Nelson upon the exercise of the GreenBlock Warrants, and (iv) the 746,671 Pre-Merger

Warrant Shares issuable to the selling stockholders upon the exercise of the Pre-Merger Warrants. For a description of the Warrants,

see “Description of Capital Stock - Warrants.”

We

are registering the offer and sale of the Resale Shares beneficially owned by the selling stockholders to satisfy certain registration

rights that we granted the selling stockholders in connection with the issuance of the Consideration Shares and the Warrants.

The

following table sets forth (i) the name of each selling stockholder, (ii) the number of shares beneficially owned by each of the respective

selling stockholders, including the Consideration Shares and the Warrant Shares, (iii) the number of Consideration Shares and Warrant

Shares that may be offered under this prospectus and (iv) the number of shares of our common stock beneficially owned by the selling

stockholders assuming all of the Consideration Shares and Warrant Shares covered hereby are sold.

The

number of shares of common stock set forth in the following table for any selling stockholder does not take into account the exercise

limitations set forth in the Warrants and described under “Description of Capital Stock-Warrants.” Accordingly, the number

of shares of common stock set forth in the following table for any stockholder may exceed the number of shares of common stock that it

could own beneficially at any given time as a result of its ownership of Warrants. As a result, the actual number of Warrant Shares that

may be issued to and sold by the selling stockholders could be materially less or more than the estimated numbers in the column titled

“Number of Shares Being Offered” depending on factors which cannot be predicted by us at this time. In addition, we do not

know how long the selling stockholders will hold the Consideration Shares or Warrant Shares before selling them, and we currently have

no agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any Consideration

Shares or Warrant Shares.

Except

as described in this prospectus, none of the selling stockholders has, or during the three years prior to the date of this prospectus

has had, any position, office or other material relationships with us or any of our predecessors or affiliates. To our knowledge, except

as set forth in the table below, none of the selling stockholders are broker-dealers or are affiliated with a broker-dealer, nor at the

time of the acquisition did any selling stockholders have direct or indirect agreements or understandings with any person to distribute

any common stock, including the Consideration Shares and the Warrant Shares.

The

information set forth in the table below is based upon information obtained from the selling stockholders. Beneficial ownership of the

selling stockholders is determined in accordance with Rule 13d-3(d) under the Exchange Act. The percentage of shares beneficially owned

after the offering is based on 43,456,853 shares of our common stock outstanding as of June 15, 2022, after giving effect to

the issuance of 4,661,312 Warrant Shares assuming full exercise of the Warrants.

As

used in this prospectus, the term “selling stockholders” includes the selling stockholders listed in the table below, together

with any additional selling stockholders listed in a prospectus supplement, and their donees, pledgees, assignees, transferees, distributees

and successors-in-interest that receive Resale Shares in any non-sale transfer after the date of this prospectus.

| | |

| | |

| | |

Beneficial Ownership After this Offering | |

| Name of Selling Stockholder | |

Shares of Common

Stock Beneficially

Owned Prior to

this Offering | | |

Number of

Shares

Being

Offered | | |

Number of

Shares | | |

Percent of

Outstanding

Common Stock | |

| Alpha Capital Anstalt | |

| 3,917,370 | (1) | |

| 6,885,118 | | |

| 4,823,175 | (2) | |

| 9.99 | % |

| GreenBlock Capital, LLC (3) | |

| 791,765 | | |

| 759,812 | | |

| 31,953 | | |

| * | |

| Christopher Nelson (4) | |

| 544,679 | | |

| 516,382 | | |

| 28,297 | | |

| * | |

| All Selling Stockholders | |

| 5,253,814 | | |

| 8,161,312 | | |

| 4,883,425 | | |

| 9.99 | % |

(1)

Includes the 3,500,000 Consideration Shares and 417,370 shares of common stock issuable upon the exercise of the Alpha Pre-Merger

Warrants and other warrants held by Alpha. This number does not include the Alpha Warrant Shares or 5,052,624 shares of

common stock issuable upon the exercise of other warrants held by Alpha that may not be exercised to the extent that such exercise will

result in Alpha (and its affiliates) beneficially owning more than 9.99% of the number of shares of our common stock outstanding immediately

after giving effect to the issuance of shares of common stock issuable upon exercise. The address of Alpha Capital Anstalt is Altenbach

8, 9490 Vaduz, Liechtenstein.

