Dead Calm Before the 5G Storm -- Heard on the Street

August 01 2019 - 2:51PM

Dow Jones News

By Dan Gallagher

The global smartphone market is taking a significant pause ahead

of the rollout of 5G services. The big question is just how long

that pause will last.

Market research firm IDC reported Wednesday that global

smartphone sales fell 2.3% year over year during the June quarter.

That is the seventh straight quarter of declines for the industry.

IDC's data showed iPhone unit sales falling 18% to 33.8 million,

which would be the lowest number of quarterly sales that Apple's

iconic smartphone line has seen in six years. Apple no longer

reports unit sales itself, but the company said in its fiscal

third-quarter report Tuesday that iPhone revenue for the same

period slid 12% year over year to about $26 billion.

Qualcomm painted an even bleaker picture on Wednesday. Fiscal

third-quarter revenue came in a bit below Wall Street's estimates,

though adjusted per-share earnings exceeded expectations. But the

company's forecast was a different story, with Qualcomm essentially

projecting a significantly weaker business for the next two

quarters as device makers and wireless carriers clean out inventory

ahead of a big 5G push next year.

Qualcomm is also hurt by its continued royalty dispute with

Huawei and the fact that the Chinese smartphone giant uses its own

chips for devices sold in that country. This means that 5G can't

appear on the scene soon enough for Qualcomm, Apple and others in

the smartphone business.

Wireless carriers are indeed pushing hard to upgrade their

networks to the next-generation technology. AT&T said on its

earnings call last week that it expects to have "nationwide 5G

coverage" by the middle of next year. Verizon said on its own call

Thursday morning that it expects to have 5G service up and running

in 30 markets by the end of this year. China also aims to have

national 5G networks in place next year,

Billed as the next generation of wireless networks, 5G promises

blazing speeds and a vastly increased data capacity needed to

underpin future technologies, such as autonomous cars.

But early reviews of 5G services have been rough, noting the

service's spotty availability and the tendency of the phones to

overheat. And those phones are expensive: the 5G version of

Samsung's latest Galaxy S10 lineup costs about 30% more than an

equivalent model without 5G. Wireless customers are already

resistant to handset prices that have been creeping well over the

$1,000 mark, and it is unclear whether faster service in limited

markets will be enough to convince them to absorb further price

increases.

And while Apple hasn't announced its plans, the company isn't

expected to introduce a 5G iPhone until late next year. That too

will likely be a significant constraint on 5G demand given the fact

that the iPhone has leading market share at the premium end of the

smartphone market where customers are more likely to upgrade early.

As fast as 5G service promises to be, the wait will be painful.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

August 01, 2019 14:36 ET (18:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

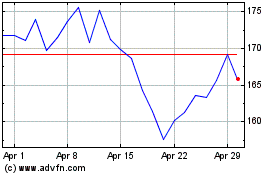

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024