Pool Corporation (Nasdaq/GSM:POOL) today announced fourth quarter

and full year 2020 results.

“As the pandemic forced families to spend more

time at home in 2020, they sought out opportunities to create or

expand existing home-based outdoor living and entertainment spaces.

This created unprecedented demand throughout our markets. Our scale

and execution, combined with favorable weather conditions, drove

truly remarkable results for the year, including an exceptionally

strong fourth quarter. I am extremely proud of the outstanding

efforts of the POOLCORP team, whose commitment to our customers,

while maintaining a safe environment for fellow employees and our

communities under very challenging conditions, is second to none,”

commented Peter D. Arvan, president and CEO.

Net sales increased 23% to a record high of $3.9

billion for the year ended December 31, 2020 compared to $3.2

billion in 2019, while base business sales increased 22%. We

realized broad sales gains across nearly all product categories.

Our sales benefited from greater swimming pool usage and high

demand for residential pool products, which was driven by

home-centric trends influenced by the COVID-19 pandemic and aided

by warmer weather conditions during the year.

Gross profit reached a record $1.1 billion for

the year ended December 31, 2020, a 22% increase over gross

profit of $924.9 million in 2019. Gross margin declined 20 basis

points to 28.7% in 2020 compared to 28.9% in 2019. The decline in

gross margin is primarily due to sales of lower margin, big-ticket

items, such as pool equipment and in-ground and above-ground pools,

which comprised a larger portion of our product mix in 2020

compared to 2019.

Selling and administrative expenses (operating

expenses) increased 14%, or $83.2 million, to $666.9 million in

2020, up from $583.7 million in 2019, with base business operating

expenses up 12% over 2019. Over half of the increase in operating

expenses, or $43.9 million, reflects higher performance-based

compensation earned by employees in 2020, while another 20% of the

increase, or $16.9 million, came from acquired businesses.

Excluding $6.9 million of impairment charges we recorded in

the first quarter of 2020 and performance-based compensation in

both periods, operating expenses increased 6%, reflecting

growth-driven labor and freight expenses and greater

facility-related costs partially offset by lower discretionary

spending. As a result of strong expense control and our ability to

leverage our existing network, operating expenses as a percentage

of net sales declined 130 basis points to 16.9% in 2020 compared to

18.2% in 2019.

Operating income for the year increased 36% to

$464.0 million, up from $341.2 million in 2019. Adjusted operating

income, excluding non-cash impairments, increased 38% from the

prior year to $471.0 million. See the reconciliation of GAAP to

non-GAAP measures below and in the addendum of this release.

Operating margin increased 110 basis points to 11.8% in 2020

compared to 10.7% in 2019.

We recorded a $28.6 million, or $0.70 per

diluted share, benefit from Accounting Standards Update (ASU)

2016-09, Improvements to Employee Share-Based Payment Accounting,

for the year ended December 31, 2020 compared to a

benefit of $23.5 million, or $0.57 per diluted share, realized

in 2019.

Net income increased 40% to a record $366.7

million in 2020 compared to $261.6 million in 2019. Adjusted net

income, excluding the $6.3 million, or $0.15 per diluted share,

impact of non-cash impairments, net of tax, increased 43% to $373.0

million. Earnings per share increased 40% to a record $8.97 per

diluted share compared to $6.40 per diluted share in 2019.

Excluding the impact of non-cash impairments, net of tax, in 2020

and the impact from ASU 2016-09 in both periods, adjusted diluted

earnings per share increased 44% to $8.42 in 2020 compared to $5.83

in 2019. Adjusted EBITDA (as defined in the addendum to this

release) increased 34% to $512.7 million in 2020 compared to $382.2

million in 2019 and was 13.0% of net sales in 2020 compared to

11.9% of net sales in 2019.

On the balance sheet at December 31, 2020,

total net receivables, including pledged receivables, increased 28%

compared to 2019, driven by our December sales growth and partially

offset by improved collections. Inventory levels increased 11% to

$781.0 million compared to $702.3 million in 2019, reflecting

normal inventory growth and $42.2 million of inventory from

recently acquired businesses. Accrued expenses and other current

liabilities increased $82.9 million to $143.7 million in 2020,

primarily reflecting increases in accrued performance-based

compensation, unrealized losses on interest rate swaps and deferred

payroll tax payments. Total debt outstanding decreased $95.4

million, or 19%, compared to last year’s balance, as we have

utilized our operating cash flows to decrease debt balances.

