Current Report Filing (8-k)

February 23 2022 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 23, 2022 (February 17, 2022)

Prospect Capital Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

MARYLAND | | 814-00659 | | 43-2048643 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

10 East 40th Street, 42nd Floor, New York, New York 10016

(Address of principal executive offices, including zip code)

(212) 448-0702

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value | PSEC | NASDAQ Global Select Market |

| 5.35% Series A Fixed Rate Cumulative Perpetual Preferred Stock, par value $0.001 | PSEC PRA | New York Stock Exchange |

Item 1.01. Entry into a Material Definitive Agreement.

On February 18, 2022, Prospect Capital Corporation (the “Company”) entered into an Amended and Restated Dealer Manager Agreement to the dealer manager agreement previously entered into on October 30, 2020 with InspereX LLC (the “Dealer Manager”) and the other agents named therein from time to time (the “Dealer Manager Agreement”), pursuant to which the Dealer Manager has agreed to serve as the Company’s agent and dealer manager for the Company’s offering of up to 10,000,000 shares (the “Authorized Amount”) of its Series 5.50% Series AA1 preferred stock and its 5.50% Series MM1 Preferred Stock, each par value $0.001 per share, and each with a liquidation preference of $25.00 per share (such Authorized Amount of 10,000,000 shares being referred to herein as the “Preferred Stock” and such $25.00 per share liquidation preference being referred to herein as the “Stated Value”). The Company may offer any future series of Preferred Stock, provided that the aggregate number of shares issued across all series of Preferred Stock offered pursuant to the Dealer Manager Agreement shall not exceed 10,000,000 shares (the “Offering”).

The Preferred Stock is registered with the Securities and Exchange Commission pursuant to an automatic shelf registration statement on Form N-2 (File No. 333-236415) under the Securities Act of 1933, as amended (the “Registration Statement”), and will be offered and sold pursuant to a prospectus supplement dated February 18, 2022, and a base prospectus dated February 13, 2020 relating to the Registration Statement (collectively, the “Prospectus,” which revises the prospectus filed on October 30, 2020).

The Dealer Manager Agreement requires the Dealer Manager to use its reasonable best efforts to sell shares of the Preferred Stock offered in the Offering. Subject to the terms, conditions and limitations described in the Dealer Manager Agreement, the Dealer Manager will purchase the Preferred Stock from the Company at a price reflecting a sales load; the Dealer Manager will receive a dealer manager fee and may retain any remaining portion of the sales load as a selling concession or reallow it to third-party broker-dealers authorized by the Dealer Manager to sell the Preferred Stock and the agents who may be approved by the Company from time to time to sell the Preferred Stock. The actual selling commission to be paid by the Company in connection with sales of the Preferred Stock will be agreed to from time to time among the Company, the Dealer Manager and each participating broker-dealer.

Pursuant to the Dealer Manager Agreement, the Company has agreed to indemnify the Dealer Manager and participating broker-dealers, and the Dealer Manager has agreed to indemnify the Company, against certain losses, claims, damages and liabilities, including but not limited to those arising out of (i) untrue statements of a material fact contained in the Registration Statement, Prospectus or any supplement thereto relating to the Offering or (ii) the omission or alleged omission to state a material fact required to be stated in the Registration Statement, Prospectus or any supplement thereto relating to the Offering.

The foregoing description of the Dealer Manager Agreement is only a summary and is qualified in its entirety by reference to the full text of the Dealer Manager Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Venable LLP, special Maryland counsel to the Company, has issued a legal opinion relating to the validity of the shares of Preferred Stock offered in the Offering, a copy of which is attached to this Form 8-K as Exhibit 5.1.

Item 3.03. Material Modification to Rights of Security Holders

On February 17, 2022, in connection with the Offering, the Company filed Articles Supplementary (the “Articles Supplementary”) with the State Department of Assessments and Taxation of Maryland (“SDAT”), reclassifying and designating 20,000,000 shares of the Company’s authorized and unissued shares of Common Stock into shares of Preferred Stock designated as “Convertible Preferred Stock, Series MM1,” and reclassifying and designating 20,000,000 shares of the Company’s authorized and unissued shares of Convertible Preferred Stock, Series AA1 into new shares of Preferred Stock also designated as “Convertible Preferred Stock, Series AA1.” The reclassification decreased the number of shares classified as Common Stock from 1,852,100,000 shares immediately prior to the reclassification to 1,832,100,000 shares immediately after the reclassification. The description of the Preferred Stock contained in the section of the Prospectus entitled “Description of the Preferred Stock” is incorporated herein by reference.