(2)

This number does not include 576,342 shares of common stock issuable upon the exercise of warrants that will continue to be held

by Alpha after this offering that may not be exercised to the extent that such exercise will result in Alpha (and its affiliates) beneficially

owning more than 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the issuance of shares

of common stock issuable upon exercise.

(3)

The address of GreenBlock Capital LLC is 420 Royal Palm Way, Suite 100, Palm Beach, FL 33480.

(4)

The address for Mr. Nelson is 420 Royal Palm Way, Suite 100, Palm Beach, FL 33480.

PLAN

OF DISTRIBUTION

We

are registering the Consideration Shares and Warrant Shares issuable upon the exercise of the Warrants that may be sold by the selling

stockholders from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling

stockholders of the Resale Shares. We will bear all fees and expenses incident to our obligation to register the Resale Shares.

The

term “selling stockholders” includes donees, pledgees, transferees or other successors in interest selling securities received

after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer. The selling

stockhholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may

be made on the principal trading market for our common stock or any other stock exchange, market or trading facility on which our common

stock is traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or

more of the following methods when selling Resale Shares:

| |

● |

ordinary

brokerage transactions and transactions in which the broker dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker dealer will attempt to sell the common stock as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker dealer as principal and resale by the broker dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

distribution

to employees, members, limited partners or stockholders of the selling stockholders; |

| |

|

|

| |

● |

in

transactions through broker dealers that agree with the selling stockholders to sell a specified number of such common stock at a

stipulated price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

by

pledge to secured debts and other obligations; |

| |

|

|

| |

● |

delayed

delivery arrangements; |

| |

|

|

| |

● |

to

or through underwriters or broker-dealers; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling stockholders may also sell the shares of our common stock under Rule 144 or any other exemption from registration under the Securities

Act, if available, rather than under this prospectus.

In

addition, a selling stockholder that is an entity may elect to make a pro rata in-kind distribution of securities to its members, partners

or stockholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution.

Such members, partners or stockholders would thereby receive freely tradeable securities pursuant to the distribution through a registration

statement. To the extent a distributee is our affiliate (or to the extent otherwise required by law), we may, at our option, file a prospectus

supplement in order to permit the distributees to use the prospectus to resell the securities acquired in the distribution.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions,

discounts or concessions from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of our common stock,

from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency

transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority (“FINRA”)

Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

To

the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In

connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with

broker-dealers or other financial institutions, which may in turn engage in short sales of our common stock in the course of hedging

the positions they assume. The selling stockholders may also sell our common stock short and deliver these shares to close out their

short positions, or loan or pledge the securities to broker-dealers that in turn may sell these shares. The selling stockholders may

also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities

which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities

such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such

transaction). The selling stockholders may also pledge securities to a broker-dealer or other financial institution, and, upon a default,

such broker-dealer or other financial institution, may effect sales of the pledged securities pursuant to this prospectus (as supplemented

or amended to reflect such transaction).

Any

broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the shares of our common stock purchased by them may be deemed to be underwriting commissions or discounts under

the Securities Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the shares of our common stock.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the shares of our common stock.

The

Resale Shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws.

In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for

sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the Resale Shares may not simultaneously

engage in market making activities with respect to our common stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of our

common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

At

the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the number

of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price

paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed

or reallowed or paid to any dealer, and the proposed selling price to the public.

LEGAL

MATTERS

Reed

Smith LLP, New York, New York, will pass upon the validity of the shares of common stock offered hereby.

EXPERTS

The

consolidated financial statements of Qualigen Therapeutics, Inc. as of December 31, 2021 and 2020 and for the year ended December 31,

2021 and for the nine-month period ended December 31, 2020, incorporated in this Prospectus by reference from the Company’s Annual

Report on Form 10-K for the year ended December 31, 2021 have been audited by Baker Tilly US, LLP, an independent registered public accounting

firm, as stated in their report thereon, incorporated herein by reference, and have been incorporated in this Prospectus and Registration

Statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

This

prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all

the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements

or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement

or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement

or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly

and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet

at the SEC’s website at http://www.sec.gov.