Cash provided by operations was $397.6 million

in 2020 compared to $298.8 million in 2019, an improvement of

$98.8 million. The improvement in cash provided by operations

primarily reflects an increase in net income and accrued expenses

and other current liabilities, which was partially offset by

year-over-year increases in our accounts receivables and inventory

balances. Our return on invested capital (as defined in the

addendum to this release) for 2020 was 39.2% compared to 29.3% in

2019.

Net sales increased 44% to $839.3 million in the

fourth quarter of 2020 compared to $582.2 million in the fourth

quarter of 2019. Sales in the fourth quarter of 2020 benefited from

continued stay-at-home trends, favorable weather nationwide and

acquisitions. Acquisitions added 4% to sales growth in the quarter.

Gross margin increased 70 basis points to 28.5% in the fourth

quarter of 2020 from 27.8% in the fourth quarter of 2019 with

increased purchase volumes driving improvements in supply chain

management.

Operating expenses increased 21% to $164.7

million in the fourth quarter of 2020 compared to $136.3 million in

the fourth quarter of 2019, primarily reflecting higher

performance-based compensation earned by employees and expenses

from recently acquired businesses. As a percentage of net sales,

operating expenses decreased to 19.6% in the fourth quarter of 2020

compared to 23.4% in the same period of 2019.

Operating income in the fourth quarter of 2020

increased 188% to $74.4 million compared to $25.8 million in the

same period of 2019. Operating margin increased 450 basis points in

the fourth quarter. We recorded a $6.0 million benefit from

ASU 2016-09, or $0.15 per diluted share, in the fourth quarter of

2020 compared to a benefit of $2.4 million, or $0.06

per diluted share, realized in the fourth quarter of 2019. Net

income in the fourth quarter of 2020 was $59.2 million compared to

$18.0 million in the comparable 2019 period. Earnings per diluted

share increased 230% to $1.45 in the fourth quarter of 2020

compared to $0.44 for the same period in 2019. Excluding the impact

from ASU 2016-09 in both periods, earnings per diluted share

increased 242% to $1.30 compared to $0.38 for the same period in

2019.

“We expect the benefits from our investments in

capacity creation and our most recent acquisitions, along with new

sales center openings, will contribute to solid growth in

2021. Long-term demand within our industry remains

strong, and we believe results in 2021 will continue to benefit

from robust consumer interest in outdoor living. Building on the

momentum that we gained in 2020, our guidance range assumes strong

growth in the first half of the year. In the second half of the

year, we expect to face tougher year-over-year comparisons and

inherent industry capacity constraints, although we remain

encouraged by positive industry outlooks. We project

earnings for 2021 will grow on top of the incredible results

delivered in 2020 and be in the range of $9.12 to $9.62 per diluted

share, including an estimated $0.11 favorable impact from ASU

2016-09,” said Arvan.

| (Unaudited) |

|

|

2021 Guidance Range |

| |

2020 |

|

Floor |

|

Ceiling |

|

Diluted EPS |

$ |

8.97 |

|

|

$ |

9.12 |

|

|

$ |

9.62 |

|

| After-tax non-cash impairment

charges |

0.15 |

|

|

— |

|

|

— |

|

| ASU 2016-09 tax benefit |

(0.70 |

) |

|

(0.11 |

) |

|

(0.11 |

) |

| Adjusted Diluted EPS |

$ |

8.42 |

|

|

$ |

9.01 |

|

|

$ |

9.51 |

|

| Year-over-year growth |

|

|

7 |

% |

|

13 |

% |

Based on our December 31, 2020 stock price,

we estimate that we have approximately $4.5 million in unrealized

excess tax benefits related to stock options that will expire and

restricted stock awards that will vest in the first quarter of

2021, adding $0.11 in diluted earnings per share in that period. We

have included the estimated first quarter benefit in our annual

earnings guidance; however, additional tax benefits could be

recognized related to stock option exercises in 2021 from grants

that expire in years after 2021, for which we have not included any

expected benefits.

POOLCORP is the world’s largest wholesale

distributor of swimming pool and related backyard products. As of

December 31, 2020, POOLCORP operates 398 sales centers in

North America, Europe and Australia, through which it distributes

more than 200,000 national brand and private label products to

roughly 120,000 wholesale customers. For more information, please

visit www.poolcorp.com.

