|

As

filed with the Securities and Exchange Commission on May __, 2018

|

Registration

No. 333-__________

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

POLARITYTE,

INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

06-1529524

|

|

(State

or Other Jurisdiction of

|

|

(I.R.S.

Employer

|

|

Incorporation

or Organization)

|

|

Identification Number)

|

1960

S. 4250 West, Salt Lake City, UT 84104

(

Address

of Principal Executive Offices, Including Zip Code

)

POLARITYTE,

INC.

2017

EQUITY INCENTIVE PLAN, AS AMENDED

(

Full

Title of the Plan

)

|

John

Stetson

|

|

Chief

Financial Officer

|

|

PolarityTE,

Inc.

|

|

1960

S. 4250 West, Salt Lake City, UT 84104

|

|

(385)

237-2279

|

(

Name,

address, including zip code, and telephone number, including area code, of agent for service

)

|

|

|

With

a copy to:

|

|

Mark

E. Lehman, Esq.

|

|

Parsons

Behle & Latimer

|

|

201

S. Main Street, Suite 1800, Salt Lake City, UT 84111

|

|

(801)

532-1234

|

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer [ ]

Non-accelerated

filer [ ]

(Do

not check if a smaller reporting company)

|

|

Accelerated

filer [ ]

Smaller

reporting company [X]

Emerging

growth company [ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Incorporating

by reference the Registration Statement on Form S-8, File No. 333-211959

CALCULATION

OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to be

registered(1)

|

|

Proposed maximum

aggregate offering price per share

|

|

|

Proposed maximum

aggregate offering

price

|

|

|

Amount of

Registration Fee

|

|

|

Common stock, par value $0.001 per share

|

|

7,300,000 shares

|

|

$

|

25.81

|

(2)

|

|

$

|

188,413,000

|

(2)

|

|

$

|

23,457.42

|

(2)

|

|

(1)

|

Pursuant

to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement

shall also cover any additional shares of the Registrant’s common stock that become issuable under the Registrant’s

2017 Equity Incentive Plan, as amended, by reason of any stock dividend, stock split, recapitalization or other similar transaction

that increases the number of the outstanding shares of the Registrant’s common stock.

|

|

|

|

|

(2)

|

Estimated

in accordance with paragraph (c) of Rule 457 under the Securities Act solely for purposes of calculating the registration

fee. The maximum offering price with respect to the shares registered herein is based on the average of the high and low sale

prices of a share of common stock as reported on The NASDAQ Capital Market on May 25, 2018.

|

EXPLANATORY

STATEMENT

This

registration statement on Form S-8 (the “Registration Statement”) relates to 7,300,000 shares of common stock of PolarityTE,

Inc. (the “Registrant,” the “Company,” “we,” “us” or “our”), $0.001

par value per share, that have been issued or granted, or may be issued or granted, pursuant to options and other awards under

our 2017 Equity Incentive Plan, as amended (and all other amendments and supplements thereto and all material documents incorporated

by reference or deemed to be incorporated by reference therein, the “2017 Plan”). Under the original 2017 Plan, a

total of 3,450,000 shares of common stock was reserved for issuance upon the grant and exercise of options and awards to officers,

directors, employees and consultants of the Company. On October 18, 2017, at the 2017 Annual Meeting of Stockholders of the Company,

the stockholders approved the proposal to amend to the 2017 Plan to increase the reservation of common stock for issuance thereunder

to 7,300,000 shares from 3,450,000 shares.

Pursuant

to General Instruction E of Form S-8, the contents of the Registration Statement on Form S-8, File No. 333-211959, which was filed

with the Securities and Exchange Commission (the “SEC”) on June 10, 2016, as amended by Post-effective Amendment No.

1 thereto filed with the SEC on July 1, 2016, (the “Prior Registration Statement”) is hereby incorporated by reference,

including each of the documents filed by us with the SEC and incorporated or deemed incorporated by reference in the Prior Registration

Statement. All filing fees for the Prior Registration Statement have been filed.

Pursuant

to Rule 429(a) of the Securities Act, the reoffer prospectus is a combined prospectus that is being filed as part of this Registration

Statement and the Prior Registration Statement. The reoffer prospectus was prepared is in accordance with General Instruction

C of Form S-8 and in accordance with the requirements of Part I of Form S-3. It may be used for reoffers and resales on a continuous

or a delayed basis in the future of common stock defined as “restricted securities” and “control securities”

under Instruction C to Form S-8 acquired by “affiliates” (as the term is defined in Rule 405 of the Securities Act)

pursuant to the exercise of stock options, restricted stock unit awards, restricted stock awards, or other awards under the 2017

Equity Plan and 2016 Equity Incentive Plan registered under the Prior Registration Statement. Pursuant to General Instruction

E of Form S-8, the reoffer prospectus included herein is a revision of the reoffer prospectus included with the Prior Registration

Statement.

PART

I

INFORMATION

REQUIRED IN THE 10(a) PROSPECTUS

Item 1.

Plan Information.

The

Company will provide each recipient (the “Recipients”) of a grant under the Plan with documents that contain information

related to the Plan, and other information including, but not limited to, the disclosure required by Item 1 of Form S-8, which

information is not required to be and is not being filed as a part of this Registration Statement on Form S-8 (the “Registration

Statement”) or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act of 1933, as amended

(the “Securities Act”). The foregoing information and the documents incorporated by reference in response to Item

3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a)

of the Securities Act. A Section 10(a) prospectus will be given to each Recipient who receives common stock covered by this Registration

Statement, in accordance with Rule 428(b)(1) under the Securities Act.

