POLARITYTE,

INC.

2017

ANNUAL REPORT

TABLE

OF CONTENTS

LETTER

TO STOCKHOLDERS

Dear

Fellow PolarityTE Stockholders,

The

last 18 months has been a very productive time for PolarityTE: we completed our merger to become a publicly-traded regenerative

biomaterials company, established our new headquarters and manufacturing facility, registered and successfully launched our first

commercial product, SkinTE, achieved multiple pipeline milestones, and continued to build our experienced and passionate team.

Highlights from this pivotal year include:

The

PolarityTE Priority—Patients:

Over the last 18 months, PolarityTE has truly transformed! With over 100 employees (50%

with graduate degrees), the Company has built a fierce team with tremendous focus on our primary cause—the development of

tangible and pragmatic technologies that aim to improve and transform patients’ lives. To achieve this goal, we want our

technologies to do more than work in a laboratory dish—we strive to develop solutions that can withstand and overcome the

challenges faced in the trenches of medicine.

The

PolarityTEAM—Corporate Growth:

Recognizing the incredible value in human capital, PolarityTE has built a management

team and Board of Directors which allow the Company to grow, develop and execute both effectively and efficiently. These include

industry veterans from the likes of Medtronic, Smith & Nephew, and McKesson, and seasoned financial markets experts from premier

investment funds and investment banks, including Highbridge Capital Management and Cowen.

An

Effective Translation SkinTE from Bench to Bedside:

In 2H 2017 we commercialized our first product, SkinTE, beginning with

a limited market release. To progress from the bench to animal models to commercial production in just 18 months provides a great

testimony to the abilities of our amazing team of scientists and clinicians that have joined our company.

Design,

Development and Scalable Buildout of PolarityTE’s New Biomedical Manufacturing Facility:

In 1H 2018 we moved our headquarters

to a new 200,000 sq. ft facility in Salt Lake City and completed the construction and validation of our first manufacturing suite.

In anticipation of strong demand for our products, we are now constructing and validating a second and third manufacturing suite.

A

Strategic and Staged Commercial Launch Process for SkinTE:

During our limited market release of SkinTE we targeted treatment

of up to fifty patients in the United States. This involved providers using SkinTE to treat patients suffering from numerous complex

wounds including large burn patients, acute trauma, chronic wounds, diabetic foot ulcers and even an epidermolysis bullosa patient.

Feedback from patients and providers has been encouraging and suggests that SkinTE will play a major role in the treatment of

these types of wounds in the future. We also hosted a KOL (Key Opinion Leader) Summit in NYC on June 25, 2018 for investors, where

providers presented clinical outcomes from various cases. The webcast of this event can be found on our website.

PolarityTE’s

Pipeline, Platform Propagation, and Technology Evolution:

We continue to develop our Core “TE” pipeline and we

have now completed preclinical validation studies for OsteoTE, which we hope to commercialize by the end of 2018, with a limited

market release commencing in early 2019. In addition, our R&D team has continued to advance related technology derivatives

from our core technology, with potential applications across a variety of tissue types.

Returns

Follow Reality:

Since the announcement of our definitive merger agreement on December 8, 2016, we have delivered a total shareholder

return of over 570%. This compares to the 29% return delivered by the Nasdaq Biotechnology Index over the same period.

SkinTE

Head to Head Clinical Trials and Upcoming Clinical Studies:

Clinical trials at multiple centers were initiated in 2018 comparing

the SkinTE tissue product to the current clinical standard of care, split-thickness skin grafts (STSG). We have continued to observe

successful interim results which remain consistent with what the company has seen in both preclinical studies and early data from

SkinTE clinical use. PolarityTE will continue to develop additional clinical studies and trials for SkinTE as well as upcoming

core TE technologies and related technology derivatives.

SkinTE

HCPCS:

In 2018, PolarityTE applied for HCPCS code for the SkinTE tissue product and received a recommendation from CMS for

a SkinTE-specific product code to be initiated in January 2019.

Strategic

Acquisition of Contract Research Organization:

In 2018, PolarityTE performed a strategic growth acquisition of the region’s

only Pre-Clinical GLP Contract Research Organization (CRO), which was an important step for the development of our strategic initiative,

PolarityRD. The fully-operational and profitable CRO business, facility, and team is expected to continue to deliver high-quality

work to outside parties, while the advanced PolarityTE pre-clinical product prototypes and technologies will be separately monitored

and developed by Johns Hopkins recruit and Chief Veterinary Officer, Caroline Garrett DVM.

Creation

of the PolarityTE ARC:

In 2018, subsequent to significant developments and advancements in the Company’s technology

and understanding of related technology derivatives (RTDs), PolarityTE sought to further expand beyond the company’s core

“TE” research and development efforts into a highly advanced and innovative research group which focuses on new composite

technologies, gene transfer, small molecule discovery and synthesis, devices and advanced biologics. This research will be conducted

at the PolarityTE Advanced Research Center (ARC).

Development

of PolarityRD and PolarityIS:

In 2018, the parent PolarityTE announced the strategic formation of two significant initial

corporate arms PolarityRD and PolarityIS, which have begun operation. PolarityRD, a service-based research and development arm

seeks to improve, enhance, support, and drive forward promising research with customers, industry partners and academic institutions

by leveraging the extraordinary human capital and equipment that PolarityTE has acquired since its inception. PolarityIS, a corporate

development arm, aims to seek out new and novel growth strategies involving M&A, licensure and partnerships related to PolarityTE

technologies, products and services.

PolarityTE’s

Digital Face—Development and Deployment of the PolarityTE RTA:

In 2018, in an effort to improve quality and direct communication

with medical providers, PolarityTE initiated the release of the PolarityTE Real-Time Assistant (RTA), our real-time digital product

support system which puts providers in touch with the provider-led PolarityTE Clinical Operations team 24 hours a day.

Continued

Development of Intellectual Property:

Twelve of the Company’s U.S. trademark applications have been allowed and the

Company is now in the active prosecution phase with all three of its U.S. non-provisional patent applications: U.S. Application

No. 14/954,335 published as US 2016/0151540; U.S. Application No. 15/650,656 published as US 2018/0154043; and U.S. Application

No. 15/650,659 published as US 2018/0154044. The Company continues to actively file patent and trademark applications to protect

its intellectual property and build out its patent portfolio as it relates to core cell-tissue biotechnologies and advanced related

technology derivates (RTDs).