This news release includes “forward-looking”

statements that involve risks and uncertainties that are generally

identifiable through the use of words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” “project,” “should” and

similar expressions and include projections of earnings. The

forward-looking statements in this release are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements speak only as of the date

of this release, and we undertake no obligation to update or revise

such statements to reflect new circumstances or unanticipated

events as they occur. Actual results may differ materially due to a

variety of factors, including impacts on our business from the

COVID-19 pandemic and the extent to which home-centric trends will

continue, accelerate or reverse; the sensitivity of our business to

weather conditions; changes in the economy and the housing market;

our ability to maintain favorable relationships with suppliers and

manufacturers; competition from other leisure product alternatives

and mass merchants; our ability to continue to execute our growth

strategies; excess tax benefits or deficiencies recognized under

ASU 2016-09 and other risks detailed in POOLCORP’s 2019 Annual

Report on Form 10-K, 2020 Quarterly Reports on Form 10-Q and

other reports and filings filed with the Securities and Exchange

Commission (SEC) as updated by POOLCORP’s subsequent filings with

the SEC.

Curtis J. ScheelDirector of Investor

Relations985.801.5341curtis.scheel@poolcorp.com

POOL

CORPORATIONConsolidated Statements of

Income (In thousands, except per share data)

| |

Three Months Ended |

|

Year Ended |

|

| |

December 31, |

|

December 31, |

|

| |

2020 |

|

2019 |

|

2020 |

|

2019 (1) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Net sales |

$ |

839,261 |

|

|

$ |

582,234 |

|

|

$ |

3,936,623 |

|

|

$ |

3,199,517 |

|

|

| Cost of sales |

600,166 |

|

|

420,184 |

|

|

2,805,721 |

|

|

2,274,592 |

|

|

|

Gross profit |

239,095 |

|

|

162,050 |

|

|

1,130,902 |

|

|

924,925 |

|

|

|

Percent |

28.5 |

|

% |

27.8 |

|

% |

28.7 |

|

% |

28.9 |

|

% |

| |

|

|

|

|

|

|

|

|

| Selling and administrative

expenses |

164,744 |

|

|

136,252 |

|

|

659,931 |

|

|

583,679 |

|

|

| Impairment of goodwill and

other assets |

— |

|

|

— |

|

|

6,944 |

|

|

— |

|

|

|

Operating income |

74,351 |

|

|

25,798 |

|

|

464,027 |

|

|

341,246 |

|

|

|

Percent |

8.9 |

|

% |

4.4 |

|

% |

11.8 |

|

% |

10.7 |

|

% |

| |

|

|

|

|

|

|

|

|

| Interest and other

non-operating expenses, net |

3,061 |

|

|

5,234 |

|

|

12,353 |

|

|

23,772 |

|

|

| Income before income taxes and

equity earnings |

71,290 |

|

|

20,564 |

|

|

451,674 |

|

|

317,474 |

|

|

| Provision for income

taxes |

12,163 |

|

|

2,592 |

|

|

85,231 |

|

|

56,161 |

|

|

| Equity earnings in

unconsolidated investments, net |

47 |

|

|

52 |

|

|

295 |

|

|

262 |

|

|

| Net income |

$ |

59,174 |

|

|

$ |

18,024 |

|

|

$ |

366,738 |

|

|

$ |

261,575 |

|

|

| |

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.47 |

|

|

$ |

0.45 |

|

|

$ |

9.14 |

|

|

$ |

6.57 |

|

|

|

Diluted |

$ |

1.45 |

|

|

$ |

0.44 |

|

|

$ |

8.97 |

|

|

$ |

6.40 |

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

40,202 |

|

|

40,047 |

|

|

40,106 |

|

|

39,833 |

|

|

|

Diluted |

40,873 |

|

|

40,952 |

|

|

40,865 |

|

|

40,865 |

|

|

| |

|

|

|

|

|

|

|

|

| Cash dividends declared per

common share |

$ |

0.58 |

|

|

$ |

0.55 |

|

|

$ |

2.29 |

|

|

$ |

2.10 |

|

|

(1) Derived from audited financial statements.