Item 2.

Registrant Information and Employee Plan Annual Information.

We

will provide to each Recipient a written statement advising of the availability of documents incorporated by reference in Item

3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) prospectus)

and of documents required to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written or

oral request by contacting:

John

Stetson

Chief

Financial Officer

PolarityTE,

Inc.

1960

S. 4250 West

Salt

Lake City, UT 84104

REOFFER

PROSPECTUS

POLARITYTE,

INC.

5,483,386

Shares of Common

Stock

This

reoffer prospectus relates to:

|

|

●

|

5,304,220

shares of our common stock, par value $0.001 per share,

issuable pursuant to awards granted under the 2017 Equity Incentive Plan, as amended (the “2017 Plan”), and

|

|

|

|

|

|

|

●

|

179,166

shares of our common stock issuable pursuant to awards granted

under the 2016 Equity Incentive Plan (the “2016 Plan”),

|

that

may be offered and sold from time to time by the selling stockholders identified in this prospectus. The 2017 Plan and 2016 Plan

are collectively the “Plans.” The Plans were adopted by the Board of directors and stockholders of PolarityTE,. Inc.,

a Delaware corporation (“Polarity,” “the Company,” “we,” “us,” or “our”).

We

have issued awards under the Plans to a number of eligible participants, including officers and directors who are affiliates of

PolarityTE (as defined in rule 405 adopted under the Securities Act) listed under the section of this prospectus entitled “Selling

Stockholders.” Subsequent to the date of this reoffer prospectus, we may grant awards under the 2017 Equity Plan to eligible

participants who are affiliates. Instruction C of Form S-8 requires that we supplement this reoffer prospectus with the names

of such affiliates and the amounts of securities to be reoffered by them as Selling Stockholders.

It

is anticipated that the Selling Stockholders will offer common shares for sale at prevailing prices on any stock exchange, market

or trading facility on which the shares are traded or in private transactions. See “Plan of Distribution.” We will

receive no part of the proceeds from sales made under this reoffer prospectus. The Selling Stockholders will bear all sales commissions

and similar expenses. Any other expenses incurred by us in connection with the registration and offering and not borne by the

Selling Stockholders will be borne by us.

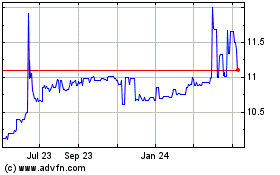

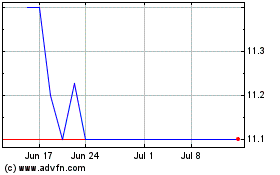

Our common stock is listed on The NASDAQ Capital

Market under the symbol “COOL.” On May 25, 2018, the last reported sale price of our common stock was $25.31

per share.

Our principal executive offices are located

at 1960 S. 4250 West, Salt Lake City, UT 84104.

Investing in our securities involves a

high degree of risk. See the section entitled “Risk Factors” on page 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF

THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is May 29,

2018.

TABLE

OF CONTENTS

You

should rely only on the information contained in this Reoffer Prospectus or any related prospectus supplement. We have not authorized

anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. The information contained in this Reoffer Prospectus or incorporated by reference herein is accurate only on the

date of this Reoffer Prospectus. Our business, financial condition, results of operations and prospects may have changed since

such date. Other than as required under the federal securities laws, we undertake no obligation to publicly update or revise such

information, whether as a result of new information, future events or any other reason.

This

Reoffer Prospectus is not an offer to sell, nor is it an offer to buy, these securities in any jurisdiction where the offer or

sale is not permitted.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained in this prospectus. This summary does not contain all the information

you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus

carefully.

Our

Business

PolarityTE™

is a commercial-stage biotechnology and regenerative biomaterials company focused on transforming the lives of patients by discovering,

designing and developing a range of regenerative tissue products and biomaterials for the fields of medicine, biomedical engineering

and material sciences. We believe that our PolarityTE platform technology is a new approach to pragmatic and functional tissue

regeneration that has the potential to address many of the challenges currently facing the regenerative medicine and cell therapy

markets to date. Recognizing the natural complexity of human tissue, our core “TE” platform begins with a small piece

of the patient’s own, or autologous, healthy tissue, rather than artificially manipulated individual cells. From this small

piece of healthy autologous tissue, we create an easily deployable, dynamic and self-propagating product, which is designed to

enhance and stimulate the patient’s own cells to regenerate the target tissues. Rather than manufacturing with synthetic

and foreign materials within artificially engineered environments, we believe our proprietary method promotes and accelerates

the patient’s tissues to undergo a form of effective regenerative healing, and uses the patient’s own body to support

the regenerative process to create the same tissue from which they were derived.

We

are a clinical-stage biotechnology and life sciences company focused on the advancement of self-complexing intelligent regenerative

materials. We believe our core “TE” platform has applications across many different indications, including, but not

limited to, the regrowth of skin, bone, cartilage, fat, muscle, blood vessels and neural elements as well as solid and hollow

organ composite tissue systems. Our first product, SkinTE™, is registered with the United States Food and Drug Administration

(“FDA”) pursuant to the regulatory pathway for human cells, tissues, and cellular and tissue-based products (HCT/Ps)

regulated solely under Section 361 of the Public Health Service Act (“361 HCT/Ps”), which permits qualifying products

to be marketed without first obtaining FDA marketing authorization or approval, and is commercially available for the repair,

reconstruction, replacement and regeneration of skin (i.e., homologous uses) for patients who have suffered from wounds, burns

or injuries that require skin coverage over both small and large areas of their body.