The

PolarityTE Vision and Pragmatic Translation of Technology Going Forward:

Over the next year, we look forward to the continued

execution of our business plan. We expect additional SkinTE clinical data to become available, we plan for the evidence of our

products’ clinical utility to be presented at conferences and in journals, and finally we expect to grow the organization

globally. We aim to grow revenues and build a company that will be capable of becoming a profitable enterprise which we hope will

continue to deliver strong returns for our stockholders.

We

are proud of the corporate and clinical advances made this year, and we remain relentlessly focused on bringing our Core “TE”

platform out of the lab and into the clinic. On behalf of my colleagues, I want to extend my gratitude for your support of PolarityTE

and our mission. Welcome to the Shift!

Sincerely,

Denver

M. Lough

Chairman

and Chief Executive Officer

PolarityTE,

Inc.

OUR

COMPANY

We

are a commercial-stage biotechnology and regenerative biomaterials company focused on transforming the lives of patients by discovering,

designing and developing a range of regenerative tissue products and biomaterials for the fields of medicine, biomedical engineering

and material sciences. We believe that our PolarityTE platform technology is a new approach to pragmatic and functional tissue

regeneration that has the potential to address many of the challenges currently facing the regenerative medicine and cell therapy

markets to date. Recognizing the natural complexity of human tissue, our core “TE” platform begins with a small piece

of the patient’s own, or autologous, healthy tissue, rather than artificially manipulated individual cells. From this small

piece of healthy autologous tissue, we create an easily deployable, dynamic and self-propagating product, which is designed to

enhance and stimulate the patient’s own cells to regenerate the target tissues. Rather than manufacturing with synthetic

and foreign materials within artificially engineered environments, we believe our proprietary method promotes and accelerates

the patient’s tissues to undergo a form of effective regenerative healing, and uses the patient’s own body to support

the regenerative process to create the same tissue from which they were derived.

We

believe our core “TE” platform has applications across many different indications, including, but not limited to,

the regrowth of skin, bone, cartilage, fat, muscle, blood vessels and neural elements as well as solid and hollow organ composite

tissue systems. Our first product, SkinTE™, is registered with the United States Food and Drug Administration (“FDA”)

pursuant to the regulatory pathway for human cells, tissues, and cellular and tissue-based products (“HCT/Ps”) regulated

solely under Section 361 of the Public Health Service Act (“361 HCT/Ps”), which permits qualifying products to be

marketed without first obtaining FDA marketing authorization or approval, and is commercially available for the repair, reconstruction,

replacement and regeneration of skin (i.e., homologous uses) for patients who have suffered from wounds, burns or injuries that

require skin coverage over both small and large areas of their body.

To

date, SkinTE has been used in a limited number of patients suffering from replacement of prior skin grafts, acute surgical reconstruction,

acute wound treatment, chronic wound treatment, acute burn treatment, post-burn reconstruction, scar and contracture revision,

keloid and hypertrophic scar revision, subacute burn and wound reconstruction, coverage and/or replacement of skin substitutes,

failed skin graft replacement, failed flaps coverage and soft tissue coverage in previously infected defects. The results we have

observed from the ongoing early stages of the human clinical application of SkinTE continue to be correlative with our preclinical

observations.

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

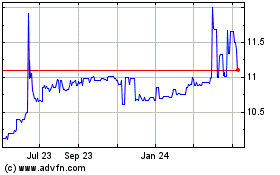

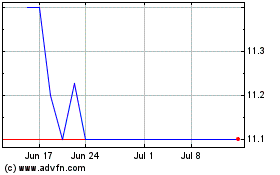

Our

common stock is listed for trading on the Nasdaq Capital Market under the symbol “COOL.” The market for our common

stock has often been sporadic, volatile and limited.

The

following table shows the high and low quotations for our common stock as reported by Nasdaq from November 1, 2015 through October

31, 2017. The prices reflect inter-dealer quotations, without retail markup, markdown or commissions, and may not represent actual

transactions.

|

|

|

High

|

|

|

Low

|

|

|

Fiscal Year 2016

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

13.68

|

|

|

$

|

3.66

|

|

|

Second Quarter

|

|

$

|

5.94

|

|

|

$

|

4.20

|

|

|

Third Quarter

|

|

$

|

6.30

|

|

|

$

|

3.66

|

|

|

Fourth Quarter

|

|

$

|

4.50

|

|

|

$

|

3.03

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year 2017

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

6.22

|

|

|

$

|

2.61

|

|

|

Second Quarter

|

|

$

|

18.90

|

|

|

$

|

3.80

|

|

|

Third Quarter

|

|

$

|

30.09

|

|

|

$

|

10.33

|

|

|

Fourth Quarter

|

|

$

|

32.63

|

|

|

$

|

17.61

|

|

Holders

of Common Stock.

On January 26, 2018, we had 120 registered holders of record of our common stock.

Dividends

and dividend policy.

Prior to October 31, 2015, we had never declared or paid any dividends on our common stock. On January

4, 2016, we declared a special cash dividend of an aggregate of $10.0 million to be paid to holders of record on January 14, 2016

of our outstanding shares of: (i) common stock (ii) Series A Convertible Preferred Stock; (iii) Series B Convertible Preferred

Stock; (iv) Series C Convertible Preferred Stock and (v) Series D Convertible Preferred Stock. The holders of record of our outstanding

preferred stock participated in receiving their pro rata portion of the dividend on an “as converted” basis. The dividend

was paid January 15, 2016. We do not anticipate paying future dividends at the present time. We currently intend to retain earnings,

if any, for use in our business.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS

OF OPERATIONS

You

should read the following discussion and analysis of our financial condition and results of operations together with our consolidated

financial statements and related notes appearing elsewhere in this Annual Report. This discussion and analysis contains forward-looking

statements that involve risks, uncertainties and assumptions. The actual results may differ materially from those anticipated

in these forward-looking statements.

Overview

On

December 1, 2016

,

Majesco Entertainment Company (

n/k/a

PolarityTE, Inc.), a Delaware corporation (the “Company”)

entered into an agreement to acquire the assets of Polarity NV (as defined below), a regenerative medicine company. The asset

acquisition was subject to shareholder approval, which was received on March 10, 2017 and the transaction closed on April 7, 2017,

as more fully described below. In January 2017, the Company changed its name to “PolarityTE, Inc.” (“Polarity”).