POOL

CORPORATIONCondensed Consolidated Balance

Sheets(In thousands)

| |

December 31, |

|

December 31, |

|

Change |

| |

2020 |

|

2019 (1) |

|

$ |

|

% |

| |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

34,128 |

|

|

$ |

28,583 |

|

|

$ |

5,545 |

|

|

19 |

% |

|

Receivables, net (2) |

122,252 |

|

|

76,648 |

|

|

45,604 |

|

|

59 |

|

|

Receivables pledged under receivables facility |

166,948 |

|

|

149,891 |

|

|

17,057 |

|

|

11 |

|

|

Product inventories, net (3) |

780,989 |

|

|

702,274 |

|

|

78,715 |

|

|

11 |

|

|

Prepaid expenses and other current assets |

17,610 |

|

|

16,172 |

|

|

1,438 |

|

|

9 |

|

| Total current assets |

1,121,927 |

|

|

973,568 |

|

|

148,359 |

|

|

15 |

|

| |

|

|

|

|

|

|

|

| Property and equipment,

net |

108,241 |

|

|

112,246 |

|

|

(4,005 |

) |

|

(4 |

) |

| Goodwill |

268,167 |

|

|

188,596 |

|

|

79,571 |

|

|

42 |

|

| Other intangible assets,

net |

12,181 |

|

|

11,038 |

|

|

1,143 |

|

|

10 |

|

| Equity interest

investments |

1,292 |

|

|

1,227 |

|

|

65 |

|

|

5 |

|

| Operating lease assets |

205,875 |

|

|

176,689 |

|

|

29,186 |

|

|

17 |

|

| Other assets |

21,987 |

|

|

19,902 |

|

|

2,085 |

|

|

10 |

|

| Total

assets |

$ |

1,739,670 |

|

|

$ |

1,483,266 |

|

|

$ |

256,404 |

|

|

17 |

% |

| |

|

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

266,753 |

|

|

$ |

261,963 |

|

|

$ |

4,790 |

|

|

2 |

% |

|

Accrued expenses and other current liabilities |

143,694 |

|

|

60,813 |

|

|

82,881 |

|

|

136 |

|

|

Short-term borrowings and current portion of long-term debt |

11,869 |

|

|

11,745 |

|

|

124 |

|

|

1 |

|

|

Current operating lease liabilities |

60,933 |

|

|

56,325 |

|

|

4,608 |

|

|

8 |

|

| Total current liabilities |

483,249 |

|

|

390,846 |

|

|

92,403 |

|

|

24 |

|

| |

|

|

|

|

|

|

|

| Deferred income taxes |

27,653 |

|

|

32,598 |

|

|

(4,945 |

) |

|

(15 |

) |

| Long-term debt, net |

404,149 |

|

|

499,662 |

|

|

(95,513 |

) |

|

(19 |

) |

| Other long-term liabilities |

38,261 |

|

|

27,970 |

|

|

10,291 |

|

|

37 |

|

| Non-current operating lease

liabilities |

146,888 |

|

|

122,010 |

|

|

24,878 |

|

|

20 |

|

| Total liabilities |

1,100,200 |

|

|

1,073,086 |

|

|

27,114 |

|

|

3 |

|

| Total stockholders’

equity |

639,470 |

|

|

410,180 |

|

|

229,290 |

|

|

56 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,739,670 |

|

|

$ |

1,483,266 |

|

|

$ |

256,404 |

|

|

17 |

% |

(1) Derived from audited financial

statements.

(2) The allowance for doubtful accounts was

$4.8 million at December 31, 2020 and $5.5 million at

December 31, 2019.

(3) The inventory reserve was $11.4 million at

December 31, 2020 and $9.0 million at December 31,

2019.

POOL

CORPORATIONCondensed Consolidated Statements of

Cash Flows(In thousands)

