Alphabet, Match Group, CVS: Stocks That Defined The Week

September 06 2019 - 5:52PM

Dow Jones News

By Francesca Fontana

Nvidia Corp.

Chip makers are holding out hope for a trade deal. Semiconductor

stock Nvidia was among the day's top gainers Thursday after the

U.S. and China said they would hold talks in Washington in October.

The impending talks have rekindled hopes for progress after the two

countries recently escalated tensions with fresh tariffs. Nvidia

shares gained 6.5% Thursday, while peers Micron Technology Inc. and

Qualcomm Inc. gained 4.7% and 2.5%, respectively.

Alphabet Inc.

Alphabet-owned YouTube agreed to pay a $170 million fine to U.S.

authorities investigating alleged abuses of children's privacy on

the widely viewed video platform. The Federal Trade Commission and

the New York state attorney general announced the penalty Wednesday

after a yearlong investigation. The probe was a response to

complaints from consumer groups that YouTube illegally collected

data on children to sell ads for products such as Barbie dolls and

Play-Doh. The FTC said YouTube tracked internet activity for

children under age 13, with the goal of keeping viewership high.

Alphabet shares added 1.1% Wednesday.

Tapestry Inc.

Tapestry has a new leader. The handbag company that combined the

Coach and Kate Spade brands ousted Victor Luis, who has been chief

executive for five years, on Wednesday and said he would be

succeeded by board Chairman Jide Zeitlin. Since Coach acquired Kate

Spade & Co. and changed its name to Tapestry in 2017, the Kate

Spade brand has struggled. Mr. Zeitlin, who will remain board

chairman, said he wasn't planning any management changes at Kate

Spade or elsewhere in the company. Mr. Zeitlin is a former Goldman

Sachs executive who has been on the board since 2006. Tapestry

shares gained 5.1% Wednesday.

CVS Health Corp.

Almost a year after the deal closed, the CVS-Aetna merger is

finally official. A federal judge approved a Justice Department

settlement late Wednesday that allowed CVS to acquire Aetna for

nearly $70 billion. While the deal closed last November, U.S.

District Judge Richard Leon has spent months questioning whether

the settlement did enough to protect competition and consumers. On

Wednesday, he said the health-care markets at issue in the case

"are not only very competitive today, but are likely to remain so

post-merger." CVS Health shares gained 1.8% Thursday.

Match Group Inc.

Investors are swiping left on Match Group. The stock fell 4.6%

Thursday after Facebook Inc. announced it is launching a dating

feature in the U.S., a competitor to Match's dating websites and

apps. Facebook users over the age of 18 can opt in to Facebook

Dating and create dating profiles that helps them find people with

common interests, events and groups. The dating profiles will be

separate from the users' main profile. The Facebook feature is

already available in 19 other countries, including Argentina,

Brazil, Canada, Mexico, Singapore and Thailand.

Kroger Co.

The largest U.S. supermarket chain is jumping on the meatless

train. Kroger shares gained 0.7% after the company said Thursday it

will roll out plant-based burger patties, grinds and other

products. The announcement comes amid rising consumer interest in

new meat replacements that have been added to menus at big

fast-food chains and other restaurants. Kroger -- which also sells

Beyond Meat Inc.'s meat-replacement products -- will put its own

plant-based deli slices, sausages and other products on shelves at

1,800 of its 2,800 stores this fall. The company said those

products will be priced below the offerings from Beyond Meat but

wouldn't say by how much.

Fannie Mae

The Trump administration said late Thursday that it would

support privatizing mortgage-finance giants Fannie Mae and Freddie

Mac, and said it wanted to curtail the firms' roles in housing

finance. Left unresolved were several key questions, such as what

to do with the government's large stakes in the firms, how to build

up their capital so they can operate as private companies again and

how to shrink Fannie and Freddie's footprint in housing. The two

companies guarantee about half of the U.S. mortgage market. The

process could take years. The lack of specifics and the murky

timeline sent shares of Fannie Mae down 8.8% Friday, while Freddie

Mac fell 8.2%.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

September 06, 2019 17:37 ET (21:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

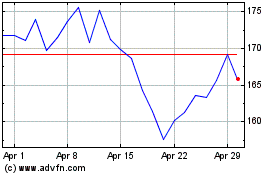

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024