On

December 1, 2016, the Company appointed Dr. Denver Lough as Chief Executive Officer, Chief Scientific Officer and Chairman of

our Board of Directors and Dr. Ned Swanson as Chief Operating Officer of the Company. Until their respective appointments, both

doctors were associated with Johns Hopkins University, Baltimore, Maryland, as full-time residents. On December 1, 2016, Dr. Lough

assigned the patent application as well as all related intellectual property to a newly-formed Nevada corporation, Polarityte,

Inc. (“Polarity NV”), and the Company entered into an Agreement and Plan of Reorganization (the “Agreement”)

with Polarity NV and Dr. Lough. As a result, at closing, the patent application would be owned by the Company without the need

for further assignments or recordation with the Patent Trademark Office.

On

April 7, 2017, the Company issued 7,050 shares of its newly authorized Series E Preferred Stock (the “Series E Preferred

Shares”) convertible into an aggregate of 7,050,000 shares of the Company’s common stock with a fair value of approximately

$104.7 million which is equal to 7,050,000 common shares times $14.85 (the closing price of the Company’s common stock as

of April 7, 2017) to Dr. Lough for the purchase of Polarity NV’s assets. Since the assets purchased were in-process research

and development assets, the total purchase price was immediately expensed as research and development - intellectual property

acquired since they have no alternative future use.

PolarityTE,

Inc. is aiming to be the first company to deliver regenerative medicine into clinical practice through tissue engineering. Subsequent

to the acquisition, the Company’s platform technology will allow it to regenerate a patient’s tissues using their

own cells.

Research

and Development Expenses.

Research and development expenses primarily represent employee related costs, including stock compensation,

for research and development executives and staff, lab and office expenses and other overhead charges.

Research

and Development - Intellectual Property Acquired.

On April 7, 2017, as payment for the Polarity NV asset acquisition, the

Company issued 7,050 shares of Series E Preferred Stock convertible into an aggregate of 7,050,000 shares of the Company’s

common stock and with a fair value of approximately $104.7 million which is equal to 7,050,000 common shares times $14.85 (the

closing price of the Company’s common stock as of April 7, 2017). Since the assets purchased were in-process research and

development assets, the total purchase price was immediately expensed as research and development - intellectual property acquired

since they have no alternative future use.

General

and Administrative Expenses.

General and administrative expenses primarily represent employee related costs, including stock

compensation, for corporate executive and support staff, general office expenses, professional fees and various other overhead

charges. Professional fees, including legal and accounting expenses, typically represent one of the largest components of our

general and administrative expenses. These fees are partially attributable to our required activities as a publicly traded company,

such as SEC filings, and corporate- and business-development initiatives.

Discontinued

Operations.

On June 23, 2017, the Company sold Majesco Entertainment Company, a Nevada corporation and wholly-owned subsidiary

of the Company (“Majesco”) to Zift Interactive LLC, a Nevada limited liability company (the “Purchaser”)

pursuant to a purchase agreement (the “Agreement”). Pursuant to the terms of the Agreement, the Company sold to the

Purchaser 100% of the issued and outstanding shares of common stock of Majesco, including all of the right, title and interest

in and to Majesco’s business of developing, publishing and distributing video game products through both retail distribution

and mobile and online digital downloading. Pursuant to the terms of the Agreement, the Company will receive total cash consideration

of approximately $100,000 ($5,000 upon signing the Agreement and 19 additional monthly payments of $5,000) plus contingent consideration

based on net revenues.

Income

Taxes.

Income taxes consist of our provisions for income taxes, as affected by our net operating loss carryforwards. Future

utilization of our net operating loss, or NOL, carryforwards may be subject to a substantial annual limitation due to the “change

in ownership” provisions of the Internal Revenue Code. The annual limitation may result in the expiration of NOL carryforwards

before utilization. Due to our history of losses, a valuation allowance sufficient to fully offset our NOL and other deferred

tax assets has been established under current accounting pronouncements, and this valuation allowance will be maintained unless

sufficient positive evidence develops to support its reversal.

In

December 2017, the federal government enacted numerous amendments to the Internal Revenue Code of 1986 pursuant to an act known

by the Tax Cuts and Jobs Act (the “TCJA”). The TCJA may impact the Company’s income tax expense (benefit) from

continuing operations in future periods. The Company has recorded a full valuation allowance on its net deferred tax assets and

therefore any impact on the value of the company’s deferred tax assets will be offset by a change in the valuation allowance.

Critical

Accounting Estimates

Our

discussion and analysis of the financial condition and results of operations is based upon our consolidated financial statements,

which have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP.

The

preparation of these consolidated financial statements requires us to make estimates and judgments that affect the reported amounts

of assets, liabilities, revenues, and expenses, and related disclosure of contingent assets and liabilities. We base our estimates

on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results

of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results could differ materially from these estimates under different assumptions or conditions.

We

have identified the policies below as critical to our business operations and to the understanding of our financial results. The

impact and any associated risks related to these policies on our business operations is discussed throughout management’s

discussion and analysis of financial condition and results of operations when such policies affect our reported and expected financial

results.

Accounting

for Stock-Based Compensation

. Stock-based compensation expense is measured at the grant date based on the fair value of the

award and is recognized as expense over the vesting period. Determining the fair value of stock-based awards at the grant date

requires judgment, including, in the case of stock option awards, estimating expected stock volatility. In addition, judgment

is also required in estimating the amount of stock-based awards that are expected to be forfeited. If actual results differ significantly

from these estimates, stock-based compensation expense and our results of operations could be materially impacted.

Accounting

for Common and Preferred Stock and Warrant transactions.

We issued units consisting of preferred shares and warrants and common

stock and warrants and subsequently remeasured certain of those warrants. Determining the fair value of the securities in these

transactions requires significant judgment, including adjustments to quoted share prices and expected stock volatility. Such estimates

may significantly impact our results of operations and losses applicable to common stockholders.

Commitments

and Contingencies.

We record a liability for contingencies when the amount is both probable and reasonably estimable. We record

associated legal fees as incurred.

Results

of Operations

Year

ended October 31, 2017 versus the year ended October 31, 2016

Research

and Development Expenses.