| |

Year Ended |

|

|

| |

December 31, |

|

|

| |

2020 |

|

2019 (1) |

|

Change |

| Operating

activities |

|

|

|

|

|

|

Net income |

$ |

366,738 |

|

|

$ |

261,575 |

|

|

$ |

105,163 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation |

27,967 |

|

|

27,885 |

|

|

82 |

|

|

Amortization |

1,431 |

|

|

1,389 |

|

|

42 |

|

|

Share-based compensation |

14,516 |

|

|

13,472 |

|

|

1,044 |

|

|

Equity earnings in unconsolidated investments, net |

(295 |

) |

|

(262 |

) |

|

(33 |

) |

|

Net losses on foreign currency transactions |

1,748 |

|

|

1,347 |

|

|

401 |

|

|

Impairment of goodwill and other assets |

6,944 |

|

|

— |

|

|

6,944 |

|

|

Other |

(396 |

) |

|

7,551 |

|

|

(7,947 |

) |

| Changes in operating assets

and liabilities, net of effects of acquisitions: |

|

|

|

|

|

|

Receivables |

(38,688 |

) |

|

(15,691 |

) |

|

(22,997 |

) |

|

Product inventories |

(42,447 |

) |

|

(14,165 |

) |

|

(28,282 |

) |

|

Prepaid expenses and other assets |

(13,744 |

) |

|

(4,218 |

) |

|

(9,526 |

) |

|

Accounts payable |

(9,212 |

) |

|

16,860 |

|

|

(26,072 |

) |

|

Accrued expenses and other current liabilities |

83,019 |

|

|

3,033 |

|

|

79,986 |

|

| Net cash provided by operating

activities |

397,581 |

|

|

298,776 |

|

|

98,805 |

|

| |

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| Acquisition of businesses, net

of cash acquired |

(124,587 |

) |

|

(8,901 |

) |

|

(115,686 |

) |

| Purchase of property and

equipment, net of sale proceeds |

(21,702 |

) |

|

(33,362 |

) |

|

11,660 |

|

| Net cash used in investing

activities |

(146,289 |

) |

|

(42,263 |

) |

|

(104,026 |

) |

| |

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| Proceeds from revolving line

of credit |

1,053,968 |

|

|

1,066,529 |

|

|

(12,561 |

) |

| Payments on revolving line of

credit |

(1,145,616 |

) |

|

(1,415,988 |

) |

|

270,372 |

|

| Proceeds from asset-backed

financing |

326,700 |

|

|

189,000 |

|

|

137,700 |

|

| Payments on asset-backed

financing |

(321,700 |

) |

|

(182,500 |

) |

|

(139,200 |

) |

| Proceeds from term

facility |

— |

|

|

185,000 |

|

|

(185,000 |

) |

| Payments on term facility |

(9,250 |

) |

|

— |

|

|

(9,250 |

) |

| Proceeds from short-term

borrowings and current portion of long-term debt |

13,822 |

|

|

30,863 |

|

|

(17,041 |

) |

| Payments on short-term

borrowings and current portion of long-term debt |

(13,698 |

) |

|

(28,286 |

) |

|

14,588 |

|

| Payments of deferred

acquisition consideration |

(281 |

) |

|

(312 |

) |

|

31 |

|

| Payments of deferred financing

costs |

(12 |

) |

|

(406 |

) |

|

394 |

|

| Proceeds from stock issued

under share-based compensation plans |

19,824 |

|

|

18,574 |

|

|

1,250 |

|

| Payments of cash

dividends |

(91,929 |

) |

|

(83,772 |

) |

|

(8,157 |

) |

| Purchases of treasury

stock |

(76,199 |

) |

|

(23,188 |

) |

|

(53,011 |

) |

| Net cash used in financing

activities |

(244,371 |

) |

|

(244,486 |

) |

|

115 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

(1,376 |

) |

|

198 |

|

|

(1,574 |

) |

| Change in cash and cash

equivalents |

5,545 |

|

|

12,225 |

|

|

(6,680 |

) |

| Cash and cash equivalents at

beginning of period |

28,583 |

|

|

16,358 |

|

|

12,225 |

|

| Cash and cash equivalents at

end of period |

$ |

34,128 |

|

|

$ |

28,583 |

|

|

$ |

5,545 |

|

(1) Derived from audited financial statements.

ADDENDUM

Base Business

The following tables break out our consolidated results into the

base business component and the excluded components (sales centers

excluded from base business):