Recent Developments

Asset Acquisition

On March 2, 2018, PolarityTE,

along with its wholly owned subsidiary, Utah CRO Services, Inc., a Nevada corporation (“Acquisition Co.”), entered

into an asset purchase agreement (the “APA”) with Ibex Group, L.L.C., a Utah limited liability company, and Ibex Preclinical

Research, Inc

.

, a Utah corporation (collectively the “Seller”). The transaction closed on May 3, 2018.

Under the APA the Company

purchased from Seller the assets and rights to its preclinical research and veterinary sciences business and related real estate

(as more fully described below). The business consists of a “

good laboratory practices

” (GLP) compliant preclinical

research facility, including vivarium, operating rooms, preparation rooms, storage facilities, and surgical and imaging equipment.

The purchase price was

$1.6 million paid $266,667 in cash at closing and the balance by delivery of a promissory note to Seller for $1,333,333 payable

in five equal installments beginning on the six-month anniversary of issuance and continuing on each six-month anniversary

thereafter with interest at the rate of 3.5% per annum.

Concurrently with the

execution and delivery of the APA, on March 2, 2018, the Company entered into a purchase and sale agreement (the “PSA”)

with Seller to purchase two parcels of real property in Cache County, Utah, consisting of approximately 1.75 combined gross acres

of land, together with the buildings, structures, fixtures, and personal property located on the real property. The transaction

also closed on May 3, 2018. The purchase price for the property was $2.0 million, which was paid in cash at closing.

Preferred Stock

Exchange and Conversion

On February 6, 2018,

15,756 Series B Preferred Shares were converted into 262,606 shares of common stock.

On March 6, 2018, we

entered into separate exchange agreements with holders of 100% of our outstanding Series F Preferred Stock, and warrants to purchase

shares of our common stock issued in connection with the Series F Preferred Stock (such warrants and Series F Preferred Stock

collectively referred to as the “Exchange Securities”) to exchange the Exchange Securities and unpaid dividends on

the Series F Preferred Stock, for common stock (the “Exchange”).

The Exchange resulted

in the following issuances: (A) all outstanding shares of Series F Preferred Stock were exchanged into 972,067 shares of restricted

common stock at an effective conversion price of $18.26 per share of common stock (the closing price of our common stock on the

Nasdaq Capital Market on February 26, 2018); (B) the right to receive 6% dividends underlying Series F Preferred Stock was terminated

and in exchange 31,324 shares of restricted common stock were issued; and (C) 322,727 warrants to purchase common stock were exchanged

for 151,872 shares of restricted common stock.

As part of the Exchange,

the holders relinquished any and all rights related to the Exchange Securities, the respective governing and other related agreements

and certificates of designation, including any related dividends, adjustment of conversion or exercise prices and repayment options.

The registration rights agreement with the holders of the Series F Preferred Stock was terminated and the holders of the Series

F Preferred Stock waived the Company’s obligation to register the shares of common stock issuable upon conversion of Series

F Preferred Stock or upon exercise of the warrants, and waived any damages, penalties and defaults related to the Company failing

to file or have declared effective a registration statement covering those shares.

On March 6, 2018, we

received conversion notices from holders of 100% of the then outstanding shares of Series A Preferred Stock, Series B Preferred

Stock and Series E Preferred Stock and issued an aggregate of 7,949,252 shares of common stock to such holders (the “Conversions”).

The shares of Series

E Preferred Stock were held by Dr. Denver Lough, our Chief Executive Officer. On March 6, 2018, we entered into a registration

rights agreement with Dr. Denver Lough, pursuant to which we agreed to file a registration statement to register the resale of

7,050,000 shares of common stock issued upon conversion of the Series E Preferred Stock within six months and to cause such registration

statement to be declared effective by the SEC as promptly as possible following its filing. Any sales of shares under the registration

statement are subject to certain limitations as specified with more particularity in the registration rights agreement. In connection

with the Exchange, certain of the holders of Exchange Securities granted Dr. Lough an irrevocable proxy to vote an aggregate of

797,296 shares of common stock held by such holders at any vote of our stockholders. Following the Exchange, Dr. Lough is entitled

to vote a total of 7,847,296 shares of common stock (inclusive of all shares which he beneficially owns and holds as of the date

of this prospectus), plus any shares he acquires pursuant to the exercise of vested options, on any matter for which a vote of

our stockholders is sought or required.

Company

Background

Our

principal executive offices are located at 1960 S. 4250 West, Salt Lake City, UT 84104 and our telephone number is (385) 237-2279.

Our web site address is www.polarityte.com.

PolarityTE,

Inc. (formerly Majesco Entertainment Company) was incorporated in 2004 under the laws of the State of Delaware. As a result of

a merger, Majesco Entertainment Company became a wholly-owned subsidiary and the sole operating business of the Company, which

changed its name to PolarityTE, Inc.

In

this prospectus, “PolarityTE,” “the Company,” “we,” “us,” and “our”

refer to PolarityTE, Inc., a Delaware corporation, unless the context otherwise requires.