For the year ended October 31, 2017, research and development expenses were approximately $7.1 million.

Research and development costs consist of salaries of approximately $2.4 million, stock-based compensation of approximately of

$1.8 million, travel related expenses of approximately $664,000, trade show related expenses of $530,000, medical equipment depreciation

of approximately $431,000, consulting expense of $240,000, rent expense of $206,000, samples expense of $179,000, medical study

expense of $174,000, health insurance of $166,000 and various other expenses totaling approximately $393,000. There was no research

and development activity in the comparative 2016 period.

Research

and Development - Intellectual Property Acquired.

For the year ended October 31, 2017, research and development - intellectual

property acquired relates to the Polarity NV asset acquisition and the issuance of 7,050 shares of Series E Preferred Stock convertible

into an aggregate of 7,050,000 shares of the Company’s common stock with a fair value of approximately $104.7 million which

is equal to 7,050,000 common shares times $14.85 (the closing price of the Company’s common stock as of April 7, 2017).

Since the assets purchased were in-process research and development assets, the total purchase price was immediately expensed

as research and development - intellectual property acquired since there is no alternative future use. There was no research and

development – intellectual property acquired activity in the comparative 2016 period.

General

and Administrative Expenses.

For the year ended October 31, 2017, general and administrative expenses increased $14.7 million

to approximately $18.8 million compared to $4.1 million for the year ended October 31, 2016. The increase is primarily due to

increased stock-based compensation of approximately $12.8 million and increased headcount and salaries related to the Company’s

new medical activities.

Loss

from continuing operations.

Loss from continuing operations for the year ended October 31, 2017 was approximately $130.5 million,

compared to a loss of approximately $3.8 million in the comparable period in 2016, primarily reflecting higher research and development

- intellectual property acquired expenses and stock-based compensation expenses.

Liquidity

and Capital Resources

As

of October 31, 2017, our cash and cash equivalents balance was $17.7 million and our working capital was approximately $2.5 million,

compared to cash and equivalents of $6.5 million and working capital of $5.4 million at October 31, 2016.

As

reflected in the consolidated financial statements, we had an accumulated deficit of approximately $259.0 million at October 31,

2017, a loss of approximately $130.5 million from continuing operations and approximately $7.6 million net cash used in continuing

operating activities for the year ended October 31, 2017. These factors raise substantial doubt about the Company’s ability

to continue as a going concern.

We

will continue to pursue fundraising opportunities that meet our long-term objectives, however, our cash position is not sufficient

to support our operations through December 2018. The consolidated financial statements do not include any adjustments related

to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might

be necessary should the Company be unable to continue as a going concern.

Series

E Preferred Shares

On

April 7, 2017, the Company issued 7,050 shares of its newly authorized Series E Preferred Stock (the “Series E Preferred

Shares”) convertible into an aggregate of 7,050,000 shares of the Company’s common stock with a fair value of approximately

$104.7 million which is equal to 7,050,000 common shares times $14.85 (the closing price of the Company’s common stock as

of April 7, 2017) to Dr. Lough for the purchase of the Polarity NV’s assets.

The

Preferred E Shares are convertible into shares of common stock based on a conversion calculation equal to the stated value of

such Preferred E Shares, plus all accrued and unpaid dividends, if any as of such date of determination, divided by the conversion

price. The stated value of each Preferred E Share is $1,000 and the initial conversion price is $1.00 per share, each subject

to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events. The Preferred

E Shares, with respect to dividend rights and rights on liquidation, winding-up and dissolution, in each case will rank senior

to the Company’s common stock and all other securities of the Company that do not expressly provide that such securities

rank on parity with or senior to the Preferred E Shares. Until converted, each Preferred E Share is entitled to two votes for

every share of common stock into which it is convertible on any matter submitted for a vote of stockholders. The Preferred E Shares

participate on an “as converted” basis with all dividends declared on the Company’s common stock.

Redeemable

Series F Preferred Shares

On

September 20, 2017, the Company sold an aggregate of $17,750,000 worth of units (the “Units”) of the Company’s

securities to accredited investors at a purchase price of $2,750 per Unit with each Unit consisting of (i) one share of the Company’s

newly authorized 6% Series F Convertible Preferred Stock, par value $0.001 per share (the “Series F Preferred Stock”),

which are convertible into one hundred (100) shares of the Company’s common stock, and (ii) a two-year warrant to purchase

322,727 shares of the Company’s common stock, at an exercise price of $30.00 per share. The Company incurred issuance costs

of approximately $356,000 associated with the Unit offering.

The

Company entered into separate registration rights agreements, and subsequently amended such agreements, with each of the investors,

pursuant to which the Company agreed to undertake to file a registration statement to register the resale of the conversion shares

and warrant shares within 150 days of the closing of the transaction, to cause such registration statement to be declared effective

by the Securities and Exchange Commission within ninety days following its filing and to maintain the effectiveness of the registration

statement until all of such conversion shares and warrant shares have been sold or are otherwise able to be sold pursuant to Rule

144 under the Securities Act, without any restrictions. In the event the Company fails to file, or obtain effectiveness of, such

registration statement with the specified period of time, the Company will be obligated to pay liquidated damages equal to the

product of one 1% percent multiplied by the aggregate subscription amount paid by such investor for every thirty (30) days during

which such filing is not made and/or effectiveness obtained, such fee being subject to certain exceptions, up to a maximum of

twelve 12% percent.

Pursuant

to the subscription agreements, for as long as the lead investor holds securities, except with certain issuances, the Company

shall not incur any senior debt or issue any preferred stock with liquidation rights senior to the securities sold thereunder.

During this period, the Company will not, without the consent of the investors holding a majority of the then issued and outstanding

shares on the date of such consent (including the lead investor), enter into any equity line of credit or similar agreement, nor

issue nor agree to issue any common stock, common stock equivalents, floating or variable priced equity linked instruments nor

any of the foregoing or equity with price reset rights (subject to adjustment for stock splits, distributions, dividends, recapitalizations

and the like).

The

shares of Series F Preferred Stock are convertible into shares of the Company’s common stock based on a conversion calculation

equal to the stated value of the Series F Preferred Stock, plus all accrued and unpaid dividends, if any, on such Series F Preferred

Stock, as of such date of determination, divided by the conversion price. The stated value of each share of Series F Preferred

Stock is $2,750 and the initial conversion price is $27.50 per share, each subject to adjustment for stock splits, stock dividends,

recapitalizations, combinations, subdivisions or other similar events.

