Plumas Bank Recognized as a Super Premier Performing Bank for Five Consecutive Years by The Findley Reports

June 08 2020 - 9:00AM

Plumas Bancorp (NASDAQ:PLBC), the holding company (the “Company”)

for Plumas Bank, recently announced that Plumas Bank has been

recognized as a “Super Premier Performing” bank for its 2019

performance by the highly-regarded consulting and reporting firm,

The Findley Reports, Inc. This is the fifth consecutive year that

this prestigious distinction has been conferred upon Plumas Bank.

Each year, The Findley Reports recognizes high

performing banks throughout California and the Western United

States as “Super Premier,” “Premier,” and “Commendable” based upon

their operating results. Banks are rated on four basic components

which include growth, return on beginning equity, net operating

income as a percentage of average assets, and loan losses as a

percentage of gross loans.

Director, President and Chief Executive Officer,

Andrew J. Ryback, commented, “Earning this distinction for five

consecutive years is a testament to the strategic vision of our

directors and executives, and the hard work and dedication of our

entire team. Our focus is to provide a superior, relationship-based

banking experience for the communities we serve. We are very proud

of our history of banking excellence as we deliver on this priority

and are honored to be recognized by The Findley Reports.”

About The Findley ReportsFor

over fifty years The Findley Reports has been recognizing the

financial performance of banking institutions

in California and the Western United States. The

Findley Reports is the reporting service of The Findley Companies.

Since 1965, The Findley Companies have earned recognition as being

knowledgeable, innovative and effective in implementing solutions

to complex situations.

About Plumas BankFounded in

1980, Plumas Bank is a locally owned and managed full-service

community bank headquartered in northeastern California. The Bank

operates thirteen branches: eleven located in the northern

California counties of Plumas, Lassen, Placer, Nevada, Modoc and

Shasta and two branches located in the northern Nevada counties of

Washoe and Carson City. The Bank also operates three loan

production offices: two located in the northern California Counties

of Placer and Butte, and one located in the southern Oregon County

of Klamath. Plumas Bank offers a wide range of financial and

investment services to consumers and businesses and has received

nationwide Preferred Lender status with the United States Small

Business Administration. For more information on Plumas Bancorp and

Plumas Bank, please visit our website at www.plumasbank.com.

This news release includes forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Exchange Act

of 1934, as amended and Plumas Bancorp intends for such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. Future events are

difficult to predict, and the expectations described above are

necessarily subject to risk and uncertainty that may cause actual

results to differ materially and adversely.

Forward-looking statements can be identified by

the fact that they do not relate strictly to historical or current

facts. They often include the words "believe," "expect,"

"anticipate," "intend," "plan," "estimate," or words of similar

meaning, or future or conditional verbs such as "will," "would,"

"should," "could," or "may." These forward-looking statements are

not guarantees of future performance, nor should they be relied

upon as representing management's views as of any subsequent date.

Forward-looking statements involve significant risks and

uncertainties and actual results may differ materially from those

presented, either expressed or implied, in this news release.

Factors that might cause such differences include, but are not

limited to: the Company's ability to successfully execute its

business plans and achieve its objectives; changes in general

economic and financial market conditions, either nationally or

locally in areas in which the Company conducts its operations;

changes in interest rates; continuing consolidation in the

financial services industry; new litigation or changes in existing

litigation; increased competitive challenges and expanding product

and pricing pressures among financial institutions; legislation or

regulatory changes which adversely affect the Company's operations

or business; loss of key personnel; and changes in accounting

policies or procedures as may be required by the Financial

Accounting Standards Board or other regulatory agencies.

In addition, discussions about risks and

uncertainties are set forth from time to time in the Company’s

publicly available Securities and Exchange Commission filings. The

Company undertakes no obligation to publicly revise these

forward-looking statements to reflect subsequent events or

circumstances.

# # #

Contact:

Elizabeth Kuipers

Plumas Bank

Vice President, Marketing Manager & Investor Relations Officer

35 S Lindan Avenue

Quincy, CA 95971

530.283.7305 x8912

investorrelations@plumasbank.com

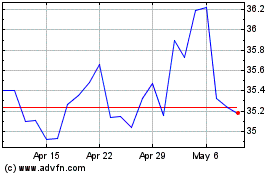

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Apr 2023 to Apr 2024