THIS

OFFERING

|

Shares of common stock outstanding prior to this offering

|

|

|

18,808,601

|

(1)

|

|

|

|

|

|

|

|

Shares being offered by the Selling Stockholders

|

|

|

5,483,386

|

|

|

|

|

|

|

|

|

Shares of common stock to be outstanding after the offering

|

|

|

23,592,404

|

(1)(2)

|

(1) As of May 29, 2018.

(2) The 5,483,386 shares offered by the Selling

Stockholders includes 699,583 shares issued as restricted stock awards under the 2017 Plan. Assumes the exercise of the

remaining 4,787,970 shares underlying stock options being offered by the Selling Stockholders.

|

Use of proceeds

|

We will not receive any proceeds from the sale of the shares of common stock offered in this prospectus, other than proceeds from the exercise of the stock options.

|

|

|

|

|

Risk Factors

|

The purchase of our common stock involves

a high degree of risk. You should carefully review and consider “Risk Factors” beginning on page 4.

|

|

|

|

|

NASDAQ Symbol

|

COOL

|

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks,

uncertainties and other factors described under “Risk Factors” in our most recent Annual Report on Form 10-K, as supplemented

and updated by subsequent quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with

the SEC, which are incorporated by reference into this prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely

affected by these risks. For more information about our SEC filings, please see “Additional Information Available to You”.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements”, which represent the Company’s current expectations or beliefs

including, but not limited to, statements concerning the Company’s operations, performance, financial condition and growth.

For this purpose, any statements contained in this prospectus that are not statements of historical fact are forward-looking statements.

Without limiting the generality of the foregoing, words such as “may”, “anticipation”, “intend”,

“could”, “estimate”, or “continue” or the negative or other comparable terminology are intended

to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, such as

credit losses, dependence on management and key personnel, variability of quarterly results, and the ability of the Company to

continue its growth strategy and competition, certain of which are beyond the Company’s control. Should one or more of these

risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ

materially from those indicated in the forward-looking statements.

Any

forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation

to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement

is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for

management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

DETERMINATION

OF OFFERING PRICE

The

Selling Stockholders may sell the common shares issued to them from time-to-time at prices and at terms then prevailing or at

prices related to the then current market price, or in negotiated transactions.

USE

OF PROCEEDS

The

shares of common stock offered hereby are being registered for the account of the Selling Stockholders named in this prospectus.

As a result, all proceeds from the sales of the common stock will go to the Selling Stockholders and we will not receive any proceeds

from the resale of the common stock by the Selling Stockholders. We will receive proceeds from the exercise of the options; however,

no assurance can be given as to when or if any or all of the options will be exercised. If any options are exercised, the proceeds

derived therefrom will be used for working capital and general corporate purposes.

SELLING

STOCKHOLDERS

The

table below sets forth information concerning the resale of the shares of common stock by the Selling Stockholders. We will not

receive any proceeds from the resale of the common stock by the Selling Stockholders other than the proceeds from the exercise

of the options. Assuming all the shares registered below are sold by the Selling Stockholders, none of the Selling Stockholders

will continue to own any shares of our common stock issued to them pursuant to the Plan, including shares of common stock issuable

upon exercise of options issued pursuant to the Plan. The following table sets forth the name of each person who is offering the

resale of shares of common stock by this prospectus, the number of shares of common stock beneficially owned by each person, the

number of shares of common stock that may be sold in this offering and the number of shares of common stock each person will own

after the offering, assuming they sell all of the shares offered.

We

will, from time to time, supplement this prospectus in order to reflect grants under the Plan and/or to name grantees who are

officers and/or directors as Selling Stockholders.

|

Name

|

|

Number of Shares of Common Stock Beneficially Owned Prior to Offering

|

|

|

Shares of Common Stock Offered in this Offering(#)