Each

holder of a Series F Preferred Share is entitled to receive dividends, in cash or in shares of the Company’s common stock

on the stated value of each share at the dividend rate, which shall be cumulative and shall continue to accrue and compound quarterly

whether or not declared and whether or not in any fiscal year there shall be net profits or surplus available for the payment

of dividends in such fiscal year. Dividends are payable quarterly in arrears on the fifteenth (15th) day of the next applicable

quarter, to the record holders of the Series F Preferred Stock on the last day of the fiscal quarter immediately preceding the

dividend payment date in shares of common stock, calculated using the VWAP of the common stock on the ninety (90) days immediately

preceding the dividend record date; provided, however, that the Company may, at its option, pay dividends in cash or in a combination

of common shares and cash.

Upon

the liquidation, dissolution or winding up of the business of the Company, whether voluntary or involuntary, each holder of preferred

shares shall be entitled to receive, for each share thereof, out of assets of the Company legally available therefor, a preferential

amount in cash equal to (and not more than) $2,750.

On

the two (2) year anniversary of the initial issuance date, any share of Series F Preferred Stock outstanding and not otherwise

already converted, shall, at the option of the holder, either (i) automatically convert into common stock of the Company at the

conversion price then in effect or (ii) be repaid by the Company based on the stated value of such outstanding shares of Series

F Preferred Stock. In addition, in the event that the Company’s common stock attains a consolidated bid price of $45 or

greater for any four (4) trading days during any eight (8) trading day period, the Series F Preferred Stock shall be automatically

converted to common stock, without any further action by the holder (subject to the conversion limitation in the event that such

conversion would result in such holder holding in excess of four and ninety-nine one-hundredths (4.99%) percent of the common

stock of the Company).

The

warrants issued in connection with the Series F Preferred Stock are liabilities pursuant to ASC 815. The warrant agreement provides

for an adjustment to the number of common shares issuable under the warrant and/or adjustment to the exercise price, including

but not limited to, if: (a) the Company issues shares of common stock as a dividend or distribution to holders of its common stock;

(b) the Company subdivides or combines its common stock (i.e., stock split); (c) adjustment of exercise price upon issuance of

new securities at less than the exercise price. Under ASC 815, warrants that provide for down-round exercise price protection

are recognized as derivative liabilities.

The

conversion feature within the Series F Preferred Stock is not clearly and closely related to the identified host instrument and,

as such, is recognized as a derivative liability measured at fair value pursuant to ASC 815.

The

initial fair value of the warrants and bifurcated embedded conversion feature, estimated to be approximately $4.3 million and

$9.3 million, respectively, was deducted from the gross proceeds of the Unit offering to arrive at the initial discounted carrying

value of the Series F Preferred Stock. The resulting discount to the aggregate stated value of the Series F Preferred Stock of

approximately $13.6 million will be recognized as accretion, similar to preferred stock dividends, over the two-year period prior

to optional redemption by the holders. The Company recognized accretion of the discount to the stated value of the Series F Preferred

Stock of approximately $369,000 in the year ended October 31, 2017 as a reduction of additional paid-in capital and an increase

in the carrying value of the Series F Preferred Stock. The accretion is presented in the Statement of Operations as a deemed dividend,

increasing net loss to arrive at net loss attributable to common stockholders.

Preferred

Share Conversion Activity

During

the year ended October 31, 2017, 3,991,487 shares of Convertible Preferred Stock Series A, 6,512 shares of Convertible Preferred

Stock Series B, 23,185 shares of Convertible Preferred Stock Series C and 129,665 shares of Convertible Preferred Stock Series

D were converted into 1,590,631 shares of common stock.

Common

Stock

On

January 18, 2017, the Company entered into separate exchange agreements (each an “Exchange Agreement”) with certain

accredited investors (the “Investors”) who purchased warrants to purchase shares of the Company’s common stock

(the “Warrants”) pursuant to the prospectus dated April 13, 2016. Pursuant to the Offering, the Company issued 250,000

shares of the Company’s common stock and Warrants to purchase 187,500 shares of common stock (taking into account the reverse

split of the Company’s common stock on a 1 for 6 basis effective with The NASDAQ Stock Market LLC on August 1, 2016). The

common stock and Warrants were offered by the Company pursuant to an effective shelf registration statement.

Under

the terms of the Exchange Agreement, each Investor exchanged each Warrant it purchased in the Offering for 0.3 shares of common

stock. Accordingly, the Company issued an aggregate of 56,250 shares of common stock in exchange for the return and cancellation

of 187,500 Warrants.

During

the year ended October 31, 2017, certain employees exercised their options at a weighted-average exercise price of $4.84 in exchange

for the Company’s common stock for an aggregated amount of 268,847 shares.

Off-Balance

Sheet Arrangements

As

of October 31, 2017, we had no off-balance sheet arrangements.

Inflation

Our

management currently believes that inflation has not had, and does not currently have, a material impact on continuing operations.

Cash

Flows

Cash

and cash equivalents and working capital were approximately $17.7 million and $2.5 million, respectively, as of October 31, 2017

compared to approximately $6.5 million and $5.4 million at October 31, 2016, respectively.

Operating

Cash Flows.

Cash used in continuing operating activities in the year ended October 31, 2017 amounted to approximately $7.6

million compared to approximately $1.9 million for the 2016 period. The increase in net cash used in continuing operating activities

mostly relates to the increase in net loss, partially offset by the research and development - intellectual property acquired

paid for in preferred shares and by the increase in share-based compensation.

Cash

provided by discontinued operating activities in the year ended October 31, 2017 amounted to approximately $33,000 compared to

approximately $113,000 for the 2016 period.

Investing

Cash Flows.

Cash used in continuing investing activities in the year ended October 31, 2017 amounted to approximately $2.5

million. The $2.5 million relates to the purchase of property and equipment (mostly medical equipment). There were no investing

activities in the 2016 period.

Financing

Cash Flows.

Net cash provided by financing activities in the year ended October 31, 2017 amounted to approximately $21.2 million

compared to approximately $8.8 million used in the 2016 period. For the year ended October 31, 2017, the $21.2 million related

to capital raising activities and proceeds from option exercises. For the year ended October 31, 2016, the $8.8 million mostly

related to a payment of a $10.0 million special cash dividend, partially offset by an equity capital raise of approximately $1.4

million.