| (Unaudited) |

Base Business |

|

Excluded |

|

Total |

| (in thousands) |

Three Months Ended |

|

Three Months Ended |

|

Three Months Ended |

| |

December 31, |

|

December 31, |

|

December 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Net sales |

$ |

807,156 |

|

|

$ |

581,817 |

|

|

$ |

32,105 |

|

|

$ |

417 |

|

|

$ |

839,261 |

|

|

$ |

582,234 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

232,247 |

|

|

162,312 |

|

|

6,848 |

|

|

(262 |

) |

|

239,095 |

|

|

162,050 |

|

| Gross margin |

28.8 |

% |

|

27.9 |

% |

|

21.3 |

% |

|

(62.8 |

)% |

|

28.5 |

% |

|

27.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

154,335 |

|

|

136,004 |

|

|

10,409 |

|

|

248 |

|

|

164,744 |

|

|

136,252 |

|

| Expenses as a % of net

sales |

19.1 |

% |

|

23.4 |

% |

|

32.4 |

% |

|

59.5 |

% |

|

19.6 |

% |

|

23.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

77,912 |

|

|

26,308 |

|

|

(3,561 |

) |

|

(510 |

) |

|

74,351 |

|

|

25,798 |

|

| Operating margin |

9.7 |

% |

|

4.5 |

% |

|

(11.1 |

)% |

|

(122.3 |

)% |

|

8.9 |

% |

|

4.4 |

% |

| (Unaudited) |

Base Business |

|

Excluded |

|

Total |

| (in thousands) |

Year Ended |

|

Year Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

|

December 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Net sales |

$ |

3,886,079 |

|

|

$ |

3,183,940 |

|

|

$ |

50,544 |

|

|

$ |

15,577 |

|

|

$ |

3,936,623 |

|

|

$ |

3,199,517 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

1,117,303 |

|

|

922,193 |

|

|

13,599 |

|

|

2,732 |

|

|

1,130,902 |

|

|

924,925 |

|

| Gross margin |

28.8 |

% |

|

29.0 |

% |

|

26.9 |

% |

|

17.5 |

% |

|

28.7 |

% |

|

28.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses (1) |

650,020 |

|

|

579,068 |

|

|

16,855 |

|

|

4,611 |

|

|

666,875 |

|

|

583,679 |

|

| Expenses as a % of net

sales |

16.7 |

% |

|

18.2 |

% |

|

33.3 |

% |

|

29.6 |

% |

|

16.9 |

% |

|

18.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss)

(1) |

467,283 |

|

|

343,125 |

|

|

(3,256 |

) |

|

(1,879 |

) |

|

464,027 |

|

|

341,246 |

|

| Operating margin |

12.0 |

% |

|

10.8 |

% |

|

(6.4 |

)% |

|

(12.1 |

)% |

|

11.8 |

% |

|

10.7 |

% |

(1) Base business and

total include $6.9 million of impairment from goodwill and other

assets.

We have excluded the results of the following

acquisitions from base business for the periods identified:

|

Acquired |

|

AcquisitionDate |

|

NetSales Centers

Acquired |

|

PeriodsExcluded |

|

TWC Distributors, Inc. (1) |

|

December 2020 |

|

10 |

|

December 2020 |

| Jet Line Products, Inc. |

|

October 2020 |

|

9 |

|

October - December 2020 |

| Northeastern Swimming Pool

Distributors, Inc. (1) |

|

September 2020 |

|

2 |

|

September - December 2020 |

| Master Tile Network LLC

(1) |

|

February 2020 |

|

4 |

|

February - December 2020 |

| W.W. Adcock, Inc. (1) |

|

January 2019 |

|

4 |

|

January - March 2020 and

January - March 2019 |

| Turf & Garden, Inc.

(1) |

|

November 2018 |

|

4 |

|

January 2020 and January

2019 |

(1) We acquired certain distribution assets of

each of these companies.

When calculating our base business results, we

exclude sales centers that are acquired, closed or opened in new

markets for a period of 15 months. We also exclude consolidated

sales centers when we do not expect to maintain the majority of the

existing business and existing sales centers that are consolidated

with acquired sales centers.

We generally allocate corporate overhead

expenses to excluded sales centers on the basis of their net sales

as a percentage of total net sales. After 15 months of operations,

we include acquired, consolidated and new market sales centers in

the base business calculation including the comparative prior year

period.

The table below summarizes the changes in our sales centers

during 2020.

|

December 31, 2019 |

373 |

|

|

Acquired locations |

25 |

|

|

New locations |

3 |

|

|

Closed/consolidated locations |

(3 |

) |

| December 31, 2020 |

398 |

|

Adjusted EBITDA

We define Adjusted EBITDA as net income or net

loss plus interest and other non-operating expense, income taxes,

depreciation, amortization, share-based compensation, goodwill and

other non-cash impairments and equity earnings or losses in

unconsolidated investments. Adjusted EBITDA is not a

measure of cash flow or liquidity as determined by generally

accepted accounting principles (GAAP). We have included Adjusted

EBITDA as a supplemental disclosure, because we believe that it is

widely used by our investors, industry analysts and others as a

useful supplemental liquidity measure in conjunction with cash

flows provided by or used in operating activities to help

investors understand our ability to provide cash flows to fund

growth, service debt, repurchase shares and pay dividends as well

as compare our cash flow generating capacity from year to year.