|

|

|

Shares of Common Stock Beneficially Owned After this Offering

|

|

|

Percentage of Common Stock Beneficially Owned After this Offering

|

|

|

Alina Trang

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Anand R. Kumar

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Andrew Kaplan

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Andrew West

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Anna Salmas

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Anna Warner

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Annette Halloran

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Anthony Blum

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Barry Honig

|

|

|

1,750,965

|

|

|

|

125,000

|

|

|

|

1,625,965

|

|

|

|

8.64

|

%

|

|

Cameron J. Hoyler

|

|

|

225,000

|

|

|

|

100,000

|

|

|

|

125,000

|

|

|

|

0.66

|

%

|

|

Caroline Garrett

|

|

|

100,000

|

|

|

|

100,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Christine Cote

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Christine Hashimoto

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Courtney Cushnir

|

|

|

20,000

|

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0.05

|

%

|

|

Daniel Howorth

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

David Blum

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

David Rector

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

David Smith

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Denver Lough

|

|

|

8,450,000

|

|

|

|

1,400,000

|

|

|

|

7,050,000

|

|

|

|

37.48

|

%

|

|

Devin Miller

|

|

|

75,000

|

|

|

|

75,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Edward Karr

|

|

|

40,000

|

|

|

|

15,000

|

|

|

|

25,000

|

|

|

|

0.13

|

%

|

|

Edward Swanson

|

|

|

946,000

|

|

|

|

946,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Emily Evans

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Emily Wirick

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Georgia Yalanis

|

|

|

50,000

|

|

|

|

50,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Gerhard Mundinger

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Holly Kramen

|

|

|

100,000

|

|

|

|

100,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Howard Hechler

|

|

|

84,887

|

|

|

|

84,887

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Ian Robinson

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Isankumar Patel

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jackie Reed

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jacob Patterson

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

James Miess

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jan Pierce

|

|

|

20,833

|

|

|

|

20,833

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jeff Dyer

|

|

|

162,522

|

|

|

|

151,000

|

|

|

|

11,522

|

|

|

|

0.06

|

%

|

|

Jenna Mathis

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jennifer Burdman

|

|

|

100,000

|

|

|

|

100,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jenny Irvin

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jeremy Martin

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jessica Francis

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Joe Abdo

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

John Stetson

|

|

|

592,313

|

|

|

|

457,500

|

|

|

|

134,813

|

|

|

|

0.72

|

%

|

|

Jon Ahlstrom

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jon Mogford

|

|

|

110,000

|

|

|

|

110,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Kendal Stauffer

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Kolby Day

|

|

|

100,000

|

|

|

|

100,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Lauri Coladonato

|

|

|

26,666

|

|

|

|

9,166

|

|

|

|

21,666

|

|

|

|

0.09

|

%

|

|

Lon Tracy

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Lyssa Lambert

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Marc Sonzo

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Mark Babb

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Mark Edgell

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Mark Granick

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Martin Robson

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Mary Lough

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Marytheresa Ifediba

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Matthew Swanson

|

|

|

141,000

|

|

|

|

141,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Maurice Nahabedian

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Michael Beeghley

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Michael Brauser

|

|

|

1,413,001

|

|

|

|

75,000

|

|

|

|

1,338,001

|

|

|

|

7.11

|

%

|

|

Michael Grant

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Michael Larson

|

|

|

6,000

|

|

|

|

6,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Michael Neumeister

|

|

|

141,000

|

|

|

|

141,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Michael Sieverts

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Mohamed Mostafa

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Mohit Bhansali

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Natalie Kirk

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Naveen Krishnan

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Neil Draper

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Neil Draper

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Nicholas Anderson

|

|

|

50,000

|

|

|

|

50,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Nicholas Baetz

|

|

|

50,000

|

|

|

|

50,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Nikolai Sopko

|

|

|

152,000

|

|

|

|

152,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Peter Hashimoto

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Pratima Labroo

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Rich Haerle

|

|

|

110,000

|

|

|

|

110,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Richard Mortensen

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Rob Rignell

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Roy Prasad

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Ryan Katz

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Ryan Mathis

|

|

|

50,000

|

|

|

|

50,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Ryan Wirick

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Saloni Kalsekar

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Sandy Hill

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Sean McOmie

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Sherry Plantholt

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Srinivas Susarla

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Stephanie Roth

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Steve Gorlin

|

|

|

110,000

|

|

|

|

110,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Steve Somchith

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Steven Milner

|

|

|

140,000

|

|

|

|

140,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Tony Medina

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Van Wagoner, Casey

|

|

|

500

|

|

|

|

500

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Wayne Saunders

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

William Hickerson

|

|

|

2,000

|

|

|

|

2,000

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

|

|

|

15,821,187

|

|

|

|

5,483,386

|

|

|

|

|

|

|

|

|

|

(1) The

number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act

of 1934, as amended, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such

rule, beneficial ownership includes any shares as to which the Selling Stockholder has sole or shared voting power or investment

power and also any shares, which the Selling Stockholder has the right to acquire within 60 days from May 29, 2018. “

Shares

Beneficially Owned Upon Completion of this Offering

” assumes the sale of all of the Common Stock offered by this Reoffer

Prospectus and no other purchases or sales of our Common Stock by the Selling stockholders.

(2) Includes

shares that are issuable upon exercise of stock options issued pursuant to the Plans, some of which are not, and will not become

vested within 60 days from May 29, 2018, and are not included in the calculation of “

Shares Beneficially Owned Prior

to this Offering

.”

(3) Applicable

percentage ownership is based on 18,808,601 shares of Common Stock outstanding as of May 29, 2018, together with securities exercisable

or convertible into shares of Common Stock within 60 days of May 29, 2018 for each stockholder, including, for purposes of the

shares beneficially owned prior to the Offering, the shares offered for resale pursuant to this Reoffer Prospectus.

PLAN

OF DISTRIBUTION

Timing

of Sales

The

Selling Stockholders may offer and sell the shares covered by this prospectus at various times. The Selling Stockholders will

act independently of our Company in making decisions with respect to the timing, manner and size of each sale.

No

Known Agreements to Resell the Shares

To

our knowledge, no Selling Stockholder has any agreement or understanding, directly or indirectly, with any person to resell the

common stock covered by this prospectus.

Offering

Price

The

sales price offered by the Selling Stockholders to the public may be:

1. the

market price prevailing at the time of sale;

2. a

price related to such prevailing market price; or

3. such

other price as the Selling Stockholders determine from time to time.

Manner

of Sale

The

common stock may be sold by means of one or more of the following methods:

1. a

block trade in which the broker-dealer so engaged will attempt to sell the common shares as agent, but may position and resell

a portion of the block as principal to facilitate the transaction;

2. Purchases

by a broker-dealer as principal and resale by that broker-dealer for its account pursuant to this prospectus;

3. ordinary

brokerage transactions in which the broker solicits purchasers;

4. through

options, swaps or derivatives;

5. in

transactions to cover short sales;

6. privately

negotiated transactions; or

7. in

a combination of any of the above methods.

