Qualcomm Cuts Forecast, Citing China -- WSJ

August 01 2019 - 3:02AM

Dow Jones News

By Asa Fitch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 1, 2019).

Qualcomm Inc. warned of multiple challenges out of China that

are hurting its outlook, including a ban on exports to telecom

company Huawei Technologies Co. and a sharp drop in smartphone

sales.

The chip maker cut its full-year forecast for global smartphone

sales by 100 million units to a range of 1.7 billion to 1.8

billion, in large part reflecting weaker demand in China. Some

handset makers are holding off on releasing new phones as they

prioritize a new generation of high-speed 5G devices coming next

year, Chief Executive Steve Mollenkopf said during a call with

analysts.

Qualcomm stopped all business with Huawei in May, when the U.S.

imposed a ban on shipments to the Chinese company, but it resumed

some shipments it determined didn't violate the restrictions

imposed by the Trump administration amid a broader political and

trade dispute. Huawei accounted for about 3% of Qualcomm's revenue

before the ban, according to a Bernstein Research estimate.

Mr. Mollenkopf said Huawei became a less-lucrative customer

after the ban because the Chinese telecom company switched focus to

its domestic market, selling more devices that don't feature

Qualcomm's chips.

Those factors contributed to Qualcomm issuing a subdued outlook

for the current quarter, projecting another revenue decrease and a

fall of as much as 40% year-over-year in its chip shipments.

Shares fell more than 4% in aftermarket trading.

The company reported a 13% slump in adjusted revenue to $4.89

billion for the quarter ended June 30. That figure missed the $5.09

billion expected by analysts surveyed by FactSet. Its adjusted

earnings per share of 80 cents exceeded a consensus forecast of 76

cents, because of expanding margins and lower research and

development spending, among other factors.

The latest earnings mark the end to a tumultuous quarter for

Qualcomm. It got a boost from an April settlement with Apple Inc.

in a protracted legal battle over its technology-licensing

practices. That triggered a $4.7 billion boost to Qualcomm's

quarterly sales before adjustments, lifting them to $9.6

billion.

In May, a San Jose, Calif., federal judge ruled in a case

brought by the Federal Trade Commission that Qualcomm violated

antitrust laws by leveraging its dominance as a supplier of

mobile-communications chips to extract higher patent royalties from

customers. Qualcomm is seeking a stay of an order requiring it to

renegotiate its licensing deals. The order could lower revenue for

its licensing division, which collects royalties from

Qualcomm-developed technologies when other companies use them.

Mr. Mollenkopf said existing licensees were continuing to pay

Qualcomm, although John Han, an executive in Qualcomm's licensing

division, said in a recent court filing that several customers were

already either threatening to stop paying royalties or would seek

to renegotiate their deals if the court doesn't grant a stay during

Qualcomm's pending appeal before the Ninth Circuit Court of

Appeals.

Qualcomm is banking on the rollout of new 5G networks to boost

its fortunes. The company has been an early leader in putting the

technology into some of the newest phones, including Samsung's

flagship S10 model. But while 5G networks are appearing in more

markets across the globe and more handset makers are releasing 5G

phones, the technology remains far from ubiquitous.

Stacy Rasgon, an analyst at Bernstein Research, said the

company's suggestion that the sales decline was merely a normal

pause in demand as a better technology hit the market wasn't

necessarily a sure thing.

"They try to spin it as it's a pause in 4G demand that they can

send to 5G," he said. "Maybe, but what gives them confidence that

it's that simple?"

Corrections & Amplifications Including a payment that was

part of a settlement with Apple, Qualcomm's quarterly revenue was

$9.6 billion. An earlier version of this article incorrectly said

it was $9.4 billion.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

August 01, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

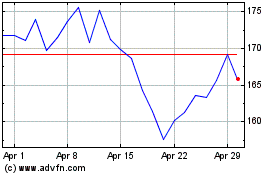

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024