Securities Registration: Employee Benefit Plan (s-8)

April 29 2020 - 4:28PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on April 29, 2020

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

QUALCOMM Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

95-3685934

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

5775 Morehouse Drive, San Diego, CA

|

|

92121

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

Amended and Restated QUALCOMM Incorporated

|

|

|

|

2016 Long-Term Incentive Plan

|

|

|

|

(Full title of the plan)

|

|

|

|

|

|

|

|

Steve Mollenkopf

|

|

|

|

Chief Executive Officer

|

|

|

|

QUALCOMM Incorporated

|

|

|

|

5775 Morehouse Drive

|

|

|

|

San Diego, California, 92121

|

|

|

|

(Name and address of agent for service)

|

|

|

|

|

|

|

|

858-587-1121

|

|

|

|

(Telephone number, including area code, of agent for service)

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer x

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company o

|

Emerging growth company o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities to be registered

|

Amount to be registered (1)

|

Proposed maximum offering price per share (2)

|

Proposed maximum aggregate offering price (2)

|

Amount of registration fee

|

|

Common Stock, Par Value $0.0001 per share (3)

|

74,500,000

|

$74.885

|

$5,578,932,500

|

$724,145

|

|

|

|

|

|

|

|

Total

|

74,500,000

|

$74.885

|

$5,578,932,500

|

$724,145

|

(1)Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement covers any additional securities to be offered or issued from stock splits, stock dividends or similar transactions or pursuant to anti-dilution adjustments.

(2)Estimated pursuant to Rule 457 solely for purposes of calculating the registration fee. The price is calculated on the basis of the average of the high and low sales prices of the registrant’s shares of common stock on April 24, 2020, as reported on the Nasdaq Global Select Market.

(3)Represents 74,500,000 additional shares of our common stock available for future issuance under the Amended and Restated QUALCOMM Incorporated 2016 Long Term Incentive Plan (as amended and restated to date, the “2016 Plan”). The shares registered hereby represent an increase to the share reserve under the 2016 Plan pursuant to an amendment and restatement of the 2016 Plan that was approved by the registrant's stockholders at the annual meeting of stockholders of the registrant held on March 10, 2020.

TABLE OF CONTENTS

EXPLANATORY NOTE

Pursuant to General Instruction E of Form S-8, QUALCOMM Incorporated (the “Company”) is filing this Registration Statement on Form S-8 (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “Commission”) to register 74,500,000 additional shares of the Company’s common stock for issuance under the Amended and Restated QUALCOMM Incorporated 2016 Long-Term Incentive Plan. This Registration Statement hereby incorporates by reference the contents of the Company’s registration statement on Form S-8 filed with the Commission on March 9, 2016 (SEC File No. 333-210048).

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The Company hereby incorporates by reference in this Registration Statement the following documents:

a.The Company’s latest annual report on Form 10-K filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), containing audited financial statements for the Company's latest fiscal year ended September 29, 2019 as filed with the Securities and Exchange Commission on November 6, 2019.

b.All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the registrant document referred to in (a) above.

c.The description of the Company’s Common Stock contained in the Company's registration statements filed under the Exchange Act, including any amendment or report filed for the purpose of updating such description.

In addition, all documents filed by the Company pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered hereby have been sold or that deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and made part hereof from their respective dates of filing (such documents, and the documents listed above, being hereinafter referred to as “Incorporated Document(s)”); provided, however, that the documents listed above or subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act in each year during which the offering made by this Registration Statement is in effect prior to the filing with the Commission of the Company’s Annual Report on Form 10-K covering such year shall cease to be Incorporated Documents or be incorporated by reference in this Registration Statement from and after the filing of such Annual Report. Notwithstanding the foregoing, the Company is not incorporating by reference any documents, portions of documents, exhibits or other information that is deemed to have been furnished to, rather than filed with, the Commission.

Any statement contained in an Incorporated Document shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed Incorporated Document modifies or supersedes such statement. Any statement contained herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed Incorporated Document modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

4.1

|

|

|

4.2

|

|

|

5.1

|

|

|

23.1

|

|

|

23.2

|

|

|

24

|

|

|

99.1

|

|

SIGNATURE

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement with respect to the Amended and Restated QUALCOMM Incorporated 2016 Long-Term Incentive Plan to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Diego, State of California, on April 29, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

QUALCOMM Incorporated

|

|

|

|

|

|

|

|

By:

|

/s/ Steve Mollenkopf

|

|

|

|

Steve Mollenkopf

|

|

|

|

Chief Executive Officer and Director

|

SIGNATURES AND POWER OF ATTORNEY

The officers and directors of QUALCOMM Incorporated whose signatures appear below hereby constitute and appoint Steve Mollenkopf and Akash Palkhiwala, and each of them, their true and lawful attorneys and agents, with full power of substitution, each with power to act alone, to sign and execute on behalf of the undersigned this Registration Statement on Form S-8 with respect to the Amended and Restated QUALCOMM Incorporated 2016 Long-Term Incentive Plan and any amendment or amendments thereto, and each of the undersigned does hereby ratify and confirm all that each of said attorney and agent, or their or his substitutes, shall do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement on Form S-8 has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Steve Mollenkopf

|

|

Chief Executive Officer and Director

|

|

April 29, 2020

|

|

Steve Mollenkopf

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Akash Palkhiwala

|

|

Executive Vice President and Chief Financial Officer

|

|

April 29, 2020

|

|

Akash Palkhiwala

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Erin Polek

|

|

Senior Vice President and Chief Accounting Officer

|

|

April 29, 2020

|

|

Erin Polek

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Mark Fields

|

|

Director

|

|

April 29, 2020

|

|

Mark Fields

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Jeffrey W. Henderson

|

|

Director

|

|

April 29, 2020

|

|

Jeffrey W. Henderson

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ann M. Livermore

|

|

Director

|

|

April 29, 2020

|

|

Ann M. Livermore

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Harish Manwani

|

|

Director

|

|

April 29, 2020

|

|

Harish Manwani

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mark D. McLaughlin

|

|

Chairman

|

|

April 29, 2020

|

|

Mark D. McLaughlin

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Clark T. Randt, Jr.

|

|

Director

|

|

April 29, 2020

|

|

Clark T. Randt, Jr.

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Irene B. Rosenfeld

|

|

Director

|

|

April 29, 2020

|

|

Irene B. Rosenfeld

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Kornelis (Neil) Smit

|

|

Director

|

|

April 29, 2020

|

|

Kornelis (Neil) Smit

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Anthony J. Vinciquerra

|

|

Director

|

|

April 29, 2020

|

|

Anthony J. Vinciquerra

|

|

|

|

|

|

|

|

|

|

|

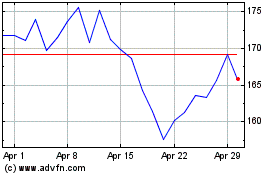

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024