The

Selling Stockholders may sell their common stock directly to purchasers or may use brokers, dealers, underwriters or agents to

sell their common stock. Brokers or dealers engaged by the Selling Stockholders may arrange for other brokers or dealers to participate.

Brokers or dealers may receive commissions, discounts or concessions from the Selling Stockholders , or, if any such broker-dealer

acts as agent for the purchaser of common stock, from the purchaser in amounts to be negotiated immediately prior to the sale.

The compensation received by brokers or dealers may, but is not expected to, exceed that which is customary for the types of transactions

involved.

Broker-dealers

may agree with a Selling Stockholder to sell a specified number of common stock at a stipulated price per common stock, and, to

the extent the broker-dealer is unable to do so acting as agent for a Selling Stockholder, to purchase as principal any unsold

common stock at the price required to fulfill the broker-dealer commitment to the Selling Stockholder.

Broker-dealers

who acquire stock as principal may thereafter resell the common stock from time to time in transactions, which may involve block

transactions and sales to and through other broker-dealers, including transactions of the nature described above, on The NASDAQ

Capital Market or otherwise at prices and on terms then prevailing at the time of sale, at prices then related to the then-current

market price or in negotiated transactions. In connection with resales of the common stock, broker-dealers may pay to or receive

from the purchasers of shares commissions as described above.

If

our Selling Stockholders enter into arrangements with brokers or dealers, as described above, we are obligated to file a post-effective

amendment to this registration statement disclosing such arrangements, including the names of any broker-dealers acting as underwriters.

The

Selling Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the sale of the common

stock may be deemed to be “underwriters” within the meaning of the Securities Act. In that event, any commissions

received by broker-dealers or agents and any profit on the resale of the common stock purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act.

We

will make copies of this prospectus available to the Selling Stockholders for the purpose of satisfying the prospectus delivery

requirements of the Securities Act.

Sales

Pursuant to Rule 144

Any

common stock covered by this prospectus that qualifies for sale pursuant to Rule 144 under the Securities Act may be sold under

Rule 144 rather than pursuant to this prospectus.

Accordingly,

during such times as a Selling Stockholder may be deemed to be engaged in a distribution of the common stock, and therefore be

considered to be an underwriter, the Selling Stockholder must comply with applicable law and, among other things:

1. may

not engage in any stabilization activities in connection with our common stock;

2. may

not cover short sales by purchasing shares while the distribution is taking place; and

3. may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as

permitted under the Exchange Act.

State

Securities Laws

Under

the securities laws of some states, the common stock may be sold in such states only through registered or licensed brokers or

dealers. In addition, in some states the common stock may not be sold unless the shares have been registered or qualified for

sale in the state or an exemption from registration or qualification is available and is complied with.

Expenses

of Registration

We

are bearing all costs relating to the registration of the common stock. These expenses are estimated to be $10,000, including,

but not limited to, legal, accounting, printing and mailing fees. The Selling Stockholders, however, will pay any commissions

or other fees payable to brokers or dealers in connection with any sale of the common stock.

LEGAL

MATTERS

The

validity of the issuance of the securities offered hereby will be passed upon for us by Parsons Behle & Latimer. Additional

legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable

prospectus supplement.

EXPERTS

The

consolidated balance sheets of PolarityTE, Inc., and its subsidiaries, as of October 31, 2017 and 2016 and the related consolidated

statements of operations, stockholders’ equity, and cash flows for each of the years then ended, have been audited by EisnerAmper

LLP, independent registered public accounting firm, as stated in their report which is incorporated herein by reference, which

report includes an explanatory paragraph about the existence of substantial doubt concerning the Company’s ability to continue

as a going concern. Such financial statements have been incorporated herein by reference in reliance on the report of such firm

given upon their authority as experts in accounting and auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important

information to you by referring you to another document that we have filed separately with the SEC. You should read the information

incorporated by reference because it is an important part of this prospectus. Any information incorporated by reference into this

prospectus is considered to be part of this prospectus from the date we file that document. We incorporate by reference the following

information or documents that we have filed with the SEC (Commission File No. 001-33762) which shall not include, in each case,

documents, or information deemed to have been furnished and not filed in accordance with SEC rules

|

|

●

|

Prospectus

Supplement dated April 12, 2018, filed pursuant Rule 424(b) and forming a part of the Registration Statement on Form S-3 (File

No. 333-219202);

|

|

|

|

|

|

|

●

|

Annual

Report on Form 10-K for the year ended October 31, 2017, filed on January 30, 2018, and Amendment No. 1 to the Annual Report

on Form 10-K filed on Form 10-K/A on February 28, 2018;

|

|

|

|

|

|

|

●

|

Quarterly

Report on Form 10-Q for the period ended January 31, 2018, filed on March 19, 2018

|

|

|

|

|

|

|

●

|

Current

Reports on Form 8-K filed on November 3, 2017, November 16, 2017, November 27, 2017, December 29, 2017, February 9, 2018,

March 7, 2018, March 8, 2018, March 8, 2018, March 8, 2018 (Form 8-K/A), March 9, 2018, April 11, 2018, April 13, 2018, April

24, 2018, May 1, 2018, and May 8, 2018; and

|

|

|

|

|

|

|

●

|

The

description of common stock contained in the Registration Statement on Form S-3/A filed with the Commission on March 26, 2018,

including any amendment or report filed for the purpose of updating such description.

|

All

documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of

any report or documents that is not deemed filed under such provisions, (1) on or after the date of filing of the registration

statement containing this prospectus and prior to the effectiveness of the registration statement, and (2) on or after the date

of this prospectus until the earlier of the date on which all of the securities registered hereunder have been sold or the registration

statement of which this prospectus is a part has been withdrawn, shall be deemed incorporated by reference in this prospectus

and to be a part of this prospectus from the date of filing of those documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently

filed document, which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any

such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this

registration statement. Under no circumstances will any information filed under items 2.02 or 7.01 of Form 8-K be deemed to be

incorporated by reference, unless such Form 8-K expressly provides to the contrary.