We believe Adjusted EBITDA should be considered

in addition to, not as a substitute for, operating income or loss,

net income or loss, cash flows provided by or used in operating,

investing and financing activities or other income statement or

cash flow statement line items reported in accordance with GAAP.

Other companies may calculate Adjusted EBITDA differently than we

do, which may limit its usefulness as a comparative measure.

The table below presents a reconciliation of

Adjusted EBITDA to net cash provided by operating activities.

Please see page 6 for our Condensed Consolidated Statements of

Cash Flows.

| (Unaudited) |

Year Ended December 31, |

| (in thousands) |

2020 |

|

2019 |

| |

|

|

|

|

Adjusted EBITDA |

$ |

512,738 |

|

|

$ |

382,212 |

|

|

Add: |

|

|

|

|

Interest and other non-operating expenses, net of interest income

(1) |

(10,206 |

) |

|

(21,992 |

) |

|

Provision for income taxes |

(85,231 |

) |

|

(56,161 |

) |

|

Net losses on foreign currency transactions |

1,748 |

|

|

1,347 |

|

|

Other |

(396 |

) |

|

7,551 |

|

|

Change in operating assets and liabilities |

(21,072 |

) |

|

(14,181 |

) |

| Net cash provided by operating

activities |

$ |

397,581 |

|

|

$ |

298,776 |

|

(1) Shown net of net losses on

foreign currency transactions and excludes amortization of deferred

financing costs as discussed below.

The table below presents a reconciliation of net

income to Adjusted EBITDA.

| (Unaudited) |

Year Ended December 31, |

| (in thousands) |

2020 |

|

2019 |

| |

|

|

|

|

Net income |

$ |

366,738 |

|

|

$ |

261,575 |

|

|

Add: |

|

|

|

|

Interest and other non-operating expenses (1) |

10,605 |

|

|

22,425 |

|

|

Provision for income taxes |

85,231 |

|

|

56,161 |

|

|

Share-based compensation |

14,516 |

|

|

13,472 |

|

|

Equity earnings in unconsolidated investments, net |

(295 |

) |

|

(262 |

) |

|

Impairment of goodwill and other assets |

6,944 |

|

|

— |

|

|

Depreciation |

27,967 |

|

|

27,885 |

|

|

Amortization (2) |

1,032 |

|

|

956 |

|

| Adjusted EBITDA |

$ |

512,738 |

|

|

$ |

382,212 |

|

(1) Shown net of interest income and net losses

on foreign currency transactions and includes amortization of

deferred financing costs as discussed below.

(2) Excludes amortization of deferred financing

costs of $399 for 2020 and $433 for 2019. This non-cash expense is

included in Interest and other non-operating expenses, net on the

Consolidated Statements of Income.

Return on Invested Capital

We calculate Return on Invested Capital (ROIC)

using trailing four quarter results. We define ROIC as Net income

adjusted for Interest and other non-operating expenses, net (net of

taxes at the effective tax rate), divided by the sum of average

Long-term debt, net, average Short-term borrowings and the current

portion of long-term debt and average Total stockholders’ equity

from our financial statements. We have included ROIC as

a supplemental disclosure, because we believe that it may be used

by our investors, industry analysts and others as a measure of the

efficiency and effectiveness of our use of capital.

ROIC is not a measure of financial performance

under GAAP. We believe ROIC should be considered in addition to,

not as a substitute for, operating income or loss, net income or

loss, cash flows provided by or used in operating, investing and

financing activities or other income statement, balance sheet or

cash flow statement line items reported in accordance with GAAP.

Other companies may calculate ROIC differently than we do, which

may limit its usefulness as a comparative measure.