FINANCIAL

STATEMENTS

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The

Board of Directors and Stockholders of

PolarityTE,

Inc.

We

have audited the accompanying consolidated balance sheets of PolarityTE, Inc. and Subsidiaries (the “Company”) as

of October 31, 2017 and 2016, and the related consolidated statements of operations, stockholders’ equity, and cash flows

for each of the years then ended. The financial statements are the responsibility of the Company’s management. Our responsibility

is to express an opinion on these financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those

standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are

free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control

over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing

audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness

of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining,

on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing

the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis for our opinion.

In

our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position

of PolarityTE, Inc. and Subsidiaries as of October 31, 2017 and 2016, and the consolidated results of their operations and their

cash flows for each of the years then ended, in conformity with accounting principles generally accepted in the United States

of America.

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

As discussed in Note 3 to the consolidated financial statements, the Company has sustained cumulative losses and recurring cash

outflows from operations through October 31, 2017 that raise substantial doubt about its ability to continue as a going concern.

Management’s plans in regard to these matters are also described in Note 3. The consolidated financial statements do not

include any adjustments that might result from the outcome of this uncertainty.

|

/s/

EisnerAmper LLP

|

|

|

|

|

|

EISNERAMPER

LLP

|

|

|

Iselin,

New Jersey

|

|

|

January

29, 2018

|

|

POLARITYTE,

INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

(in

thousands, except share and per share amounts)

|

|

|

October 31, 2017

|

|

|

October 31, 2016

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

17,667

|

|

|

$

|

6,523

|

|

|

Prepaid expenses and other current assets

|

|

|

237

|

|

|

|

47

|

|

|

Receivable from Zift

|

|

|

60

|

|

|

|

-

|

|

|

Current assets related to discontinued operations

|

|

|

-

|

|

|

|

163

|

|

|

Total current assets

|

|

|

17,964

|

|

|

|

6,733

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

2,173

|

|

|

|

18

|

|

|

Receivable from Zift, non-current

|

|

|

15

|

|

|

|

-

|

|

|

Total non-current assets

|

|

|

2,188

|

|

|

|

18

|

|

|

TOTAL ASSETS

|

|

$

|

20,152

|

|

|

$

|

6,751

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

1,939

|

|

|

$

|

474

|

|

|

Warrant liability and embedded derivative

|

|

|

13,502

|

|

|

|

70

|

|

|

Current liabilities related to discontinued operations

|

|

|

-

|

|

|

|

810

|

|

|

Total current liabilities

|

|

|

15,441

|

|

|

|

1,354

|

|

|

Total liabilities

|

|

|

15,441

|

|

|

|

1,354

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable convertible preferred stock – Series F - 6,455 shares authorized, issued and outstanding at October 31, 2017; liquidation preference - $17,750.

|

|

|

4,541

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY:

|

|

|

|

|

|

|

|

|

Convertible preferred stock - 9,993,545 shares authorized, 3,230,655 and 7,374,454 shares issued and outstanding at October 31, 2017 and 2016, aggregate liquidation preference $2,140 and $4,854,

respectively

|

|

|

109,995

|

|

|

|

10,153

|

|

|

Common stock - $.001 par value; 250,000,000 shares authorized; 6,515,524 and 2,782,963 shares issued and outstanding at October 31, 2017 and 2016, respectively

|

|

|

7

|

|

|

|

3

|

|

|

Additional paid-in capital

|

|

|

149,173

|

|

|

|

123,417

|

|

|

Accumulated deficit

|

|

|

(259,005

|

)

|

|

|

(128,176

|

)

|

|

Total stockholders’ equity

|

|

|

170

|

|

|

|

5,397

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$

|

20,152

|

|

|

$

|

6,751

|

|

See

accompanying notes

POLARITYTE,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS

(in

thousands, except share and per share amounts)

|

|

|

For the Years Ended October 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Operating costs and expenses

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$

|

7,107

|

|

|

$

|

-

|

|

|

Research and development - intellectual property acquired

|

|

|

104,693

|

|

|

|

-

|

|

|

General and administrative

|

|

|

18,812

|

|

|

|

4,099

|

|

|

|

|

|

130,612

|

|

|

|

4,099

|

|

|

Operating loss

|

|

|

(130,612

|

)

|

|

|

(4,099

|

)

|

|

Other income

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

23

|

|

|

|

18

|

|

|

Change in fair value of derivatives

|

|

|

109

|

|

|

|

248

|

|

|

Net loss from continuing operations

|

|

|

(130,480

|

)

|

|

|

(3,833

|

)

|

|

Loss from discontinued operations

|

|

|

(449

|

)

|

|

|

(807

|

)

|

|

Gain on sale of discontinued operations

|

|

|

100

|

|

|

|

-

|

|

|

Loss from discontinued operations, net

|

|

|

(349

|

)

|

|

|

(807

|

)

|

|

Net loss

|

|

|

(130,829

|

)

|

|

|

(4,640

|

)

|

|

Special cash dividend attributable to preferred stockholders

|

|

|

-

|

|

|

|

(6,002

|

)

|

|

Deemed dividend – accretion of discount on Series F preferred stock

|

|

|

(369

|

)

|

|

|

-

|

|

|

Cumulative dividends on Series F preferred stock

|

|

|

(124

|

)

|

|

|

-

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(131,322

|

)

|

|

$

|

(10,642

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted:

