Amended Current Report Filing (8-k/a)

August 17 2021 - 6:03AM

Edgar (US Regulatory)

PILGRIMS PRIDE CORP0000802481true00008024812021-08-112021-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 11, 2021

PILGRIM'S PRIDE CORPORATION

(Exact Name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

1-9273

|

75-1285071

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

1770 Promontory Circle

|

|

80634-9038

|

|

Greeley

|

CO

|

|

(Zip Code)

|

|

(Address of principal executive offices)

|

|

|

|

Registrant's telephone number, including area code: (970) 506-8000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of Exchange on Which Registered

|

|

Common Stock, Par Value $0.01

|

|

PPC

|

|

The Nasdaq Stock Market LLC

|

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

The sole purpose of this amendment to the Current Report on Form 8-K filed with the Security and Exchange Commission on August 11, 2021 is to add inline eXtensible Business Reporting Language (“XBRL”) tagging to the cover page of this Form 8-K/A and to update Item 9.01 to provide a hyperlink to Exhibit 10.1 and furnish Exhibit 104. All other information in the Form 8-K remains unchanged.

Item 1.01 Entry into a Material Definitive Agreement.

On August 9, 2021, Pilgrim’s Pride Corporation (the “Company”), and certain of the Company’s subsidiaries entered into a Fifth Amended and Restated Credit Agreement (the “New Credit Agreement”) with CoBank, ACB, as administrative agent and collateral agent, and the other lenders party thereto. The New Credit Agreement increased the size of the revolver from $750.0 million to $800.0 million, increased the size of the term loan from an outstanding principal amount of approximately $431.3 million to $700.0 million (providing a delayed draw term loan commitment of approximately $268.7 million) and amended certain covenants.

In addition, under the New Credit Agreement, the maturity date of the revolving loan commitment and the term loans was extended from July 20, 2023 to August 9, 2026.

Outstanding borrowings under the revolving loan commitment and the term loans bear interest at a per annum rate equal to (i) in the case of LIBOR loans, based on the Company’s net senior secured leverage ratio, between LIBOR plus 1.25% and LIBOR plus 2.75% and (ii) in the case of base rate loans, based on the Company’s net senior secured leverage ratio, between the base rate plus 0.25% and base rate plus 1.75% thereafter.

The New Credit Agreement continues to contain customary financial and other various covenants for transactions of this type, including restrictions on the Company's ability to incur additional indebtedness, incur liens, pay dividends, make certain restricted payments, consummate certain asset sales, enter into certain transactions with the Company’s affiliates, or merge, consolidate and/or sell or dispose of all or substantially all of our assets.

All obligations under the New Credit Agreement continue to be unconditionally guaranteed by certain of the Company’s non-Mexican and non-European subsidiaries and continue to be secured by a first priority lien on substantially all of the assets of the Company and its non-Mexican and non-European subsidiaries that constitute guarantors.

The foregoing description of the New Credit Agreement and the transactions contemplated by the New Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the text of the New Credit Agreement, which is filed as Exhibit 10.1 hereto and incorporated into this report by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

Exhibit Number

|

|

10.1

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PILGRIM’S PRIDE CORPORATION

|

|

|

|

|

|

|

Date:

|

August 16, 2021

|

|

/s/ Matthew Galvanoni

|

|

|

|

|

Matthew Galvanoni

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

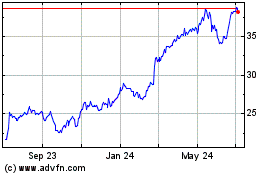

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Apr 2023 to Apr 2024