The

Company will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered,

upon such person’s written or oral request, a copy of any and all of the information incorporated by reference in this prospectus,

other than exhibits to such documents, unless such exhibits are specifically incorporated by reference into the information that

this prospectus incorporates. Requests should be directed to the Corporate Secretary at John Stetson, Chief Financial Officer,

PolarityTE, Inc., 1960 S. 4250 West, Salt Lake City, UT 84104, telephone number (385) 237-2279. You may also find these documents

in the “Investor Relations” section of our website,

www.incontact.com

. The information on our website is not

incorporated into this prospectus.

INDEMNIFICATION

Under

the certificate of incorporation and bylaws of the Company the Board of Directors has the authority to indemnify officers and

directors to the fullest extent permitted by Delaware law. Further, the Company has separate indemnification agreements with certain

of its officers and directors. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to

our directors, officers, and controlling persons, or to the extent any of the Selling Stockholders are entitled to indemnification

under their agreements with us, we have been advised that in the opinion of the SEC such indemnification is against public policy

as expressed in the Securities Act and is, therefore, unenforceable.

ADDITIONAL

INFORMATION AVAILABLE TO YOU

This

prospectus is part of a Registration Statement on Form S-8 that we filed with the SEC. Certain information in the Registration

Statement has been omitted from this prospectus in accordance with the rules of the SEC. We file annual, quarterly and special

reports, proxy statements and other information with the SEC. You can inspect and copy the Registration Statement as well as reports,

proxy statements and other information we have filed with the SEC at the public reference room maintained by the SEC at 100 F

Street N.E. Washington, D.C. 20549. You can obtain copies from the public reference room of the SEC at 100 F Street N.E. Washington,

D.C. 20549, upon payment of certain fees. You can call the SEC at 1-800-732-0330 for further information about the public reference

room. We are also required to file electronic versions of these documents with the SEC, which may be accessed through the SEC’s

World Wide Web site at http://www.sec.gov.

5,483,386

SHARES OF COMMON

STOCK

PROSPECTUS

May 29, 2018

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

ITEM

3. INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The

following documents previously filed by the Company with the Securities and Exchange Commission (“Commission”) pursuant

to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

|

|

●

|

Prospectus

Supplement dated April 12, 2018, filed pursuant Rule 424(b) and forming a part of the Registration Statement on Form S-3 (File

No. 333-219202);

|

|

|

|

|

|

|

●

|

Annual

Report on Form 10-K for the year ended October 31, 2017, filed on January 30, 2018, and Amendment No. 1 to the Annual Report

on Form 10-K filed on Form 10-K/A on February 28, 2018;

|

|

|

|

|

|

|

●

|

Quarterly

Report on Form 10-Q for the period ended January 31, 2018, filed on March 19, 2018

|

|

|

|

|

|

|

●

|

Current

Reports on Form 8-K filed on November 3, 2017, November 16, 2017, November 27, 2017, December 29, 2017, February 9, 2018,

March 7, 2018, March 8, 2018, March 8, 2018, March 8, 2018 (Form 8-K/A), March 9, 2018, April 11, 2018, April 13, 2018, April

24, 2018, May 1, 2018, and May 8, 2018; and

|

|

|

|

|

|

|

●

|

The

description of common stock contained in the Registration Statement on Form S-3/A filed with the Commission on March 26, 2018,

including any amendment or report filed for the purpose of updating such description.

|

All

documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of

any report or documents that is not deemed filed under such provisions, (1) on or after the date of filing of the registration

statement containing this prospectus and prior to the effectiveness of the registration statement, and (2) on or after the date

of this prospectus until the earlier of the date on which all of the securities registered hereunder have been sold or the registration

statement of which this prospectus is a part has been withdrawn, shall be deemed incorporated by reference in this prospectus

and to be a part of this prospectus from the date of filing of those documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently

filed document, which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any

such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this

registration statement. Under no circumstances will any information filed under items 2.02 or 7.01 of Form 8-K be deemed to be

incorporated by reference, unless such Form 8-K expressly provides to the contrary.

ITEM

4. DESCRIPTION OF SECURITIES

Not

applicable.

ITEM

5. INTERESTS OF NAMED EXPERTS AND COUNSEL

Not

applicable.

ITEM

6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

The

Company’s restated certificate of incorporation and restated bylaws provide that each person who was or is made a party

or is threatened to be made a party to or is otherwise involved (including, without limitation, as a witness) in any action, suit

or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she is or was a director

or an officer of the Company or is or was serving at our request as a director, officer, or trustee of another corporation, or

of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan, whether

the basis of such proceeding is alleged action in an official capacity as a director, officer or trustee or in any other capacity

while serving as a director, officer or trustee, shall be indemnified and held harmless by us to the fullest extent authorized

by the Delaware General Corporation Law (the “DGCL”) against all expense, liability and loss (including attorneys’

fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such.