We

maintain a website at www.tempesttx.com. Information contained in or accessible through our website does not constitute a part of this

prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information

in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part

the information or documents listed below that we have filed with the SEC (Commission File No. 001-37428):

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with the SEC on March 31, 2022, as amended

on Form 10-K/A filed on April 29, 2022; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, which was filed with the SEC on May 13, 2022; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K (other than information furnished rather than filed) filed with the SEC on January 18, 2022, March 4,

2022, May 4, 2022 and June 2, 2022; and |

| |

|

|

| |

● |

the

description of our common stock, which is registered under Section 12 of the Exchange Act, in our registration statement on Form

8-A, filed with the SEC on June 15, 2015, as updated by Exhibit 4.15 to our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022. |

All

filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus

is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective

amendment that indicates the termination of the offering of the shares of our common stock made by this prospectus and will become a

part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements

the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede

any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference

to the extent that statements in the later filed document modify or replace such earlier statements.

You

can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Qualigen

Therapeutics, Inc.

2042

Corte Del Nogal

Carlsbad,

California 92011

Attn:

Secretary

You

may also access the documents incorporated by reference in this prospectus through our website www.qualigeninc.com. Except for the specific

incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in this prospectus

or the registration statement of which it forms a part.

Item

14. Other Expenses of Issuance and Distribution

The

following table sets forth an estimate of the fees and expenses payable by us in connection with the sale of the securities being registered.

| | |

Amount | |

| SEC registration fees | |

$ | 445 | |

| Accounting fees and expenses | |

| 8,500 | |

| Legal fees and expenses | |

| 10,000 | |

| Miscellaneous fees and expenses | |

| 1,055 | |

| Total | |

$ | 20,000 | |

Item

15. Indemnification of Directors and Officers

Our

amended and restated certificate of incorporation provides that we shall indemnify, to the fullest extent authorized by the Delaware

General Corporation Law (“DGCL”), each person who is involved in any litigation or other proceeding because such person is

or was a director or officer of Qualigen Therapeutics, Inc. or is or was serving as an officer or director of another entity at our request,

against all expense, loss or liability reasonably incurred or suffered in connection therewith. Our amended and restated certificate

of incorporation provides that the right to indemnification includes the right to be paid expenses incurred in defending any proceeding

in advance of its final disposition, provided, however, that such advance payment will only be made upon delivery to us of an undertaking,

by or on behalf of the director or officer, to repay all amounts so advanced if it is ultimately determined that such director is not

entitled to indemnification. If we do not pay a proper claim for indemnification in full within 30 days after we receive a written claim

for such indemnification, our certificate of incorporation and our bylaws authorize the claimant to bring an action against us and prescribe

what constitutes a defense to such action.

Section

145 of the Delaware General Corporation Law permits a corporation to indemnify any director or officer of the corporation against expenses

(including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with

any action, suit or proceeding brought by reason of the fact that such person is or was a director or officer of the corporation, if

such person acted in good faith and in a manner that he reasonably believed to be in, or not opposed to, the best interests of the corporation,

and, with respect to any criminal action or proceeding, if he or she had no reason to believe his or her conduct was unlawful. In a derivative

action, (i.e., one brought by or on behalf of the corporation), indemnification may be provided only for expenses actually and reasonably

incurred by any director or officer in connection with the defense or settlement of such an action or suit if such person acted in good

faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, except that

no indemnification shall be provided if such person shall have been adjudged to be liable to the corporation, unless and only to the

extent that the court in which the action or suit was brought shall determine that the defendant is fairly and reasonably entitled to

indemnity for such expenses despite such adjudication of liability.