The foregoing description of the Preferred Stock is only a summary and is qualified in its entirety by reference to the full text of the Articles Supplementary, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Item 3.03 above with respect to the Articles Supplementary is incorporated in this Item 5.03 in its entirety.

Item 7.01. Regulation FD Disclosure.

The Company is declaring (with respect to the MM1 Shares), and previously declared (with respect to the AA1 Shares), distributions to preferred shareholders based on an annual rate equal to 5.50% of the stated value of $25 per share of the AA1 and MM1 Shares, from the date of issuance or, if later, from the most recent dividend payment date (the first business day of the month, with no additional dividend accruing in May as a result), as follows:

| | | | | | | | | | | |

| Series AA1 and MM1 Monthly Cash 5.50% Preferred Shareholder Distribution | Record Date | Payment Date | Monthly Amount ($ per share), before pro ration for partial periods |

| March 2022 | 3/23/2022 | 4/1/2022 | $0.114583 |

| April 2022 | 4/20/2022 | 5/2/2022 | $0.114583 |

| May 2022 | 5/18/2022 | 6/1/2022 | $0.114583 |

The information disclosed under this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

Preferred Stock Dividend Reinvestment Plan

In connection with the Offering, effective as of February 18, 2022, the Company amended and restated its Preferred Stock Distribution Reinvestment Plan (the “DRIP”) to include the Preferred Stock. Under the DRIP, holders of Preferred Stock (“preferred stockholders”) will have dividends on their Preferred Stock automatically reinvested in additional shares of such Preferred Stock at a price per share of $25.00 if they so elect. Once enrolled in the DRIP, preferred stockholders may elect to reinvest all, but not less than all, of their dividends in additional shares of Preferred Stock, until they terminate their participation in the DRIP. The Company will pay all fees or other charges on shares of Preferred Stock purchased through the DRIP.

Shares of Preferred Stock purchased under the DRIP will come from the Company’s authorized but unissued shares of Preferred Stock. Shares of Preferred Stock received through the DRIP will be of the same series and have the same original issue date for purposes of calculating the fee associated with a preferred stockholder’s election to convert shares of Preferred Stock held by the preferred stockholder prior to the listing of the Preferred Stock on a national securities exchange and for other terms of the Preferred Stock based on issuance date as the Preferred Stock for which the dividend was declared. The Company may terminate the DRIP at any time in its sole discretion. The description of the DRIP contained in the section of the Prospectus entitled “Preferred Stock Dividend Reinvestment Plan” is incorporated herein by reference.

The foregoing description of the DRIP is only a summary and is qualified in its entirety by reference to the full text of the DRIP, a copy of which is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Other Agreements

In connection with the Offering, the Company is also filing (i) a form of Master Selected Dealer Agreement as an exhibit hereto (which is an exhibit to the Dealer Manager Agreement and incorporated herein by reference to Exhibit 1.1) (ii) a form of subscription agreement and (iii) the Escrow Agreement, dated as of February 18, 2022, by and between the Company, and UMB Bank, National Association, a national banking association, as escrow agent.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| |

| 1.1 | | Dealer Manager Agreement, dated February 18, 2022, by and among, the Company, Prospect Capital Management L.P., Prospect Administration LLC, InspereX LLC and the Agents named therein and added from time to time. |

| 3.1 | | Articles Supplementary to the Articles of Amendment and Restatement of Prospect Capital Corporation. |

| 4.1 | | Form of Subscription Agreement |

| 5.1 | | Opinion of Venable LLP |

| 10.1 | | Escrow Agreement, by and between Prospect Capital Corporation and UMB Bank, National Association |

| 99.1 | | Amended and Restated Preferred Stock Dividend Reinvestment Plan |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

Prospect Capital Corporation

By: /s/ M. Grier Eliasek

Name: M. Grier Eliasek

Title: Chief Operating Officer

Date: February 23, 2022

Index to Exhibits

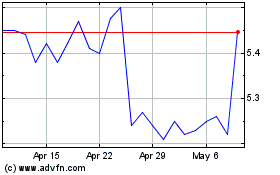

Prospect Capital (NASDAQ:PSEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

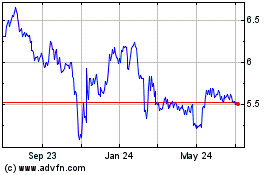

Prospect Capital (NASDAQ:PSEC)

Historical Stock Chart

From Apr 2023 to Apr 2024