Section

145 of the DGCL permits a corporation to indemnify any director or officer of the corporation against expenses (including attorneys’

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with any action, suit or

proceeding brought by reason of the fact that such person is or was a director or officer of the corporation, if such person acted

in good faith and in a manner that he reasonably believed to be in, or not opposed to, the best interests of the corporation,

and, with respect to any criminal action or proceeding, if he or she had no reason to believe his or her conduct was unlawful.

In a derivative action, (

i.e

., one brought by or on behalf of the corporation), indemnification may be provided only for

expenses actually and reasonably incurred by any director or officer in connection with the defense or settlement of such an action

or suit if such person acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the

best interests of the corporation, except that no indemnification shall be provided if such person shall have been adjudged to

be liable to the corporation, unless and only to the extent that the court in which the action or suit was brought shall determine

that the defendant is fairly and reasonably entitled to indemnity for such expenses despite such adjudication of liability.

Pursuant

to Section 102(b)(7) of the DGCL, Article Ninth of the Company’s restated certificate of incorporation eliminates the liability

of a director to the Company or its stockholders for monetary damages for such a breach of fiduciary duty as a director, except

for liabilities arising:

|

●

|

from

any breach of the director’s duty of loyalty to us or our stockholders;

|

|

|

|

|

●

|

from

acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

|

|

|

|

●

|

under

Section 174 of the DGCL; and

|

|

|

|

|

●

|

from

any transaction from which the director derived an improper personal benefit.

|

The

Company carries insurance policies insuring its directors and officers against certain liabilities that they may incur in their

capacity as directors and officers.

The

Company has entered into indemnification agreements with each of its directors. Pursuant to the indemnification agreements, the

Company is required to, among other things, indemnify each indemnitee against all expenses (including, attorneys’ fees,

disbursements and retainers, fees and disbursements of expert witnesses, private investigators and professional advisors and other

disbursements and expenses) actually and reasonably incurred in connection with certain proceedings that relate to the indemnitee’s

corporate status (as defined in the indemnification agreements). The Company also is required to indemnify for expenses incurred

by the indemnitee if, by reason of his or her corporate status, such indemnitee is a witness in any proceeding. Further, the Company

is required to indemnify for expenses incurred by the indemnitee in defense of a proceeding to the extent the indemnitee has been

successful on the merits or otherwise. Finally, if the indemnitee is involved in certain proceedings as a result of the indemnitee’s

corporate status, the Company is required to advance all expenses incurred by or on behalf of the indemnitee in connection with

such proceeding, without regard to the indemnitee’s ability to repay the expenses and without regard to the indemnitee’s

ultimate entitlement to indemnification under the other provisions of the indemnification agreement; provided, however, that to

the extent required by the DGCL, the indemnitee must repay all the expenses paid to the indemnitee if it is finally determined

that the indemnitee is not entitled to be indemnified.

The

indemnification agreements contain certain exceptions to the Company’s obligation to indemnify. Among these exceptions,

the Company is not obligated to make any indemnity in connection with any claim made against the indemnitee: (i) for which payment

has actually been made to or on behalf of the indemnitee under any insurance policy or other indemnity provision, except with

respect to any excess beyond the amount paid under any insurance policy or other indemnity provisions; (ii) for an accounting

of profits made from the purchase and sale (or sale and purchase) by the indemnitee of securities of the Company within the meaning

of Section 16(b) of the Exchange Act, or similar provisions of state statutory law or common law; or (iii) for which payment is

prohibited by applicable law.

The

indemnification agreements also require the Company to, from time to time, make a good faith determination whether or not it is

practicable to obtain and maintain a policy or policies of insurance with a reputable insurance company providing the indemnitee

with coverage for losses from wrongful acts and, to the extent we obtain such insurance, an indemnitee who is a director shall

be named as an insured. However, the Company is not obligated to obtain or maintain such insurance.

All

agreements and obligations of the Company contained in the indemnification agreements will continue during the period when the

director who is a party to an indemnification agreement is a director of the Company (or is serving at the request of the Company

as a director, officer, employee or other agent of another corporation, partnership, joint venture, trust, employee benefit plan

or other enterprise) and will continue thereafter so long as such director shall be subject to any possible claim or threatened,

pending or completed action, suit or proceeding, whether civil, criminal, arbitrational, administrative or investigative. In addition,

the indemnification agreements provide for partial indemnification and advance of expenses. In the event of a change of control,

the Company (or any successor to the interests of the Company) shall be obligated to continue, procure and otherwise maintain

in effect, for a period of six (6) years from the effective date of the change of control, a policy, or policies, of insurance

providing each director with coverage for losses from alleged wrongful acts occurring on or before the change of control.

The

indemnification provisions contained in our certificate of incorporation, restated by-laws and in the indemnity agreements may

discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. These provisions

also may have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such

an action, if successful, might otherwise benefit us and our stockholders. Furthermore, a stockholder’s investment may be

adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these

indemnification provisions. We believe that these provisions and the directors’ and officers’ liability insurance

policy are necessary to attract and retain talented and experienced directors and officers.

ITEM

7. EXEMPTION FROM REGISTRATION CLAIMED

Not

applicable.

ITEM

8. EXHIBITS

See

Exhibit Index following signature page.

ITEM

9. UNDERTAKINGS

(a)

The undersigned registrant hereby undertakes:

(1)

to file, during any period in which offers or sales are being made of the securities registered hereby, a post-effective

amendment to this registration statement:

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)