Qualcomm Wins Antitrust Respite -- WSJ

August 24 2019 - 3:02AM

Dow Jones News

By Brent Kendall and Asa Fitch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 24, 2019).

A federal appeals court froze a ruling that Qualcomm Inc. had

committed an array of antitrust violations, a boost for the chip

maker that allows it to maintain its business practices for the

time being.

The court decision Friday is a setback for the Federal Trade

Commission, which had sued the company alleging it engaged in an

illegal monopoly that harmed smartphone manufacturers and rival

chip producers.

The San Francisco-based Ninth U.S. Circuit Court of Appeals

granted a request by Qualcomm to stay the order by U.S. District

Judge Lucy Koh that the company change the way it licenses its

cellular technology.

Judge Koh's ruling, issued in May, found the company leveraged

its dominance in smartphone chips to force device manufacturers to

pay unreasonably high royalty rates for Qualcomm's intellectual

property.

Qualcomm argued its business practices were justified and

perfectly lawful and said a stay was necessary because Judge Koh's

ruling would irreparably harm the company while it was appealing

the case.

Shares of Qualcomm were down 4% at $74.04 in afternoon trading

on the Nasdaq Stock Market.

Friday's court action isn't a definitive reading of the merits

of Qualcomm's appeal, but it indicated the company has a fair shot

at winning.

The appeals court's seven-page order said Qualcomm "has shown,

at minimum, the presence of serious questions" about whether Judge

Koh's ruling against the chip maker was correct.

Qualcomm said it welcomed the ruling and believed the case would

ultimately go its way. The Ninth Circuit's stay "will allow

Qualcomm to continue to invest in inventing the fundamental

technologies at the heart of mobile communications at this critical

time of transition to 5G, " said Don Rosenberg, executive vice

president and general counsel for the company.

Qualcomm.shares spiked after the court's action then fell along

with the much of the tech industry when U.S.-China trade tensions

flared, with President Trump blasting Beijing's imposition of

tariffs on $75 billion worth of U.S. products.

Qualcomm supplies China's biggest smartphone makers. Last month,

the chip maker cut its full-year forecast for smartphone sales and

warned that challenges emanating from China are hurting its

business.

Bruce Hoffman, director of the FTC's bureau of competition,

expressed disappointment in Friday's court ruling, but, he said,

"We respect the decision and look forward to defending the district

court's decision on the merits." He said some conditions imposed on

Qualcomm remain in effect, including monitoring provisions and a

requirement that the company not interfere with customers who might

want to talk to the government about antitrust matters.

The stay means Qualcomm won't have to change its practices while

the litigation runs its course, which could take at least another

year. The appeals court said it will hear oral arguments in

January.

The case dates back to the start of 2017, when antitrust

officials at the FTC sued Qualcomm in the waning days of the Obama

administration. The case has produced an unusual split between two

federal antitrust agencies, with the Justice Department under the

Trump administration stepping into the case to support

Qualcomm.

The FTC had argued that staying Judge Koh's ruling would allow

Qualcomm to perpetuate anticompetitive actions that have spurred

higher prices and created roadblocks to innovation. The Justice

Department, on the other hand, said the judge's ruling could deal a

blow to Qualcomm's position as a leader in 5G wireless technology,

potentially to the detriment of national security.

The appeals court said the rift within the government was

another reason it delayed court-ordered changes to Qualcomm's

business. "This case is unique, as the government itself is divided

about the propriety of the judgment and its impact on the public

interest," the court said.

As Qualcomm faced FTC scrutiny, Apple Inc. in 2017 sued the chip

maker on similar grounds, alleging it charged above-market rates

for licenses to its patents. The Apple-Qualcomm legal battle grew

to encompass cases in China, Germany and other far-flung locales

before the companies reached a global settlement in April.

That deal dissipated the uncertainty hanging over Qualcomm, but

the FTC case could still shake the company to its core.

Judge Koh's ruling required the company to renegotiate its

licensing deals with phone makers and allow chip-making rivals to

use its intellectual property at reasonable rates.

Playing by those rules would cut into a licensing business that

currently accounts for almost two-thirds of Qualcomm's earnings

before taxes as of its fiscal third quarter. In court testimony,

Qualcomm executives have warned that some licensees were already

threatening to hold back payments as the court battle dragged

on.

--Tripp Mickle contributed to this article.

Write to Brent Kendall at brent.kendall@wsj.com and Asa Fitch at

asa.fitch@wsj.com

(END) Dow Jones Newswires

August 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

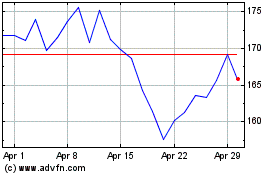

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024