Pursuant

to Section 102(b)(7) of the Delaware General Corporation Law, our amended and restated certificate of incorporation eliminates the liability

of a director to us or our stockholders for monetary damages for such a breach of fiduciary duty as a director, except for liabilities

arising:

| |

● |

from any breach of the

director’s duty of loyalty to us or our stockholders; |

| |

|

|

| |

● |

from acts or omissions

not in good faith or which involve intentional misconduct or a knowing violation of law; |

| |

|

|

| |

● |

under Section 174 of the

DGCL; or |

| |

|

|

| |

● |

from any transaction from

which the director derived an improper personal benefit. |

We

have entered into indemnification agreements with each of our current directors and officers. These agreements provide for the indemnification

of such persons for all reasonable expenses and liabilities incurred in connection with any action or proceeding brought against them

by reason of the fact that they are or were serving in such capacity. We believe that these indemnification agreements are necessary

to attract and retain qualified persons as directors and officers. Furthermore, we have obtained director and officer liability insurance

to cover liabilities our directors and officers may incur in connection with their services to us.

We

also maintain general liability insurance which covers certain liabilities of our directors and officers arising out of claims based

on acts or omissions in their capacities as directors or officers, including liabilities under the Securities Act of 1933, as amended.

Item

16. Exhibits

| |

|

|

|

Incorporated

by Reference |

| Exhibit

No. |

|

Description |

|

Form |

|

File

No. |

|

Exhibit |

|

Filing

Date |

| |

|

|

|

|

|

|

|

|

|

|

| 2.1 |

|

Agreement and Plan of Merger, among Ritter Pharmaceuticals, Inc., RPG28 Merger Sub, Inc. and Qualigen, Inc., dated January 15, 2020 |

|

8-K |

|

001-37428 |

|

2.1 |

|

January 21, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 2.2 |

|

Amendment No. 1 to Agreement and Plan of Merger among Ritter Pharmaceuticals, Inc., RPG28 Merger Sub, Inc. and Qualigen, Inc., dated February 1, 2020 |

|

S-4 |

|

333-236235 |

|

Annex B |

|

April 6, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 2.3 |

|

Amendment No. 2 to Agreement and Plan of Merger among Ritter Pharmaceuticals, Inc., RPG28 Merger Sub, Inc. and Qualigen, Inc., dated March 26, 2020 |

|

S-4 |

|

333-236235 |

|

Annex C |

|

April 6, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 2.4 |

|

Contingent Value Rights Agreement, dated May 22, 2020, among the Company, John Beck in the capacity of CVR Holders’ Representative and Andrew J. Ritter in his capacity as a consultant to the Company. |

|

8-K |

|

001-37428 |

|

2.4 |

|

May 29, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.1 |

|

Amended and Restated Certificate of Incorporation |

|

8-K |

|

001-37428 |

|

3.1 |

|

July 1, 2015 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.2 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation |

|

8-K |

|

001-37428 |

|

3.1 |

|

September 15, 2017 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.3 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation |

|

8-K |

|

001-37428 |

|

3.1 |

|

March 22, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.4 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series Alpha Preferred Stock of the Company, filed with the Delaware Secretary of State on May 20, 2020 |

|

8-K |

|

001-37428 |

|

3.1 |

|

May 29, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.5 |

|

Certificate of Amendment to the Certificate of Incorporation of the Company, filed with the Delaware Secretary of State on May 22, 2020 [reverse stock split] |

|

8-K |

|

001-37428 |

|

3.2 |

|

May 29, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.6 |

|

Certificate of Merger, filed with the Delaware Secretary of State on May 22, 2020 |

|

8-K |

|

001-37428 |

|

3.3 |

|

May 29, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.7 |

|

Certificate of Amendment to the Certificate of Incorporation of the Company, filed with the Delaware Secretary of State on May 22, 2020 [name change] |

|

8-K |

|

001-37428 |

|

3.4 |

|

May 29, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.8 |

|

Amended and Restated Bylaws of the Company, through August 10, 2021 |

|

10-Q |

|

001-37428 |

|

3.8 |

|

August 16, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.9 |

|

Warrant Agency Agreement between Ritter Pharmaceuticals, Inc. and Corporate Stock Transfer, Inc. and Form of Warrant Certificate |

|

8-K |

|

001-37428 |

|

4.1 |

|

October 4, 2017 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.10 |

|

First Amendment to Warrant Agency Agreement between Ritter Pharmaceuticals, Inc. and Corporate Stock Transfer, Inc. |