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$

|

(26.50

|

)

|

|

$

|

(1.83

|

)

|

|

Loss from discontinued operations

|

|

|

(0.07

|

)

|

|

|

(0.38

|

)

|

|

Net loss

|

|

|

(26.57

|

)

|

|

|

(2.21

|

)

|

|

Special cash dividend attributable to preferred stockholders

|

|

|

-

|

|

|

|

(2.87

|

)

|

|

Deemed dividend – accretion of discount on Series F preferred stock

|

|

|

(0.07

|

)

|

|

|

-

|

|

|

Cumulative dividends on Series F preferred stock

|

|

|

(0.03

|

)

|

|

|

-

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(26.67

|

)

|

|

$

|

(5.08

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted:

|

|

|

4,923,327

|

|

|

|

2,096,022

|

|

See

accompanying notes

POLARITYTE,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS’ EQUITY

(in

thousands, except share and per share amounts)

|

|

|

Preferred

Stock

|

|

|

Common

Stock

|

|

|

Additional Paid-in

|

|

|

Accumulated

|

|

|

Total Stockholders’

|

|

|

|

|

Number

|

|

|

Amount

|

|

|

Number

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Equity

|

|

|

Balance - October 31, 2015

|

|

|

9,025,265

|

|

|

$

|

10,694

|

|

|

|

1,851,503

|

|

|

$

|

2

|

|

|

|

128,497

|

|

|

$

|

(123,536

|

)

|

|

$

|

15,657

|

|

|

Issuance of common stock in connection with:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted stock grants

|

|

|

-

|

|

|

|

-

|

|

|

|

356,666

|

|

|

|

1

|

|

|

|

(1

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Conversion of Series A preferred stock

|

|

|

(1,638,810

|

)

|

|

|

(401

|

)

|

|

|

273,135

|

|

|

|

-

|

|

|

|

401

|

|

|

|

-

|

|

|

|

-

|

|

|

Conversion of Series D preferred stock

|

|

|

(12,001

|

)

|

|

|

(140

|

)

|

|

|

20,002

|

|

|

|

-

|

|

|

|

140

|

|

|

|

-

|

|

|

|

-

|

|

|

Proceeds from stock option exercise

|

|

|

-

|

|

|

|

-

|

|

|

|

31,657

|

|

|

|

-

|

|

|

|

129

|

|

|

|

-

|

|

|

|

129

|

|

|

Stock based compensation expense

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,142

|

|

|

|

-

|

|

|

|

3,142

|

|

|

Shares issued for cash

|

|

|

-

|

|

|

|

-

|

|

|

|

250,000

|

|

|

|

-

|

|

|

|

1,406

|

|

|

|

-

|

|

|

|

1,406

|

|

|

Warrant liability

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(318

|

)

|

|

|

-

|

|

|

|

(318

|

)

|

|

Allocation of warrant offering cost

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

21

|

|

|

|

-

|

|

|

|

21

|

|

|

Special cash dividend

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(4,640

|

)

|

|

|

(4,640

|

)

|

|

Balance as of October 31, 2016

|

|

|

7,374,454

|

|

|

$

|

10,153

|

|

|

|

2,782,963

|

|

|

$

|

3

|

|

|

$

|

123,417

|

|

|

$

|

(128,176

|

)

|

|

$

|

5,397

|

|

|

Issuance of common stock in connection with:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conversion of Series A preferred stock to common stock

|

|

|

(3,991,487

|

)

|

|

|

(976

|

)

|

|

|

761,798

|

|

|

|

1

|

|

|

|

975

|

|

|

|

-

|

|

|

|

-

|

|

|

Conversion of Series B preferred stock to common stock

|

|

|

(6,512

|

)

|

|

|

(549

|

)

|

|

|

108,543

|

|

|

|

-

|

|

|

|

549

|

|

|

|

-

|

|

|

|

-

|

|

|

Conversion of Series C preferred stock to common stock

|

|

|

(23,185

|

)

|

|

|

(1,809

|

)

|

|

|

504,184

|

|

|

|

1

|

|

|

|

1,808

|

|

|

|

-

|

|

|

|

-

|

|

|

Conversion of Series D preferred stock to common stock

|

|

|

(129,665

|

)

|

|

|

(1,517

|

)

|

|

|

216,106

|

|

|

|

-

|

|

|

|

1,517

|

|

|

|

-

|

|

|

|

-

|

|

|

Issuance of Series E preferred stock for research and development

intellectual property

|

|

|

7,050

|

|

|

|

104,693

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

104,693

|

|

Proceeds from stock option

exercises

|

|

|

-

|

|

|

|

-

|

|

|

|

268,847

|

|

|

|

-

|

|

|

|

1,301

|

|

|

|

-

|

|

|

|

1,301

|

|

|

Warrants exchanged for common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

56,250

|

|

|

|

-

|

|

|

|

78

|

|

|

|

-

|

|

|

|

78

|

|

|

Stock-based compensation expense

|

|

|

-

|

|

|

|

-

|

|

|

|

1,057,500

|

|

|

|

1

|

|

|

|

17,744

|

|

|

|

-

|

|

|

|

17,745

|

|

|

Common stock issued for cash

|

|

|

-

|

|

|

|

-

|

|

|

|

759,333

|

|

|

|

1

|

|

|

|

2,277

|

|

|

|

-

|

|

|

|

2,278

|

|

|

Deemed dividend – accretion of discount on Series F preferred

stock

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(369

|

)

|

|

|

-

|

|

|

|

(369

|

)

|

|

Cumulative dividends on Series F preferred stock

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(124

|

)

|

|

|

-

|

|

|

|

(124

|

)

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(130,829

|

)

|

|

|

(130,829

|

)

|

|

Balance as of October 31, 2017

|

|

|

3,230,655

|

|

|

$

|

109,995

|

|

|

|

6,515,524

|

|

|

$

|

7

|

|

|

$

|

149,173

|

|

|

$

|

(259,005

|

)

|

|

$

|

170

|

|

See

accompanying notes

POLARITYTE,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in

thousands)

|

|

|

For the Years Ended October 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(130,829

|

)

|

|

$

|

(4,640

|

)

|

|

Loss from discontinued operations

|

|

|

349

|

|

|

|

807

|

|

|

Loss from continuing operations

|

|

|

(130,480

|

)

|

|

|

(3,833

|

)

|

|

Adjustments to reconcile net loss from continuing operations to net cash used in continuing operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

