UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

1-34392

(Commission File Number)

|

(Check one):

|

|

Form 10-K x

|

|

Form 20-F ¨

|

|

Form 11-K ¨

|

|

Form 10-Q ¨

|

|

Form 10-D ¨

|

|

|

|

Form N-SAR ¨

|

|

Form N-CSR ¨

|

|

|

|

|

|

|

For Period Ended: December 31, 2020

¨ Transition Report

on Form 10-K

¨ Transition Report

on Form 20-F

¨ Transition Report

on Form 11-K

¨ Transition Report

on Form 10-Q

¨ Transition Report

on Form N-SAR

For the Transition Period Ended: _________________________

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

|

PART I - REGISTRANT INFORMATION

Plug Power Inc.

Full Name of Registrant

Former Name if Applicable: N/A

968

Albany Shaker Road

Address of Principal Executive Office (Street

and Number)

Latham, New

York 12110

City, State and Zip Code

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable

effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if

appropriate)

|

|

|

(a) The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

x

|

|

(b) The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

|

(c) The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III – NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K,

10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

For the year ended December 31, 2020, Plug Power Inc. (the

“Company”) became a large accelerated filer for the first time and, as a result, the Company has a shortened

filing deadline of 60 days rather than 75 days to file its Annual Report on Form 10-K for the year ended December 31, 2020

(the “Form 10-K”). The Company requires additional time to complete the procedures relating to its year-end

reporting process, including the completion of the Company’s financial statements and procedures relating

to management’s assessment of the effectiveness of internal controls, and the Company is therefore unable to file the

Form 10-K by March 1, 2021, the prescribed filing due date. The Company is working diligently to complete the necessary work, including review and assessment of the treatment of certain costs with regards to

classification between Research and Development versus Costs of Goods Sold, the recoverability of right of use assets

associated with certain leases, and certain internal controls over these and other areas. It is possible that one or more of

these items may result in charges or adjustments to current and/or prior period financial statements. The Company is still

evaluating whether any such charges or adjustments would be required and, if required, whether any such charges or

adjustments would be material; but any charges, if required, would be non-cash in nature and any such adjustments or charges

would not impact the Company’s guidance on forward projections. The Company expects to file the Form 10-K within the extension period

provided under Rule 12b-25 under the Securities Exchange Act of 1934, as amended.

PART IV- OTHER INFORMATION

(1) Name and telephone number of person to contact in regard

to this notification

|

Paul Middleton

|

|

(518)

|

|

738-0281

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13

or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months

or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

x Yes o No

(3) Is it anticipated that any significant change in results

of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof? x Yes oNo

If so, attach an explanation of the anticipated change, both

narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company expects that the fourth quarter and full year 2020

result of operations to be included in the Form 10-K will reflect significant changes from the fourth quarter and full year 2019.

The Company expects that the fourth quarter and full year 2020 results of operations will be consistent with those disclosed in

the Company’s press release furnished as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the Securities

and Exchange Commission on February 25, 2021, subject to any adjustments resulting from completion of the year-end reporting process

and the audit of the Company’s financial statements.

Cautionary Note on Forward-Looking Statements

This Form 12b-25 contains "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks

and uncertainties about the Company, including but not limited to statements about the Company's expectations relating to its

2020 financial results, possible charges and adjustments to current and/or prior period financial statements, and the

timing of the filing of the Form 10-K. You are cautioned that such statements should not be read as a guarantee of future

performance or results and will not necessarily be accurate indications of the times that, or by which, such performance or

results will have been achieved. Such statements are subject to risks and uncertainties that could cause actual performance

or results to differ materially from those expressed in these statements. You are cautioned that such statements should not

be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times that,

or by which, such performance or results will have been achieved. Such statements are subject to risks and uncertainties that

could cause actual performance or results to differ materially from those expressed in these statements. In particular, the

risks and uncertainties include, among other things, the risk that we continue to incur losses and might never achieve or

maintain profitability; the risk that we will need to raise additional capital to fund our operations and such capital may

not be available to us; the risk of dilution to our stockholders and/or stock price; the risk that our lack of extensive

experience in manufacturing and marketing products may impact our ability to manufacture and market products on a profitable

and large-scale commercial basis; the risk that unit orders may not ship, be installed and/or converted to revenue, in whole

or in part; the risk that a loss of one or more of our major customers, or if one of our major customers delays payment of or

is unable to pay its receivables, a material adverse effect could result on our financial condition; the risk that a sale of

a significant number of shares of stock could depress the market price of our common stock; the risk that our convertible

senior notes, if settled in cash, could have a material effect on our financial results; the risk that our convertible note

hedges may affect the value of our convertible senior notes and our common stock; the risk that negative publicity related to

our business or stock could result in a negative impact on our stock value and profitability; the risk of potential losses

related to any product liability claims or contract disputes; the risk of loss related to an inability to maintain an

effective system of internal controls; our ability to attract and maintain key personnel; the risks related to the use of

flammable fuels in our products; the risk that pending orders may not convert to purchase orders, in whole or in part; the

cost and timing of developing, marketing and selling our products; the risks of delays in or not completing our product

development goals; our ability to obtain financing arrangements to support the sale or leasing of our products and services

to customers; our ability to achieve the forecasted gross margin on the sale of our products; the cost and availability of

fuel and fueling infrastructures for our products; the risks, liabilities, and costs related to environmental, health and

safety matters; the risk of elimination of government subsidies and economic incentives for alternative energy products;

market acceptance of our products and services, including GenDrive, GenSure and GenKey systems; the volatility of our stock

price; our ability to establish and maintain relationships with third parties with respect to product development,

manufacturing, distribution and servicing, and the supply of key product components; the cost and availability of components

and parts for our products; the risk that possible new tariffs could have a material adverse effect on our business; our

ability to develop commercially viable products; our ability to reduce product and manufacturing costs; our ability to

successfully market, distribute and service our products and services internationally; our ability to improve system

reliability for our products; competitive factors, such as price competition and competition from other traditional and

alternative energy companies; our ability to protect our intellectual property; the risk of dependency on information

technology on our operations and the failure of such technology; the cost of complying with current and future federal, state

and international governmental regulations; our subjectivity to legal proceedings and legal compliance; the risks associated

with potential future acquisitions; and other risks and uncertainties referenced in our public filings with the Securities

and Exchange Commission (the “SEC”). For additional disclosure regarding these and other risks faced by the

Company, see the disclosures contained in the Company's public filings with the SEC including the "Risk Factors"

section of the Company's Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Reports on Form 10-Q

for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020. You should consider these factors in evaluating

the forward-looking statements included in this communication and not place undue reliance on such statements. The

forward-looking statements are made as of the date hereof, and the Company undertakes no obligation to update such statements

as a result of new information.

Plug Power Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Date: March 2, 2021

|

|

|

|

|

By:

|

/s/ Paul Middleton

|

|

|

|

Paul Middleton

|

|

|

|

Chief Financial Officer

|

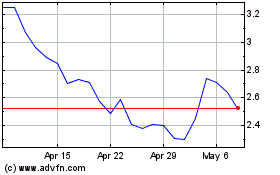

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

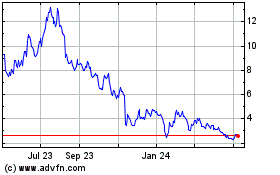

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024