The table below presents our calculation of ROIC

at December 31, 2020 and 2019.

| (Unaudited) |

Year Ended December 31, |

| (in thousands) |

2020 |

|

2019 |

| Numerator (trailing

four quarters total): |

|

|

|

|

Net income |

$ |

366,738 |

|

|

$ |

261,575 |

|

| Interest and other

non-operating expenses, net |

12,353 |

|

|

23,772 |

|

| Less: taxes on Interest and

other non-operating expenses, net at 18.9% and 17.7%,

respectively |

(2,335 |

) |

|

(4,208 |

) |

| |

$ |

376,756 |

|

|

$ |

281,139 |

|

| Denominator (average

of trailing four quarters): |

|

|

|

| Long-term debt, net |

$ |

432,829 |

|

|

$ |

595,247 |

|

| Short-term borrowings and

current portion of long-term debt |

12,373 |

|

|

17,323 |

|

| Total stockholders’

equity |

516,040 |

|

|

346,049 |

|

| |

$ |

961,242 |

|

|

$ |

958,619 |

|

| |

|

|

|

| Return on invested

capital |

39.2 |

% |

|

29.3 |

% |

Adjusted Diluted EPS and Adjusted 2021 Diluted EPS

Guidance

We have included adjusted diluted EPS, which is

a non-GAAP financial measure, in this press release as a

supplemental disclosure to demonstrate the impact of our non-cash

impairment charge recorded in the first quarter of 2020 and tax

benefits from ASU 2016-09 on our 2020 and 2019 diluted EPS and to

provide investors and others with additional information about our

potential future operating performance. We believe

adjusted diluted EPS should be considered in addition to, not as a

substitute for, diluted EPS presented in accordance with GAAP and

in the context of our other forward-looking and cautionary

statements in this press release.

The table below presents a reconciliation of diluted EPS to

adjusted diluted EPS.

| (Unaudited) |

Year Ended December 31, |

| |

2020 |

|

2019 |

|

Diluted EPS |

$ |

8.97 |

|

|

$ |

6.40 |

|

|

After-tax non-cash impairment charges |

0.15 |

|

|

— |

|

|

ASU 2016-09 tax benefit |

(0.70 |

) |

|

(0.57 |

) |

| Adjusted Diluted EPS |

$ |

8.42 |

|

|

$ |

5.83 |

|

Please see page 3 for a reconciliation of

projected 2021 diluted EPS to adjusted projected 2021 diluted EPS.

We have included adjusted projected 2021 diluted EPS, which is a

non-GAAP financial measure, in this press release as a supplemental

disclosure to demonstrate the impact of projected tax benefits from

ASU 2016-09 on our projected 2021 diluted EPS and to provide

investors and others with additional information about our

potential future operating performance. We believe

adjusted projected 2021 diluted EPS should be considered in

addition to, not as a substitute for, projected 2021 diluted EPS

presented in accordance with GAAP and in the context of our other

forward-looking and cautionary statements in this press

release.

Adjusted Income Statement

Information

We have included adjusted operating income and

adjusted net income, which are non-GAAP financial measures, in this

press release as supplemental disclosures, because we believe these

measures are useful to investors and others in assessing our

year-over-year operating performance. We believe these measures

should be considered in addition to, not as a substitute for,

operating income and net income presented in accordance with GAAP,

respectively, and in the context of our other disclosures in this

press release. Other companies may calculate these non-GAAP

financial measures differently than we do, which may limit their

usefulness as comparative measures.

The table below presents a reconciliation of

operating income to adjusted operating income.

| |

|

| (Unaudited) |

Year Ended December 31, |

| (in thousands) |

2020 |

|

Operating income |

$ |

464,027 |

|

|

Impairment of goodwill and other assets |

6,944 |

|

| Adjusted operating income |

$ |

470,971 |

|

The table below presents a reconciliation of net income to

adjusted net income.

| |

|

| (Unaudited) |

Year Ended December 31, |

| (in thousands) |

2020 |

|

Net income |

$ |

366,738 |

|

|

Impairment of goodwill and other assets |

6,944 |

|

|

Tax impact on impairment of long-term note (1) |

(654 |

) |

| Adjusted net income |

$ |

373,028 |

|

(1) As described in our April 23,

2020 earnings release, our effective tax rate at March 31, 2020 was

a 0.1% benefit. Excluding impairment from goodwill and intangibles

and tax benefits from ASU 2016-09 recorded in the first quarter of

2020, our effective tax rate for the first quarter of 2020 was

25.4%, which we used to calculate the tax impact related to the

$2.5 million long-term note impairment.

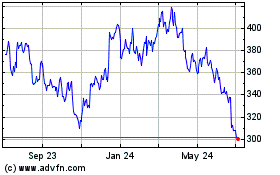

Pool (NASDAQ:POOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pool (NASDAQ:POOL)

Historical Stock Chart

From Apr 2023 to Apr 2024