Qualcomm Reports Higher Revenue for Latest Quarter, Cuts Outlook Amid Pandemic

April 29 2020 - 6:24PM

Dow Jones News

By Maria Armental and Asa Fitch

Wireless chip maker Qualcomm Inc. reported a nearly 5% revenue

increase in the March quarter, as the chip business offset a slight

revenue decline in its licensing arm.

The San Diego-based company shipped 129 million chips in the

quarter, a roughly 17% decline from the previous quarter but within

its guidance of 125 million to 145 million.

The mobile-chip giant warned in February that while it projected

fewer chip shipments in the quarter, it expected the money it made

per chip "to be meaningfully higher," driven by launches of

fifth-generation, or 5G, wireless technology devices.

On Wednesday, Qualcomm said the coronavirus pandemic led to a

roughly 21% decline in handset demand compared with its projections

and cut its guidance for the current quarter by about 30%,

projecting 125 million to 145 million in chip shipments.

Overall, Qualcomm reported a second-quarter profit of $468

million, or 41 cents a share. On an adjusted basis, profit rose to

88 cents a share from 77 cents a share a year earlier.

Meanwhile, revenue rose to $5.22 billion from $4.98 billion a

year earlier.

The results beat Wall Street expectations for adjusted profit

and revenue, according to FactSet.

This quarter, Qualcomm expects 29 cents to 49 cents a share in

profit, or 60 cents to 80 cents a share on an adjusted basis, and

$4.4 billion to $5.2 billion in revenue. Analysts expect 57 cents a

share, or 78 cents a share as adjusted, on $4.89 billion in

revenue.

Qualcomm Chief Executive Steve Mollenkopf said the 5G road map

remained intact, even if some handset makers might change the

timing of handset launches due to the pandemic and the resulting

drop in demand. The company was keeping its 2020 estimate of 5G

global handset shipments unchanged, he said.

Last year, the company projected between 175 million and 225

million units.

The recovery in China after the virus subsided there, he added,

could indicate how demand returns in other countries.

"China had a pretty deep dip and is really well along the way to

recovery now," he said. "You can apply a similar type of model

basis to the rest of the world."

Qualcomm said it reached new patent licensing agreements with

Chinese handset makers Oppo and Vivo, effective April 1 following

delays in payments from them under prior agreements as negotiations

for new deals progressed. There was no change in a long-running

license-fee dispute with Chinese telecom giant Huawei Technologies

Co., from which the company said it hadn't received any revenues in

the six months through March 29, the end of the second quarter.

Negotiations toward a licensing agreement are continuing,

however.

Shares, which in January traded near $100 record levels, closed

Wednesday at $78.97 and rose 2% to $80.79 in after-hours

trading.

Write to Maria Armental at maria.armental@wsj.com and Asa Fitch

at asa.fitch@wsj.com

(END) Dow Jones Newswires

April 29, 2020 18:09 ET (22:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

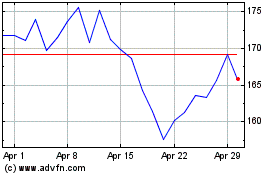

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024