Current Report Filing (8-k)

September 24 2018 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

_______________________

Date of Report (Date of earliest event reported):

September 20, 2018

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

0-18370

|

36-3922969

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification No.)

|

6410 West Howard Street, Niles, Illinois 60714

(Address of principal executive offices, including zip code)

(847) 966-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01.

Entry into a Material Definitive Agreement.

On September 20, 2018, Perma-Pipe International Holdings, Inc. (“Holdings”) and certain of its US and Canadian subsidiaries (collectively together with Holdings, the “North American Loan Parties”) entered into a new Revolving Credit and Security Agreement (the “Credit Agreement”) with PNC Bank, National Association, as administrative agent and lender (“PNC”), providing for a new three-year $18 million senior secured revolving credit facility, subject to a borrowing base including various reserves (the “Senior Credit Facility”). The Senior Credit Facility replaced the existing $15 million Credit and Security Agreement, dated September 24, 2014, among various subsidiaries of Holdings and Bank of Montreal, as successor by assignment to BMO Harris Bank N.A., as amended (the “Prior Credit Agreement”). The obligations under the Senior Credit Facility are currently guaranteed by Perma-Pipe Canada, Inc. Each of the North American Loan Parties other than Perma-Pipe Canada, Inc. is a borrower under the Senior Credit Facility (collectively, the “Borrowers”).

The Borrowers are and will be using borrowings under the new Senior Credit Facility (i) to pay off outstanding amounts under the Prior Credit Agreement (which totaled approximately USD $3,773,823 plus CAD 4,794,528) and cash collateralize a letter of credit (USD $154,500), (ii) to fund future capital expenditures; (iii) to fund on-going working capital needs; and (iv) for other corporate purposes. The Senior Credit Facility will bear interest at a rate equal to an alternate base rate or LIBOR, plus, in each case, an applicable margin. The applicable margin will be based on the average quarterly undrawn availability with respect to the Senior Credit Facility. Interest on alternate base rate borrowings will generally be payable monthly in arrears and interest on LIBOR borrowings will generally be payable in arrears on the last day of each interest period. Additionally, the Borrowers will pay a 0.375% per annum facility fee on the unused portion of the Senior Credit Facility. The facility fee will be payable quarterly in arrears.

Subject to certain exceptions, the borrowings under the Senior Credit Facility will be secured by substantially all of the North American Loan Parties’ assets. The Senior Credit Facility will mature on September 20, 2021. Subject to certain qualifications and exceptions, the Senior Credit Facility contains covenants that, among other things, restrict the North American Loan Parties’ ability to create liens, merge or consolidate, consummate acquisitions, make investments, dispose of assets, incur debt, and pay dividends and other distributions. In addition, the North American Loan Parties cannot allow capital expenditures to exceed $3 million annually (plus a limited carryover of unused amounts).

The Senior Credit Facility also contains financial covenants requiring (i) the North American Loan Parties to achieve consolidated net income (excluding the financial performance of foreign subsidiaries not parties to the Credit Agreement) before interest, taxes, depreciation, amortization and certain other adjustments (“EBITDA”) of at least $1,807,000 for the period from August 1, 2018 through October 31, 2018; (ii) the North American Loan Parties to achieve EBITDA of at least $2,462,000 for the period from August 1, 2018 through January 31, 2019; (iii) the North American Loan Parties to achieve a ratio of its EBITDA (with certain additional adjustments) to the sum of scheduled cash principal payments on indebtedness for borrowed money and interest payments on the advances under the Senior Credit Facility (excluding from the calculation items related to the financial performance of foreign subsidiaries not parties to the Credit Agreement) to be not less than 1.10 to 1.00 for the nine-month period ending April 30, 2019 and for the quarter ending July 31, 2019 and each quarter end thereafter on a trailing four-quarter basis; and (iv) Holdings and its subsidiaries to achieve a ratio of its EBITDA (with certain additional adjustments) to the sum of scheduled cash principal payments on indebtedness for borrowed money and interest payments on the advances under the Senior Credit Facility of not less than 1.10 to 1.00 for the nine-month period ending October 31, 2018 and for the quarter ending January 31, 2019 and each quarter end thereafter on a trailing four-quarter basis.

The Senior Credit Facility contains customary events of default. If an event of default occurs and is continuing, then PNC may terminate all commitments to extend further credit and declare all amounts outstanding under the Senior Credit Facility due and payable immediately. In addition, if any of the North American Loan Parties or certain of their subsidiaries become the subject of voluntary or involuntary proceedings under any bankruptcy, insolvency or similar law, then any outstanding obligations under the Senior Credit Facility will automatically become immediately due and payable. Loans outstanding under the Senior Credit Facility will bear interest at a rate of 2.00% per annum in excess of the otherwise applicable rate (i) while a bankruptcy event of default exists or (ii) upon the lenders’ request, during the continuance of any other event of default.

The foregoing description of the Senior Credit Facility does not purport to be complete and is qualified in its entirety by reference to the full text of the Senior Credit Facility filed herewith as Exhibit 10.1 and incorporated herein by reference.

Item 1.02.

Termination of a Material Definitive Agreement.

On September 20, 2018, the Prior Credit Agreement was replaced by the Credit Agreement.

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information included in Item 1.01 above is incorporated herein by reference.

Item 9.01.

Financial Statements and Exhibits.

(a)

Not applicable.

(b)

Not applicable.

(c)

Not applicable.

(d)

Exhibits. The following exhibit is being furnished herewith:

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

|

Revolving Credit and Security Agreement, dated September 20, 2018, among the North American Loan Parties, PNC and the other parties thereto.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

Date: September 20, 2018

By:

/s/ Karl J. Schmidt

Karl J. Schmidt

Vice President and Chief Financial Officer

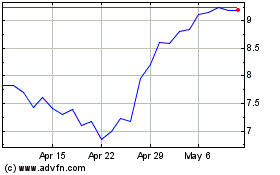

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Mar 2024 to Apr 2024

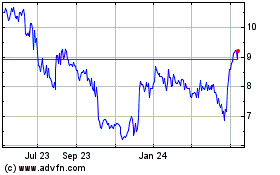

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Apr 2023 to Apr 2024