|

8-K |

|

001-37428 |

|

4.1 |

|

May 7, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.11 |

|

Second Amendment to Warrant Agency Agreement between the Company and Equiniti Group plc, dated November 9, 2020 |

|

10-K |

|

001-37428 |

|

4.3 |

|

March 31, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.12 |

|

Warrant, issued by the Company in favor of Alpha Capital Anstalt, dated May 22, 2020 [post-Merger] |

|

8-K |

|

001-37428 |

|

10.13 |

|

May 29, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.13 |

|

Form of Warrant, issued by the Company in favor of GreenBlock Capital LLC and its designees, dated May 22, 2020 [post-Merger] |

|

8-K |

|

001-37428 |

|

10.10 |

|

May 29, 2020 |

| 4.14 |

|

Common Stock Purchase Warrant for 1,920,768 shares in favor of Alpha Capital Anstalt, dated July 10, 2020 |

|

8-K |

|

001-37428 |

|

10.2 |

|

July 10, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.15 |

|

Pre-Funded Common Stock Purchase Warrant for 1,920,768 shares in favor of Alpha Capital Anstalt, dated July 10, 2020 |

|

8-K |

|

001-37428 |

|

10.3 |

|

July 10, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.16 |

|

Common Stock Purchase Warrant for 1,287,829 shares in favor of Alpha Capital Anstalt, dated August 4, 2020 |

|

8-K |

|

001-37428 |

|

10.3 |

|

August 4, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.17 |

|

“Two-Year” Common Stock Purchase Warrant for 1,348,314 shares in favor of Alpha Capital Anstalt, dated December 18, 2020 |

|

8-K |

|

001-37428 |

|

10.3 |

|

December 18, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.18 |

|

“Deferred” Common Stock Purchase Warrant for 842,696 shares in favor of Alpha Capital Anstalt, dated December 18, 2020 |

|

8-K |

|

001-37428 |

|

10.4 |

|

December 18, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.19 |

|

“Prefunded” Common Stock Purchase Warrant for 1,000,000 shares in favor of Alpha Capital Anstalt, dated December 18, 2020 |

|

8-K |

|

001-37428 |

|

10.5 |

|

December 18, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.20 |

|

Form of liability classified Warrant to Purchase Common Stock (“exploding warrant”) |

|

10-K |

|

001-37428 |

|

4.13 |

|

March 31, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.13 |

|

Form of “service provider” (non-“exploding”) compensatory equity classified Warrant |

|

10-K |

|

001-37428 |

|

4.14 |

|

March 31, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.14 |

|

Description of Common Stock |

|

10-K |

|

001-37428 |

|

4.7 |

|

March 31, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.15 |

|

Amended and Restated Common Stock Purchase Warrant to GreenBlock Capital LLC (300,000 shares) |

|

10-Q |

|

001-

37428 |

|

4.15 |

|

May 13, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.16 |

|

Amended and Restated Common Stock Purchase Warrant to Christopher Nelson (300,000 shares) |

|

10-Q |

|

001-37428 |

|

4.16 |

|

May 13, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 5.1 |

|

Opinion of Reed Smith LLP |

|

|

|

|

|

|

|

Filed herewith |

| |

|

|

|

|

|

|

|

|

|

|

| 23.1 |

|

Consent of Reed Smith LLP (included in the opinion filed as Exhibit 5.1) |

|

|

|

|

|

|

|

Filed herewith |

| |

|

|

|

|

|

|

|

|

|

|

| 23.2 |

|

Consent of Baker Tilly US, LLP |

|

|

|

|

|

|

|

Filed herewith |

| |

|

|

|

|

|

|

|

|

|

|

| 24.1 |

|

Power of Attorney (included on the signature page hereto). |

|

|

|

|

|

|

|

Filed herewith |

| |

|

|

|

|

|

|

|

|

|

|

| 107 |

|

Filing Fee Table |

|

|

|

|

|

|

|

Filed herewith |

Item

17. Undertakings

The

undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement.

Provided,

however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of

prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required