432

|

|

|

|

-

|

|

|

Stock based compensation expense

|

|

|

16,627

|

|

|

|

2,042

|

|

|

Research and development - intellectual property acquired

|

|

|

104,693

|

|

|

|

-

|

|

|

Change in fair value of derivatives

|

|

|

(109

|

)

|

|

|

(248

|

)

|

|

Offering costs expensed

|

|

|

-

|

|

|

|

21

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets

|

|

|

(190

|

)

|

|

|

54

|

|

|

Accounts payable and accrued expenses

|

|

|

1,411

|

|

|

|

85

|

|

|

Net cash used in continuing operating activities

|

|

|

(7,616

|

)

|

|

|

(1,879

|

)

|

|

Net cash provided by discontinued operating activities

|

|

|

33

|

|

|

|

113

|

|

|

Net cash used in operating activities

|

|

|

(7,583

|

)

|

|

|

(1,766

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(2,544

|

)

|

|

|

-

|

|

|

Net cash used in continuing investing activities

|

|

|

(2,544

|

)

|

|

|

-

|

|

|

Net cash provided by discontinued investing activities

|

|

|

25

|

|

|

|

-

|

|

|

Net cash used in investing activities

|

|

|

(2,519

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Special cash dividend

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

Proceeds from stock options exercised

|

|

|

1,301

|

|

|

|

129

|

|

|

Net proceeds from the sale of preferred stock and warrants

|

|

|

17,667

|

|

|

|

-

|

|

|

Net proceeds from the sale of common stock and warrants

|

|

|

-

|

|

|

|

1,406

|

|

|

Proceeds from the sale of common stock

|

|

|

2,278

|

|

|

|

-

|

|

|

Payments to Zift

|

|

|

-

|

|

|

|

(299

|

)

|

|

Net cash provided by (used in) financing activities

|

|

|

21,246

|

|

|

|

(8,764

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

11,144

|

|

|

|

(10,530

|

)

|

|

Cash and cash equivalents - beginning of period

|

|

|

6,523

|

|

|

|

17,053

|

|

|

Cash and cash equivalents - end of period

|

|

$

|

17,667

|

|

|

$

|

6,523

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental schedule of non-cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

Conversion of Series A preferred stock to common stock

|

|

$

|

976

|

|

|

$

|

401

|

|

|

Conversion of Series B preferred stock to common stock

|

|

$

|

549

|

|

|

$

|

-

|

|

|

Conversion of Series C preferred stock to common stock

|

|

$

|

1,809

|

|

|

$

|

-

|

|

|

Conversion of Series D preferred stock to common stock

|

|

$

|

1,517

|

|

|

$

|

140

|

|

|

Warrants exchanged for common stock shares

|

|

$

|

78

|

|

|

$

|

-

|

|

|

Establishment of warrant liability in connection with Series F Preferred Stock issuance

|

|

$

|

4,299

|

|

|

$

|

-

|

|

|

Establishment of derivative liability in connection with Series F Preferred Stock issuance

|

|

$

|

9,319

|

|

|

$

|

-

|

|

|

Deemed dividend – accretion of discount on Series F preferred stock

|

|

$

|

369

|

|

|

$

|

-

|

|

|

Common stock shares and warrants issued for offering costs

|

|

$

|

-

|

|

|

$

|

75

|

|

|

Unpaid liability for acquisition of property and equipment

|

|

$

|

54

|

|

|

$

|

-

|

|

|

Cumulative dividends on Series F preferred stock

|

|

$

|

124

|

|

|

$

|

-

|

|

See

accompanying notes

POLARITYTE,

INC. AND SUBSIDIARIES

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

1.

PRINCIPAL BUSINESS ACTIVITY AND BASIS OF PRESENTATION

Asset

Acquisition and Name Change.

On December 1, 2016

,

Majesco Entertainment Company (

n/k/a

PolarityTE, Inc.), a

Delaware corporation (the “Company”) entered into an agreement to acquire the assets of Polarity NV (as defined below),

a regenerative medicine company. The asset acquisition was subject to shareholder approval, which was received on March 10, 2017

and the transaction closed on April 7, 2017, as more fully described below. In January 2017, the Company changed its name to “PolarityTE,

Inc.”

On

December 1, 2016, the Company appointed Dr. Denver Lough as Chief Executive Officer, Chief Scientific Officer and Chairman of

our Board of Directors and Dr. Ned Swanson as Chief Operating Officer of the Company. Until their respective appointments, both

doctors were associated with Johns Hopkins University, Baltimore, Maryland, as full-time residents. On December 1, 2016, Dr. Lough

assigned the patent application as well as all related intellectual property to a newly-formed Nevada corporation, Polarityte,

Inc. (“Polarity NV”), and the Company entered into an Agreement and Plan of Reorganization (the “Agreement”)

with Polarity NV and Dr. Lough. As a result, at closing, the patent application would be owned by the Company without the need

for further assignments or recordation with the Patent Trademark Office.

On

April 7, 2017, the Company issued 7,050 shares of its newly authorized Series E Preferred Stock (the “Series E Preferred

Shares”) convertible into an aggregate of 7,050,000 shares of the Company’s common stock with a fair value of approximately

$104.7 million which is equal to 7,050,000 common shares times $14.85 (the closing price of the Company’s common stock as

of April 7, 2017) to Dr. Lough for the purchase of the Polarity NV’s assets. Since the assets purchased were in-process

research and development assets, the total purchase price was immediately expensed as research and development - intellectual

property acquired since they have no alternative future use.

Drs.

Lough and Swanson lead the Company’s current efforts focused on scientific research and development and in this regard on

December 1, 2016, the Company leased laboratory space and purchased laboratory equipment in Salt Lake City, Utah. Subsequent expenditures

include the purchase of medical equipment, including microscopes for high end real-time imaging of cells and tissues required

for tissue engineering and regenerative medicine research. The Company has added additional facilities, and established university

and scientific relationships and collaborations in order to pursue its business. None of these activities were performed by Dr.

Lough or Dr. Swanson prior to December 1, 2016 in connection with their university positions or privately.

Dr.

Lough is the named inventor under a pending patent application for a novel regenerative medicine and tissue engineering platform

filed in the United States and elsewhere. The Company believes that its future success depends significantly on its ability to

protect its inventions and technology. Prior to December 1, 2016, no employees, consultants or partners engaged in any business

activity related to the patent application and no licenses or contracts were granted related to the patent application, other

than professional services related to preparation and filing of the patent.

There

was never any intent to acquire an ongoing business and no ongoing business was acquired. The asset is preserved in a stand-alone

entity merely as a vehicle to provide the Company a seamless means to acquire the asset (a patent application) without undue cost,

expense and time. Polarity NV has never had employees and, therefore, no employees were acquired in the transaction.

The

Company adopted ASU 2017-01,

Business Combinations (Topic 805), Clarifying the Definition of a Business

, during the first